Income Tax Form Templates

Documents:

2505

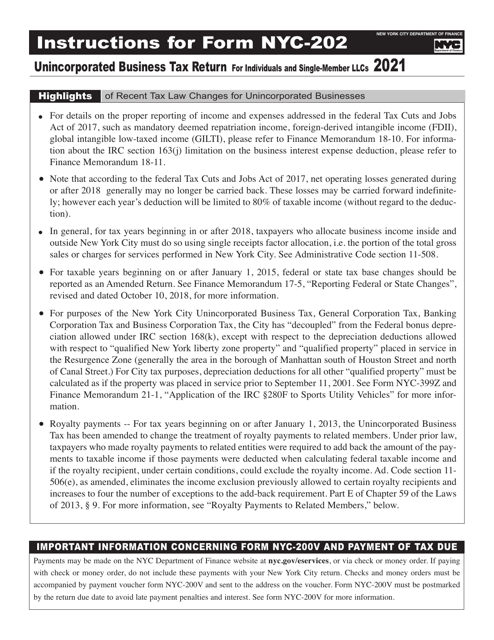

This Form is used for filing the Unincorporated Business Tax Return for individuals and single-member LLCs in New York City. It provides instructions on how to report and calculate taxes on business income.

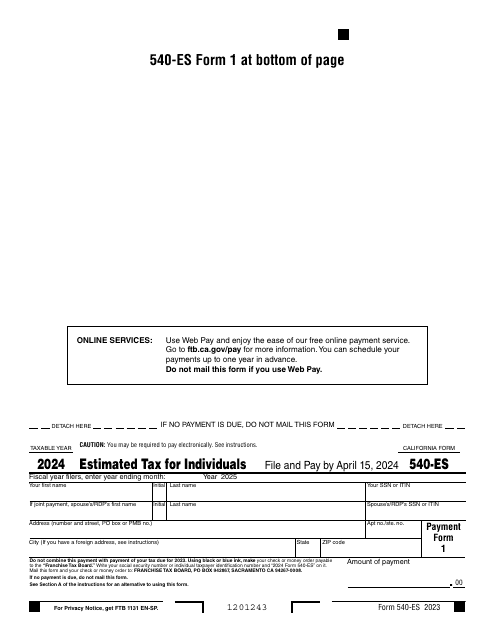

Fill out this form over the course of a year to pay your taxes in the state of California.

