Income Tax Form Templates

Documents:

2505

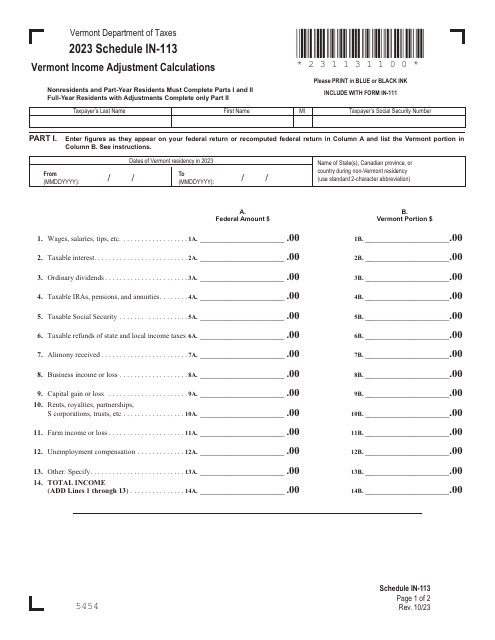

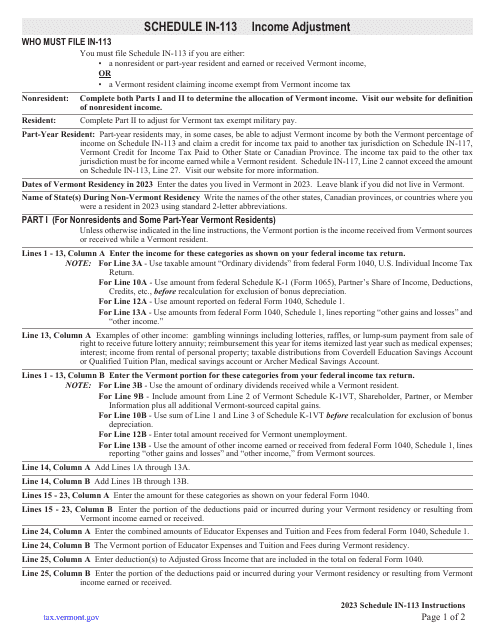

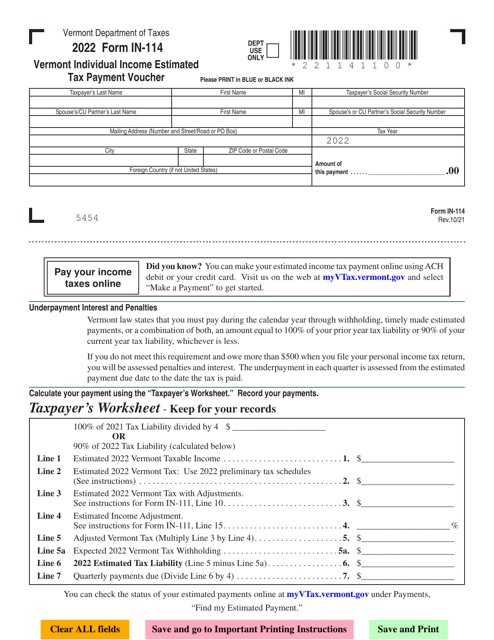

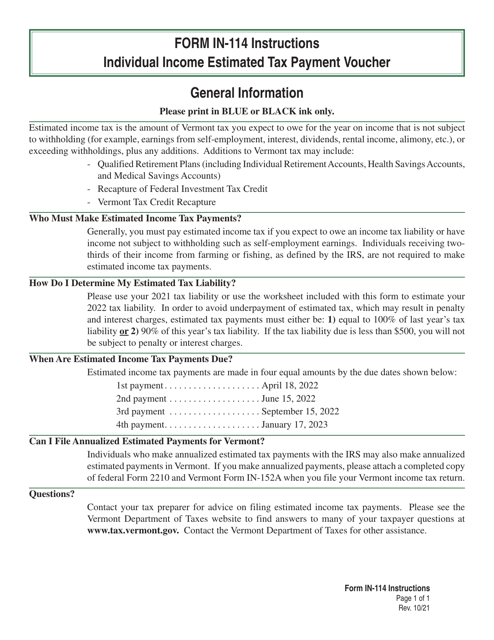

