Income Tax Form Templates

Documents:

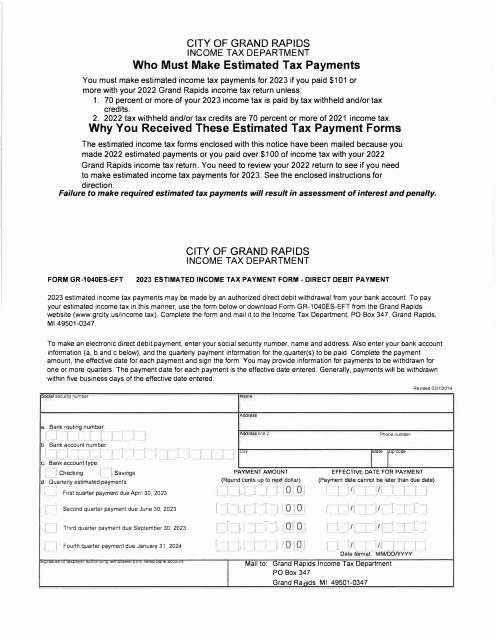

2505

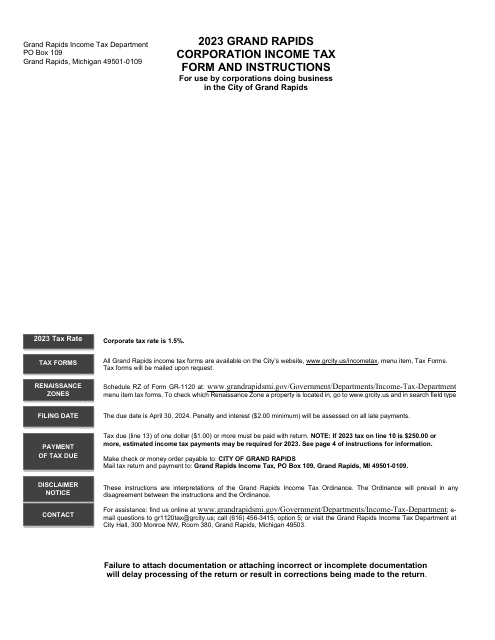

This document provides instructions for filing the Corporation Income Tax Return specifically for businesses located in the City of Grand Rapids, Michigan. It explains how to report and calculate corporate income tax owed to the city.

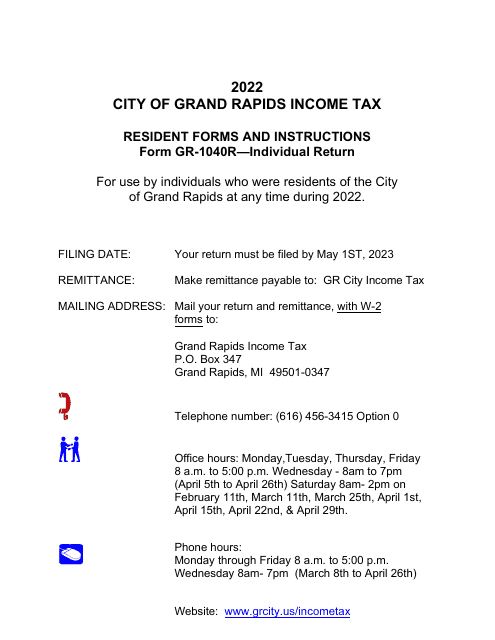

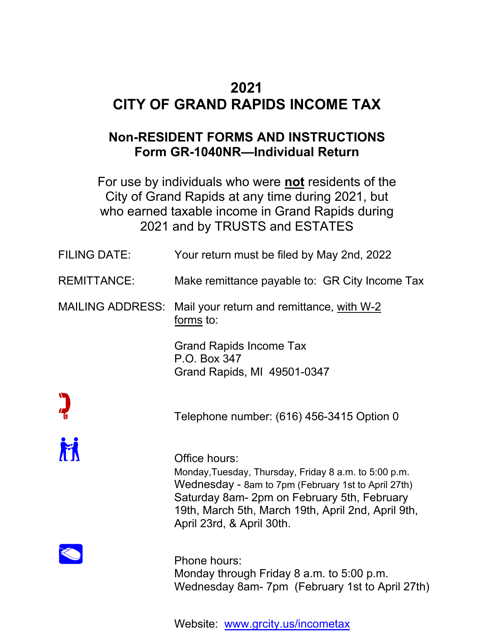

This Form is used for filing individual income tax returns for non-residents of Grand Rapids, Michigan.

