Income Tax Form Templates

Documents:

2505

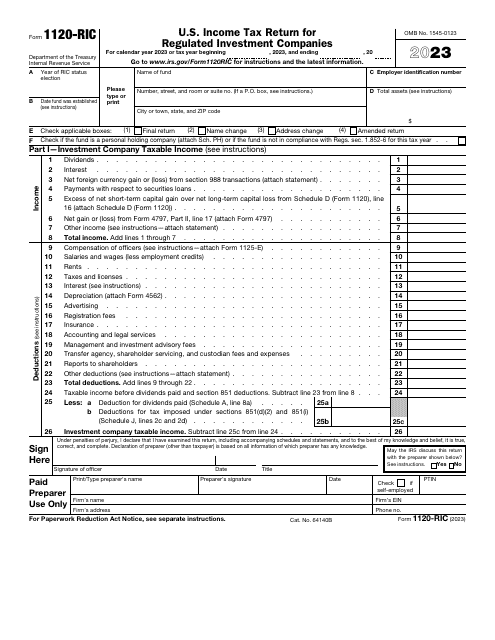

This is a fiscal form used by regulated investment companies to inform the government about their revenue over the course of the tax year, describe their losses and gains, claim tax deductions and credits, and compute their tax liability correctly.

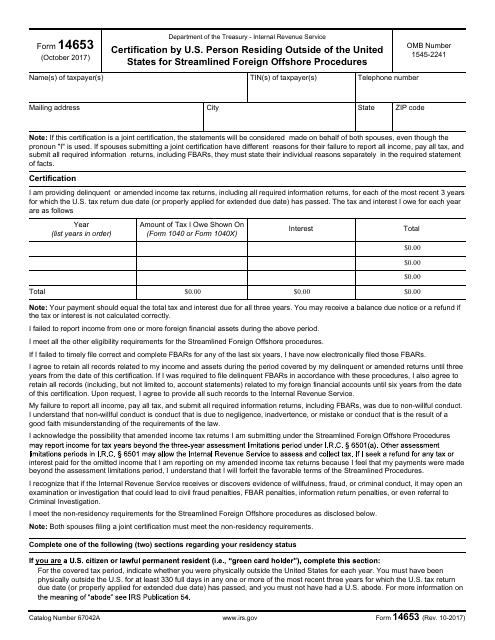

This form is used for certifying that a U.S. person residing outside of the United States is eligible for the Streamlined Foreign Offshore Procedures offered by the IRS.

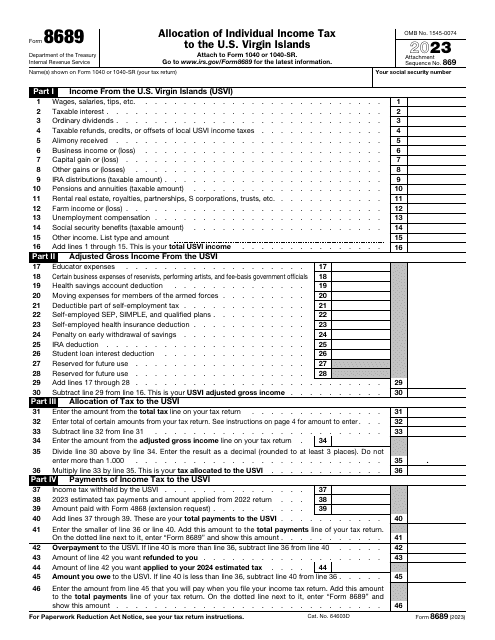

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

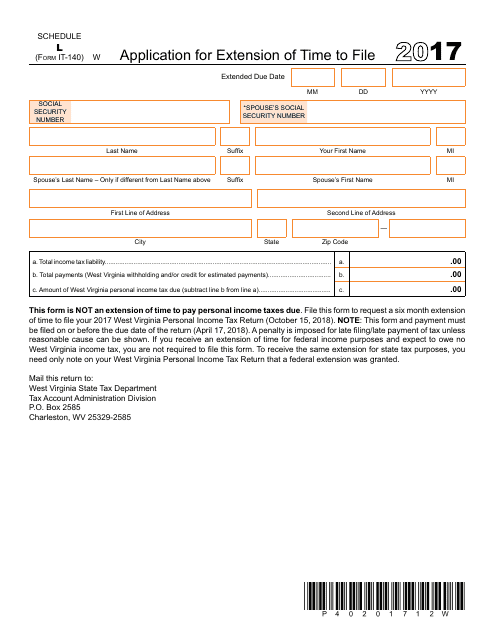

This form is used for applying for an extension of time to file your West Virginia state income tax return, Form IT-140.