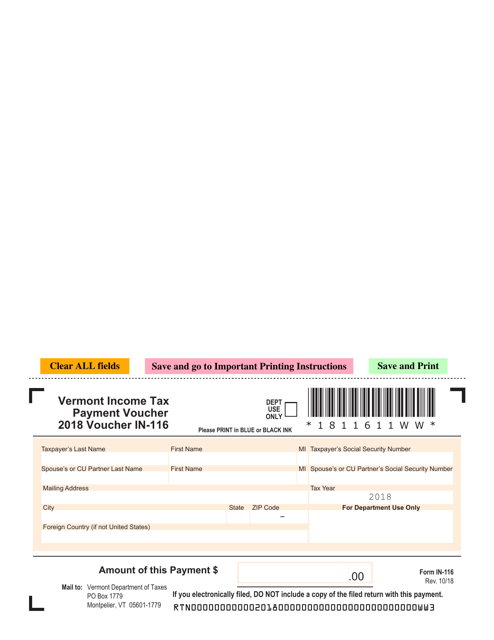

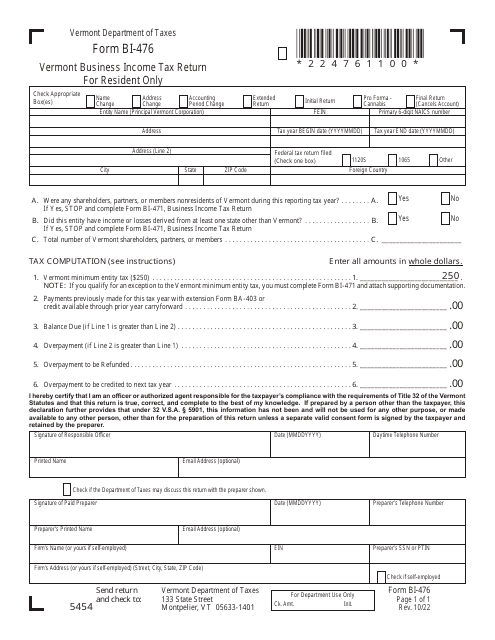

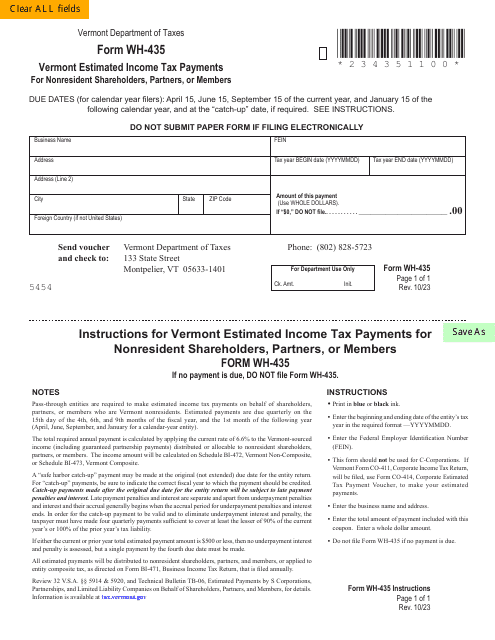

This document is used for making income tax payments in the state of Vermont.

