Income Tax Form Templates

Documents:

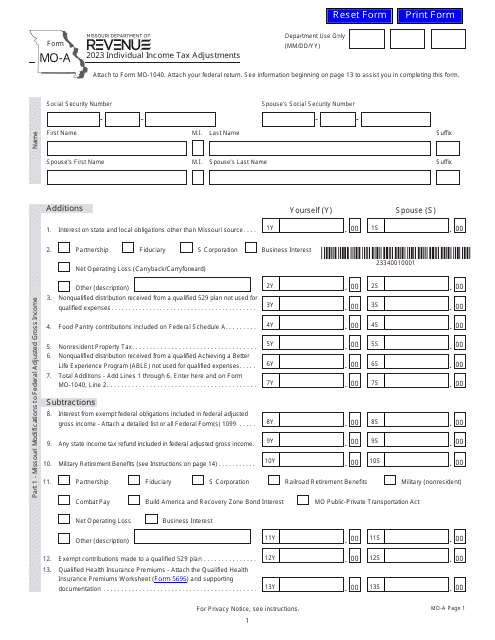

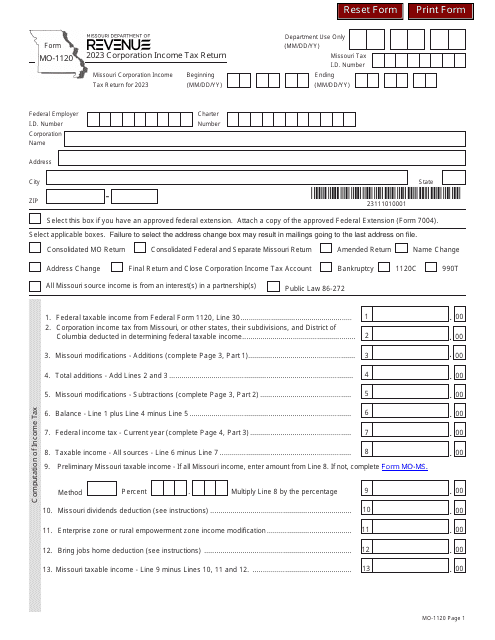

2505

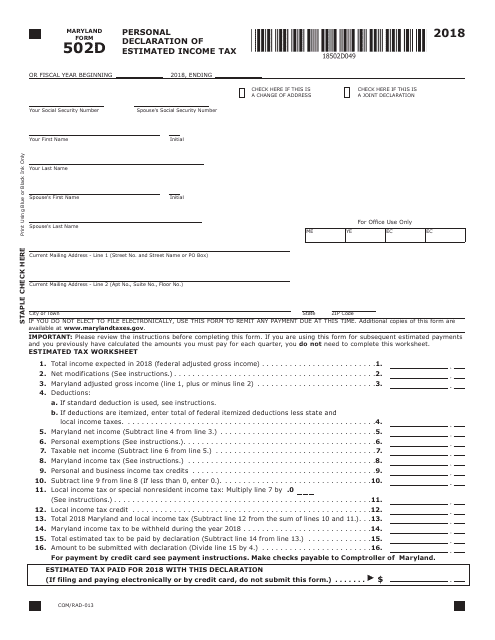

This form is used for residents of Maryland to declare their estimated income tax for the year. It allows individuals to calculate and submit their projected income tax liability to the state.