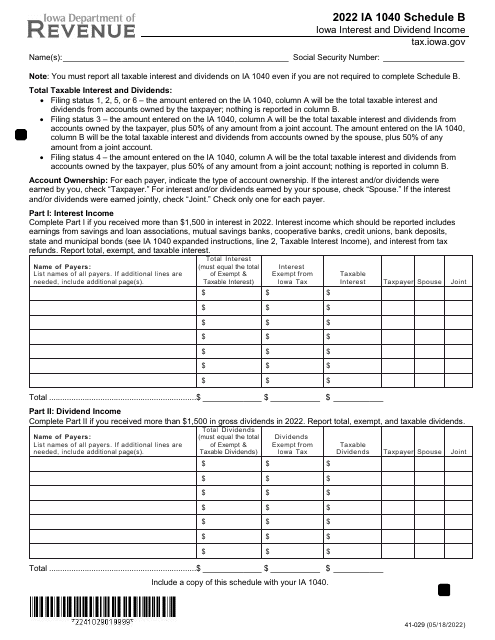

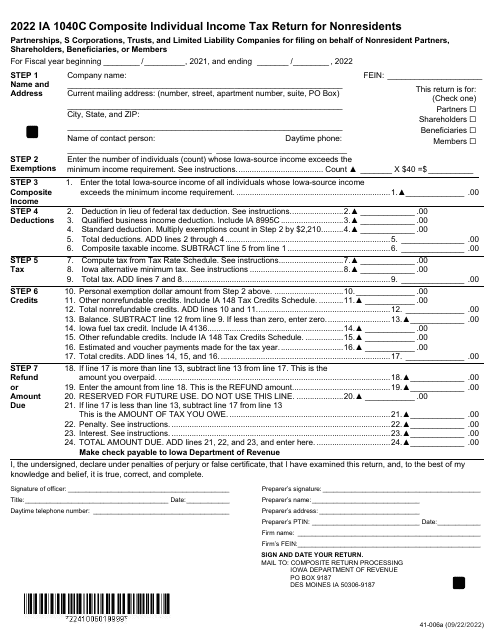

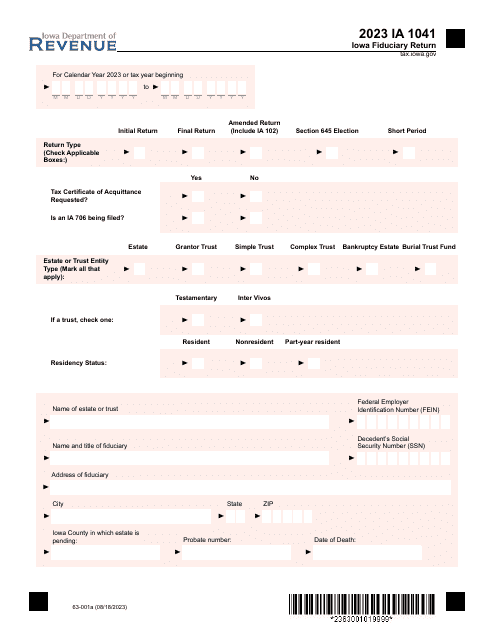

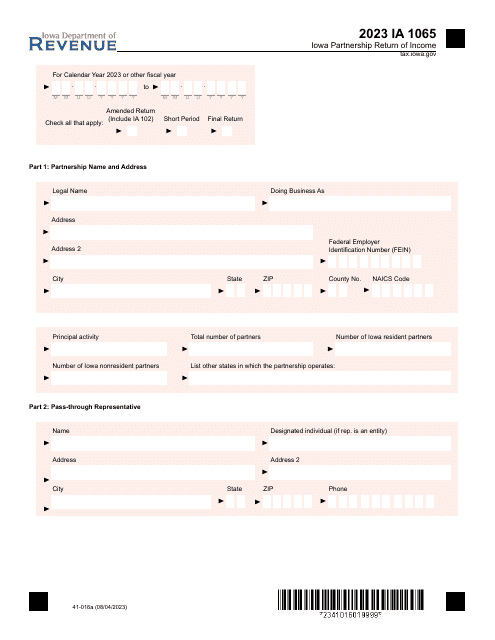

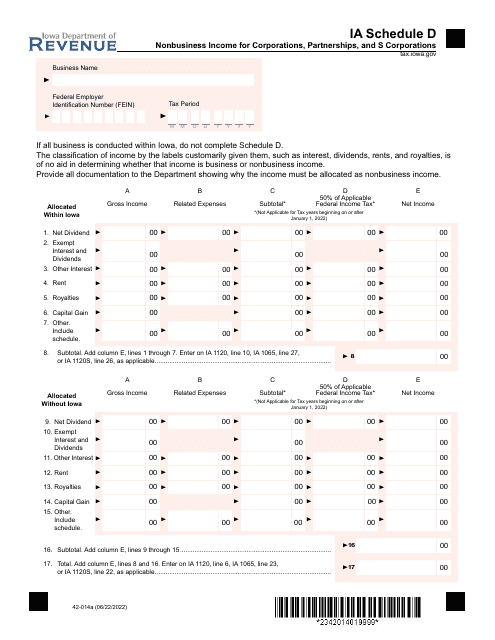

This document is used for filing the Iowa Partnership Return of Income for partnership businesses in Iowa. It includes instructions on how to fill out Form IA1065, providing guidance on reporting income, deductions, and credits specific to Iowa state tax laws.