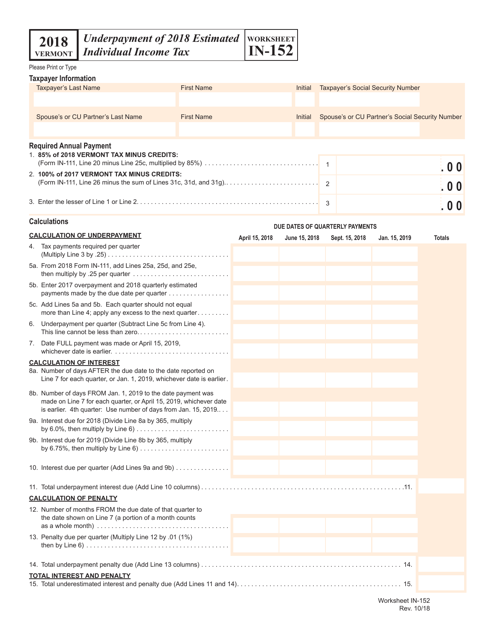

This form is used for calculating and reporting any underpayment of estimated individual income tax in Vermont for the year 2018.

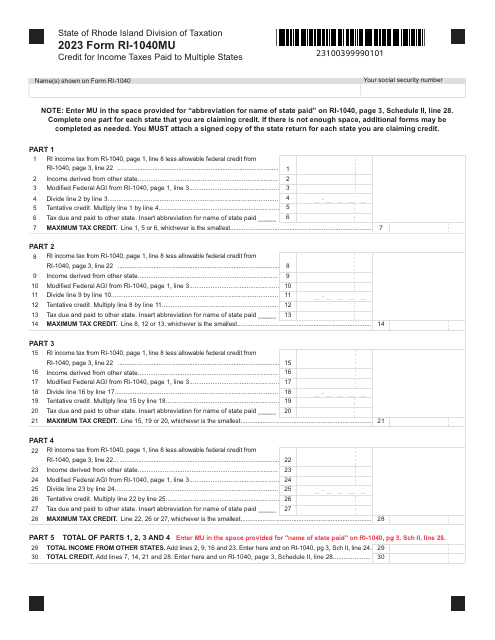

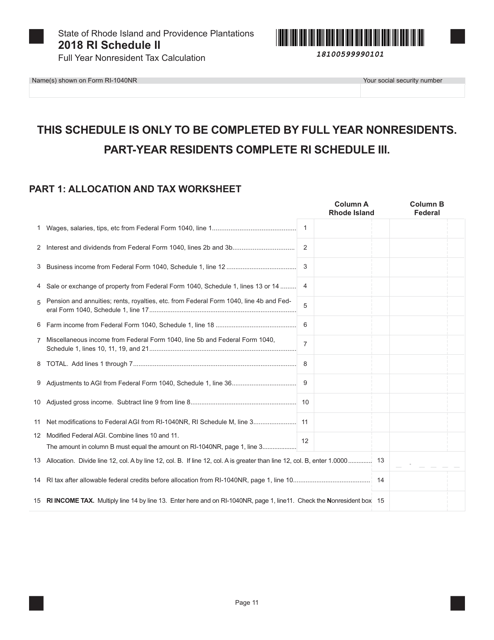

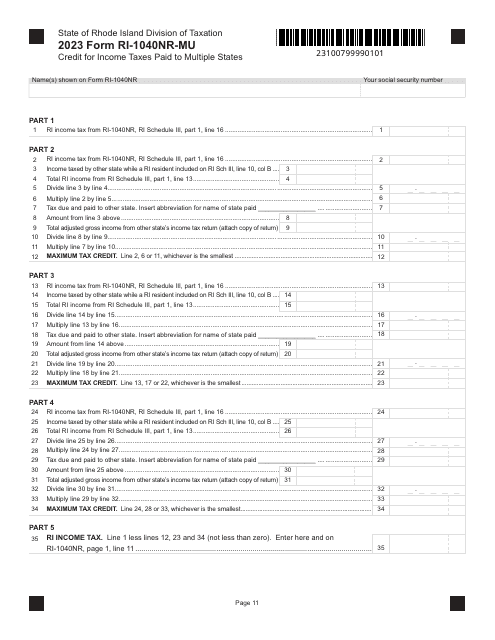

This document is used for calculating the full-year nonresident tax for Schedule II in Rhode Island.

