Tax Regulations Templates

Documents:

480

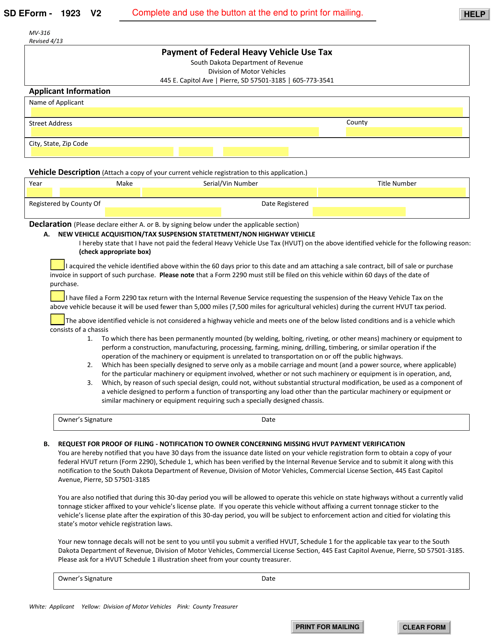

This form is used for paying the federal heavy vehicle use tax in South Dakota.

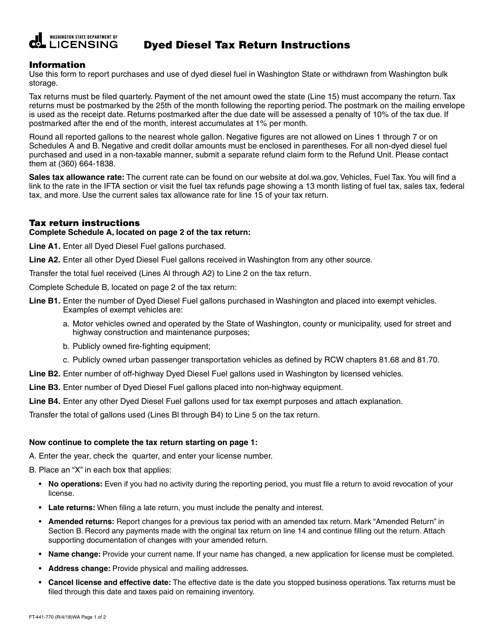

This form is used for reporting and paying taxes on dyed diesel fuel in the state of Washington.

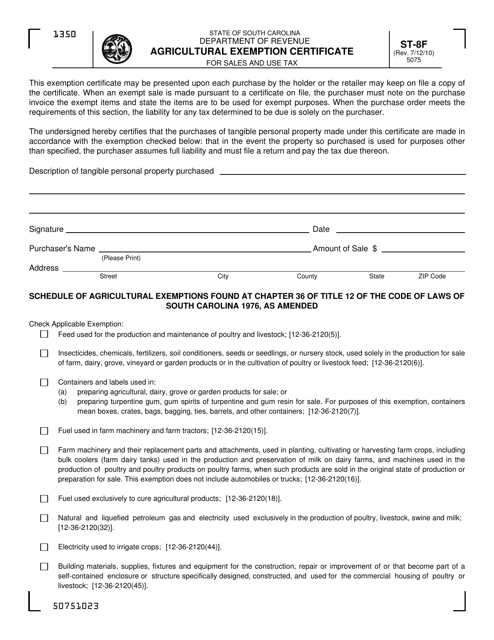

This form is used for claiming an exemption from sales and use tax on agricultural products in South Carolina. It provides instructions on how to properly fill out and submit the Form ST-8F Agricultural Exemption Certificate.

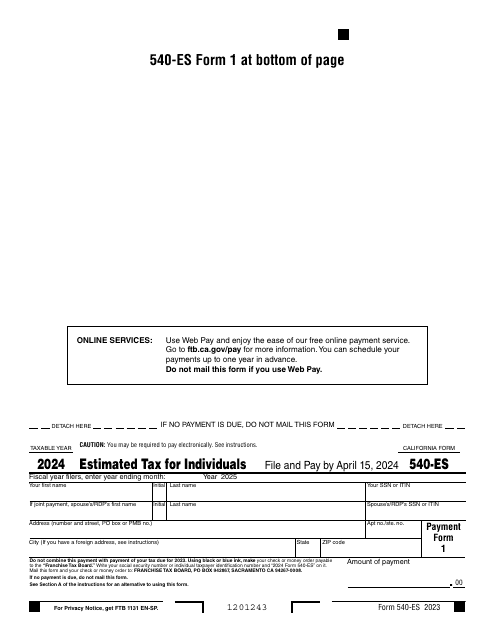

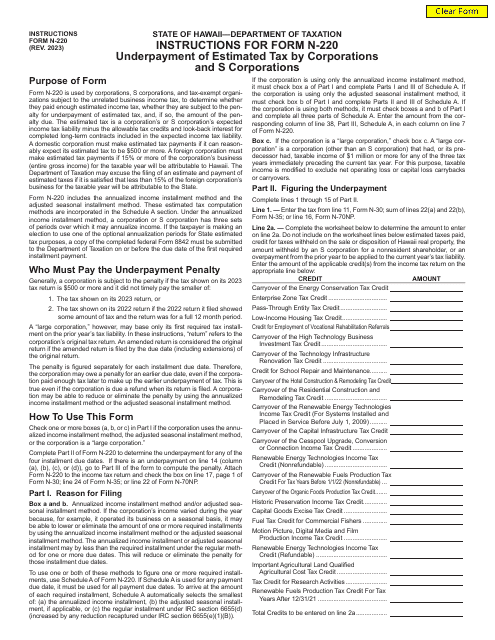

Fill out this form over the course of a year to pay your taxes in the state of California.