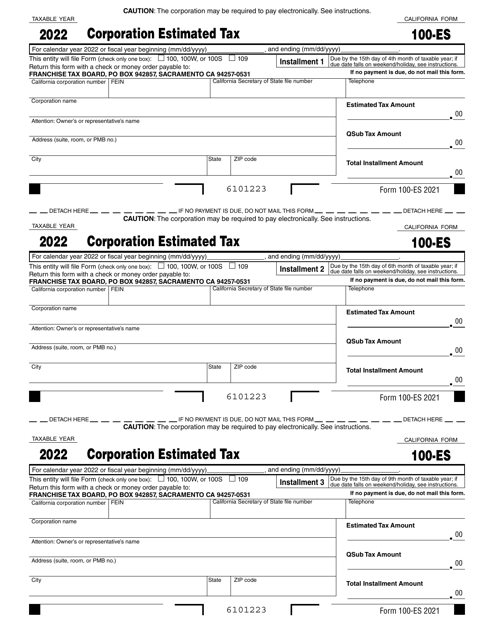

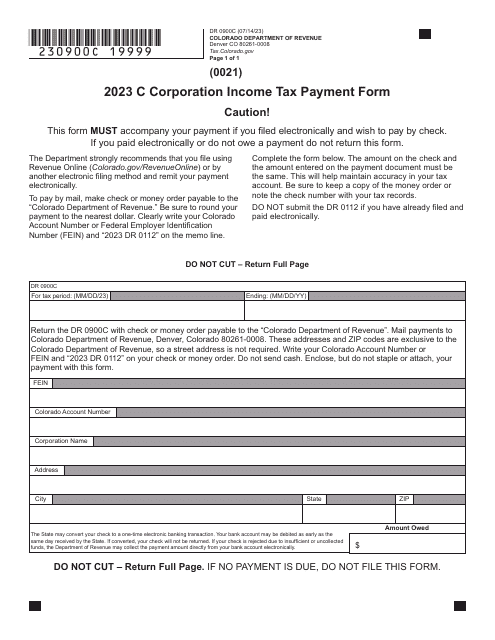

This is a legal document that various financial corporations based in California use to figure estimated tax for a corporation and then mail to the Franchise Tax Board to pay corporate income tax.

