Income Tax Form Templates

Documents:

2505

This research document explores the impact of corporate tax reform on economic growth and wages. It examines how changes in corporate taxes can affect these factors.

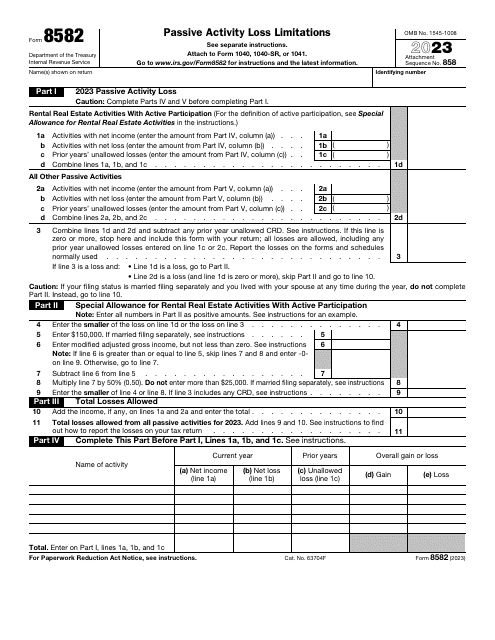

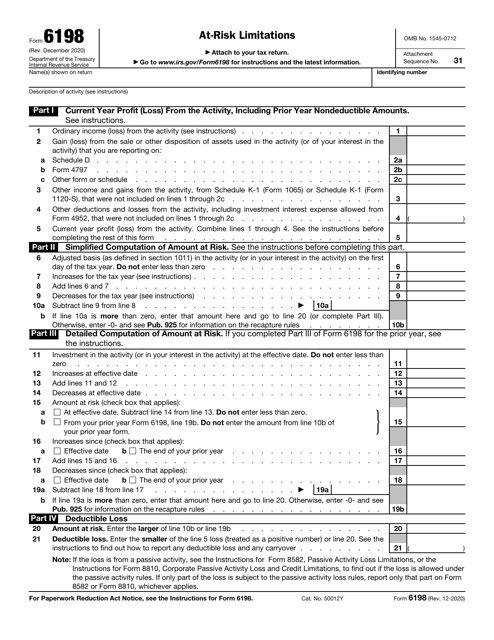

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

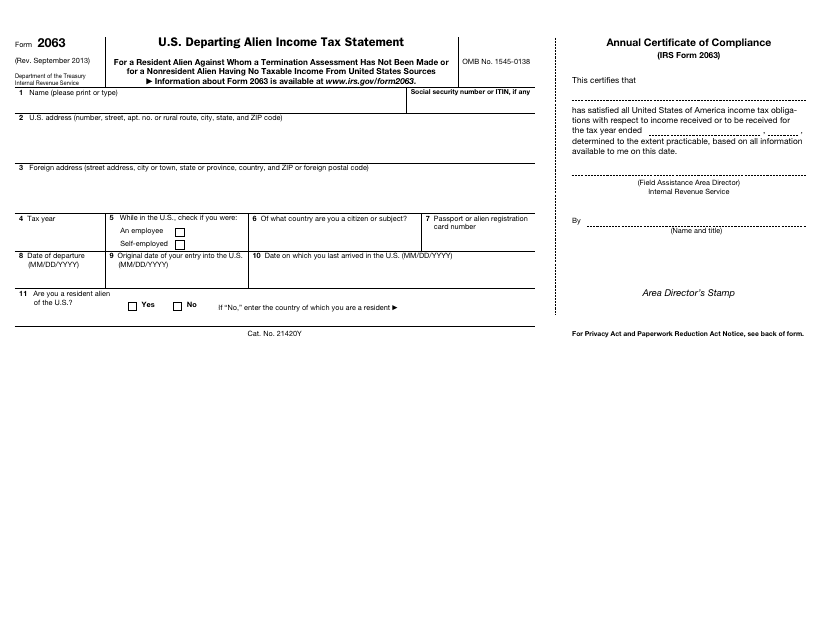

This form is used for reporting income earned by non-resident aliens who are leaving the United States.

