Income Tax Form Templates

Documents:

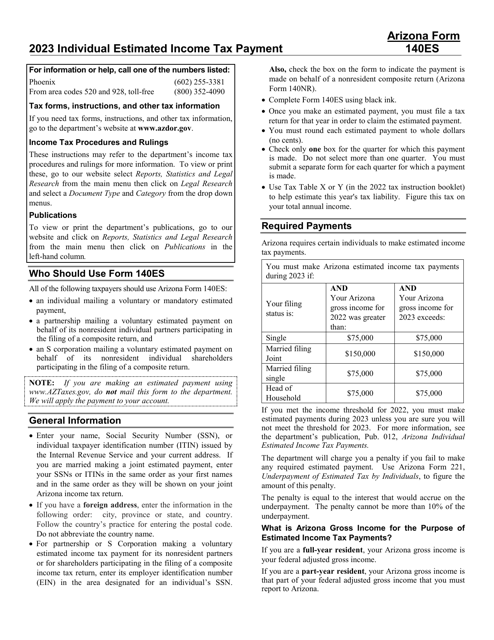

2505

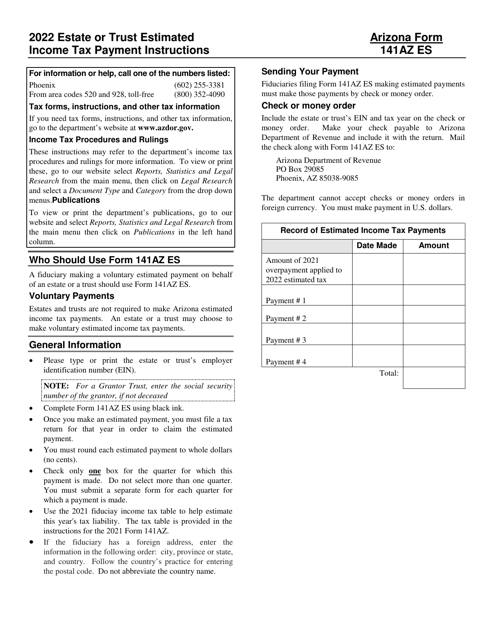

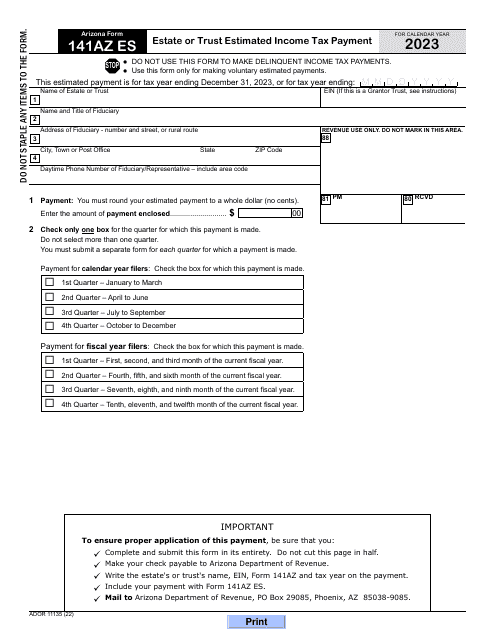

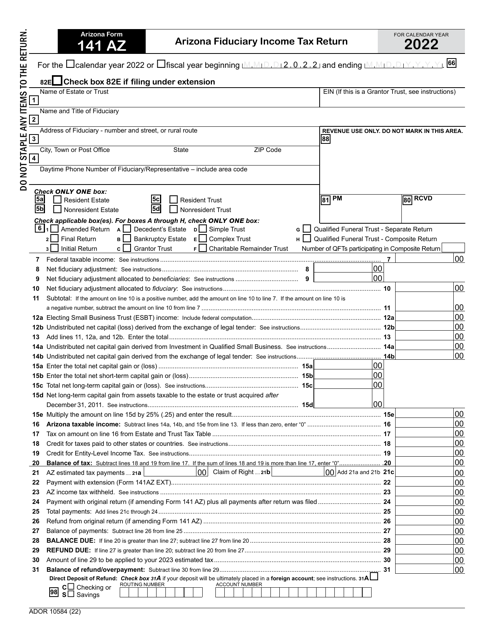

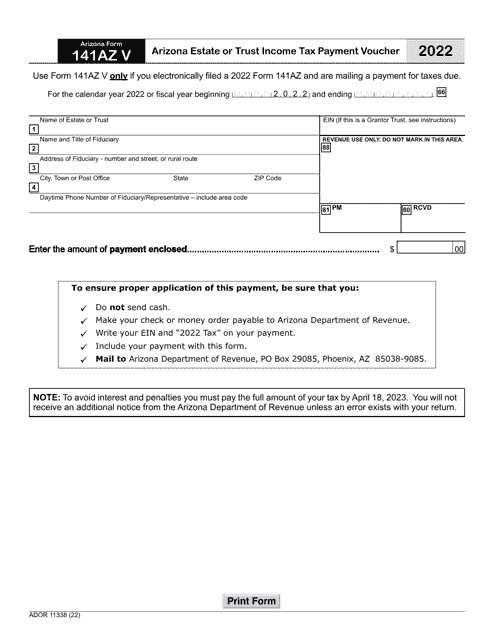

This Form is used for making estimated income tax payments for estates or trusts in Arizona.

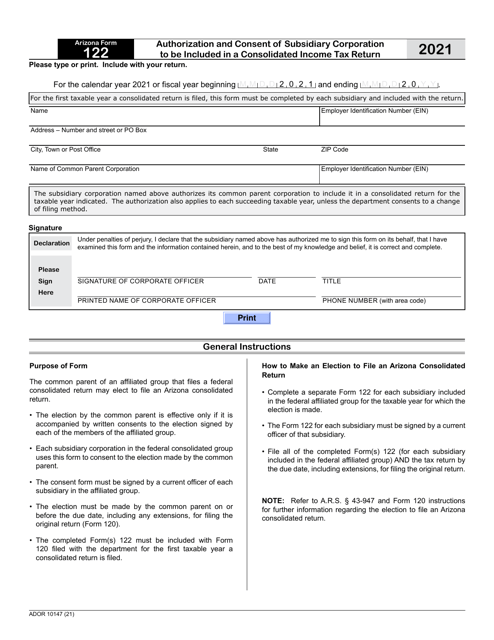

This form is used for authorizing and consenting a subsidiary corporation to be included in a consolidated income tax return in the state of Arizona.