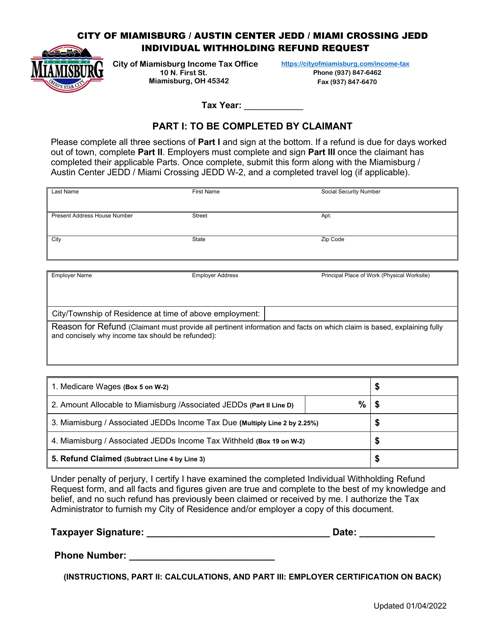

This document is used for requesting a refund of individual withholding taxes paid to the City of Miamisburg, Ohio.

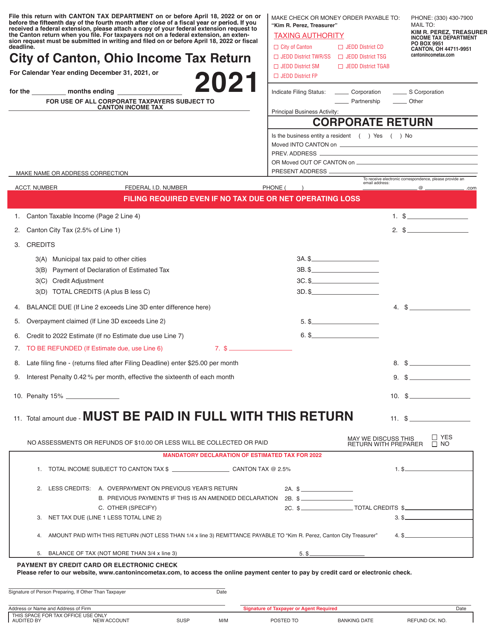

This document is used for filing corporate income tax returns for businesses operating in the City of Canton, Ohio.

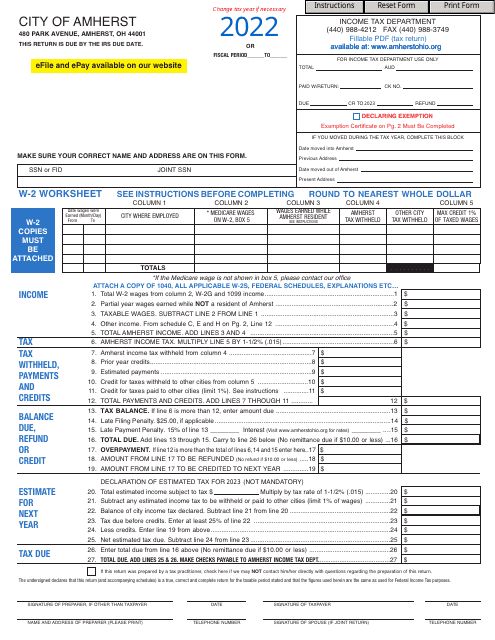

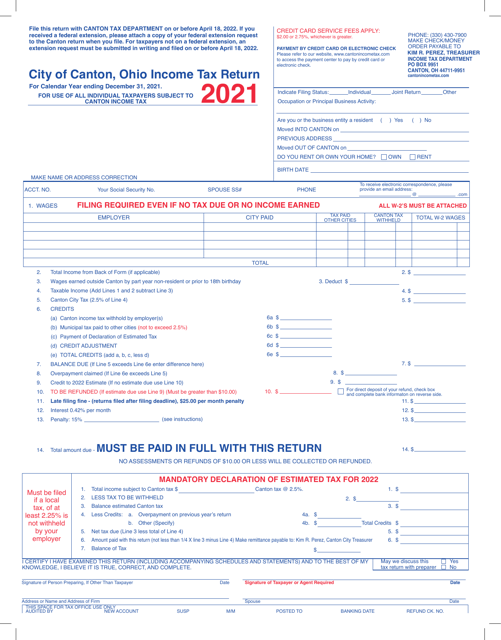

This form is used for filing the individual income tax return for residents of the city of Canton, Ohio.

