Income Tax Form Templates

Documents:

2505

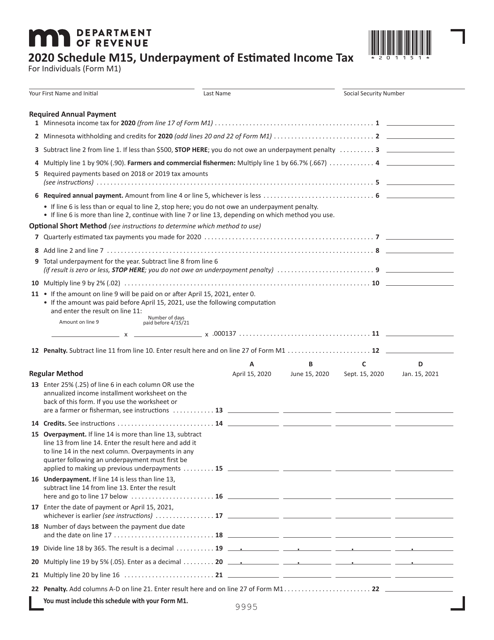

This form is used for calculating underpayment of estimated income tax in the state of Minnesota.

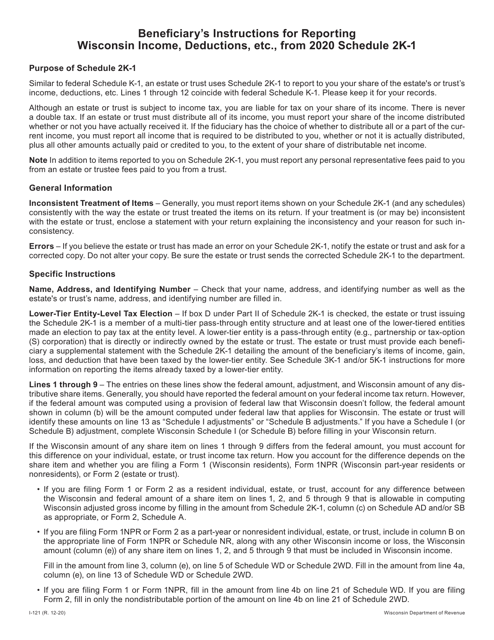

This document provides instructions for completing Schedule 2K-1, which calculates a beneficiary's share of income, deductions, and other information related to Wisconsin taxes. These instructions guide taxpayers on how to accurately report their income and deductions on this form.

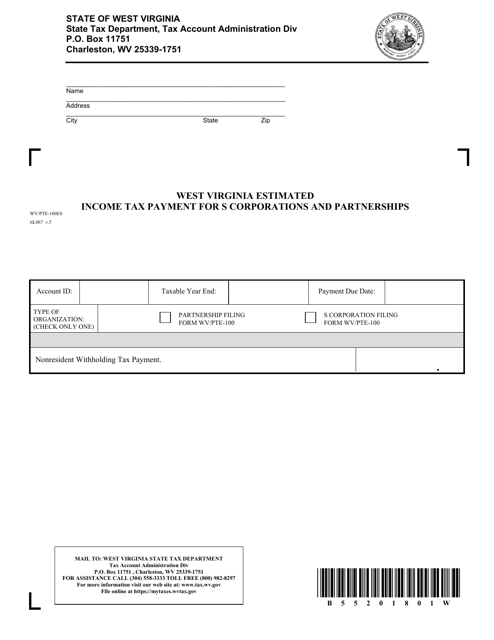

This Form is used for making estimated income tax payments for S Corporations and Partnerships in the state of West Virginia.