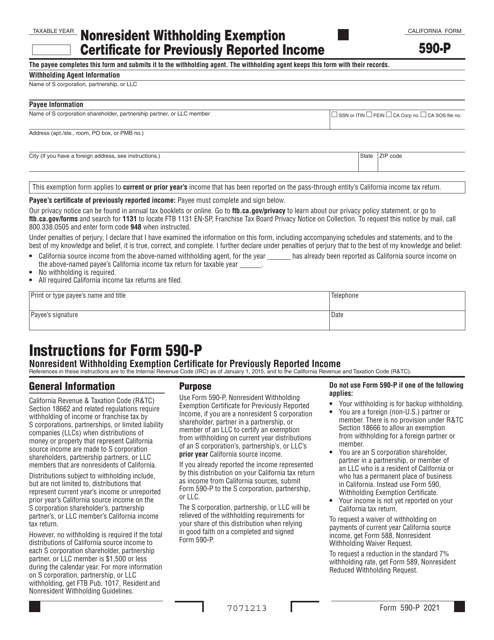

Form 590-P Nonresident Withholding Exemption Certificate for Previously Reported Income - California

This Form is used for claiming an exemption from nonresident withholding for previously reported income in California.

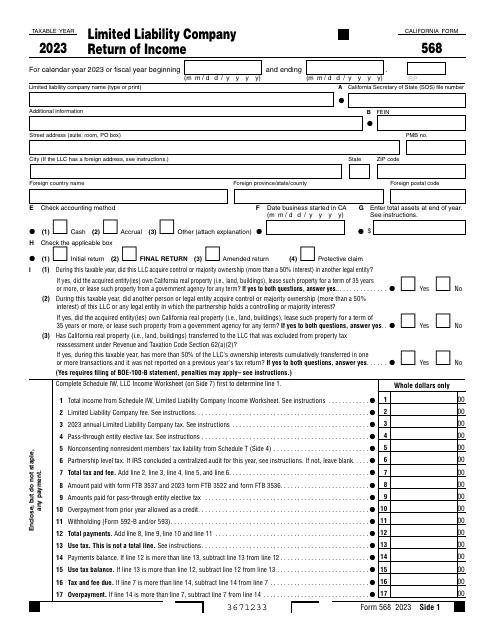

This document is supposed to be filled out only by a Limited Liability Company (LLC) classified as a Partnership. They should use this form as an income tax return that should be filed every year.