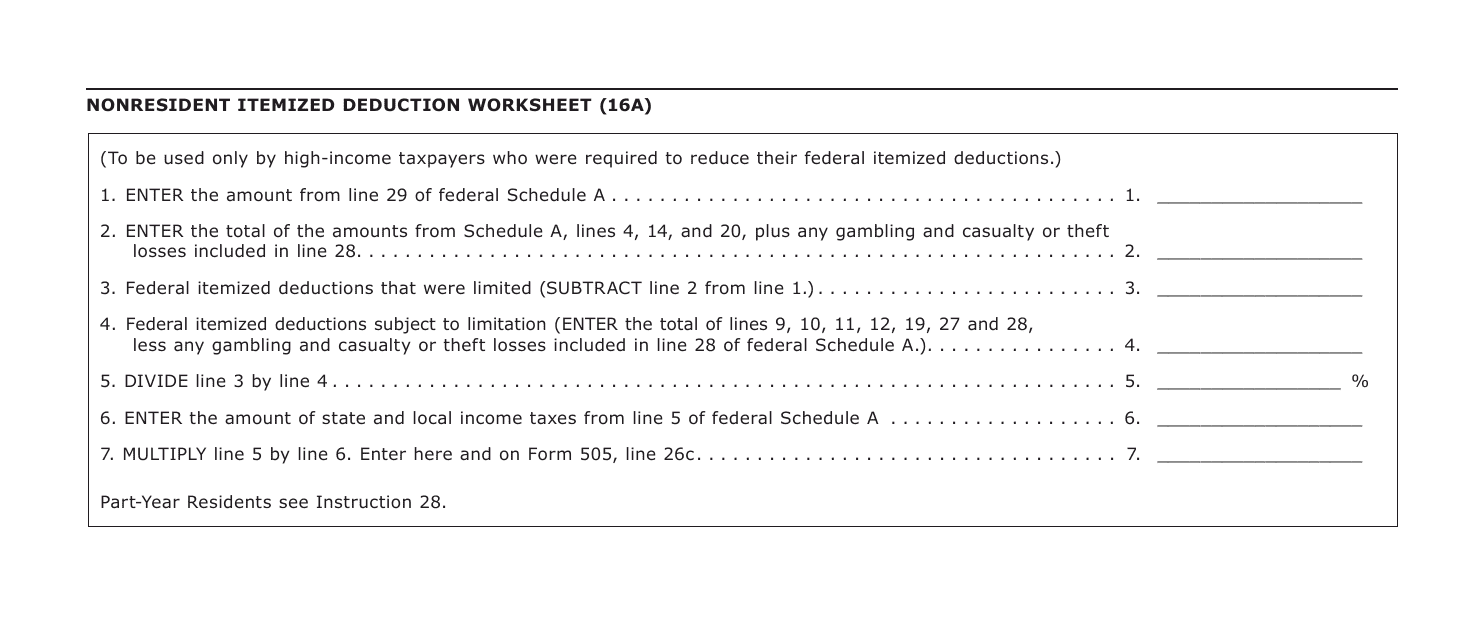

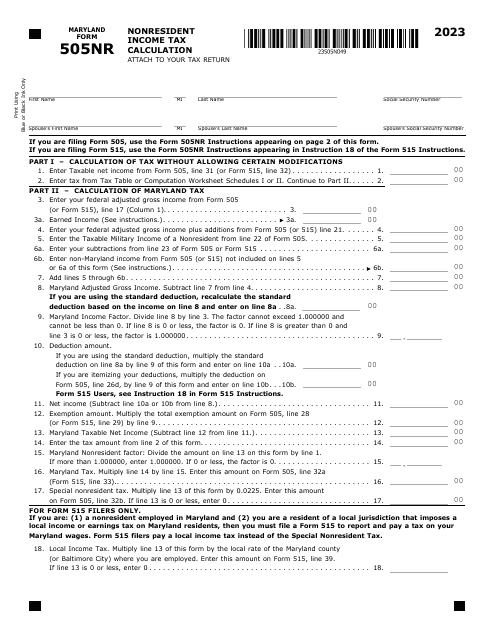

This form is used for calculating nonresident itemized deductions for Maryland state taxes.