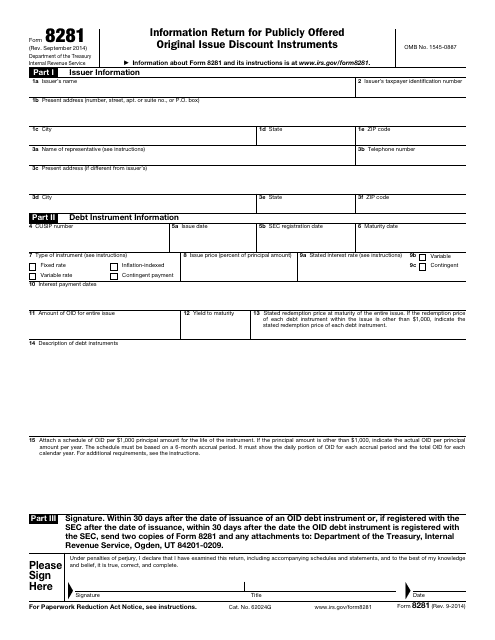

This is a written form filled out and filed by the taxpayers that issued publicly offered debt instruments with an original issue discount.

This is a fiscal form used by taxpayers that need to inform the tax organs about the financial profit they generated through transactions with real estate.

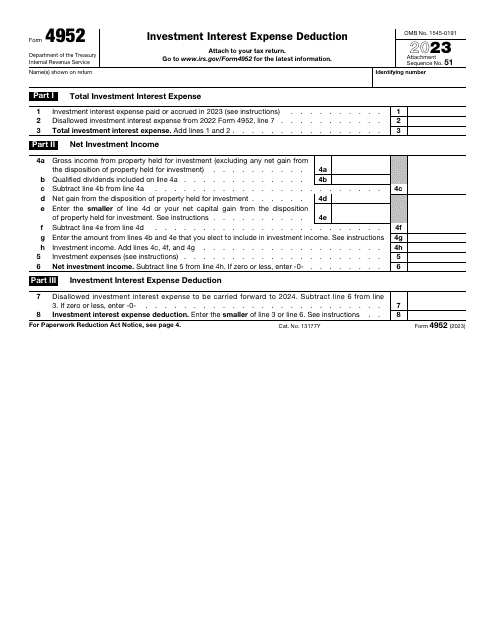

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

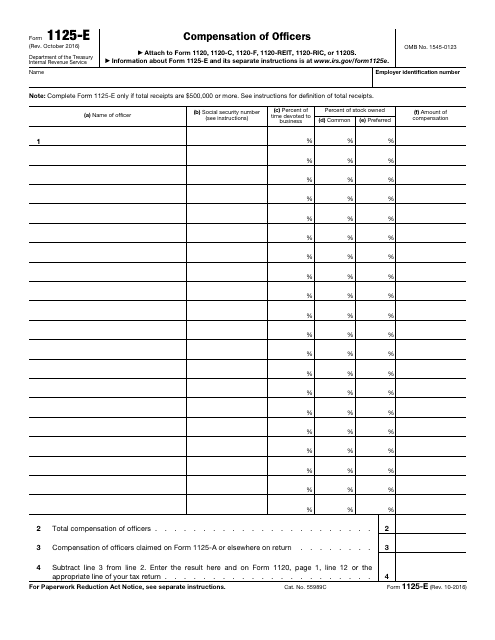

This IRS form is used to provide a detailed report in regards to the deduction for compensation of officers when an entity has $500,000 or more in total receipts.

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

This is a supplementary form used by employers to handle errors they have made upon filing IRS Form W-2, Wage and Tax Statement.

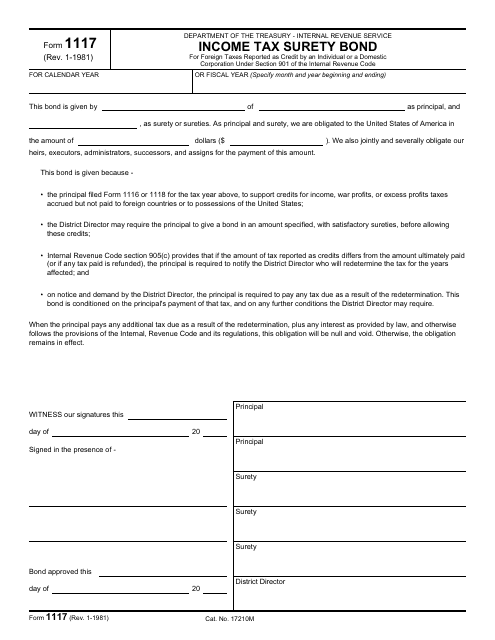

This document is used for filing an income tax surety bond with the Internal Revenue Service (IRS).