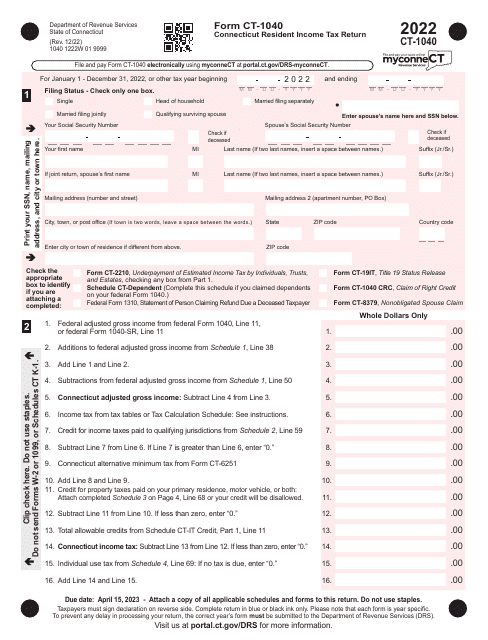

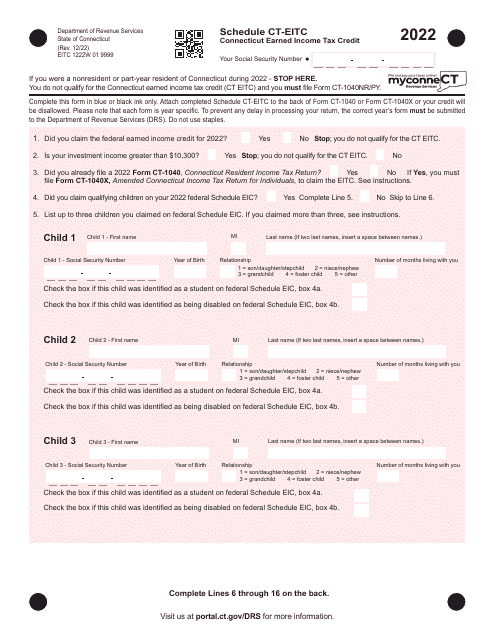

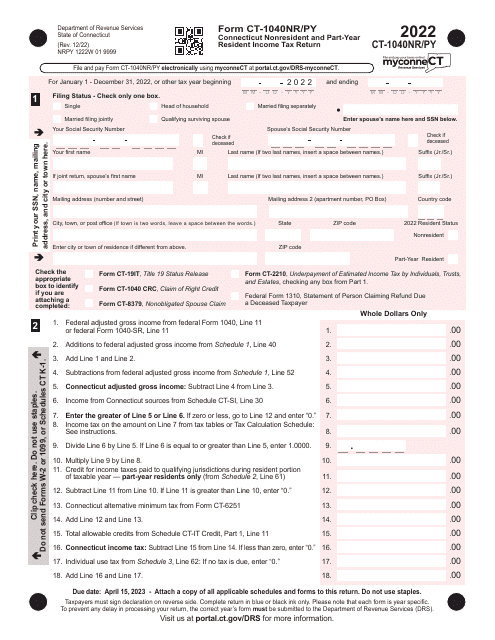

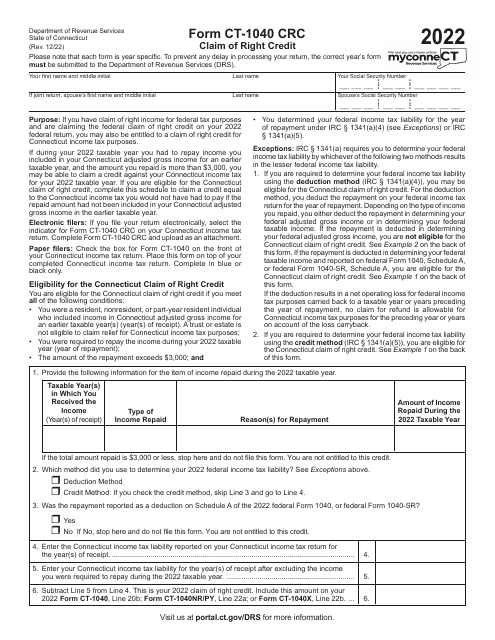

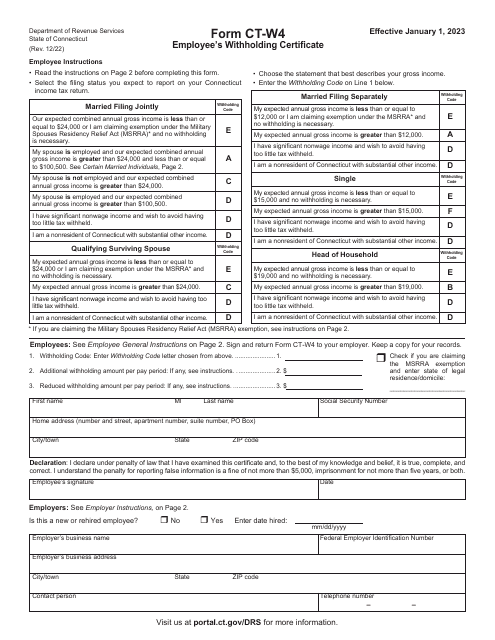

Use this form to withhold the proper amount of taxes when being employed in the state of Connecticut.

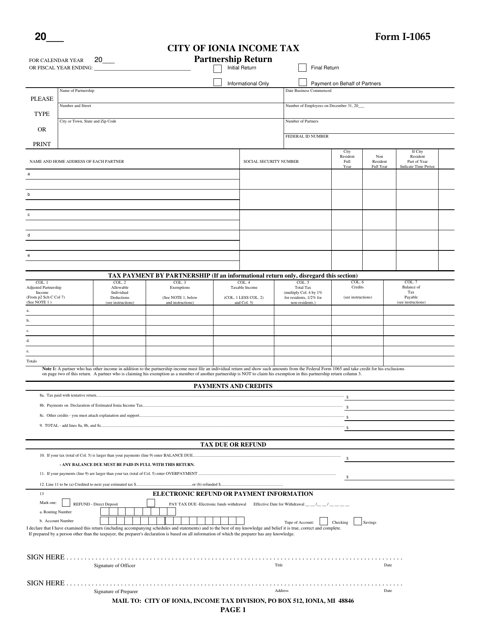

This form is used for reporting income tax for partnerships in the City of Ionia, Michigan.

