Income Tax Form Templates

Documents:

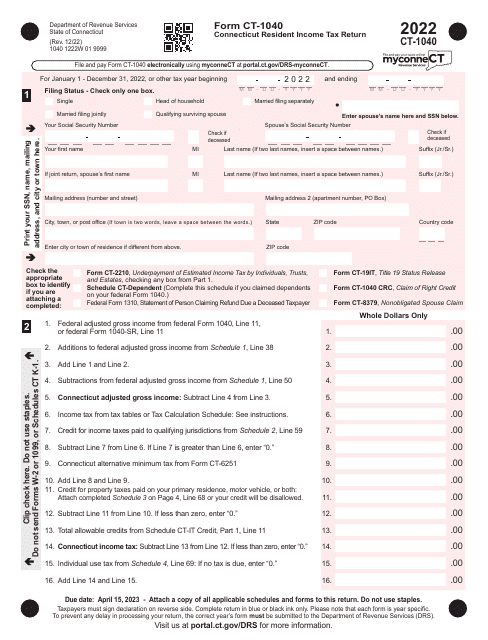

2505

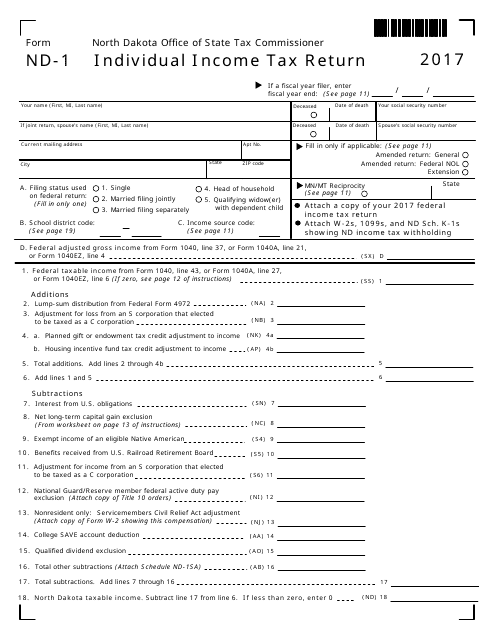

This form is used for filing individual income tax returns in the state of North Dakota.

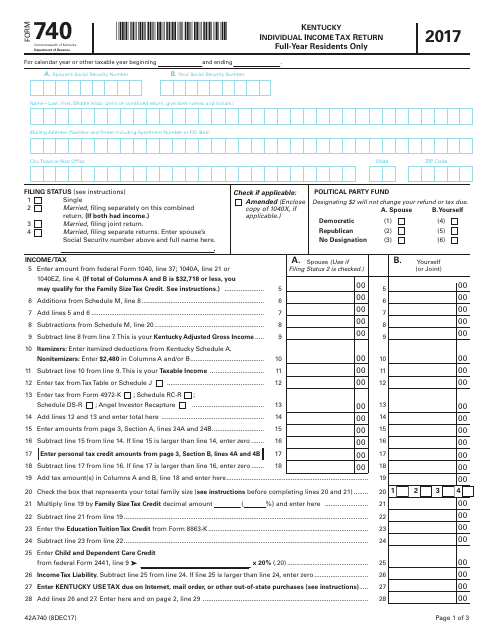

This form is used for filing individual income tax returns for full-year residents of Kentucky.

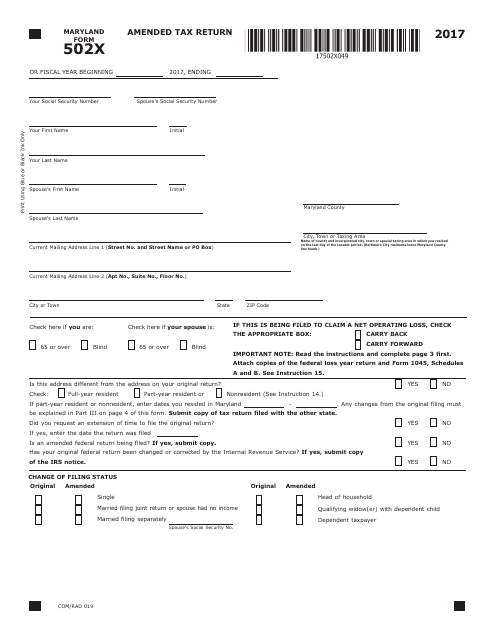

This form is used for filing an amended tax return in the state of Maryland.

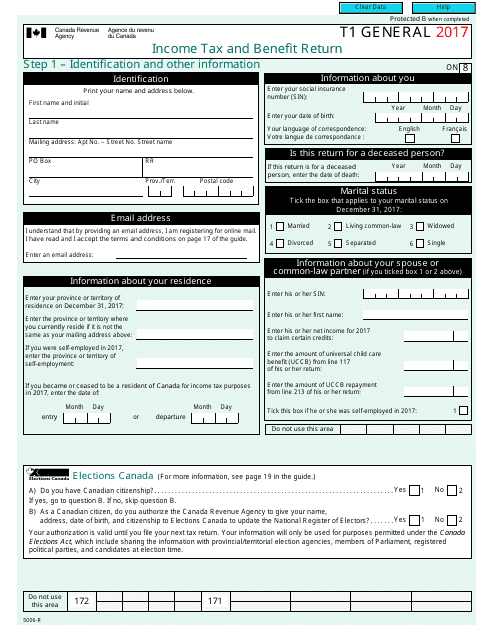

Canadian residents may use this official statement to report their income tax and list all sources of their personal income.