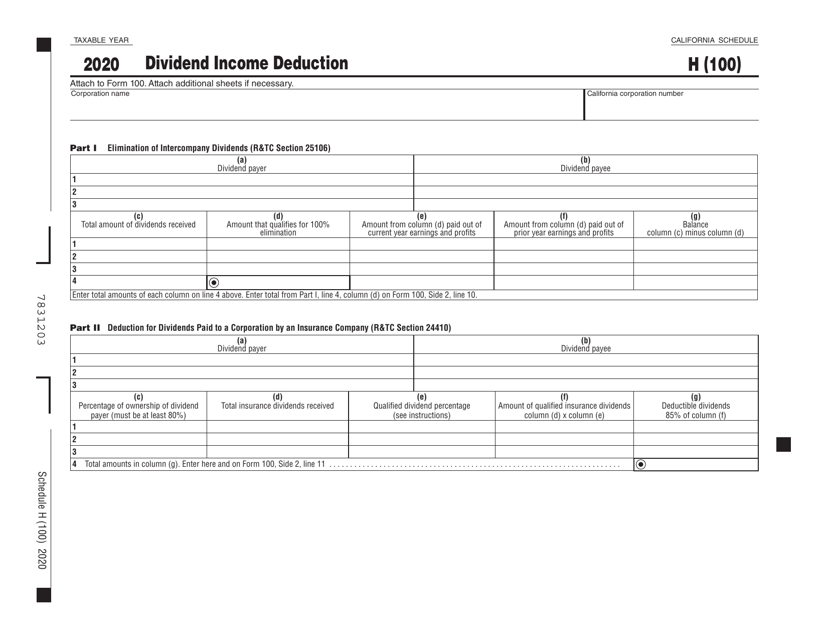

This form is used for claiming a deduction on dividend income in the state of California.

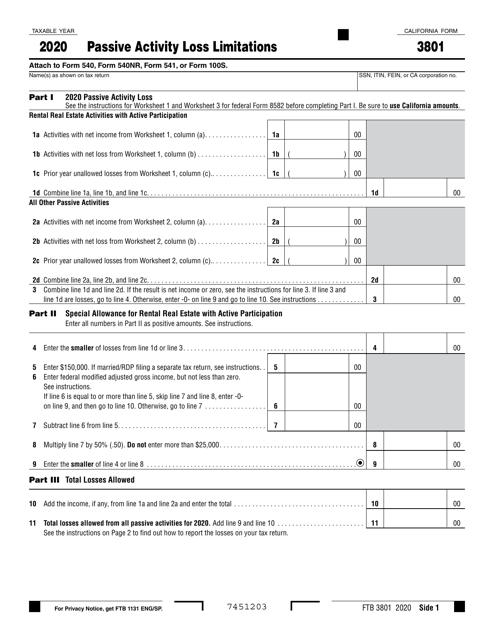

This form is used for reporting passive activity loss limitations in California.

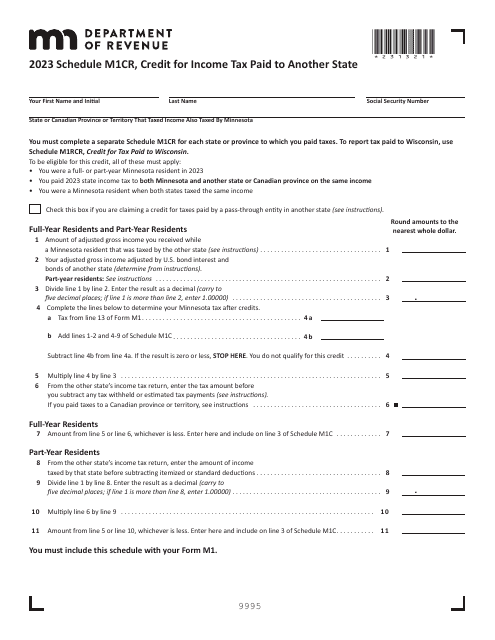

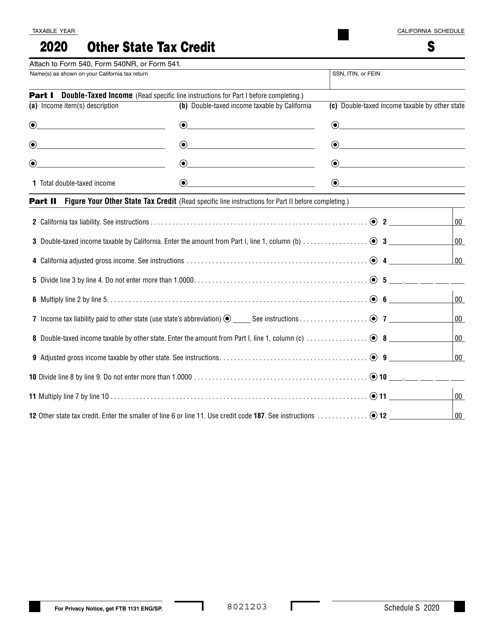

This document is used for claiming a tax credit for taxes paid to another state while being a resident of California.

