Income Tax Form Templates

Documents:

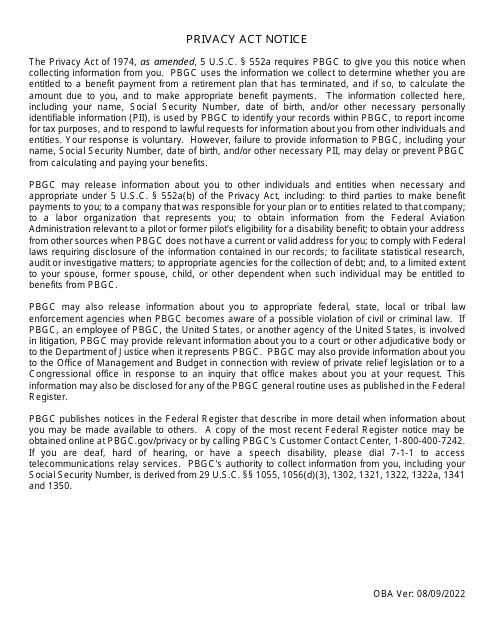

2505

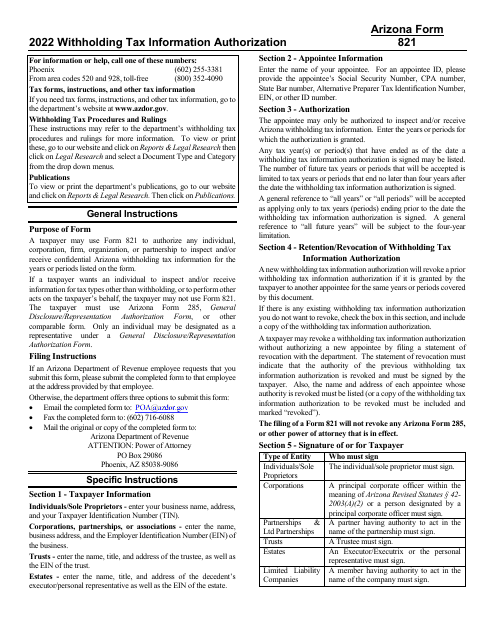

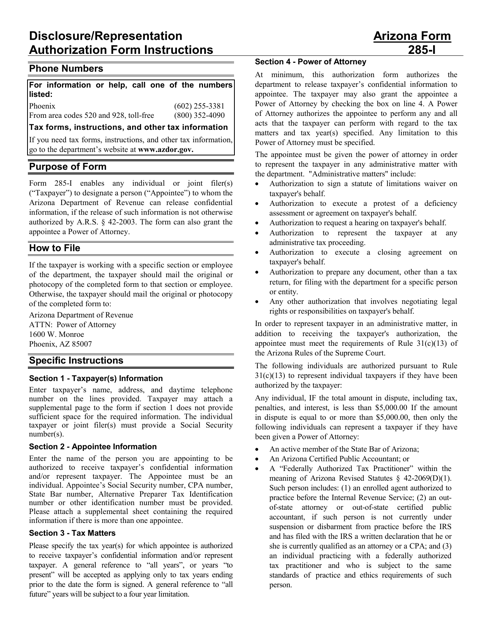

This Form is used for authorizing the disclosure and representation of individual income tax information in Arizona.