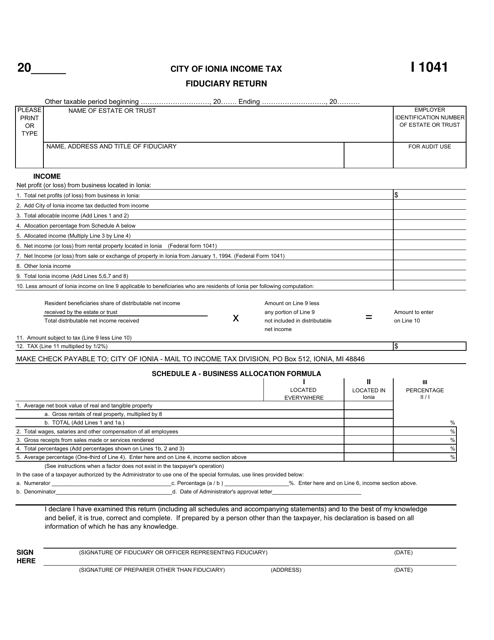

This form is used for filing the Fiduciary Return for the City of Ionia, Michigan. It is specifically for individuals who are acting as fiduciaries for an estate or trust in the city of Ionia, Michigan.

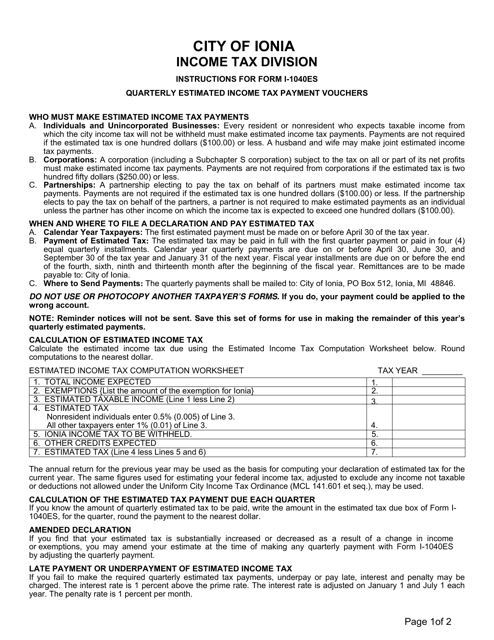

This Form is used for making estimated income tax payments to the City of Ionia, Michigan.