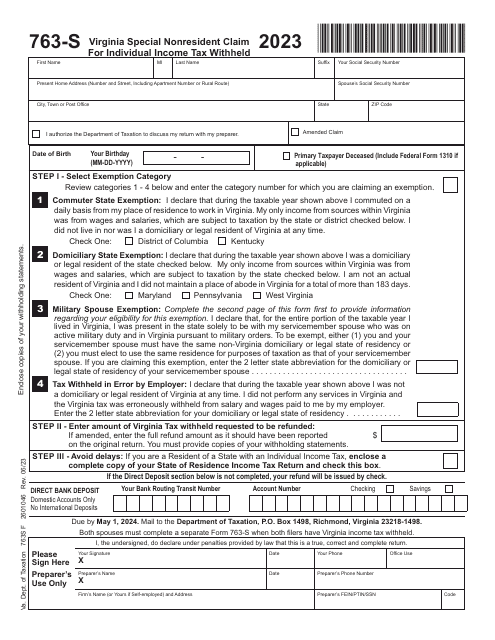

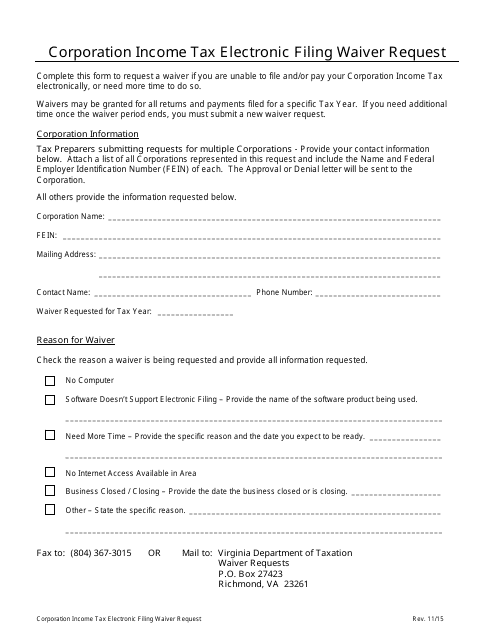

This document is used to request a waiver for electronic filing of corporation income tax in the state of Virginia.

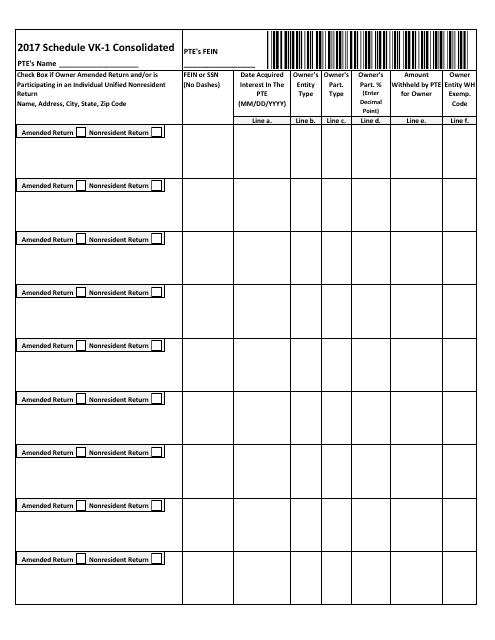

This document is used for reporting consolidated income and expenses in the state of Virginia.