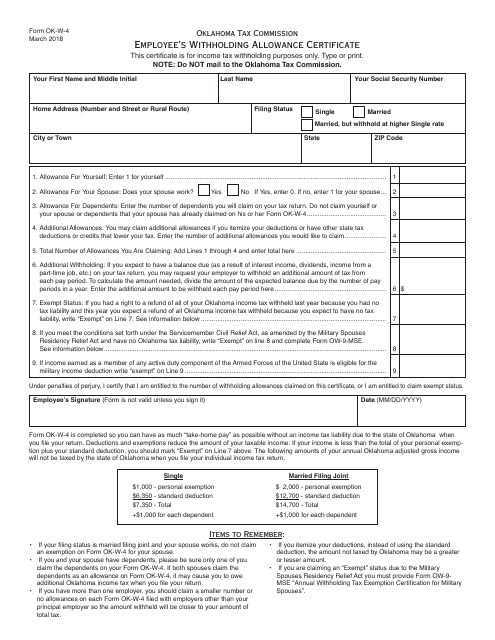

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

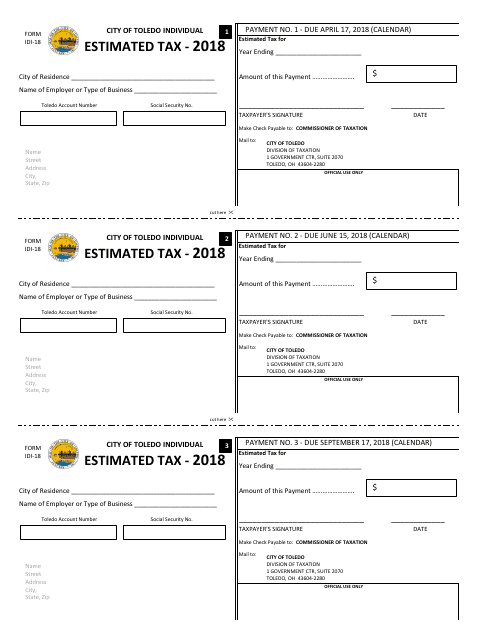

This form is used for individuals in Toledo, Ohio to submit their estimated taxes.

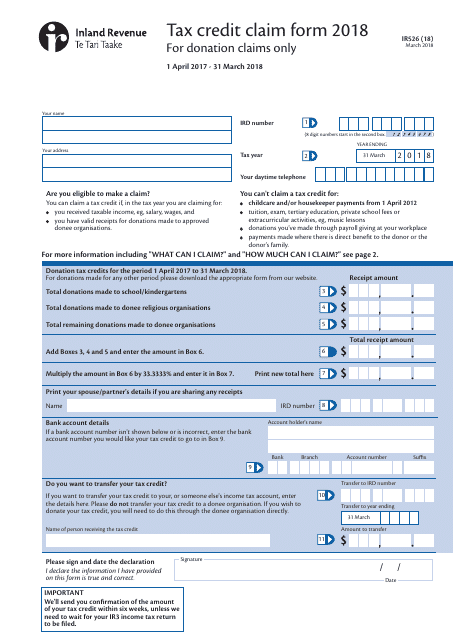

This form is used for claiming tax credits in New Zealand.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

This form is used for providing information to your employer regarding the amount of federal income tax to be withheld from your paycheck. It is specifically designed for residents of Oklahoma.

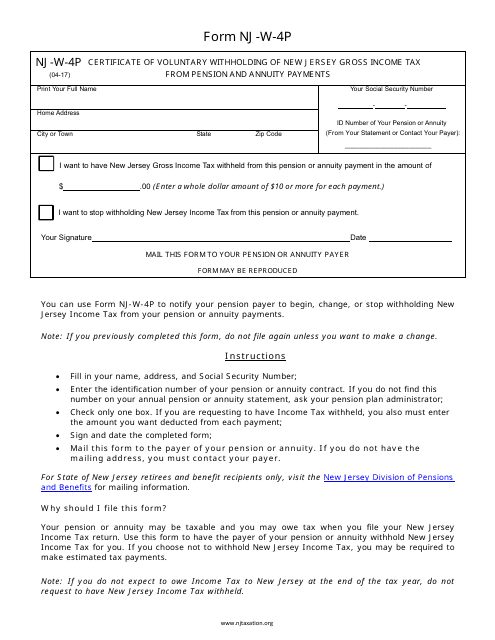

This Form is used for voluntary withholding of New Jersey Gross Income Tax from pension and annuity payments in the state of New Jersey. It allows individuals to request the withholding of a certain amount from their pension or annuity payments to cover their state income tax liability.