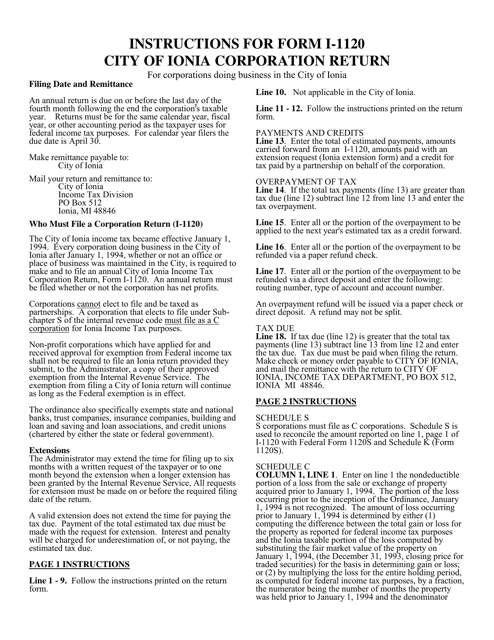

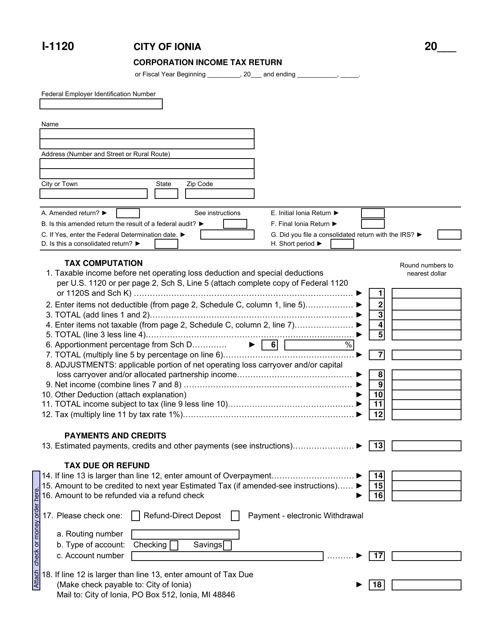

This Form is used for filing the Corporation Income Tax Return for businesses in the City of Ionia, Michigan. It includes instructions on how to accurately report income, deductions, and credits for the tax year.

This Form is used for filing the Corporation Income Tax Return for businesses located in the City of Ionia, Michigan.

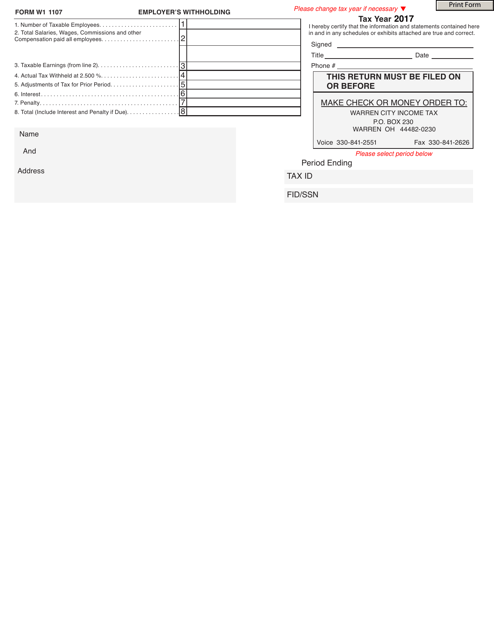

This form is used for employers in the City of Warren, Ohio to report and remit withholding taxes from their employees' wages.

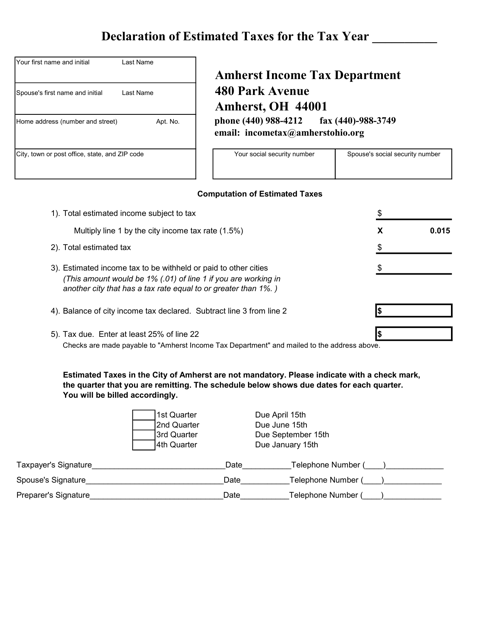

This document is used for declaring estimated taxes in Amherst, Ohio.