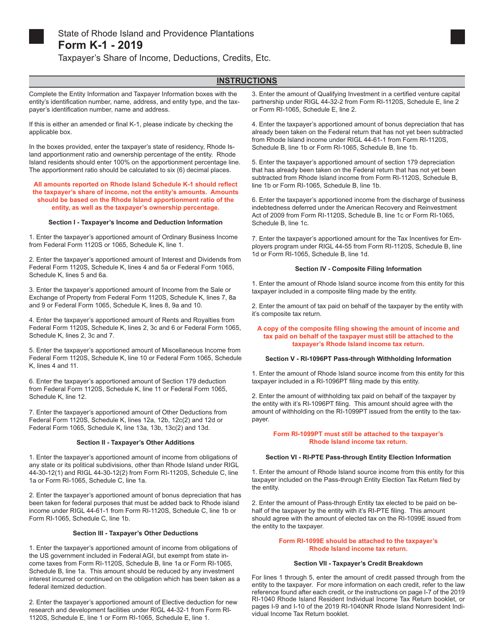

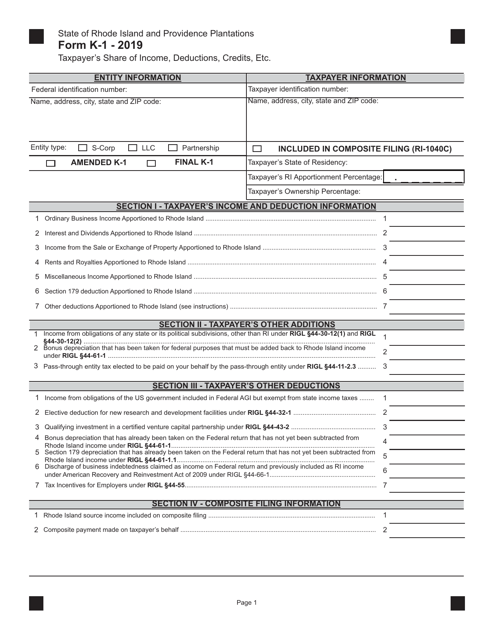

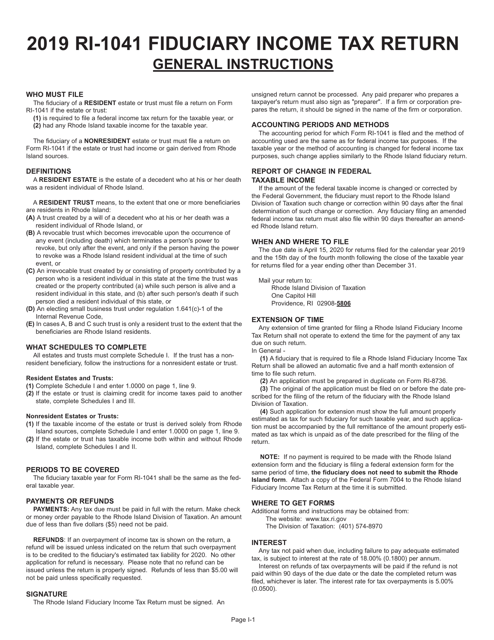

Instructions for Form K-1 Taxpayer's Share of Income, Deductions, Credits, Etc. - Rhode Island, 2019

