Income Tax Form Templates

Documents:

2505

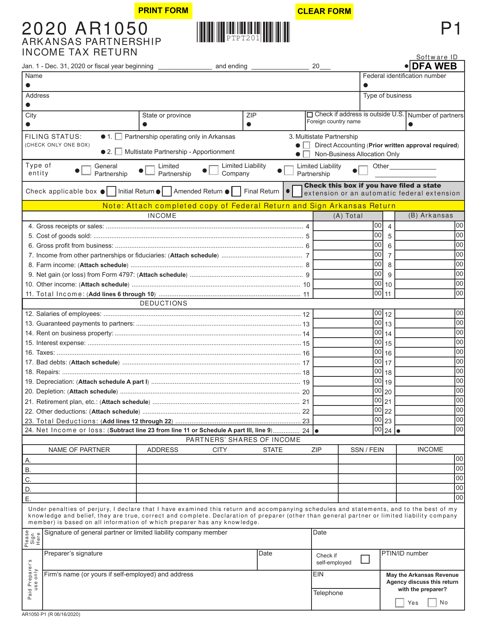

This document is used for filing the Arkansas Partnership Income Tax Return in the state of Arkansas for businesses that are registered as partnerships.

This document is used for filing the Arkansas S Corporation Income Tax Return for S Corporations in Arkansas. It provides instructions on how to accurately complete and submit the tax return form.

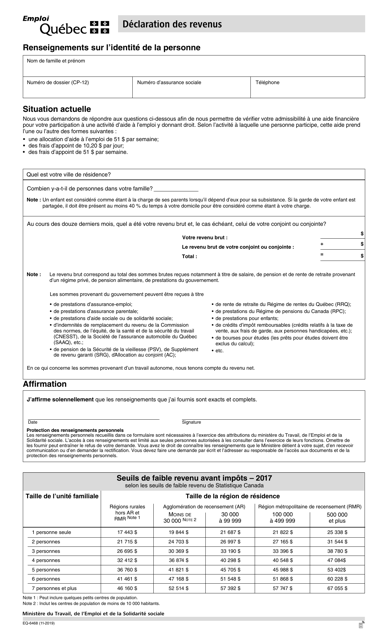

This Form is used for declaring income in Quebec, Canada. (French)

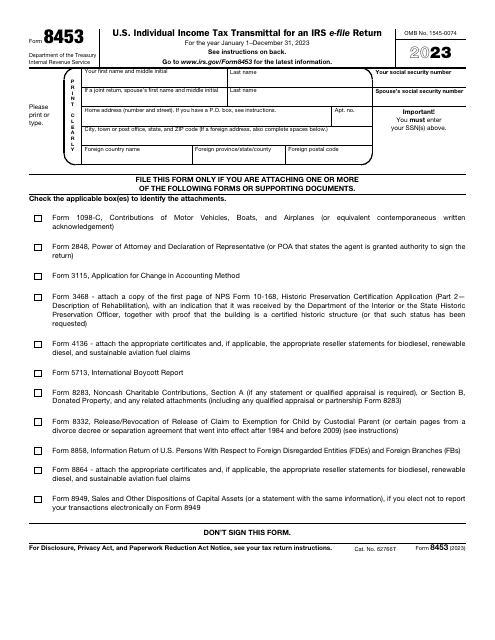

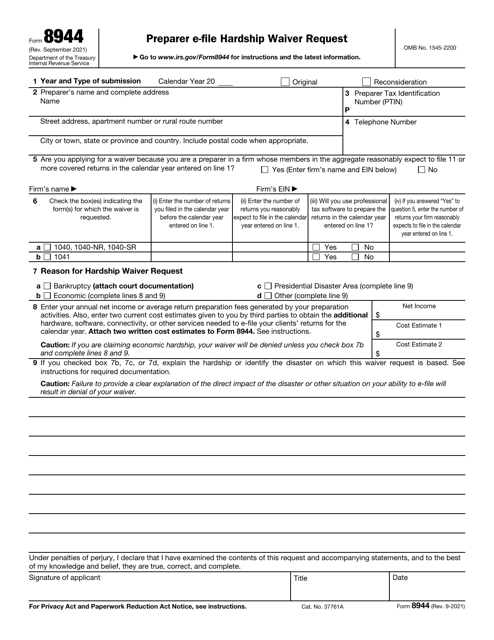

This is a formal statement completed by specified tax return preparers that cannot e-file income tax returns because of economic hardship, bankruptcy, or presidentially declared disaster.