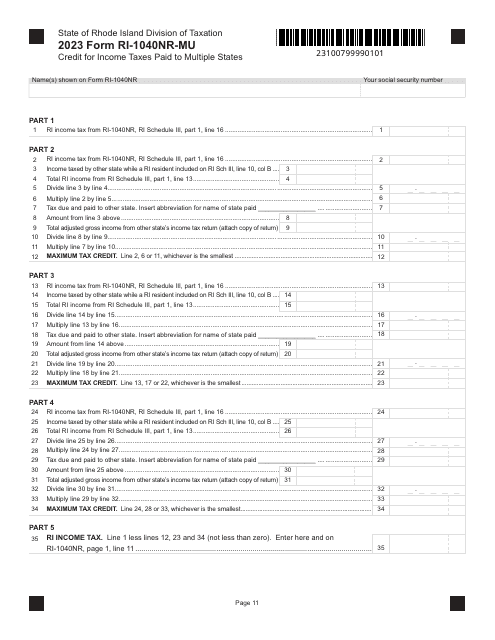

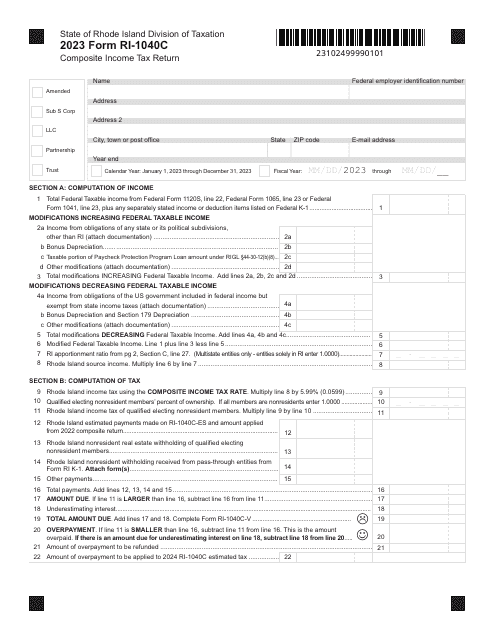

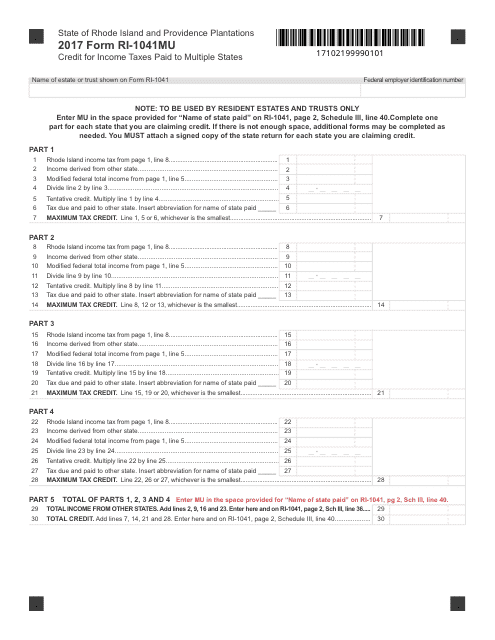

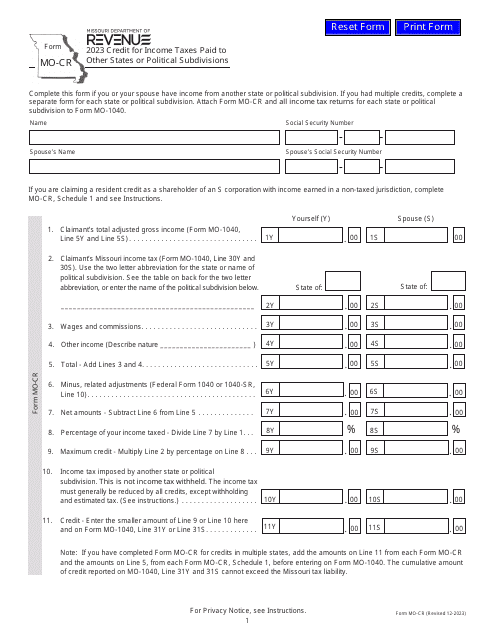

This form is used for claiming a credit for income taxes paid to multiple states when filing taxes in Rhode Island.