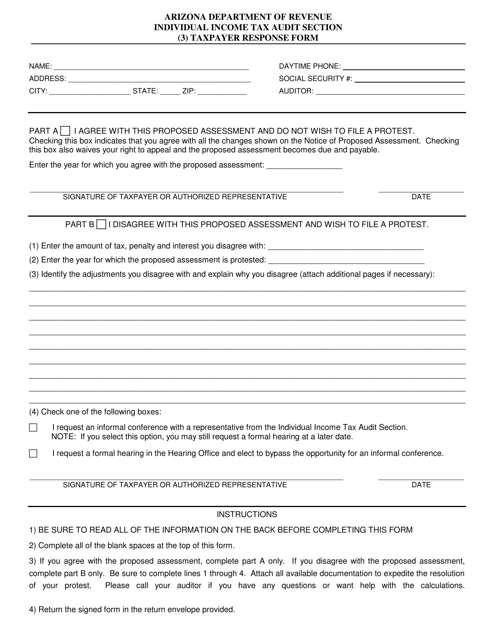

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

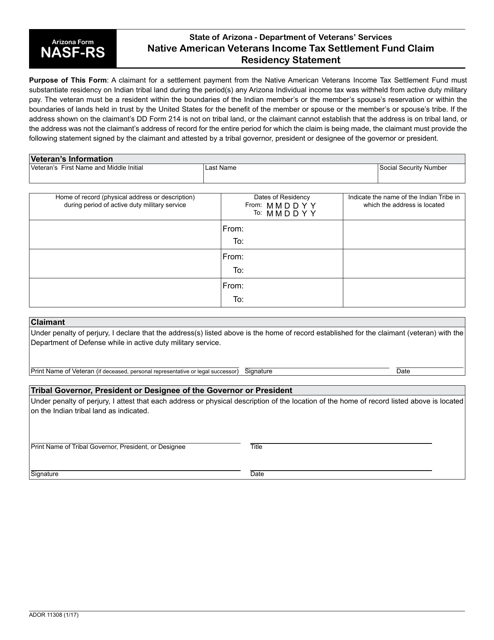

This form is used for Native American veterans to make a claim for residency in Arizona regarding the income tax settlement fund.

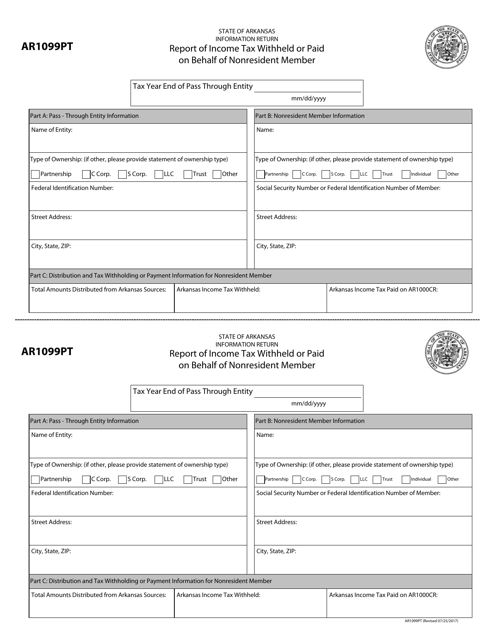

This form is used for reporting income tax withheld or paid on behalf of a nonresident member in Arkansas.

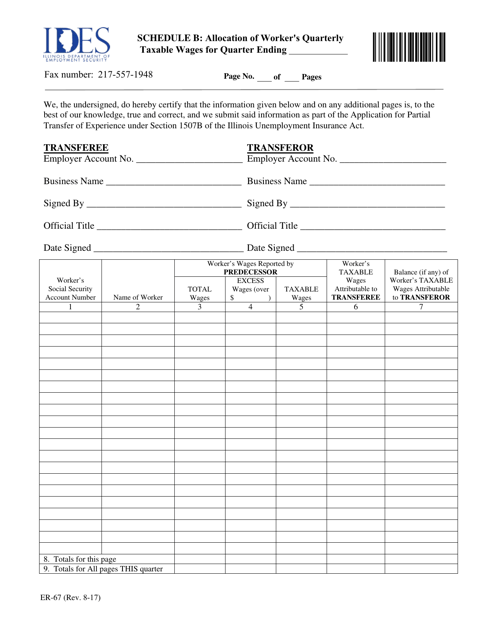

This Form is used for allocating worker's quarterly taxable wages in Illinois.

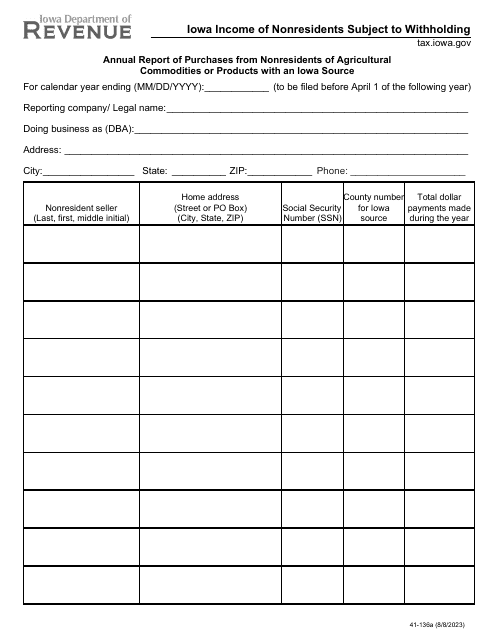

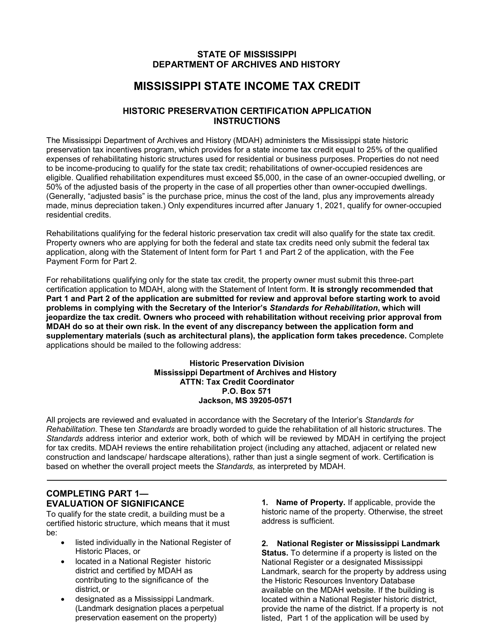

This document is for applying for a state income tax credit for historic preservation in Mississippi.