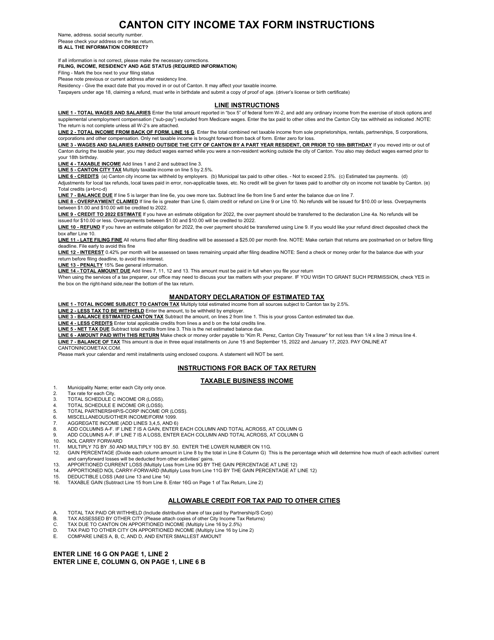

This Form is used for filing your Individual Income Tax Return with the City of Canton, Ohio. It provides step-by-step instructions for completing your tax return and ensures that you accurately report your income and claim any applicable deductions and credits.

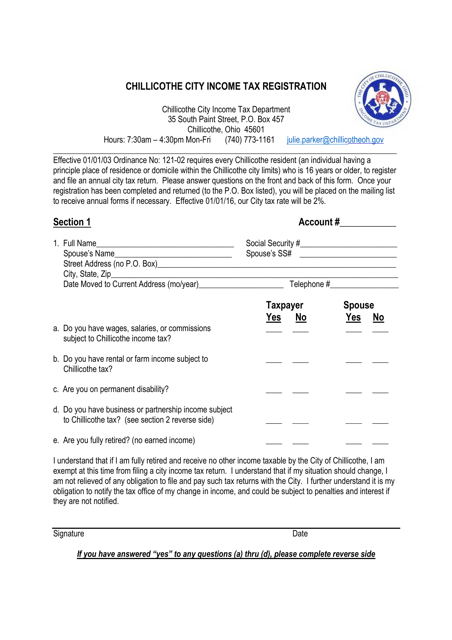

This Form is used for registering for income tax in the City of Chillicothe, Ohio.