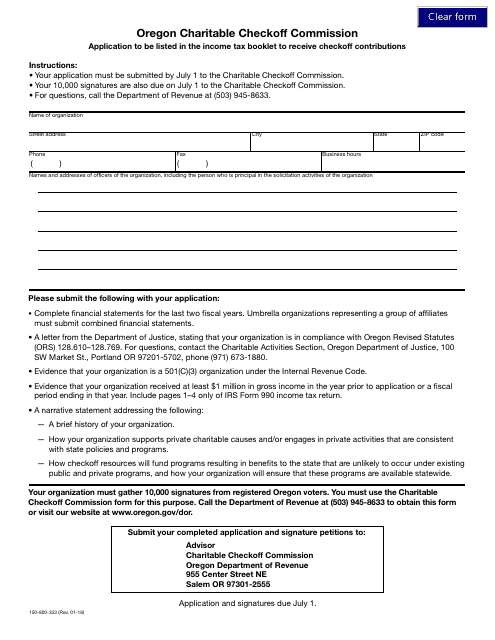

This form is used for applying to be listed in the Oregon income tax booklet in order to receive checkoff contributions.

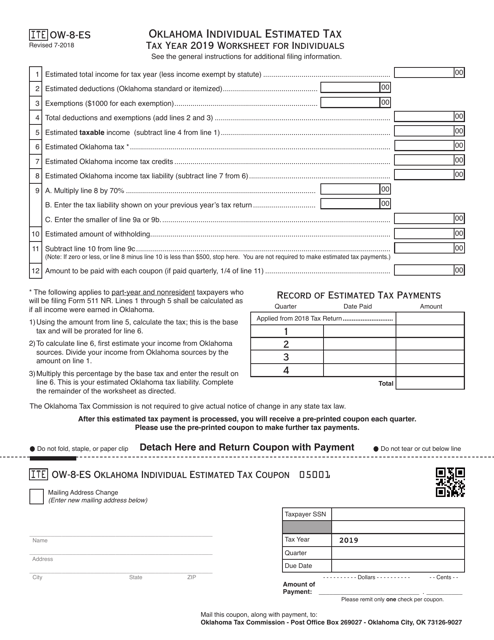

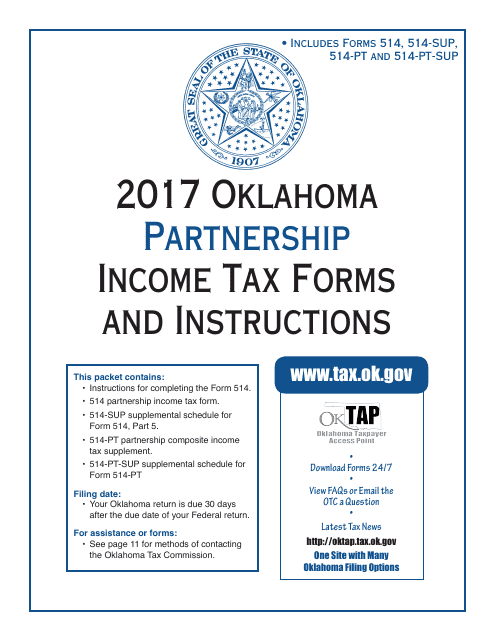

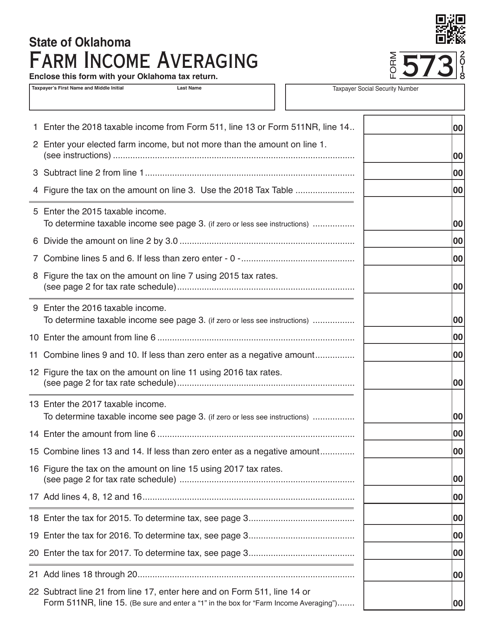

This document provides the necessary forms and instructions for filing partnership income taxes in the state of Oklahoma.