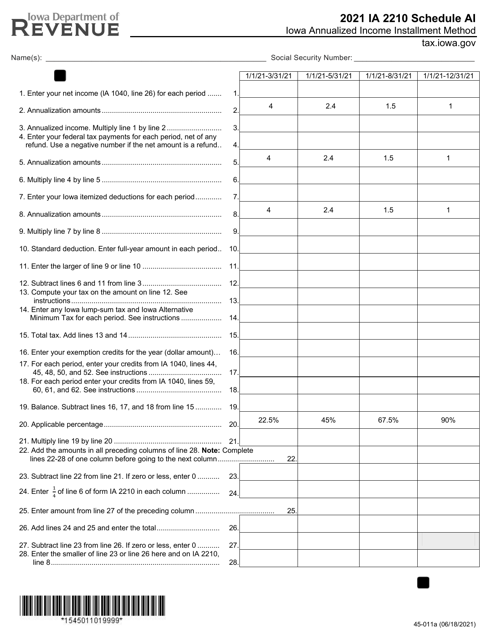

This Form is used for calculating and reporting Iowa state income tax using the Annualized Income Installment Method in Iowa.

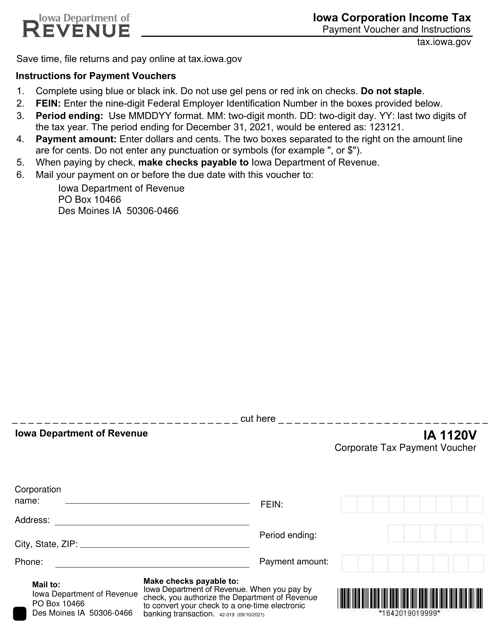

This document is a payment voucher used for corporations in Iowa to pay their income tax.

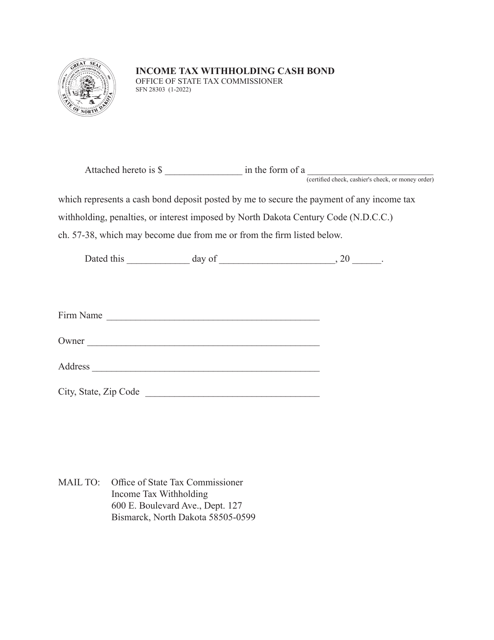

This form is used for individuals or businesses in North Dakota to provide a cash bond as a guarantee for their income tax withholding.