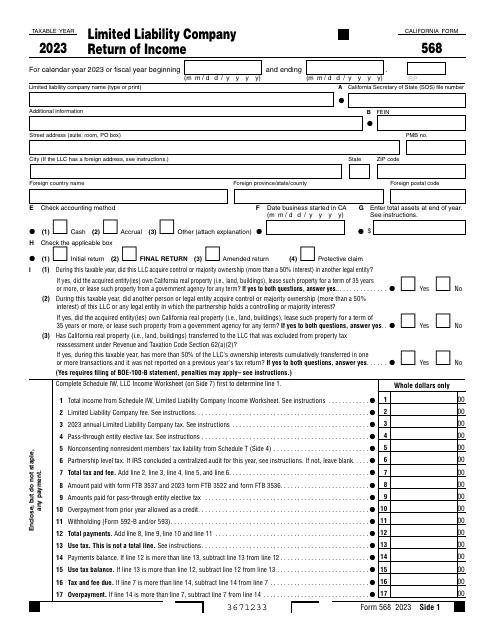

This document is supposed to be filled out only by a Limited Liability Company (LLC) classified as a Partnership. They should use this form as an income tax return that should be filed every year.

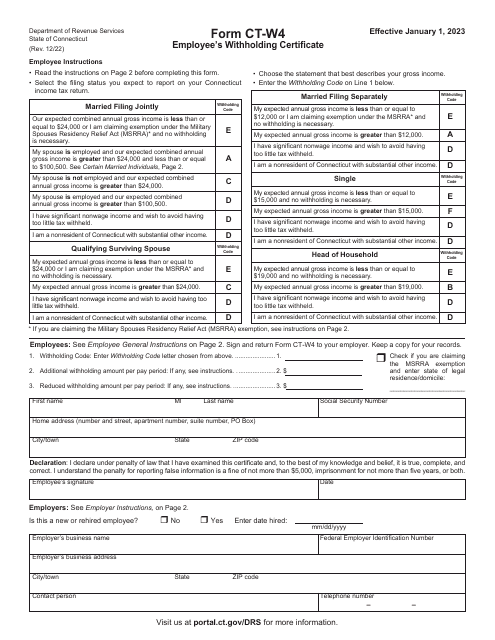

Use this form to withhold the proper amount of taxes when being employed in the state of Connecticut.

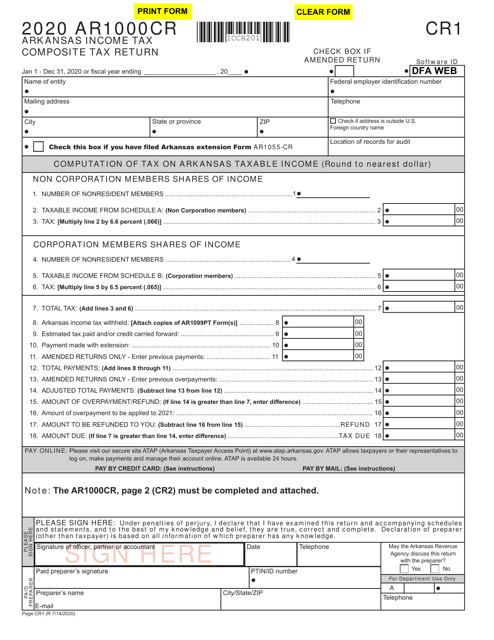

This document is used for filing a composite tax return for Arkansas income tax.

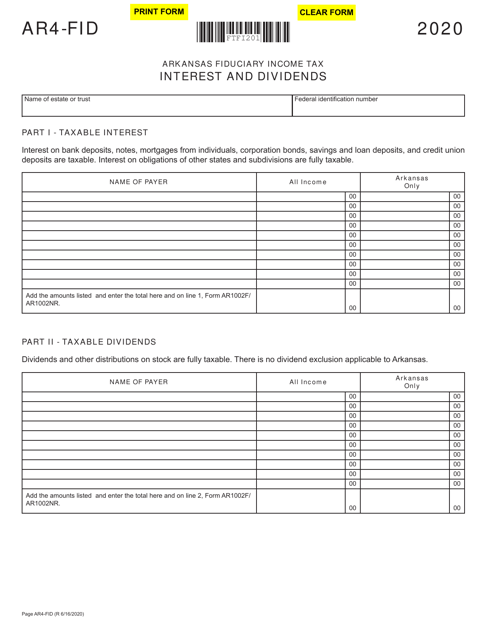

This form is used for reporting income from interest and dividends in Arkansas for fiduciary entities.