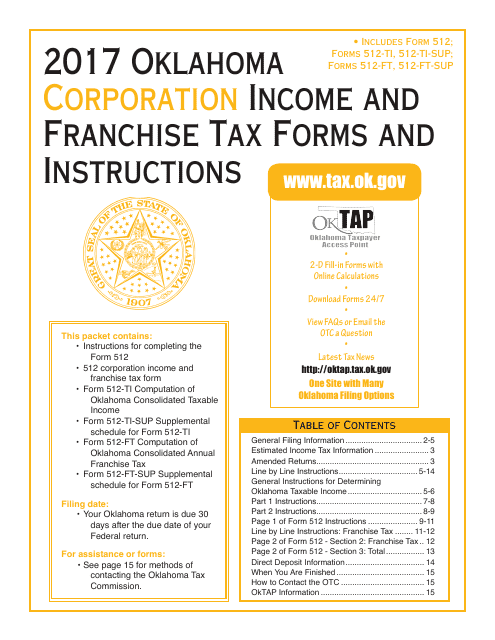

This document provides the necessary forms and instructions for filing corporation income and franchise taxes in the state of Oklahoma.

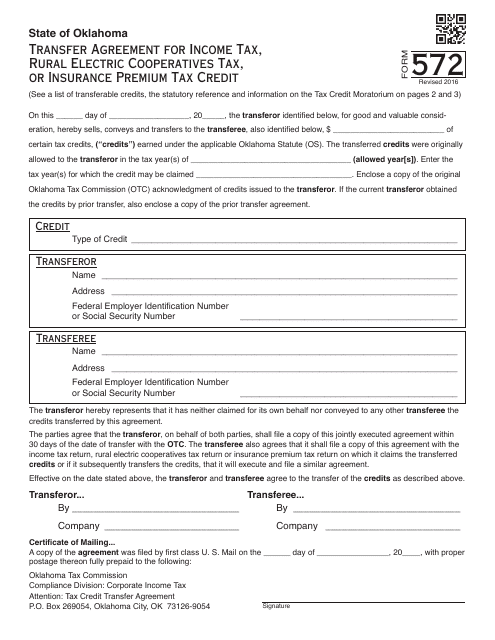

This document is used for transferring agreement related to income tax, rural electric cooperatives tax, or insurance premium tax credit in Oklahoma.

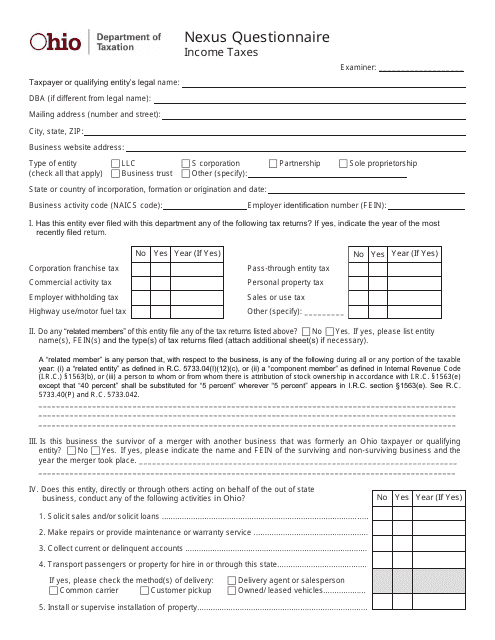

This document is a questionnaire specifically for Ohio residents to determine their income tax obligations. It helps individuals gather and provide the necessary information for completing their tax returns.