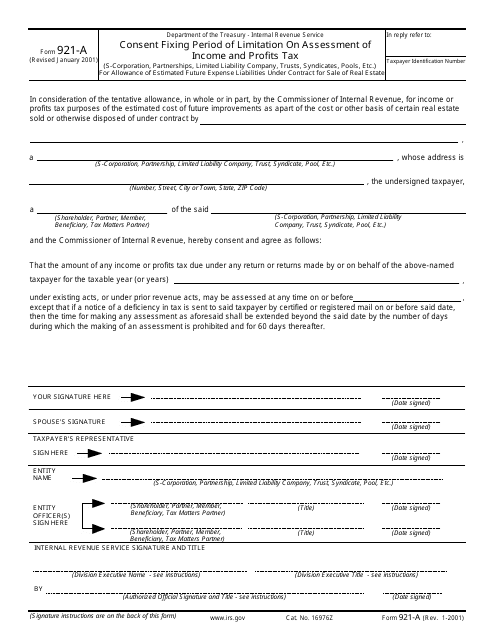

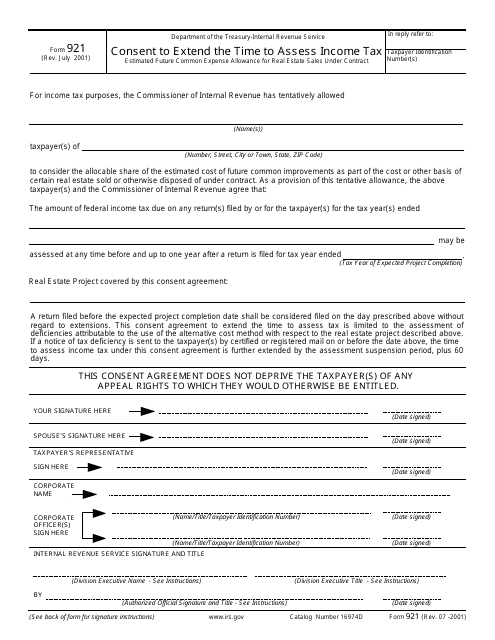

This is a legal document filed by real estate developers to extend the period for tax assessment and request the use of the estimated costs of common modifications and improvements on a project-by-project basis.

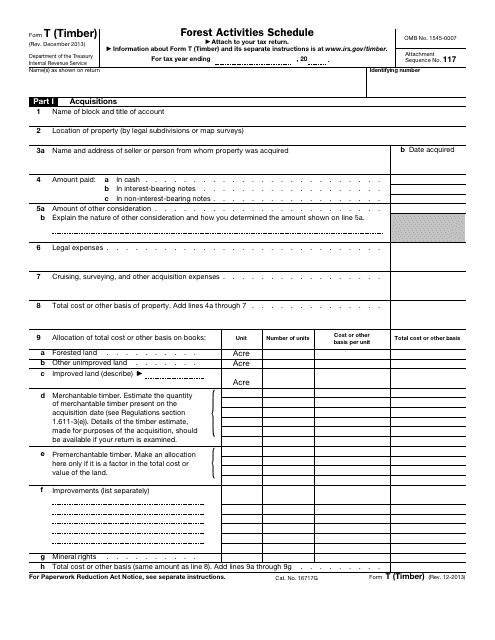

This document for reporting forest activities related to timber to the IRS.