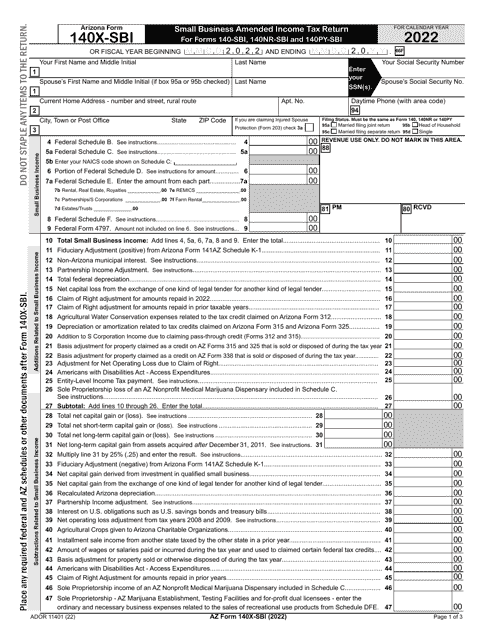

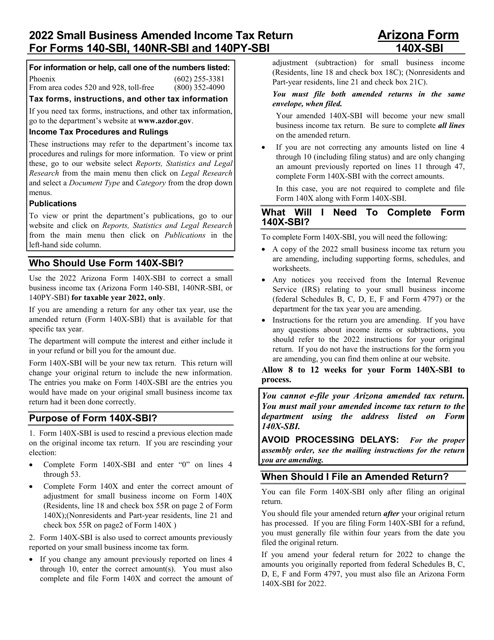

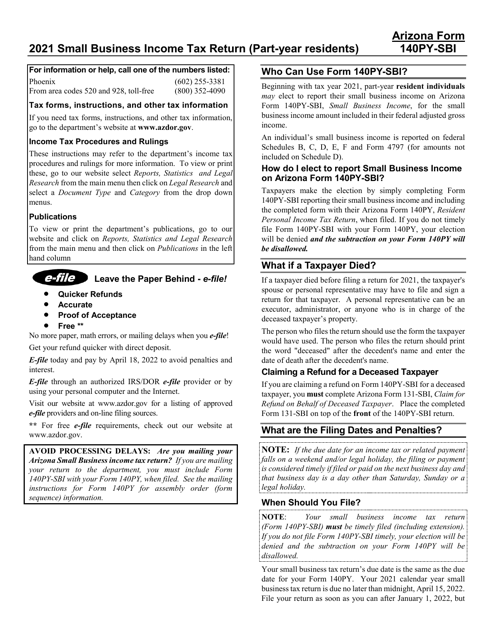

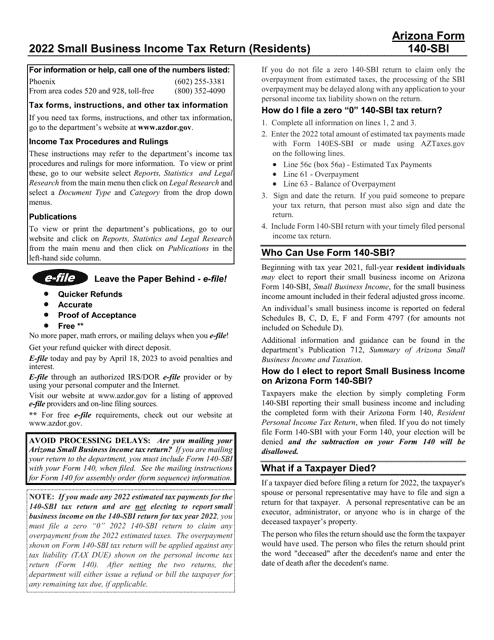

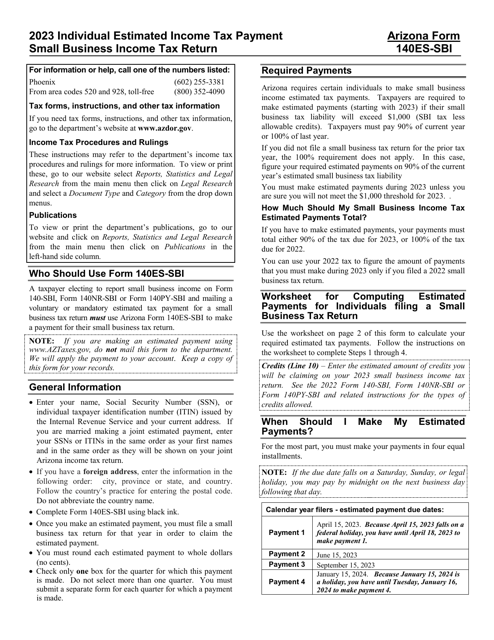

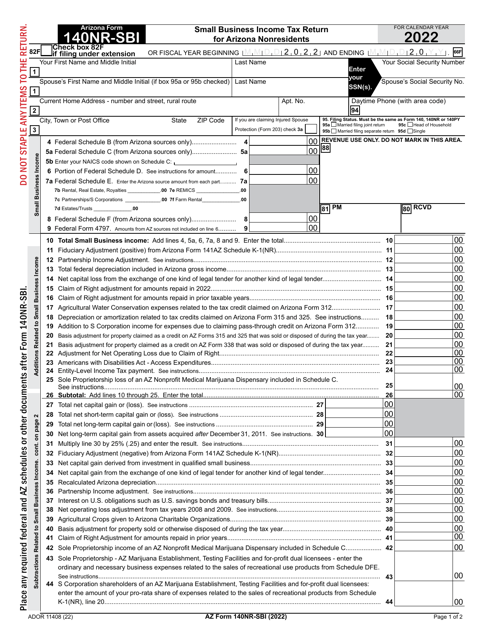

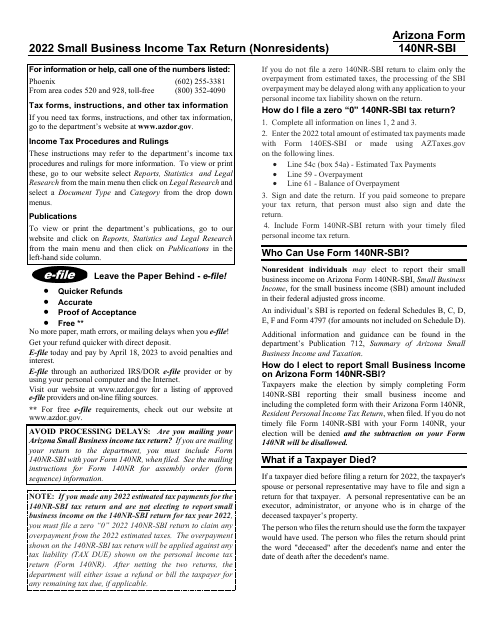

This type of document is the form required for filing the Small Business Income Tax Return in Arizona for individuals with a small business. It provides instructions on how to properly fill out and submit the Form 140PY-SBI.