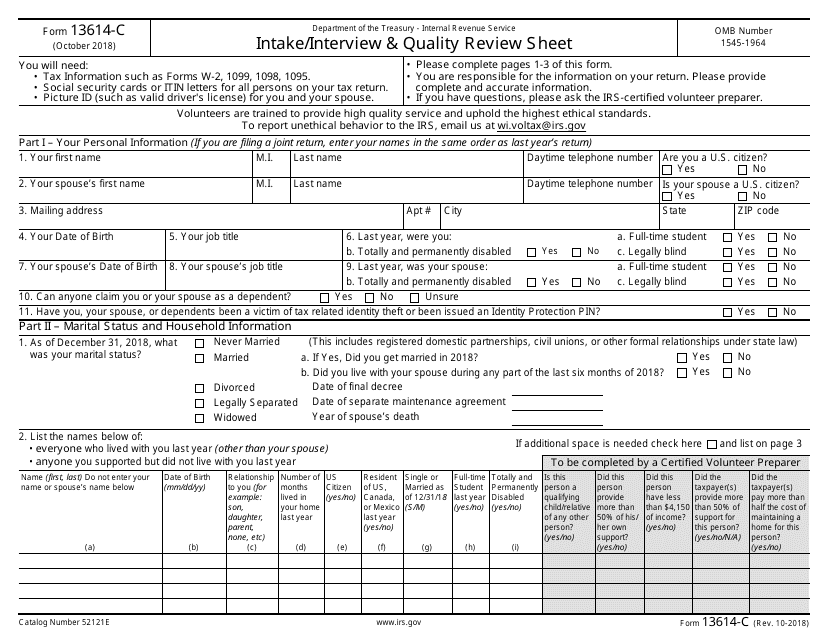

This Form is used for gathering information and conducting interviews with taxpayers to ensure the quality and accuracy of their tax returns.

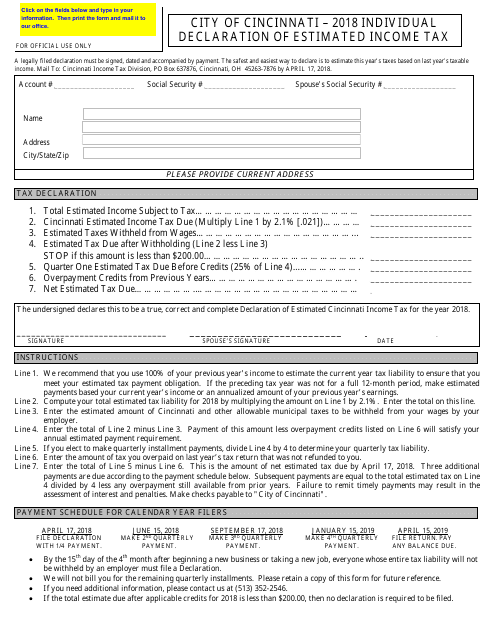

This document is used for individuals to declare their estimated income tax in the City of Cincinnati, Ohio. It is used to estimate and pay the amount of income tax owed to the city throughout the year.

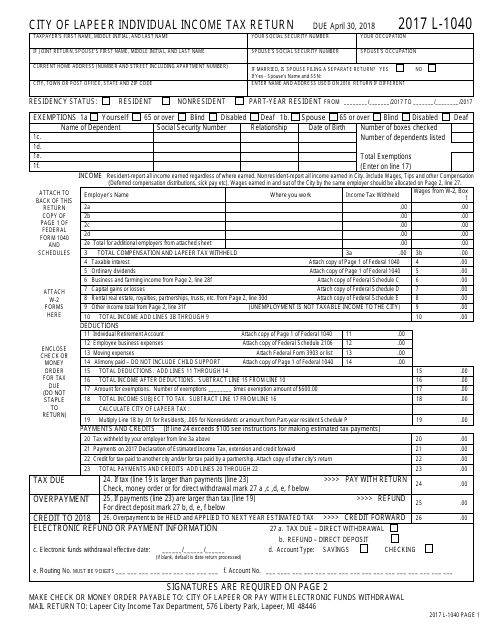

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

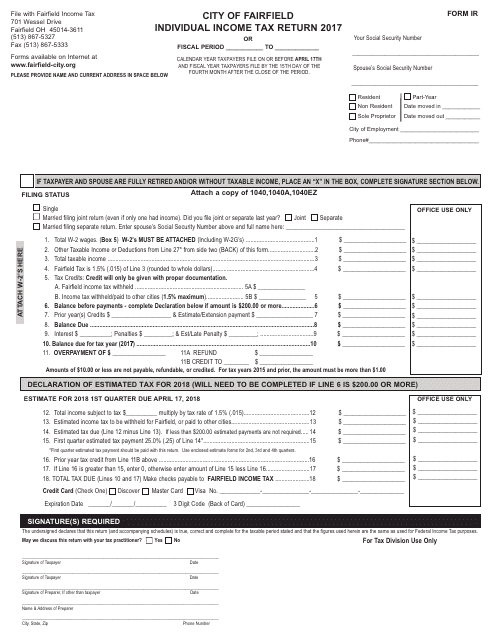

This form is used for filing an individual income tax return in the city of Fairfield, Ohio.