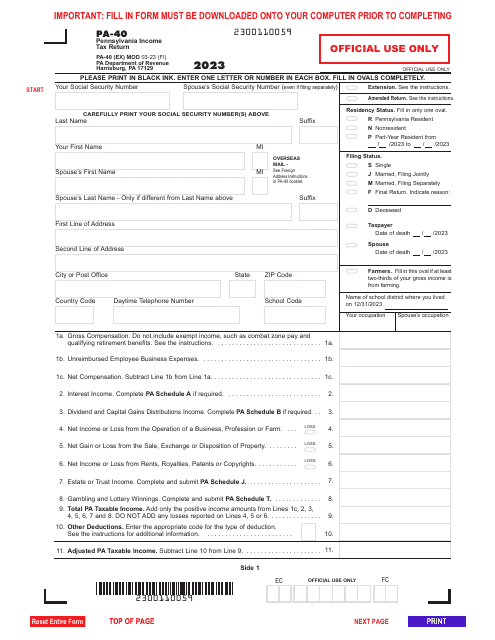

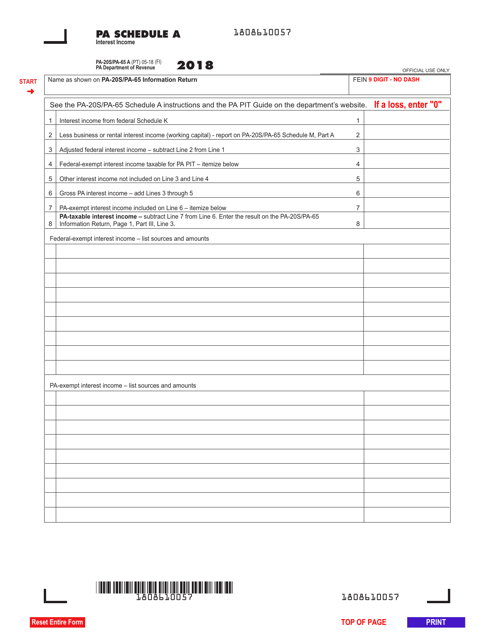

This type of document is used for reporting interest income specifically for residents of Pennsylvania.

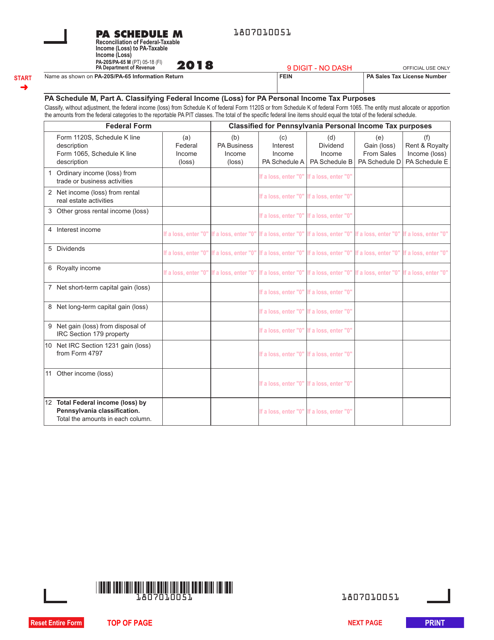

This Form is used for reconciling federal-taxable income (loss) to Pennsylvania taxable income (loss) in Pennsylvania.

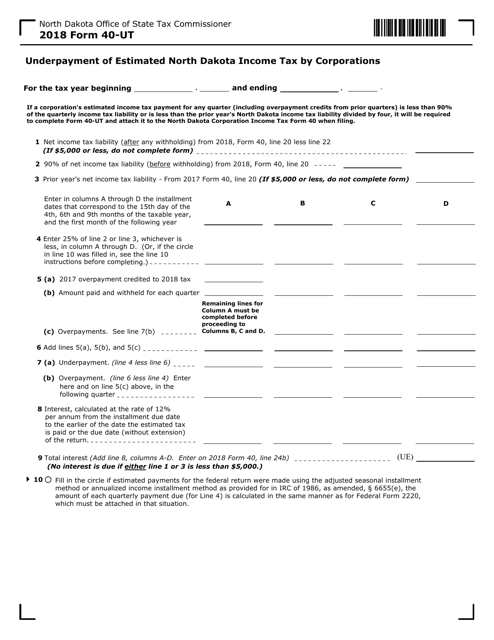

This form is used for corporations in North Dakota to report underpayment of estimated income tax.