IRS W-2 Forms and Instructions for 2023

What Are IRS W-2 Forms?

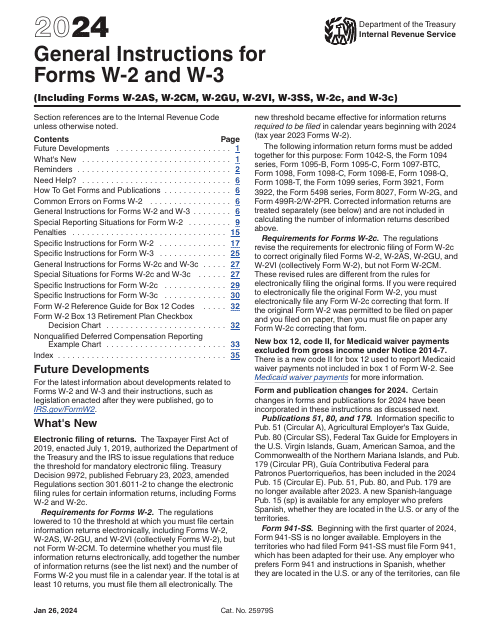

The IRS W-2 Forms are a series of six documents issued by the Internal Revenue Service (IRS). The main aim of these forms is to furnish the information about earnings to the employees, IRS, and the Social Security Administration (SSA) and to correct the already furnished information.

The forms consist of several copies. The filing rules are quite strict. You cannot print out the electronic versions of the documents for filing them via mail. File the electronic versions using e-filing service only. If you prefer paper versions, you must order them from the IRS. An extension to submit the forms is provided in limited cases, like natural disasters, fire, or any other extraordinary situation. Failure to file the forms on time without a valid reason may result in penalties. The amount of penalties depends on the delay period.

You can download the series from the link below.

What Are the Different Types of W-2 Forms?

The series includes the following publications:

- IRS Form W-2, Wage and Tax Statement. Complete this type of the form if you are an employer engaged in business or trade and paid remuneration for services performed by your employees, from which Medicare, social security, or income taxes were withheld.

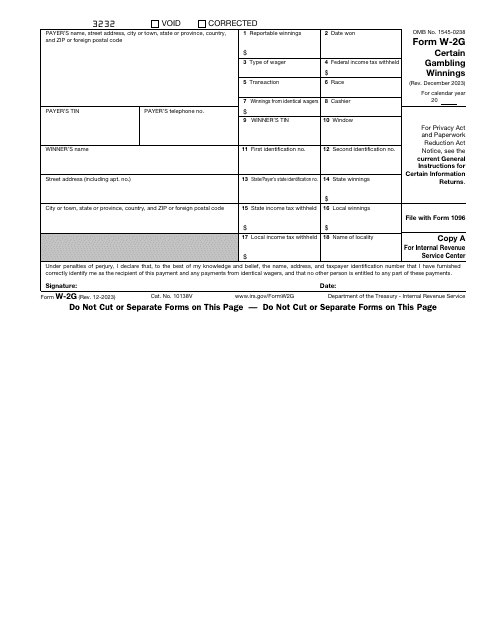

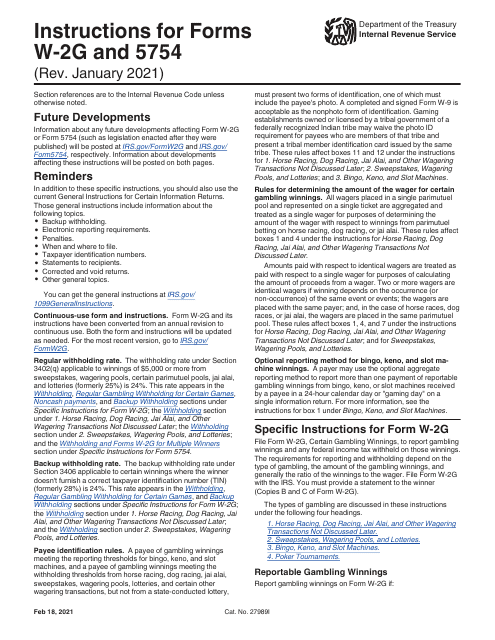

- IRS Form W-2G, Certain Gambling Winnings. Submit this document to inform about gambling winnings and tax withheld on them. The filling out requirements for this form may differ depending on the type of gambling, the amount of winnings, and the ratio of the winnings to the wager.