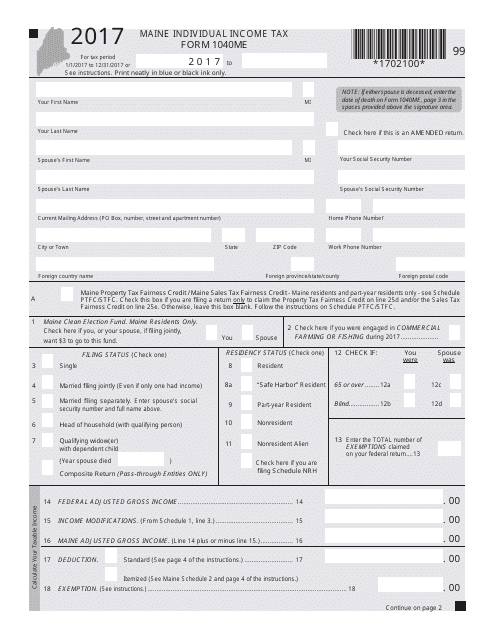

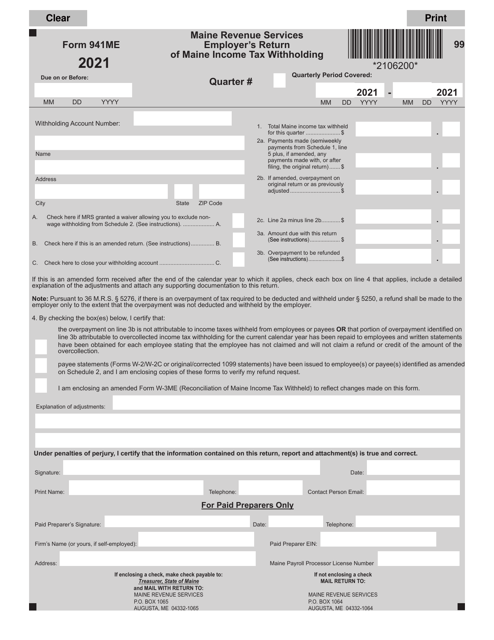

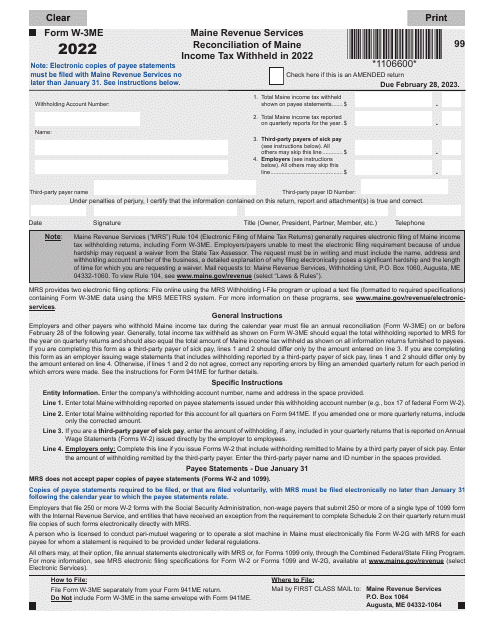

This Form is used for filing individual income tax in the state of Maine.

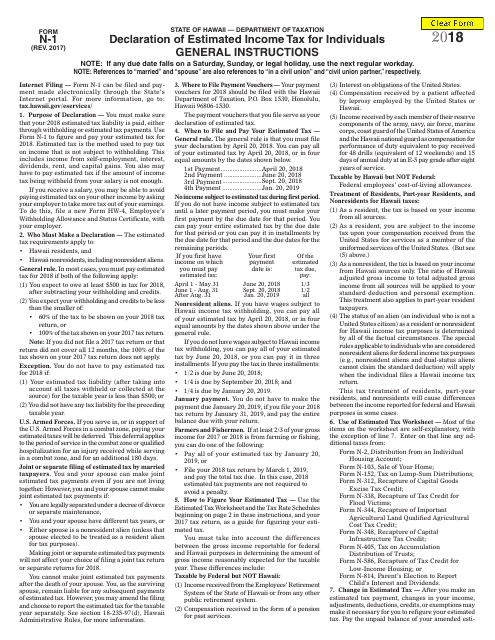

This form is used for individuals in Hawaii to declare their estimated income tax for the year. It is used to estimate and pay taxes throughout the year, rather than waiting until the tax return is due.

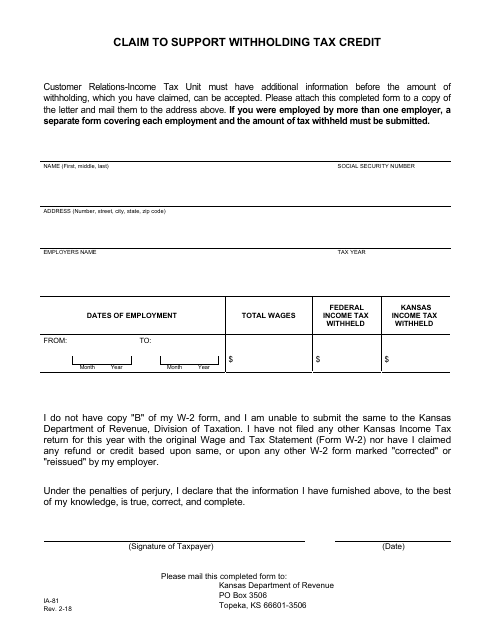

This Form is used for residents of Kansas to claim a withholding tax credit.

