Tax Regulations Templates

Documents:

480

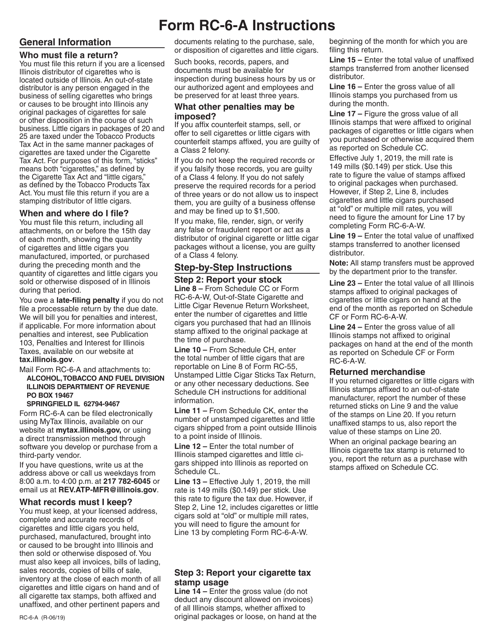

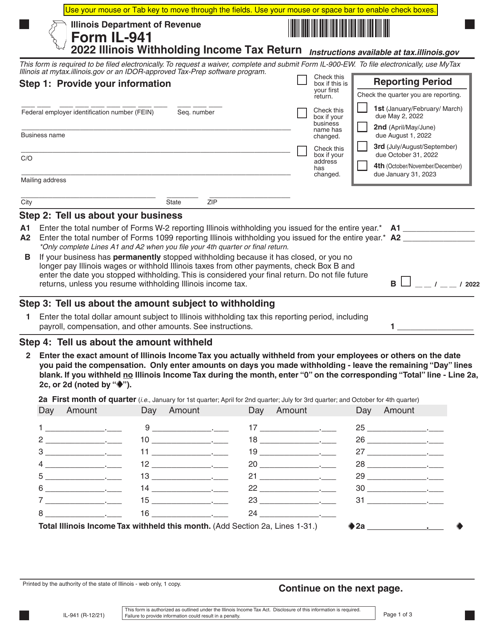

This Form is used for reporting cigarette and little cigar revenue generated out-of-state. It is specific to the state of Illinois.

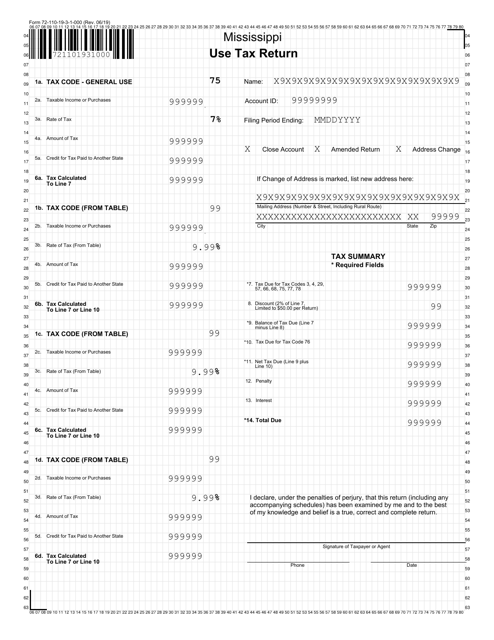

This form is used for reporting and paying use tax in the state of Mississippi. Use tax is a tax on goods and services purchased outside of the state but used within Mississippi.

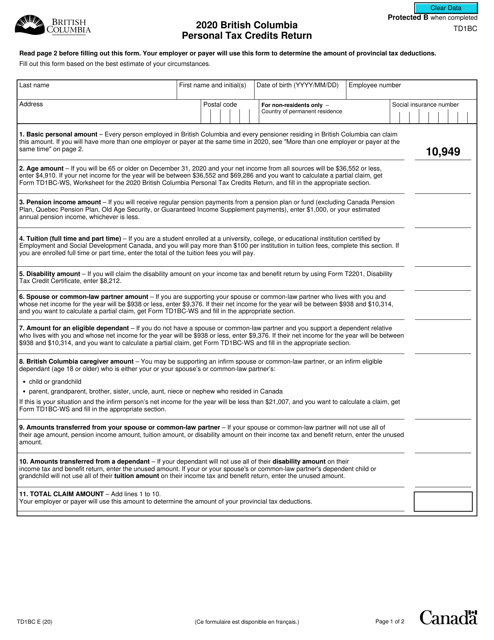

This form is used for claiming personal tax credits in the province of British Columbia, Canada. It allows individuals to reduce the amount of income tax they owe based on various tax credits they may be eligible for.