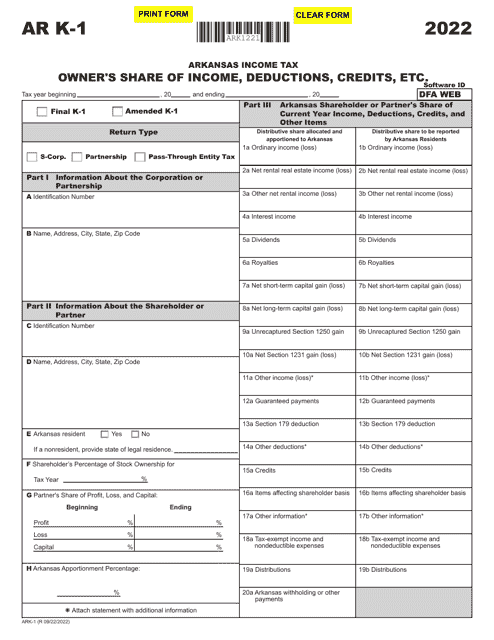

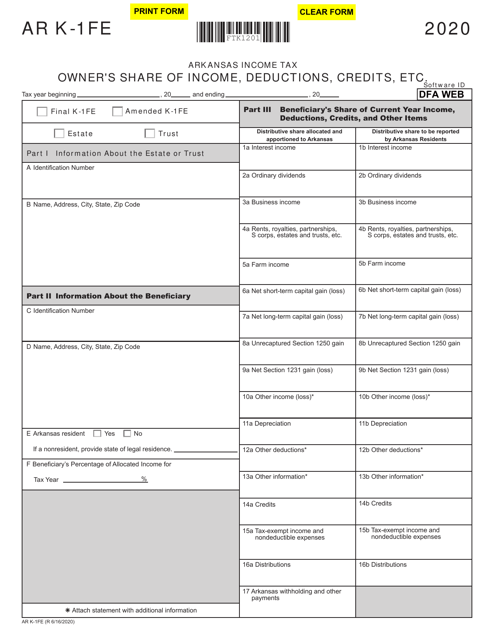

This form is used for reporting an owner's share of income, deductions, credits, and other financial details for Arkansas income tax purposes.

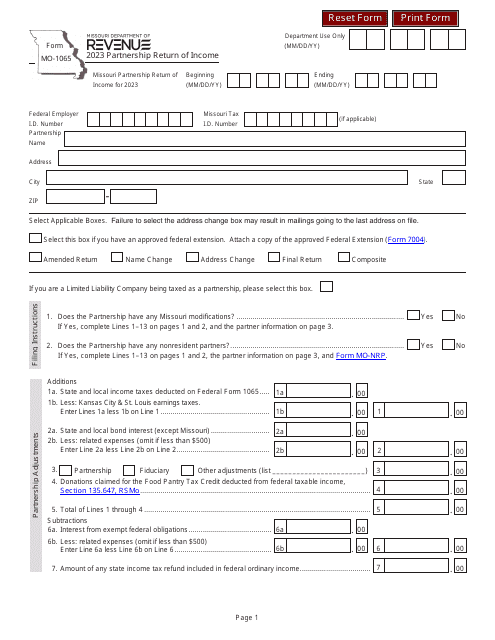

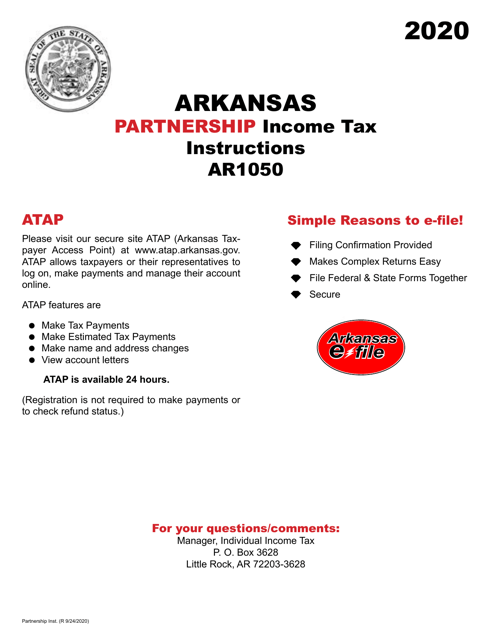

This document is used for filing the Arkansas Partnership Income Tax Return in the state of Arkansas. It provides instructions on how to report partnership income and deductions for tax purposes.