Tax Regulations Templates

Documents:

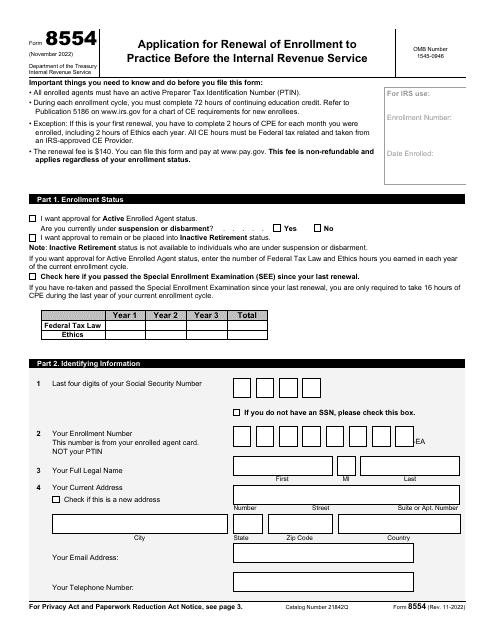

480

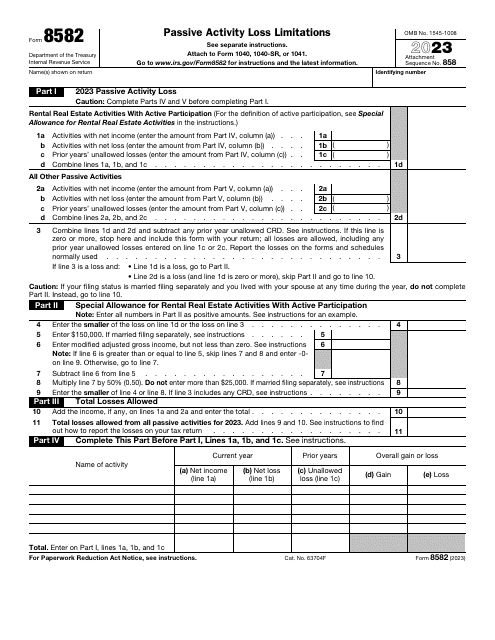

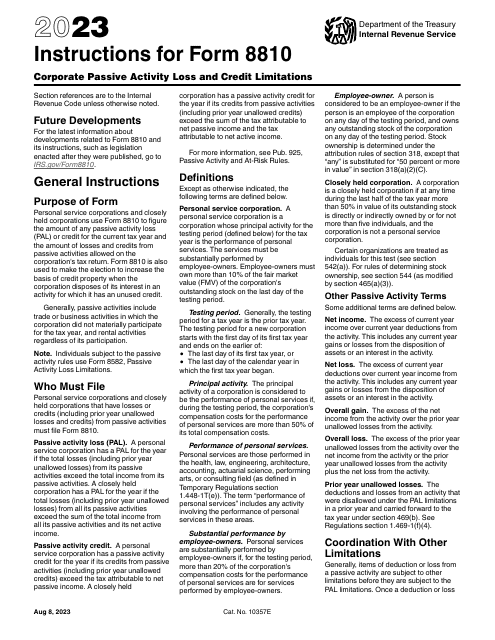

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

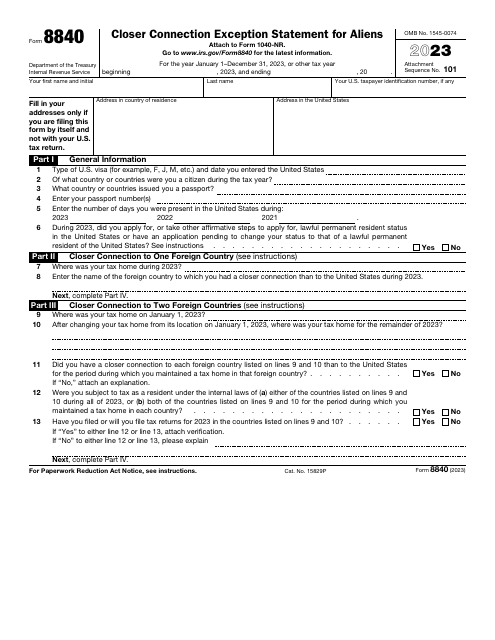

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

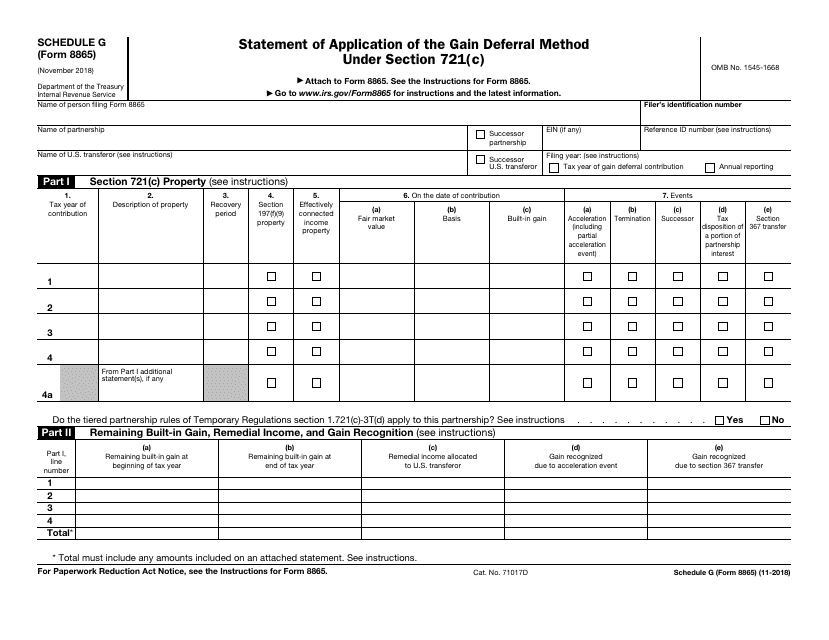

This Form is used for reporting the application of the gain deferral method under Section 721(c) on IRS Form 8865 Schedule G.

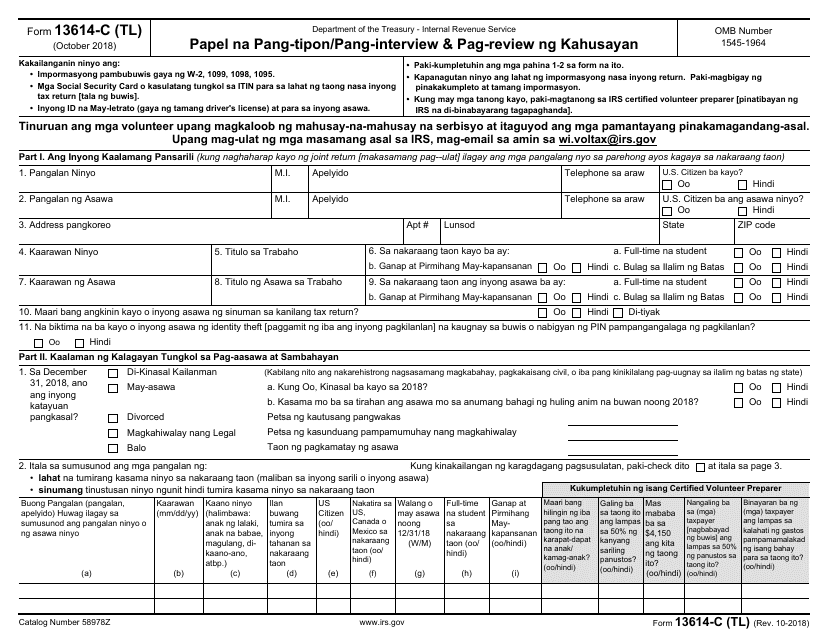