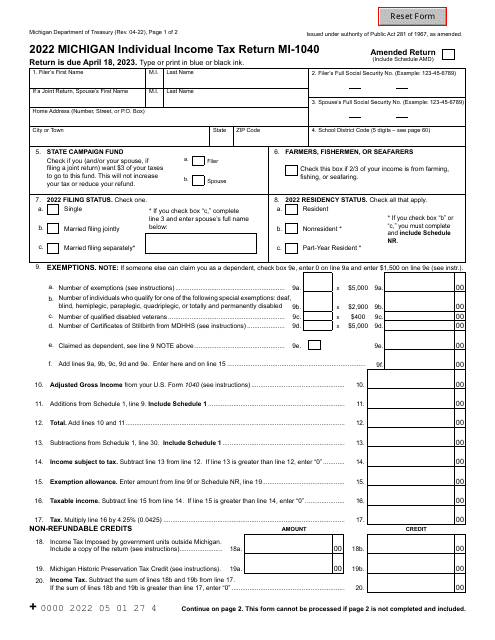

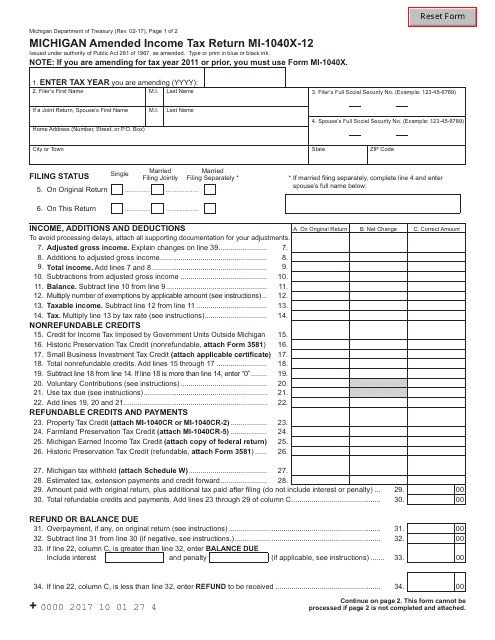

This form is used for filing an amended income tax return in the state of Michigan.

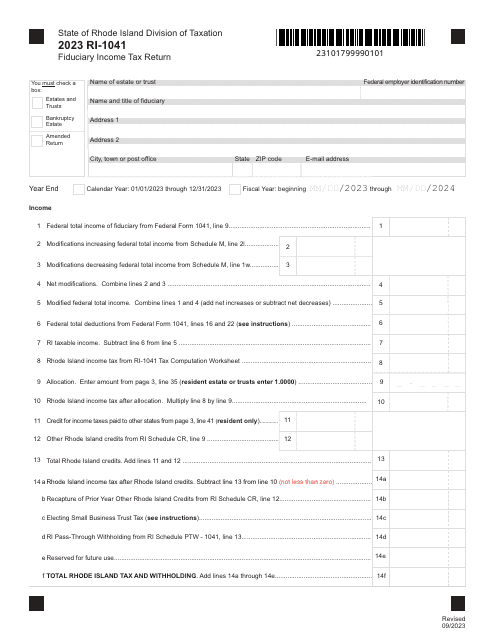

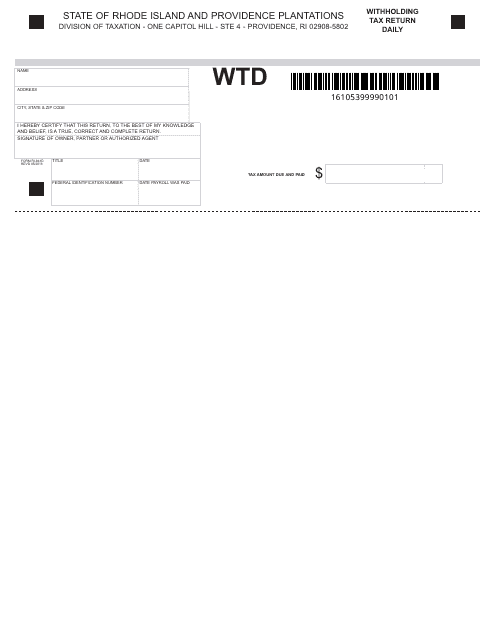

This Form is used for reporting and remitting the withholding tax withholdings made on a daily basis in the state of Rhode Island.

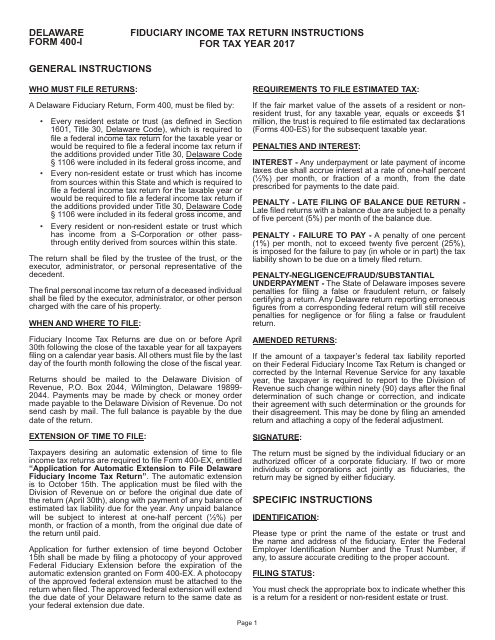

This Form is used for filing the Fiduciary Income Tax Return in the state of Delaware. It provides instructions on how to report income, deductions, and credits for trusts and estates.