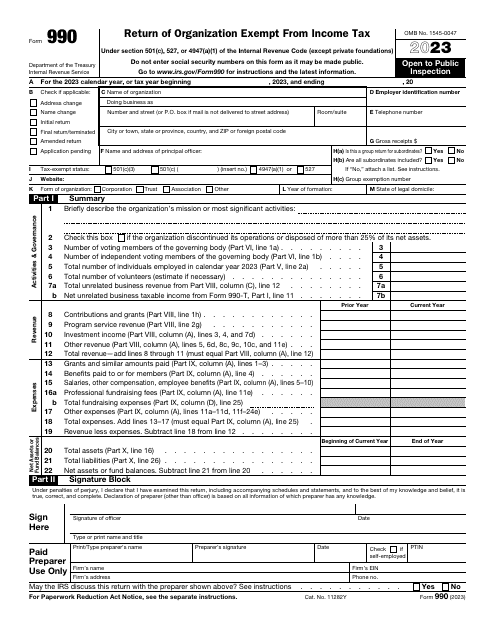

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

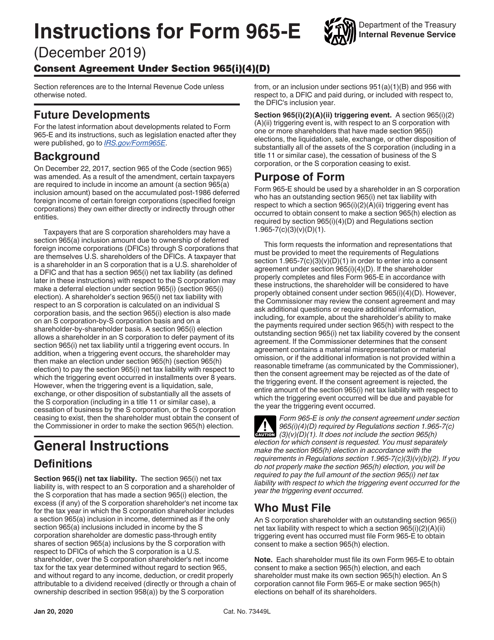

This document is used for completing the IRS Form 965-E Consent Agreement under Section 965(I)(4)(D). It provides instructions on how to properly fill out the form and comply with the requirements.

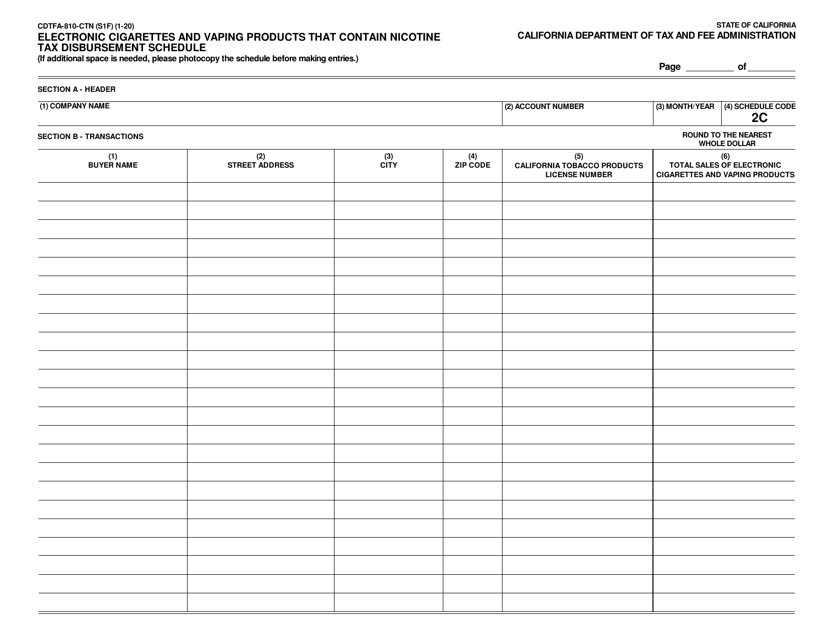

This form is used for the tax disbursement schedule for electronic cigarettes and vaping products containing nicotine in California.

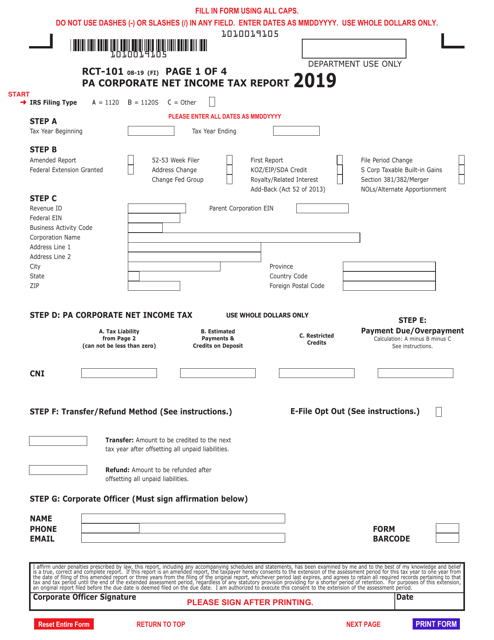

This form is used for reporting corporate net income tax in the state of Pennsylvania.