This document is for individuals who speak Tagalog and need assistance with their tax intake process. It is used to gather information about the taxpayer's financial situation for the IRS.

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.

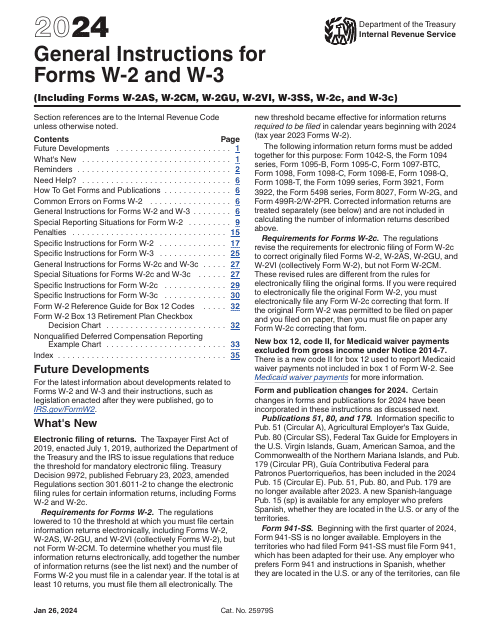

This document provides instructions for various IRS forms including 1096, 1097, 1098, 1099, 3821, 3822, 5498, and W-2G. The instructions guide individuals or organizations on how to fill out these specific information returns required by the IRS.