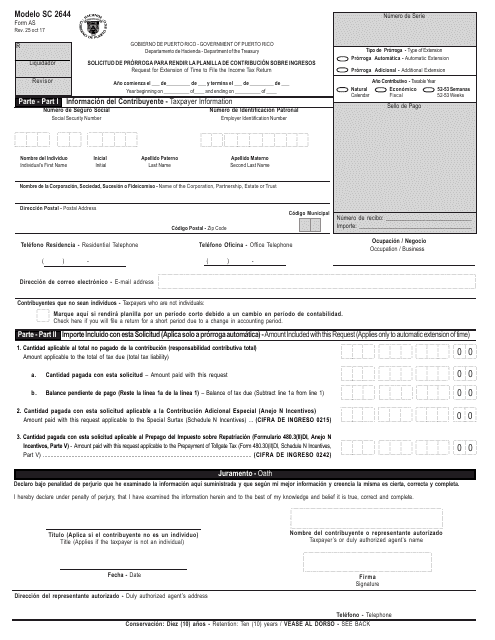

This form is used for requesting an extension to submit the income tax return in Puerto Rico.

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

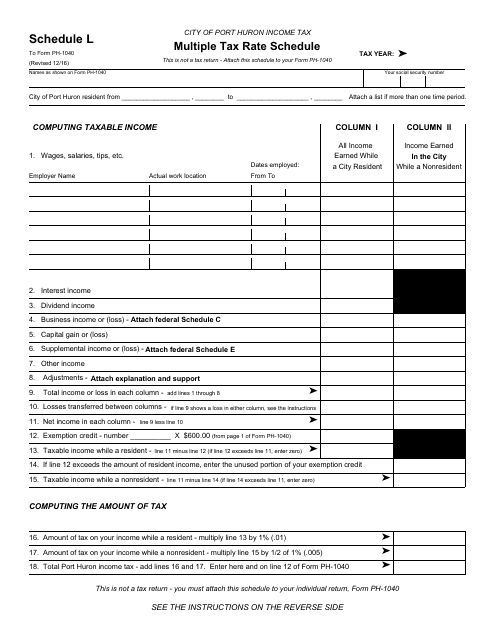

This form is used for determining the applicable tax rate for residents of the City of Port Huron, Michigan.

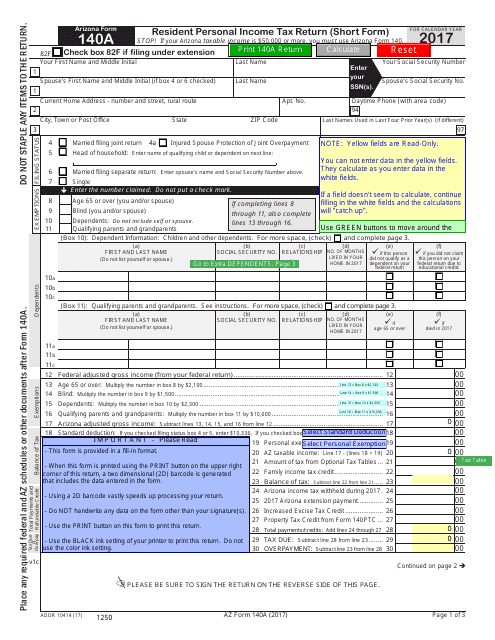

This Form is used for Arizona residents to file their personal income taxes using the short form.

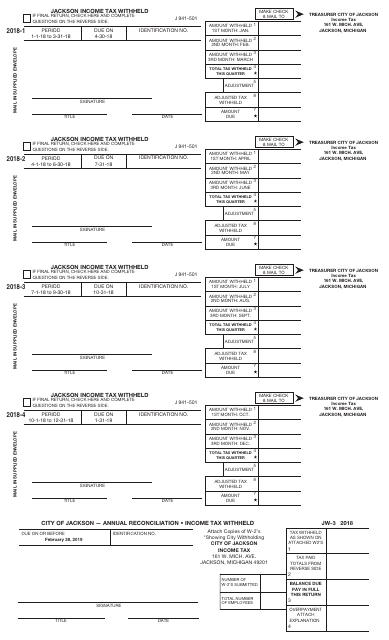

This form is used for reporting income tax withheld by employers in the City of Jackson, Michigan.