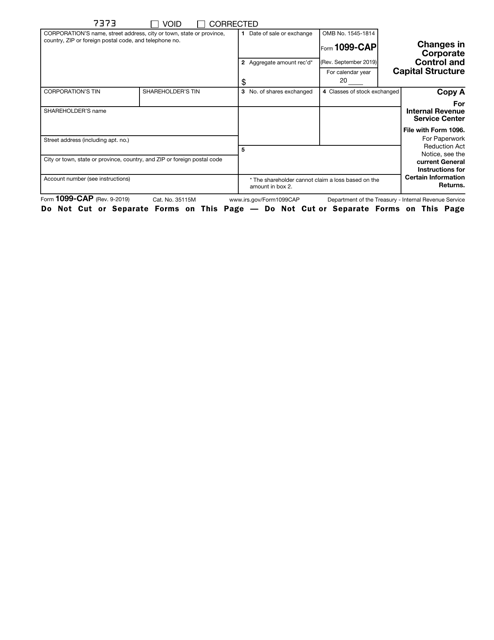

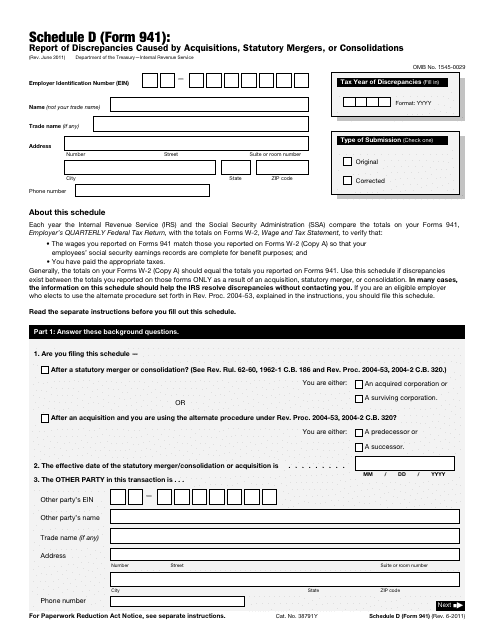

This document is used to report discrepancies resulting from acquisitions, statutory mergers, or consolidations. It is specific to Form 941, which is used by employers to report employment taxes.

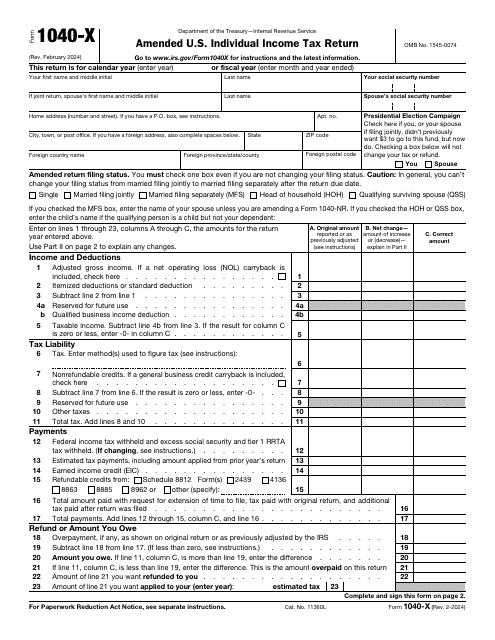

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

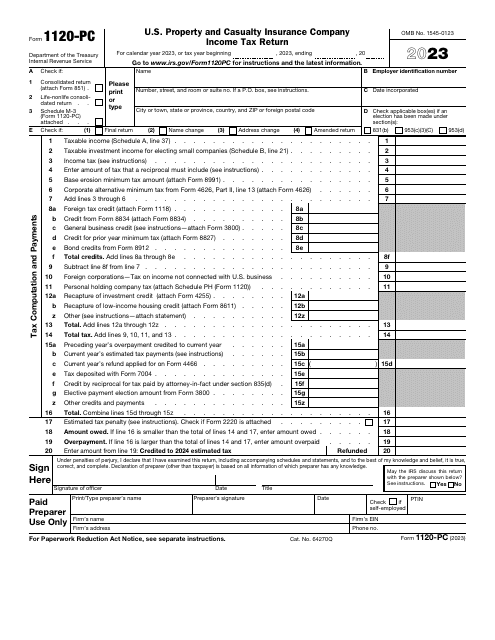

This form is filed by non-life insurance companies wishing to inform the Internal Revenue Service (IRS) of their income, deductions, and credits, as well as to figure their income tax liability.

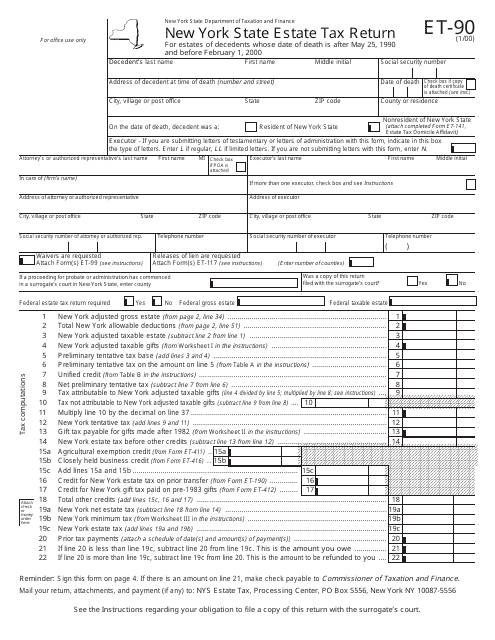

This form is used for reporting and paying estate taxes in the state of New York.