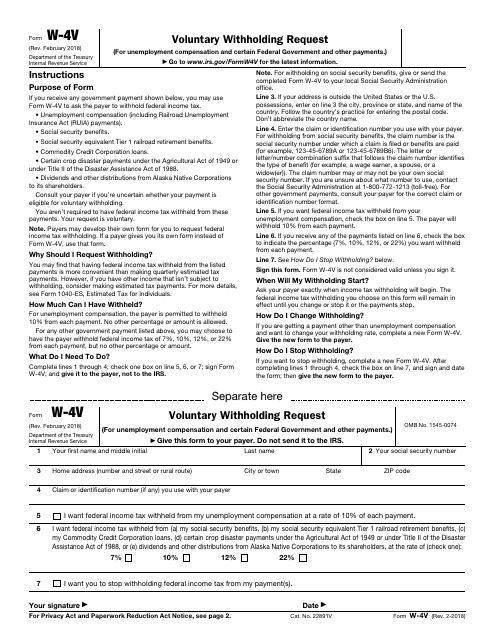

This is a fiscal document used by recipients of government payments to secure tax deductions from those amounts before the payments are sent to them.

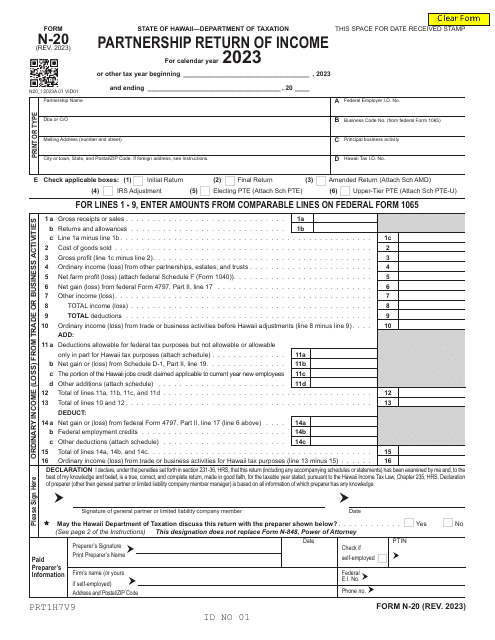

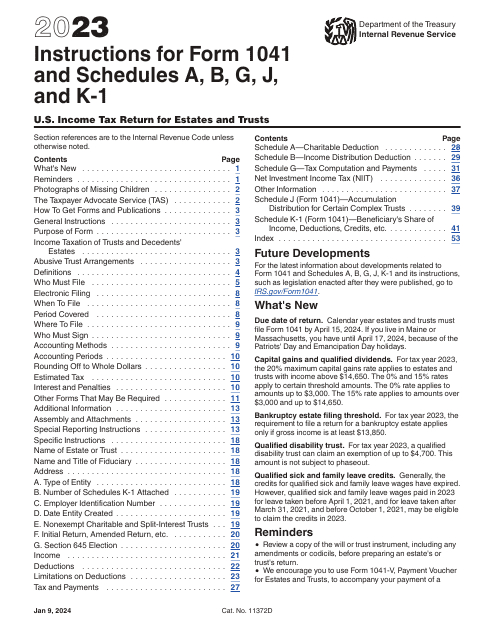

This Form is used for reporting income and expenses of electing large partnerships in the United States.

This document provides instructions for various IRS forms including W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. These forms are used to certify the foreign status of the taxpayer and claim eligibility for tax treaty benefits, exemption from withholding, or reduced withholding rates. The instructions guide taxpayers on how to complete these forms correctly and provide required information to the IRS.