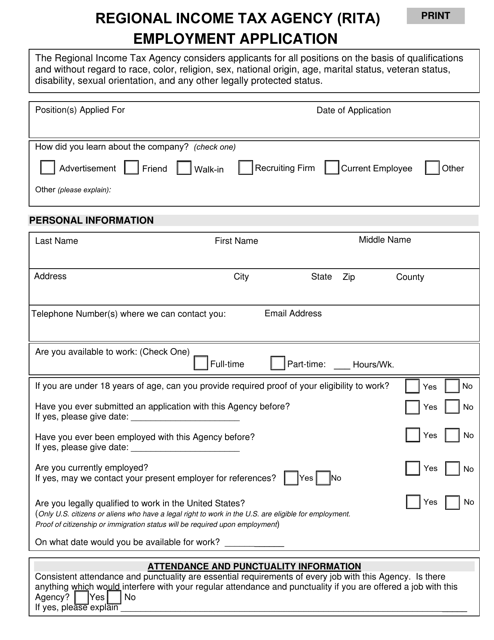

This document is the employment application for the Regional Income Tax Agency (RITA) in Ohio.

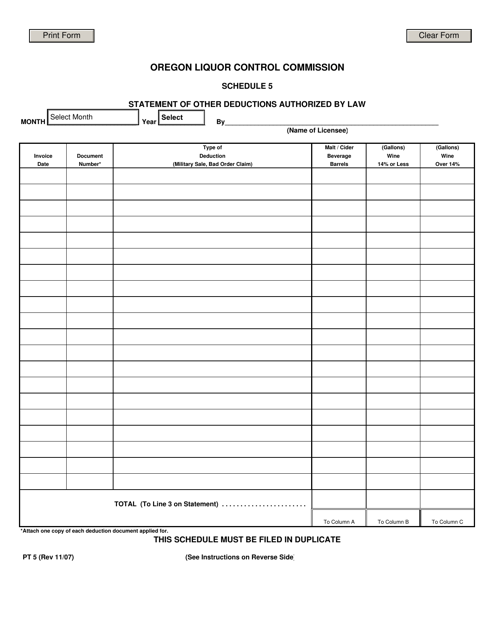

This Form is used for reporting other deductions authorized by law in the state of Oregon. It allows taxpayers to claim deductions that are not covered by other forms or schedules.

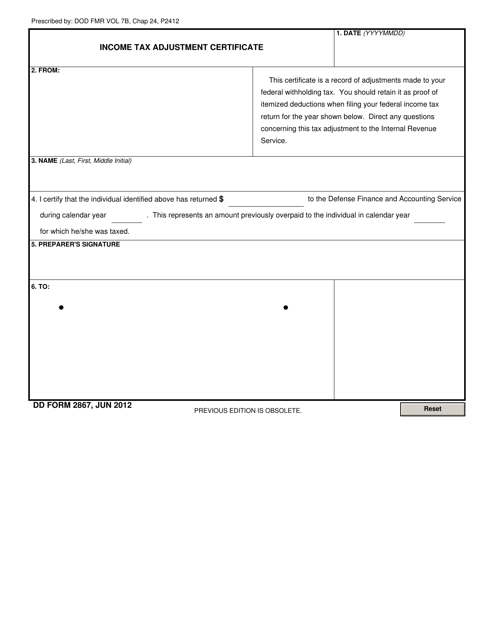

This form is used for filing an income tax adjustment certificate for military personnel.

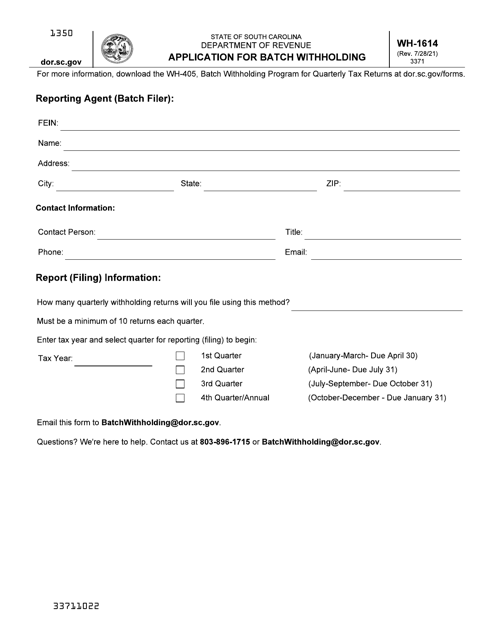

This form is used to apply for batch withholding in the state of South Carolina.