This Form is used for reporting information related to tax credit bonds and specified tax credit bonds to the IRS. It provides instructions for completing the IRS Form 8038-TC.

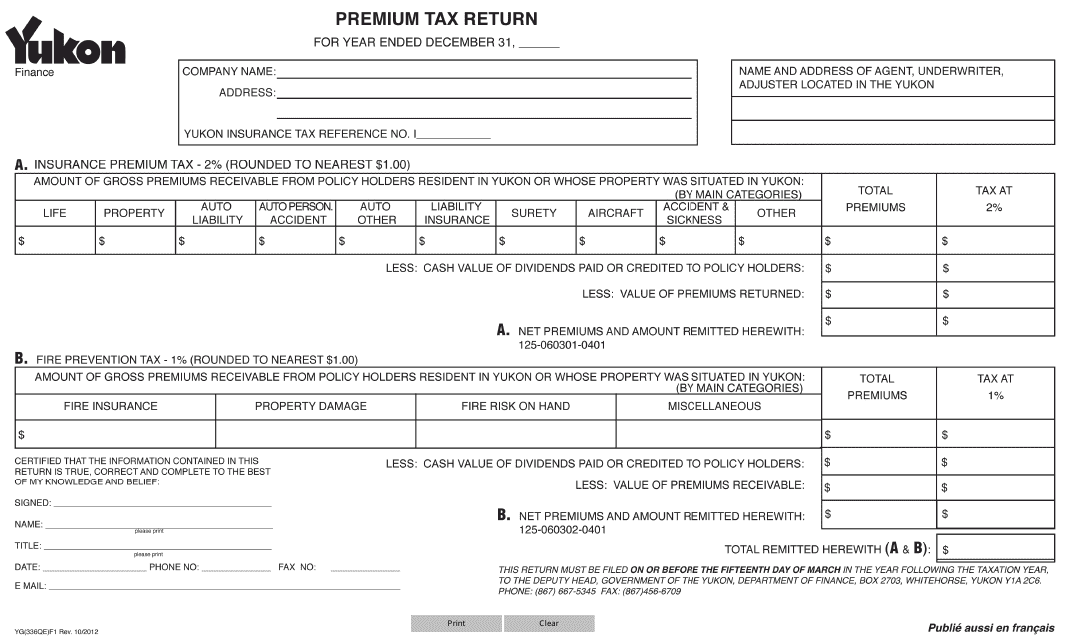

This form is used for filing premium tax returns in Yukon, Canada.

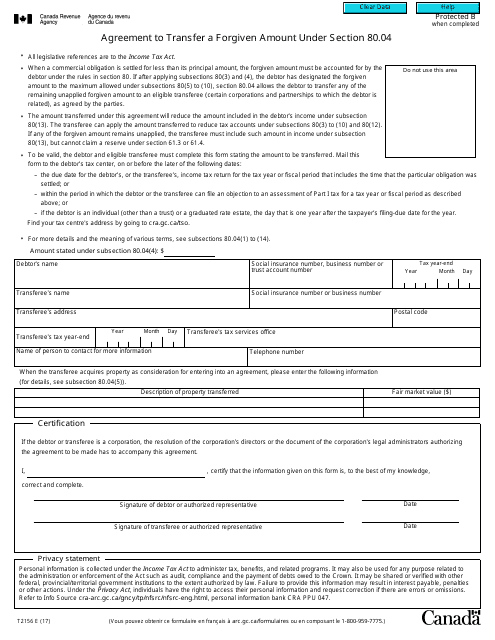

This form is used for transferring a forgiven amount under Section 80.04 in Canada.