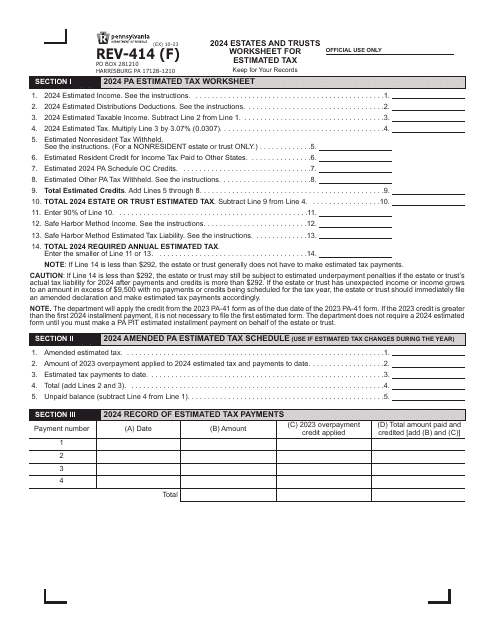

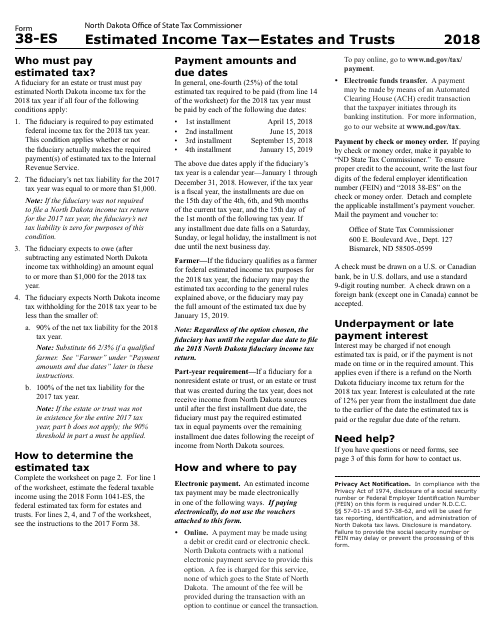

This Form is used for estimating income tax for estates and trusts in North Dakota.