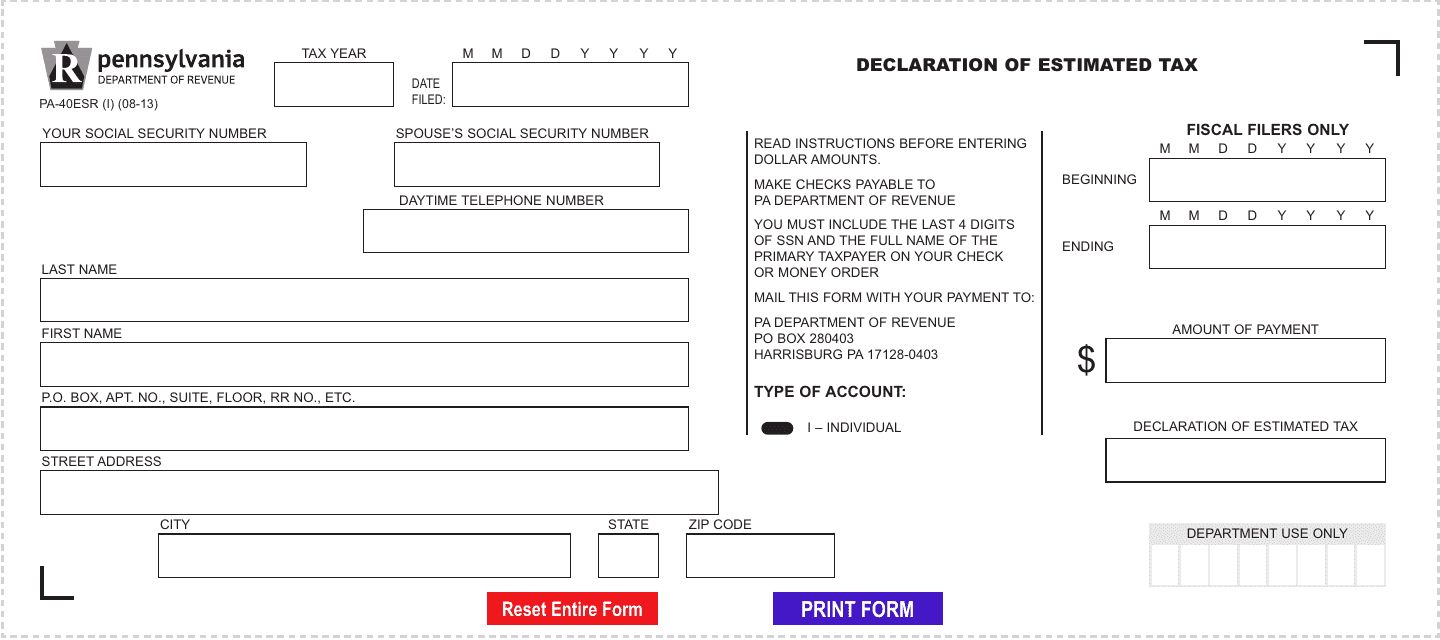

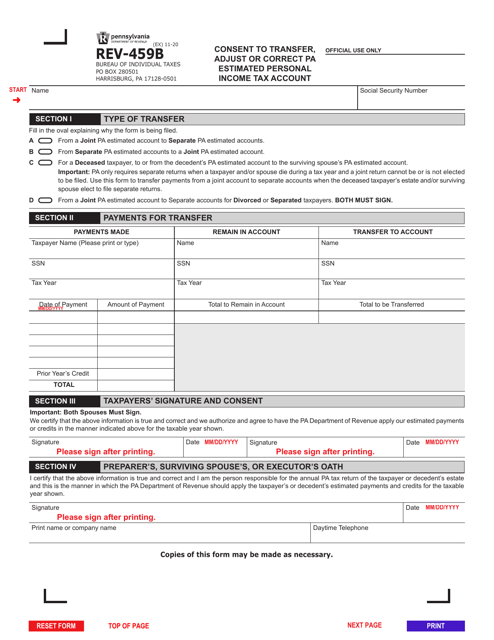

This form is used for declaring estimated tax in the state of Pennsylvania.

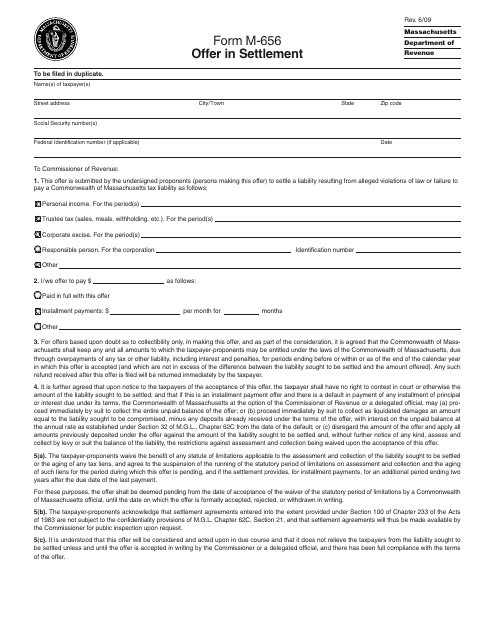

This form is used for making an offer in settlement in the state of Massachusetts.