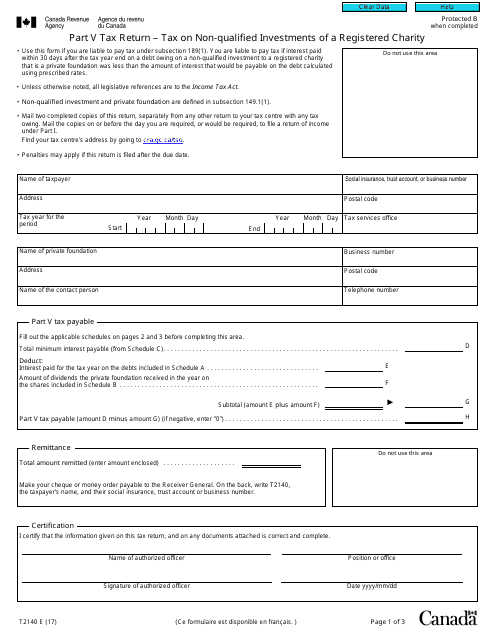

This form is used for reporting and paying taxes on non-qualified investments made by a registered charity in Canada.

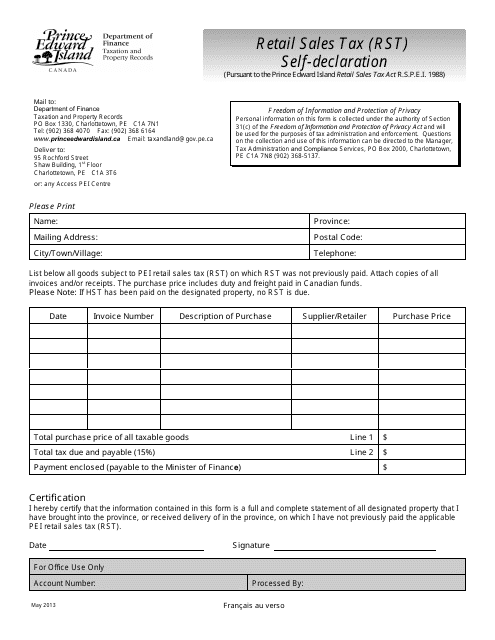

This document is used for self-declaration of Retail Sales Tax (RST) in Prince Edward Island, Canada. It pertains to businesses reporting and paying their retail sales tax obligations to the provincial government.

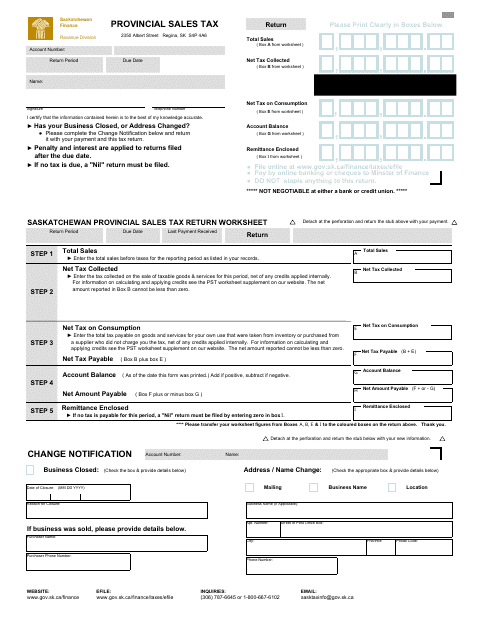

This Form is used for reporting and remitting the Provincial Sales Tax in the province of Saskatchewan, Canada.

This document provides instructions for completing and filing the Provincial Sales Tax Return in Saskatchewan, Canada. It guides taxpayers on how to report and pay their sales tax obligations to the provincial government.

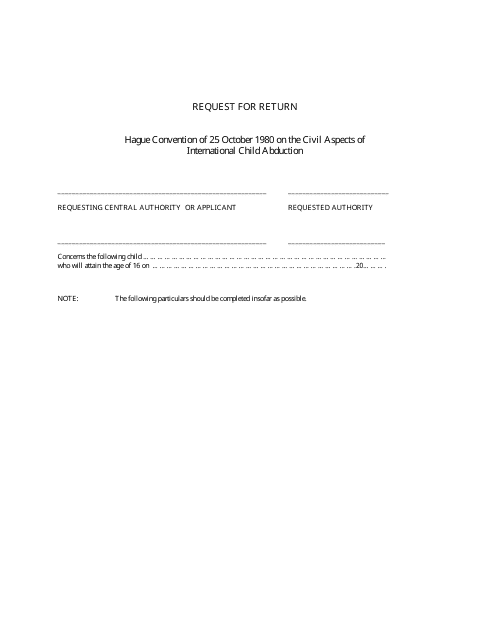

This document is used to request a return in the province of Saskatchewan, Canada.