- IRS Form W-2C, Corrected Wage and Tax Statements. Fill out this form to correct the errors on the W-2 Forms you filed with the SSA and provided to your employees.

- IRS Form W-2GU, Guam Wage and Tax Statement. File this version of the form to report Guam salaries.

- IRS Form W-2VI, U.S. Virgin Islands Wage and Tax Statement. Report U.S. Virgin Islands wages on this form.

- IRS Form W-2AS, American Samoa Wage and Tax Statement. Use this form to provide information about American Samoa wages.

What Are Forms W-2 Used For?

Use the IRS W-2 forms if you are an employer who has one or more employees and paid salary to these employees during the previous tax year. If you have several employees, you must file a separate form for every one of them. The set of forms also contains documents you can use to correct information you have already filed with the SSA or provided to your employees and to report gambling winnings and the federal income tax withheld on those winnings. The employee uses the information provided via the W-2 forms to prepare their individual tax returns (Forms 1040).

What Is the Difference between the W-4 and W-2 Forms?

The main difference between Forms W-4 and W-2 is that the first one is an input document when the second is an output document. Form W-4 is filled out by the employee when the Form W-2 is completed by the employer. The Form W-4, Employee's Withholding Allowance Certificate is a form the employees use to inform the employer about the amount they want to withhold from their pays. Form W-2 is used by the employer to provide the employees with information about their year-end earnings and deductions.

Where to Send W-2 Forms?

Mail the paper versions of the IRS W-2 forms to the SSA, Direct Operations Center, Wilkes-Barre, PA 18769-0001. If you submit the forms using Certified Mail, change the ZIP-code to 18769-0002. If you send the documents via an IRS-approved private delivery service, add to address “Attn: W-2 Process, 1150 E. Mountain Dr.” and change the ZIP-code to 18702-7997. Besides, the SSA encourages you to send them the W-2 forms using an e-filing service. If you file 250 and more forms at a time, you must use e-filing service only;

Where Can I Get W-2 Forms?

Download the electronic versions of the W-2 forms below. If you prefer paper versions, you can send the order to: Internal Revenue Service, 1201 N. Mitsubishi Motorway, Bloomington, IL 61705-6613. Your forms are usually delivered within 10 business days after the IRS receives your request;

When Are W-2 Forms Due?

The W-2 Form due date is January 31. You may request an extension by submitting Form 8809, Application for Extension of Time to File Information Returns. If the IRS grants you permission, you will have an additional 30 days to file your forms with the Social Security Administration. However, you still have to furnish the forms to your employees by the due date. To ask permission to provide the forms to your employees later, send a separate letter to Internal Revenue Service, Attn: Extension of Time Coordinator, 240 Murall Drive, Mail Stop 4360, Kearneysville, WV 25430.

Related Articles

Documents:

14

This is a formal report filed by gambling facilities to outline the winnings of their clients and certify they deducted taxes from the sum of money won.

This is a supplementary form used by employers to handle errors they have made upon filing IRS Form W-2, Wage and Tax Statement.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

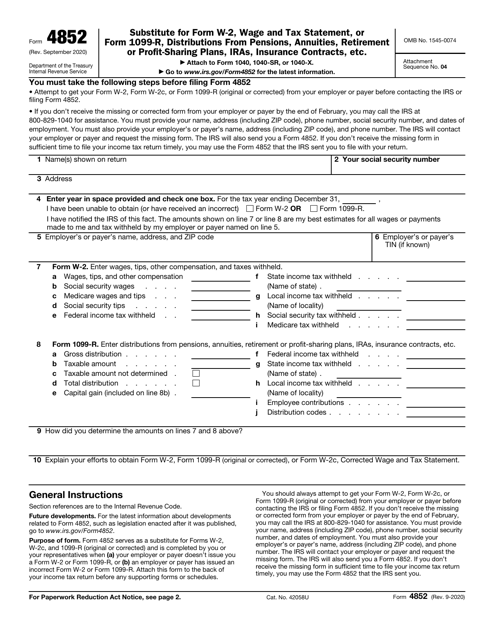

This is a formal statement taxpayers should use to report their income correctly in case they did not receive the main documentation they are expected to file.