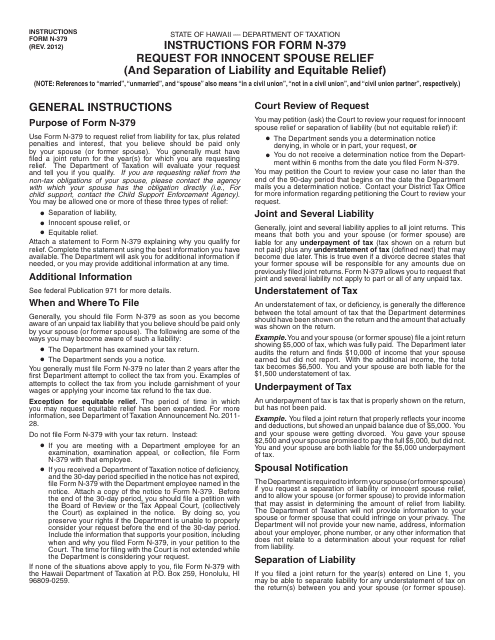

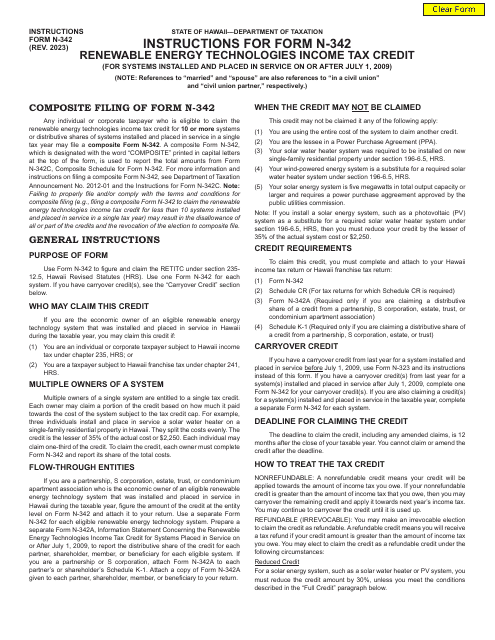

This Form is used for requesting innocent spouse relief in the state of Hawaii. It provides instructions on how to apply for relief from joint tax liability when a spouse or former spouse believes they should not be held responsible for the other spouse's tax obligations.

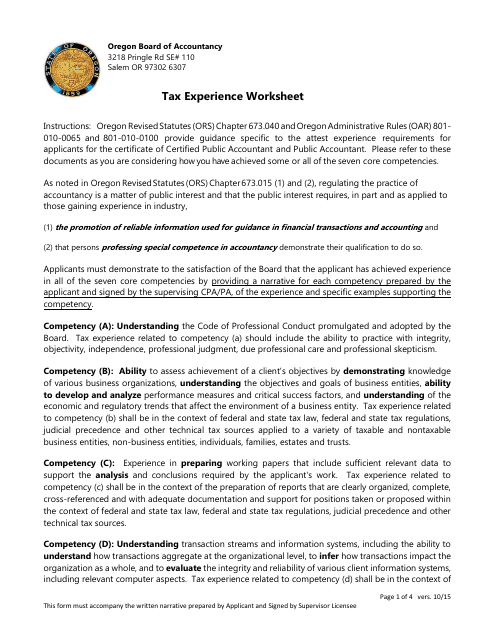

This document is a worksheet specifically for individuals with tax experience in Oregon. It can be used to organize and track relevant information when preparing state taxes in Oregon.

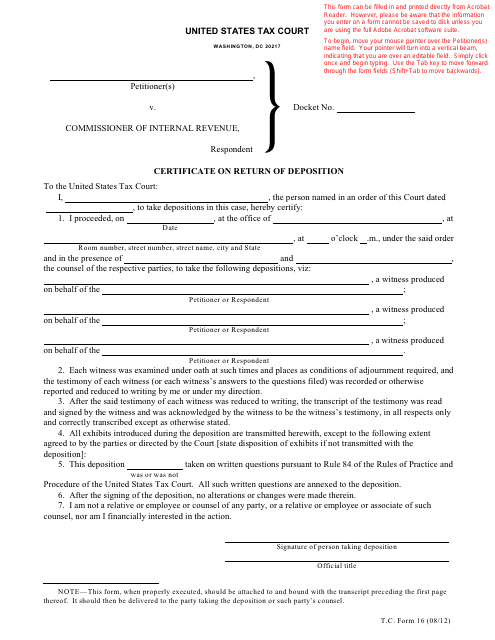

This Form is used for filing a certificate on the return of a deposition in a legal case.