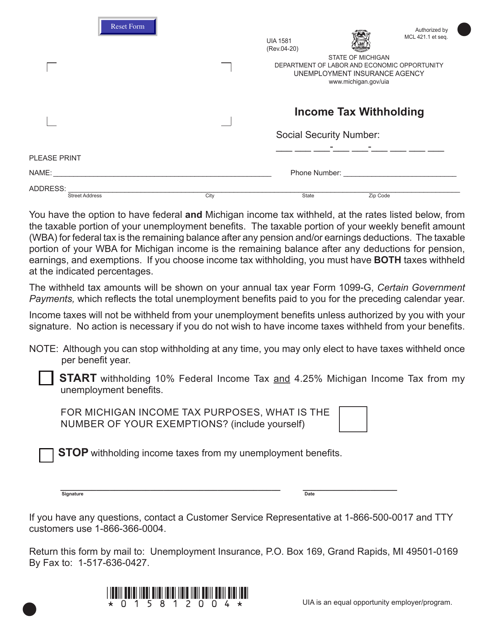

This Form is used for reporting and documenting income tax withholding for residents of Michigan.

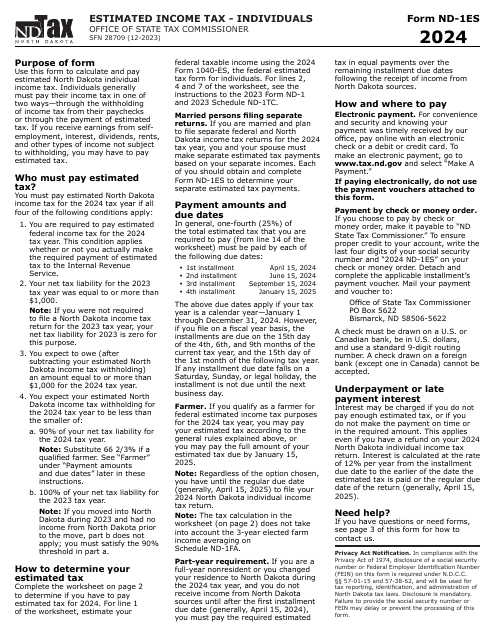

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

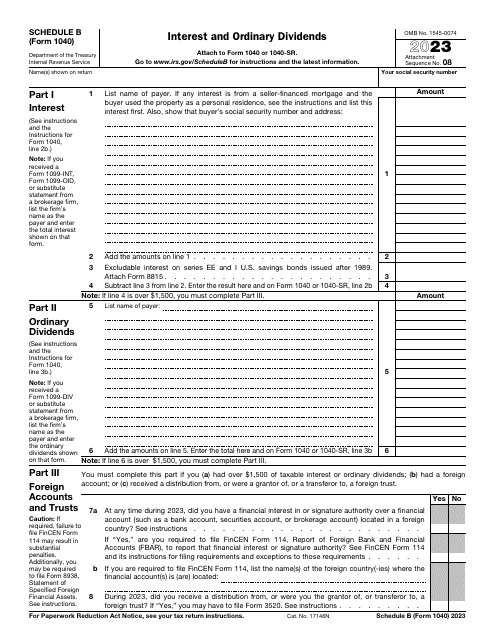

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

This is an IRS form that includes the details of an installment sale.

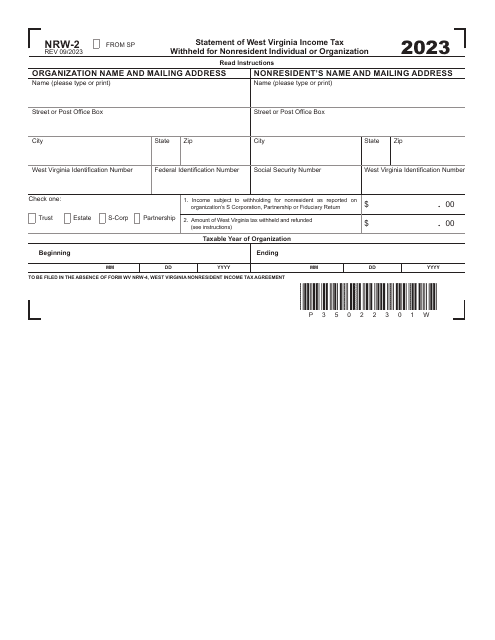

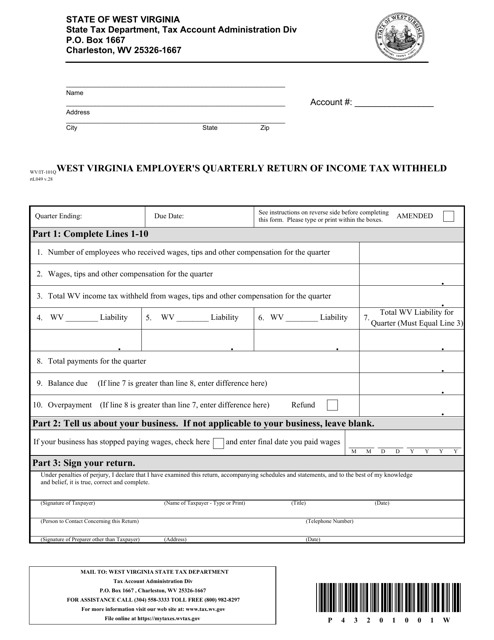

This form is used by employers in West Virginia to report the income tax withheld from their employees' wages on a quarterly basis.

This Form is used for Missouri taxpayers who have exceptional circumstances and low income to apply for certain tax benefits.