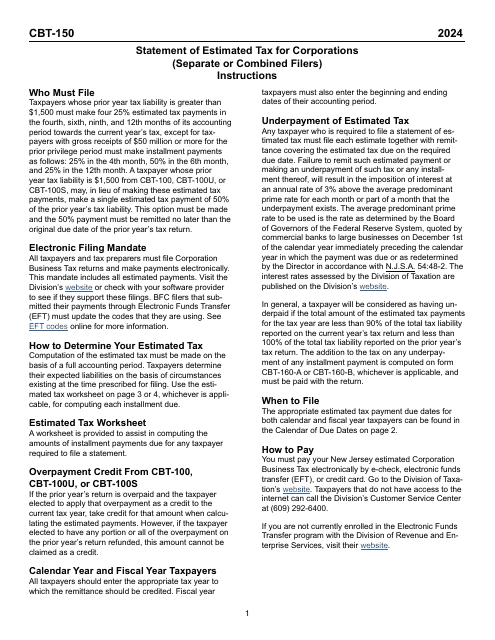

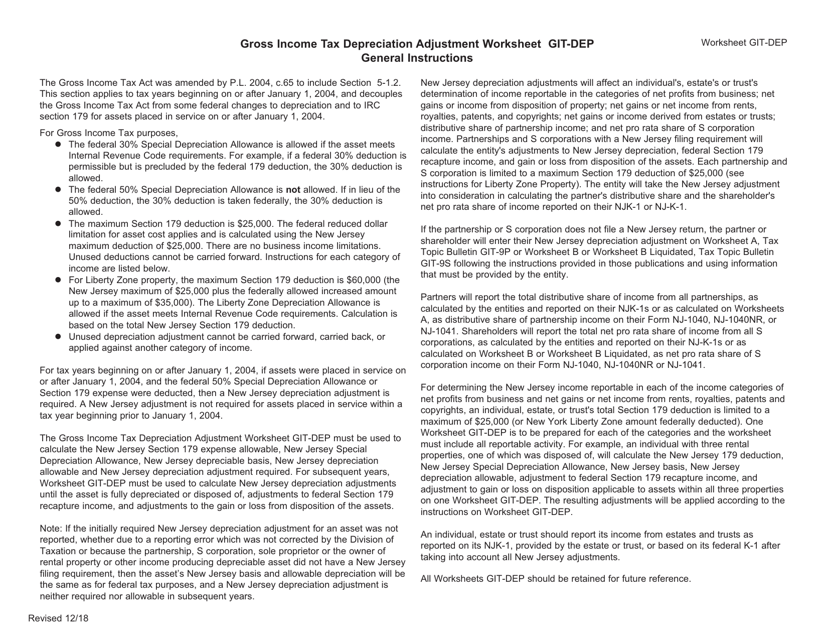

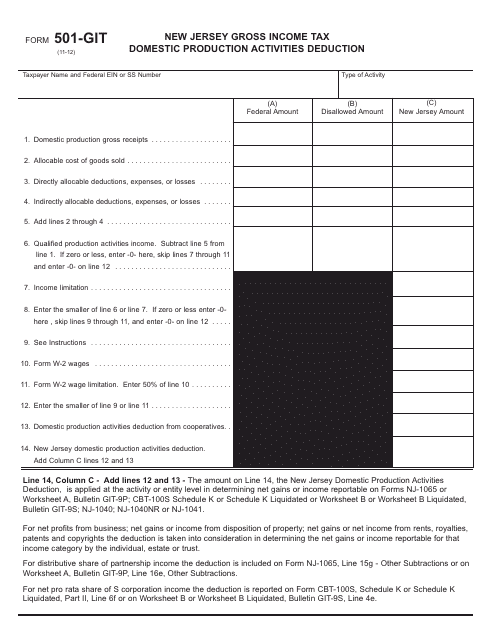

This form is used for claiming the New Jersey Gross Income Tax Domestic Production Activities Deduction in New Jersey. It helps individuals or businesses calculate and report the deduction.

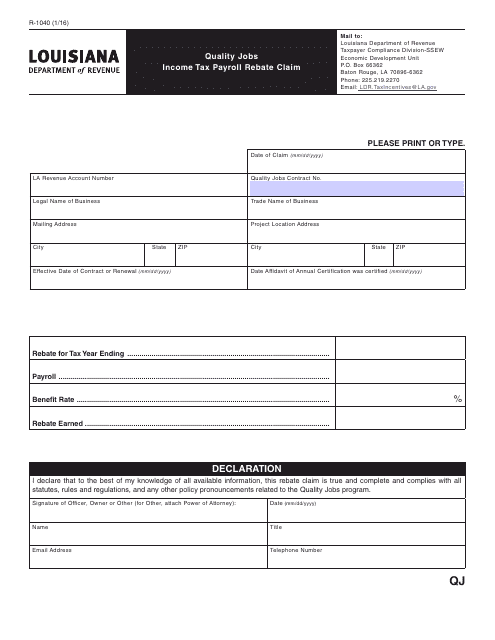

This form is used for claiming a rebate on income tax payroll for quality jobs in Louisiana. It helps taxpayers to receive a refund for their contribution to job growth and development in the state.

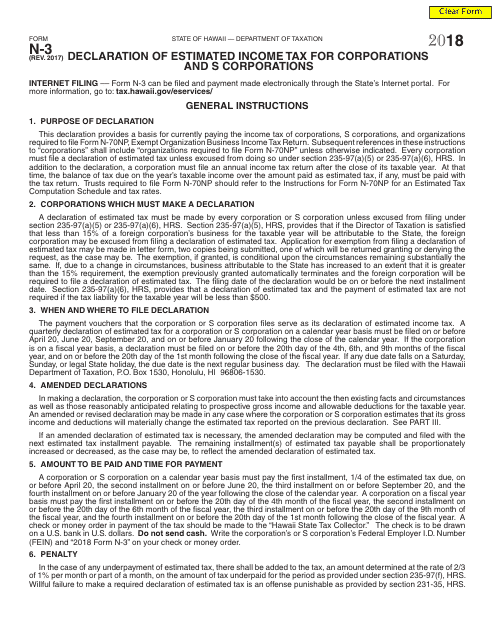

This Form is used for corporations and S corporations in Hawaii to declare their estimated income tax.