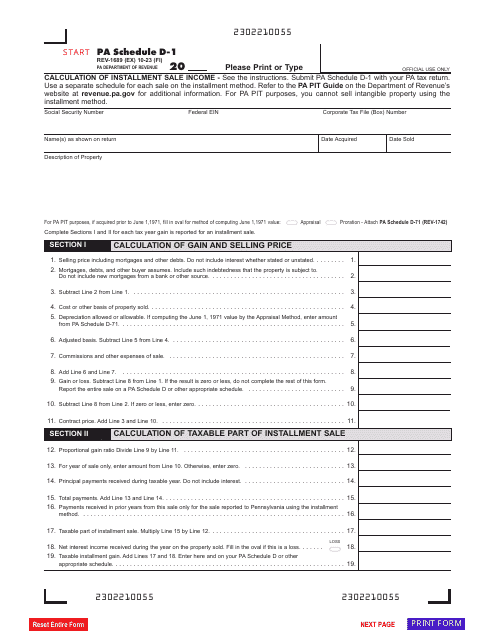

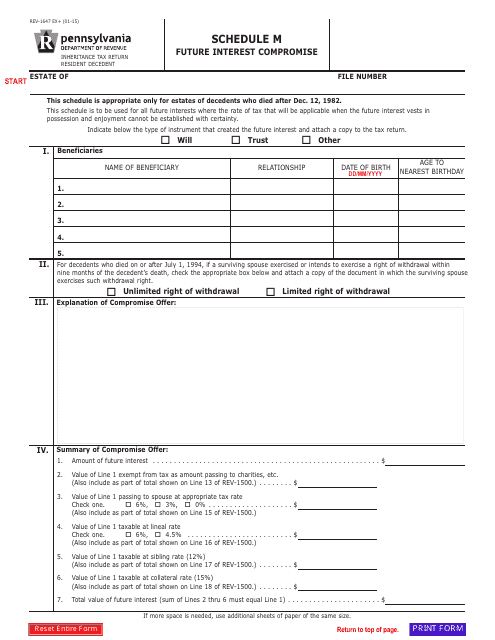

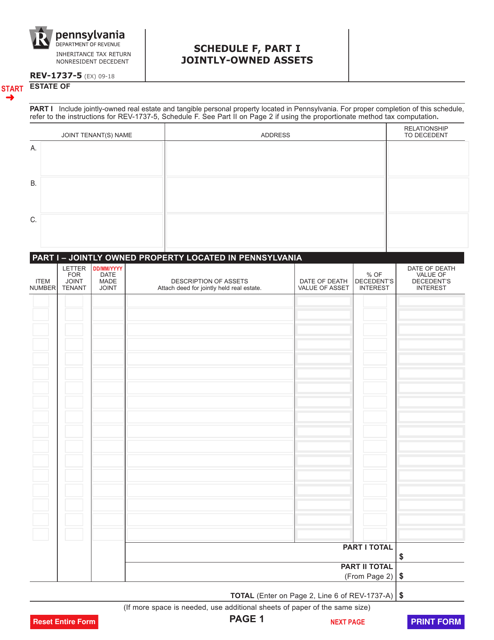

This Form is used for declaring future interest compromise in Pennsylvania.

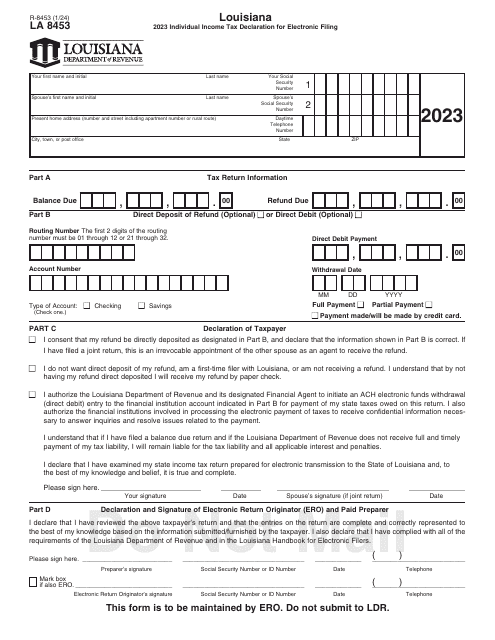

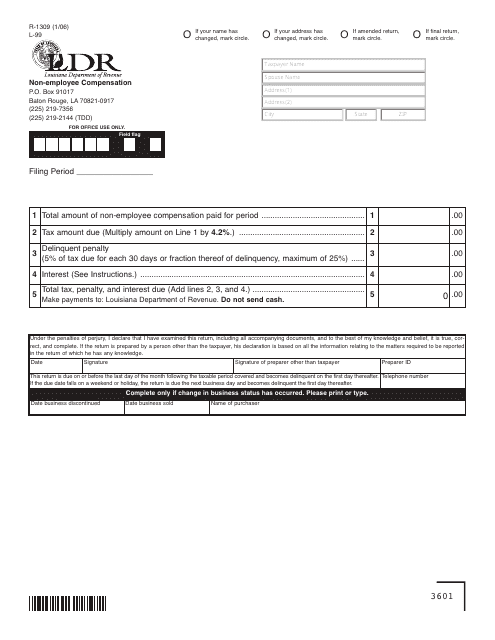

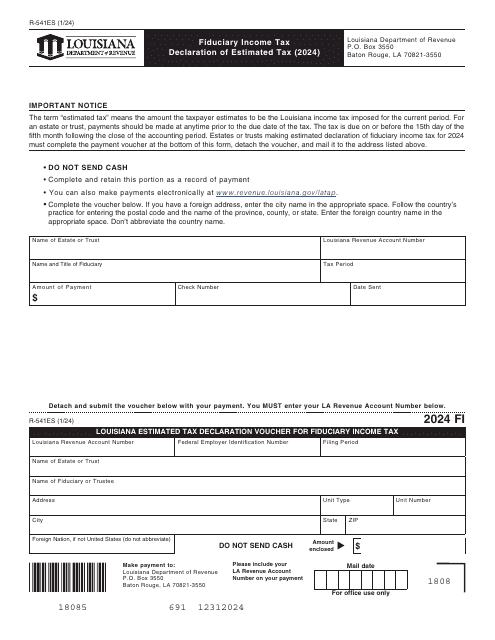

This form is used for reporting non-employee compensation in the state of Louisiana.