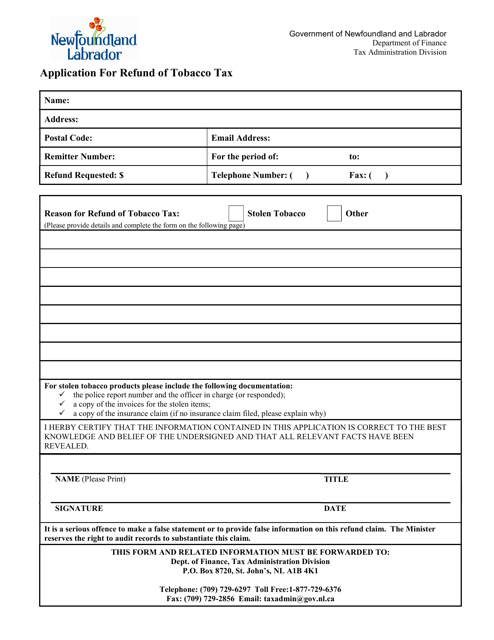

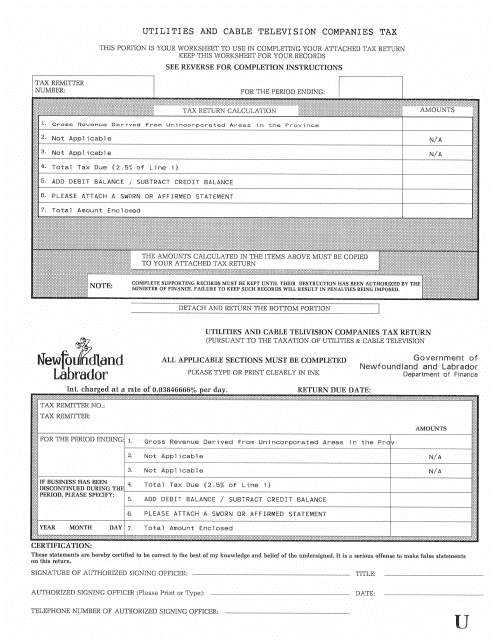

This document is for the tax regulations related to utilities and cable television companies in Newfoundland and Labrador, Canada. It provides information on the taxes applicable to these industries in the province.

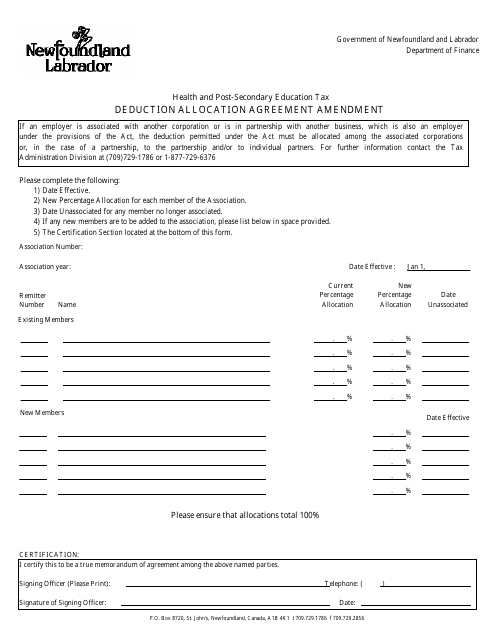

This document is used for amending the Health and Post-secondary Education Tax Deduction Allocation Agreement in Newfoundland and Labrador, Canada.

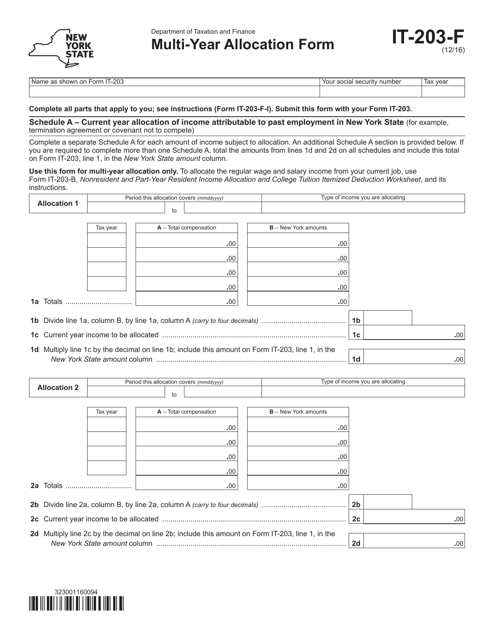

This Form is used for allocating income and deductions for multiple years in New York.