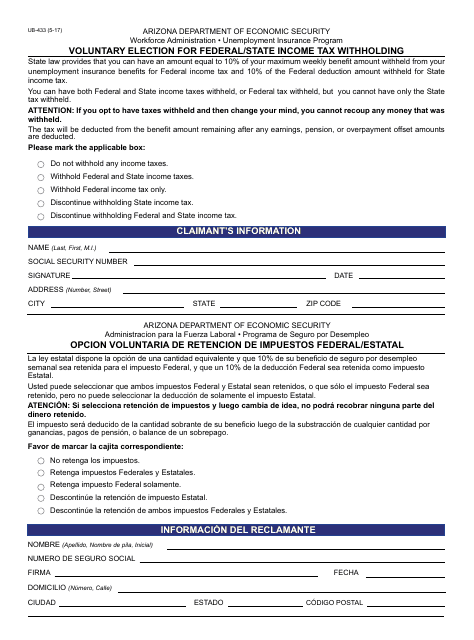

This form is used for voluntary election for federal/state income tax withholding in Arizona. It is available in both English and Spanish.

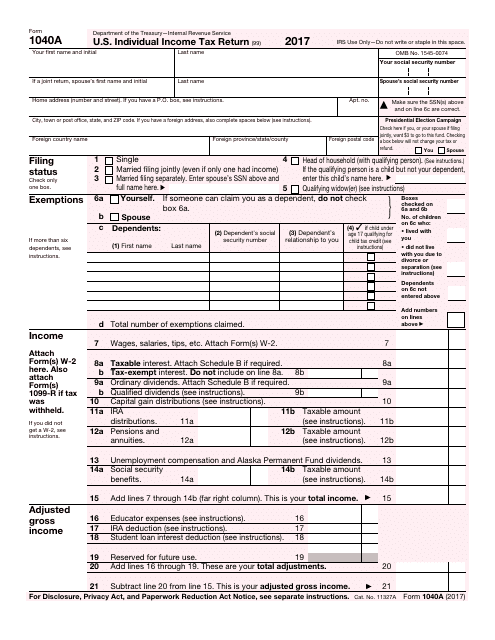

This Form is used for filing a simplified version of the U.S. Individual Income Tax Return. It is intended for taxpayers who have limited income and deductions.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

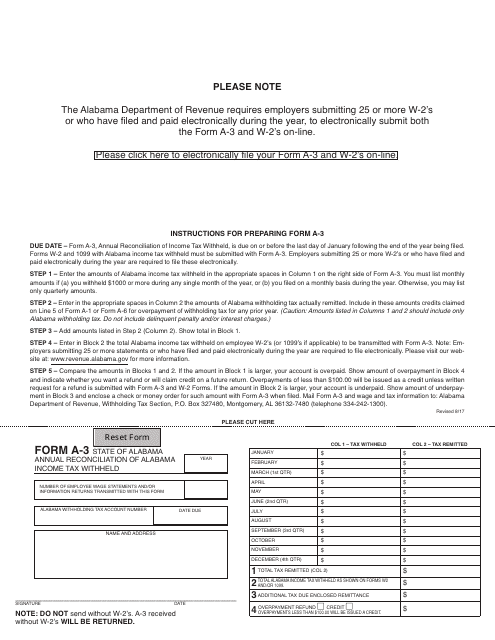

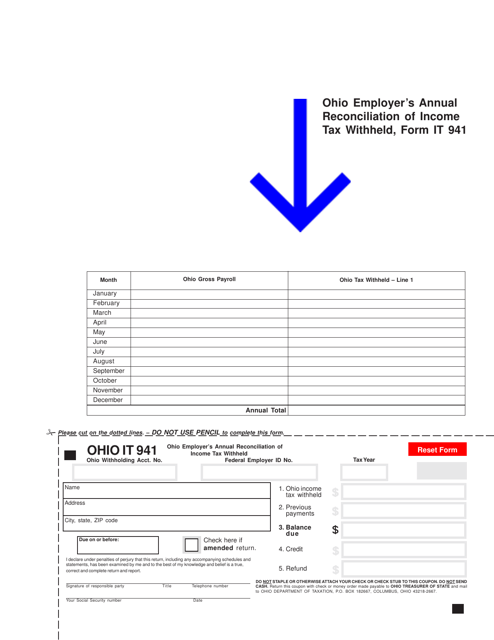

This form is used for the annual reconciliation of Alabama income tax withheld in the state of Alabama.