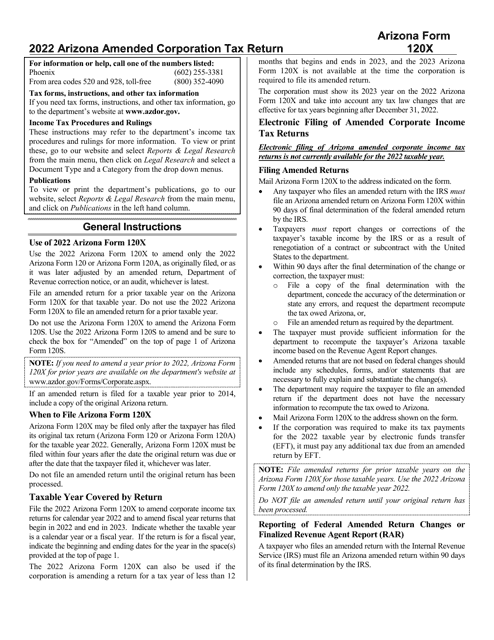

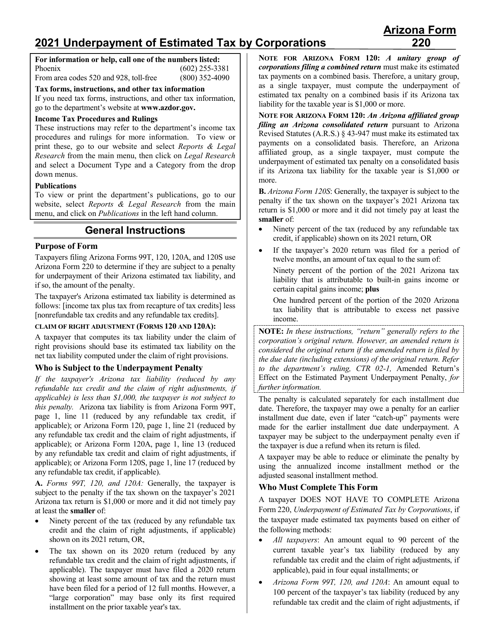

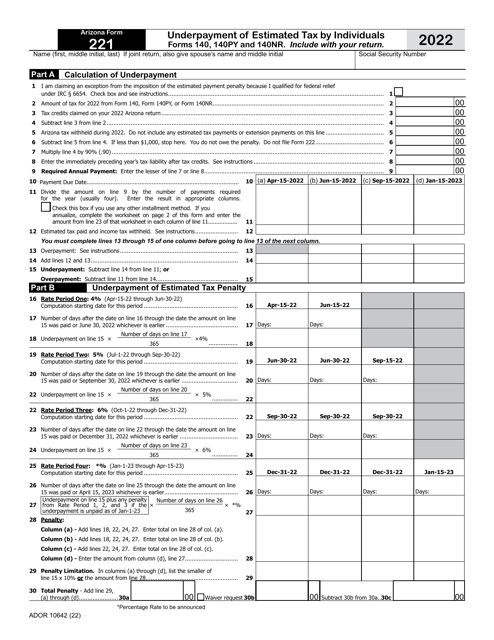

This form is used for addressing underpayment of estimated tax by corporations in Arizona. It provides instructions for filing Form 220, ADOR10342.

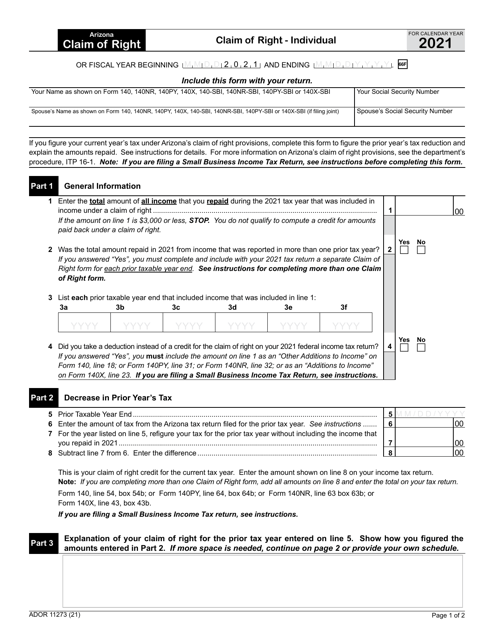

This form is used for individuals in Arizona to make a Claim of Right. It provides a way for individuals to express their claim to certain funds or property.