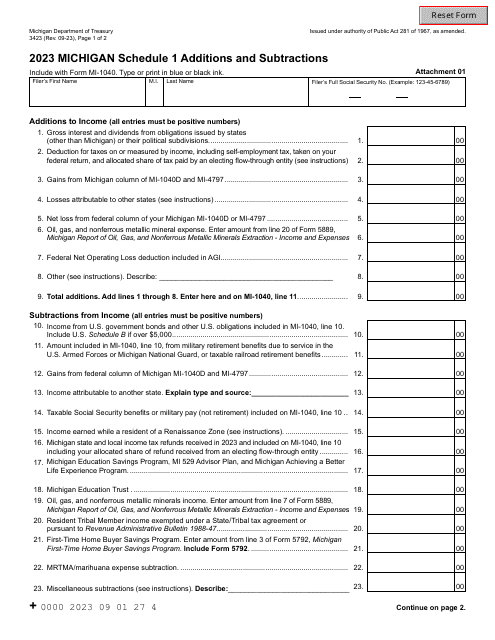

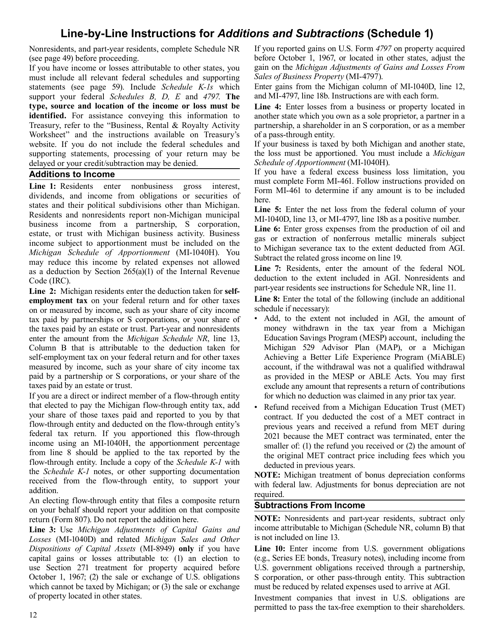

This document provides instructions for completing Schedule 1, which is used to report any additions or subtractions to your Michigan income tax return. It guides you through the process of determining what types of income or deductions should be included, and how to fill out the necessary forms.

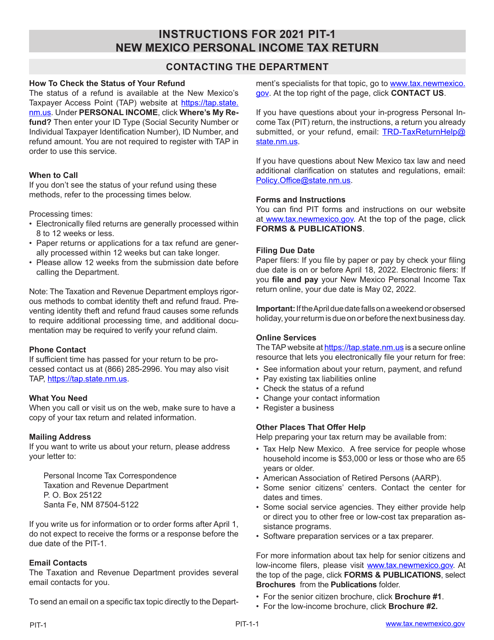

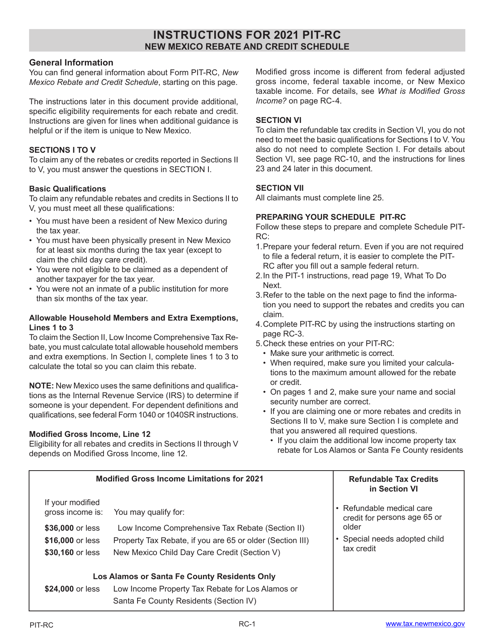

This Form is used for filing the New Mexico Personal Income Tax Return in the state of New Mexico. It provides instructions on how to accurately complete and submit the PIT-1 form for income taxes.

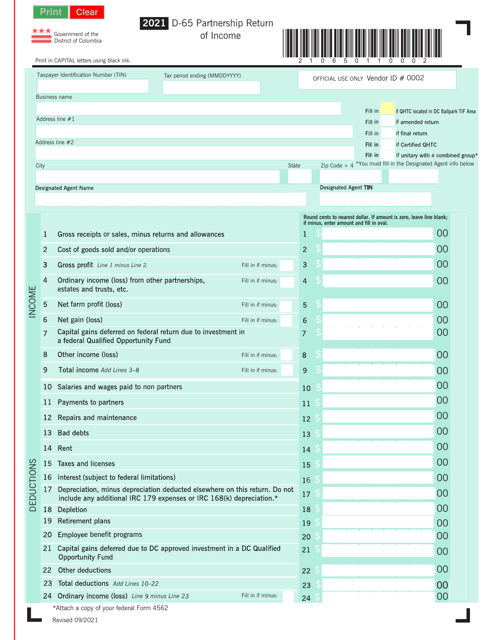

This form is used for reporting partnership income and deductions for taxpayers in Washington, D.C.