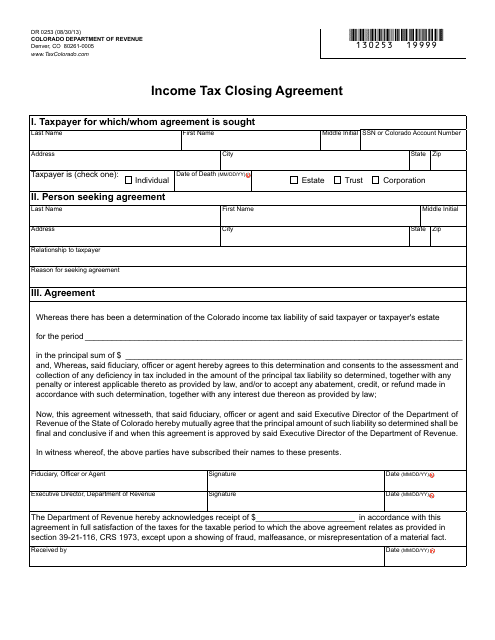

This form is used for filing an income tax closing agreement in the state of Colorado. It is used to resolve any outstanding tax issues with the Colorado Department of Revenue.

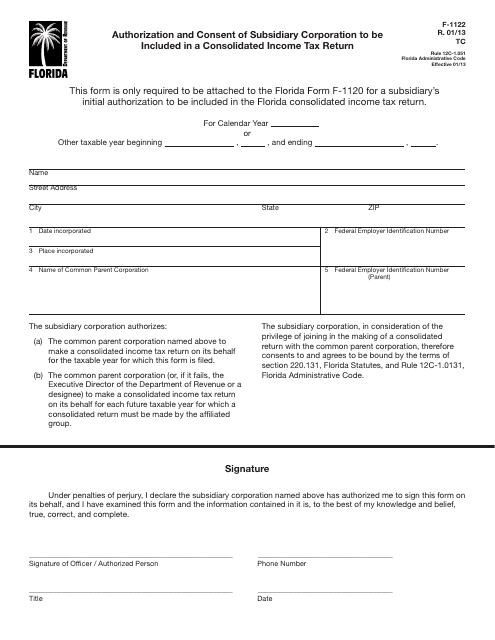

This form is used for a subsidiary corporation in Florida to authorize and give consent to be included in a consolidated income tax return.

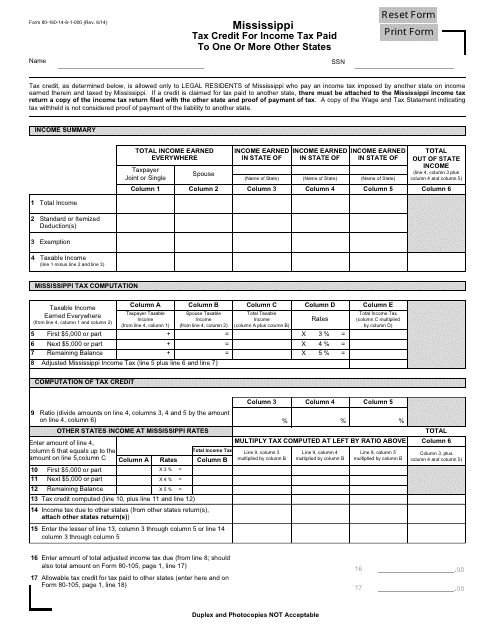

This Form is used for claiming a tax credit in Mississippi for income tax paid to other states.

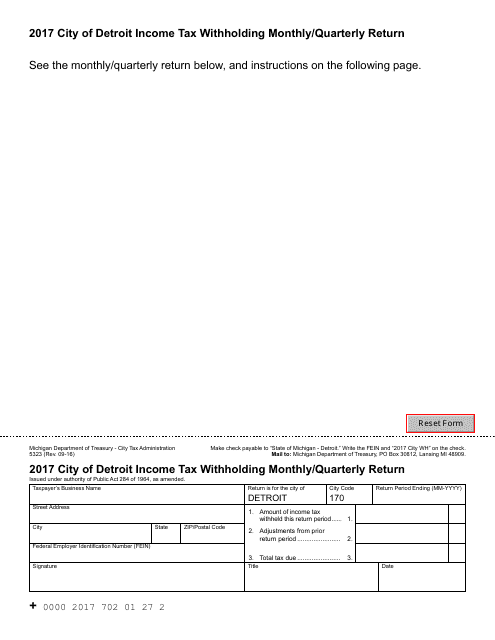

This form is used by businesses in the City of Detroit to report their monthly or quarterly income tax withholdings for employees.