This form is used for applying for a determination from the IRS for an employee benefit plan.

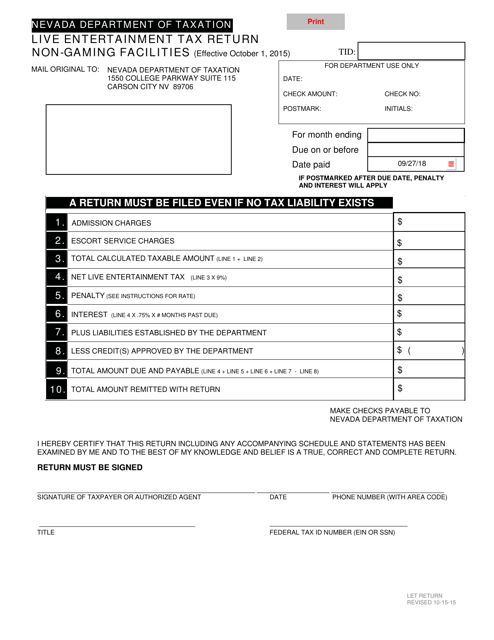

This document explains the Live Entertainment Tax regulations in Nevada for non-gaming establishments with an occupancy of more than 200 people. It covers the tax requirements and guidelines for businesses that provide live entertainment services to their customers.

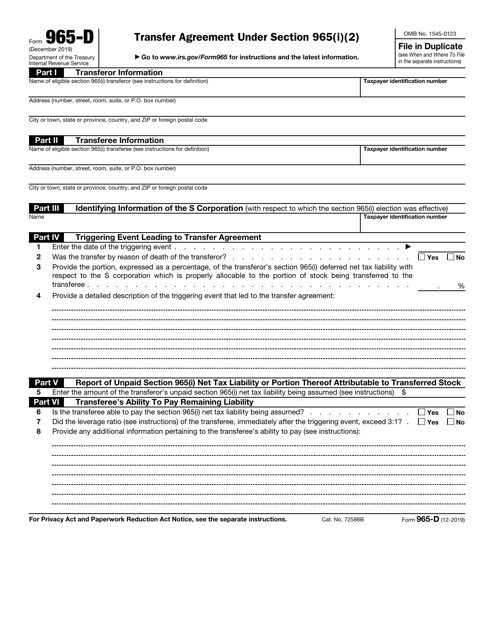

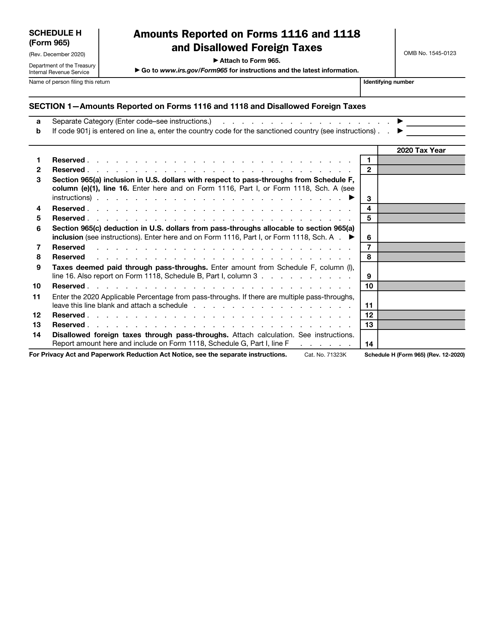

This form is used for transferring assets under Section 965(I)(2) of the IRS Code.

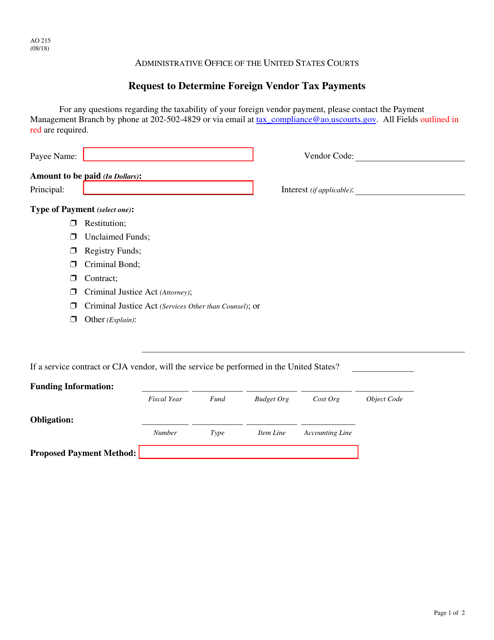

This form is used for requesting the determination of tax payments made by a foreign vendor.