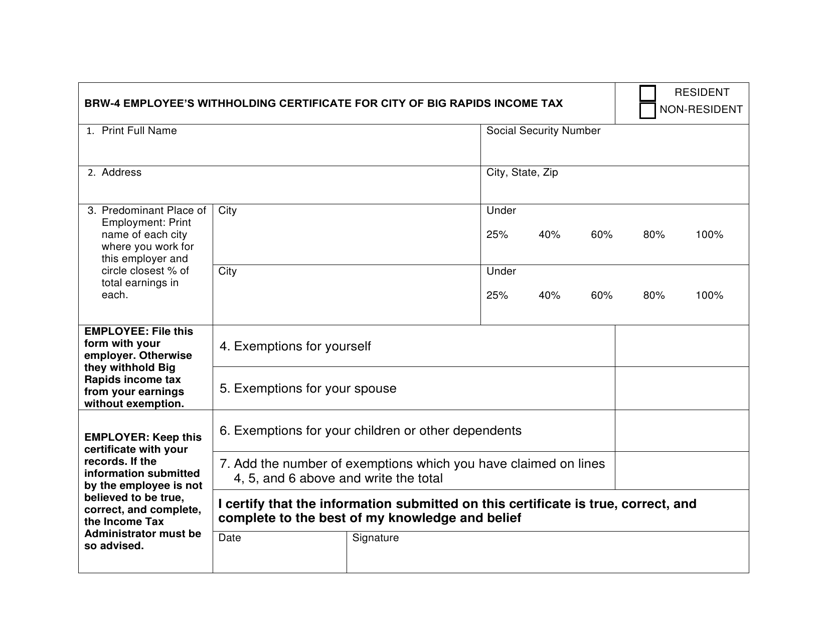

This form is used for employees of the City of Big Rapids, Michigan to declare their withholding for city income tax purposes.

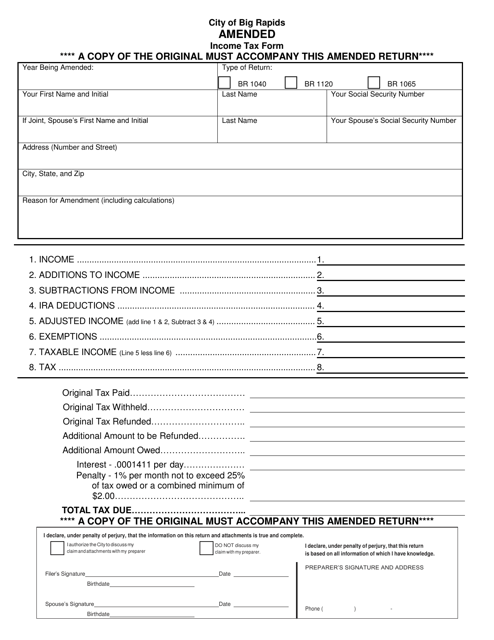

This Form is used for amending income tax returns for residents of Big Rapids, Michigan.

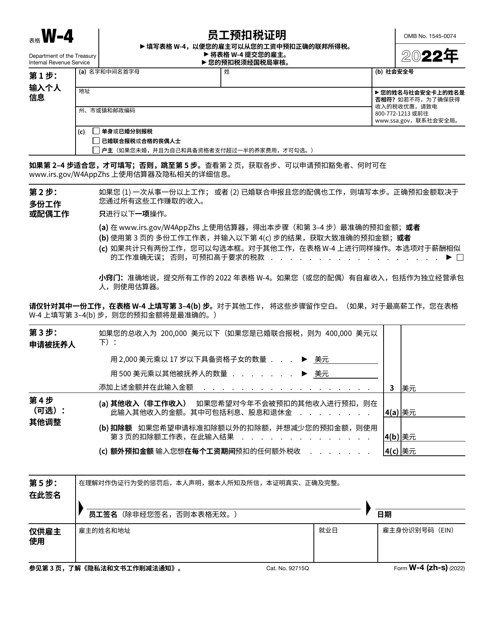

This Form is used for Chinese Simplified version of the IRS Form W-4 Employee's Withholding Certificate. It is used by employees to indicate their tax withholding preferences for income earned in the United States.