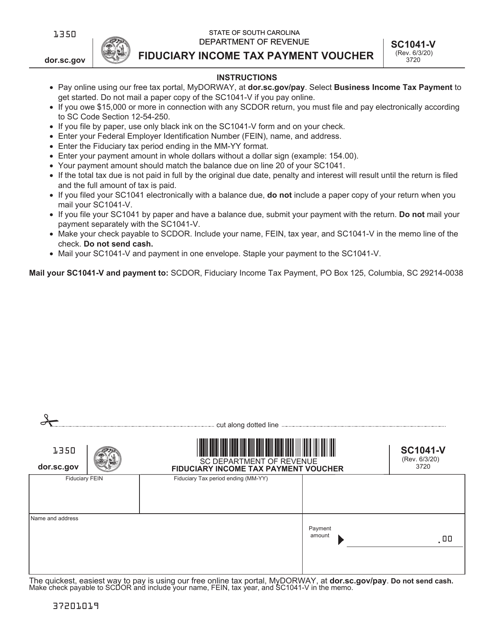

This form is used for making income tax payments as a fiduciary in South Carolina.

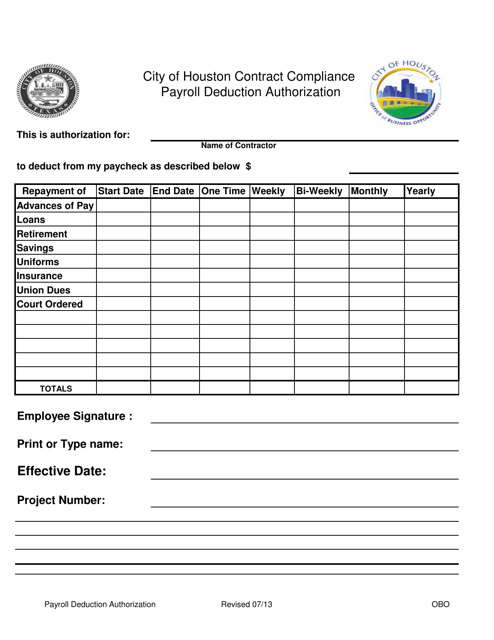

This document is used for authorizing payroll deductions for employees of the City of Houston, Texas. It allows employees to designate a portion of their salary to be deducted for various purposes such as benefits, taxes, or charitable contributions.

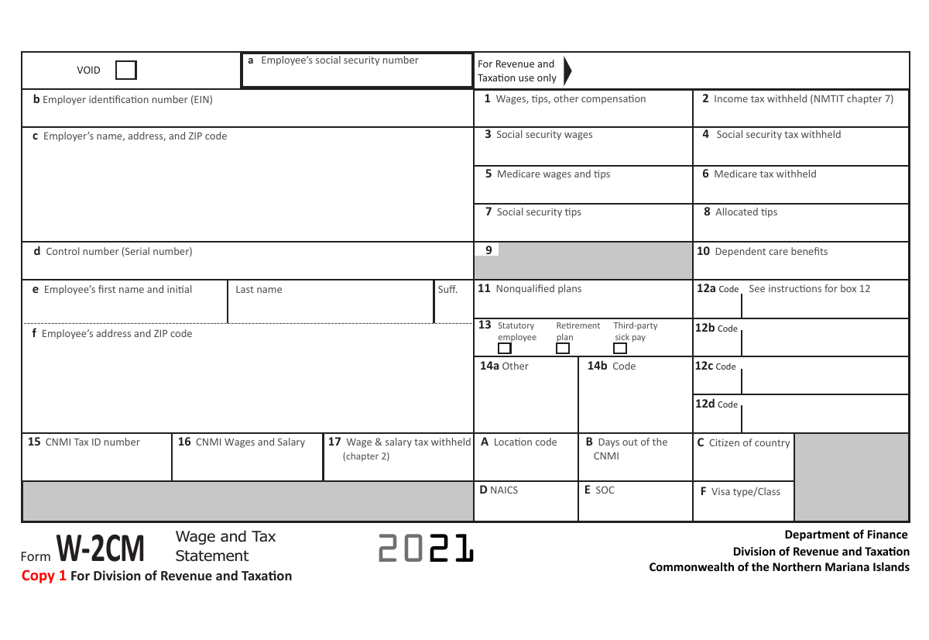

This Form is used for reporting wages and taxes in the Northern Mariana Islands.