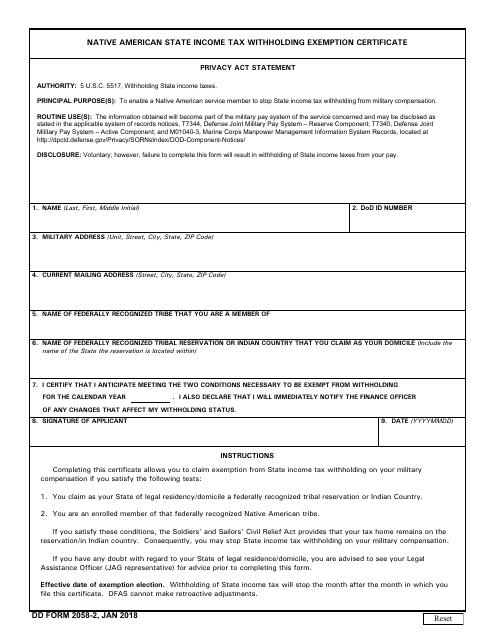

This is a document used by Native American service men and service women to claim state income tax exemption on their military pay.

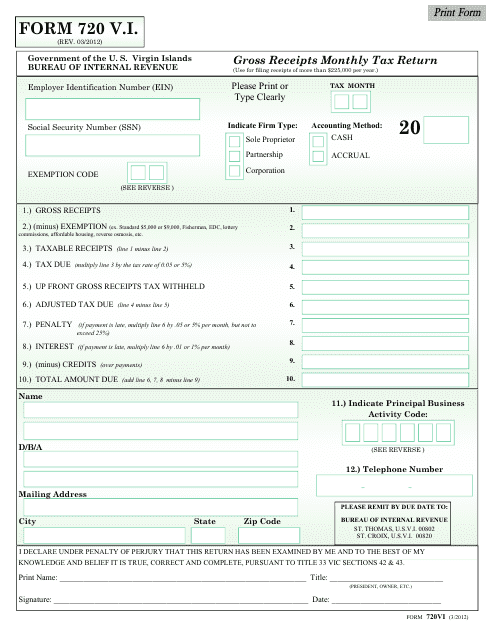

This form is used for reporting monthly gross receipts tax in the US Virgin Islands.

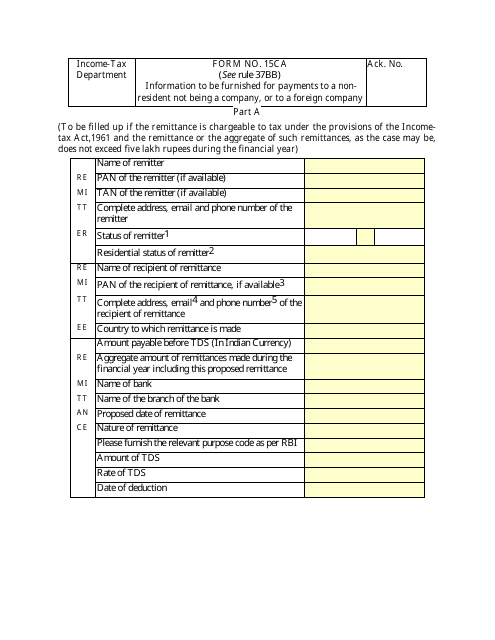

This form is used for providing information about payments made to non-residents or foreign companies in India. It is necessary for tax purposes and ensuring compliance with Indian regulations.

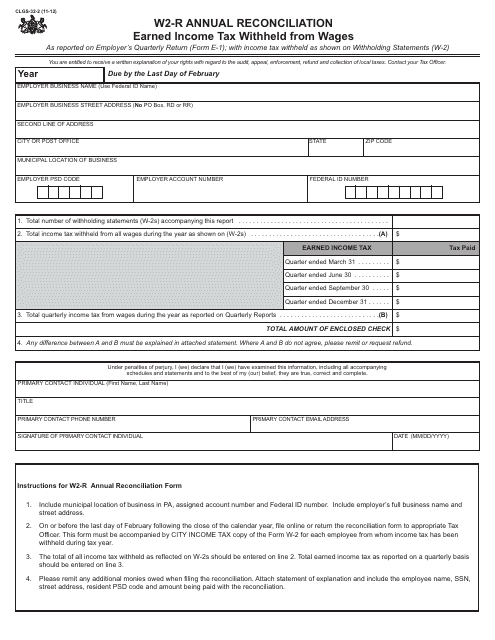

This form is used for the annual reconciliation of local earned income tax withheld from wages in Pennsylvania by employers.