Tax Regulations Templates

Documents:

480

This document provides tax information for motor vehicle dealers in Florida. It covers topics such as sales tax, registration fees, and dealer licensing requirements.

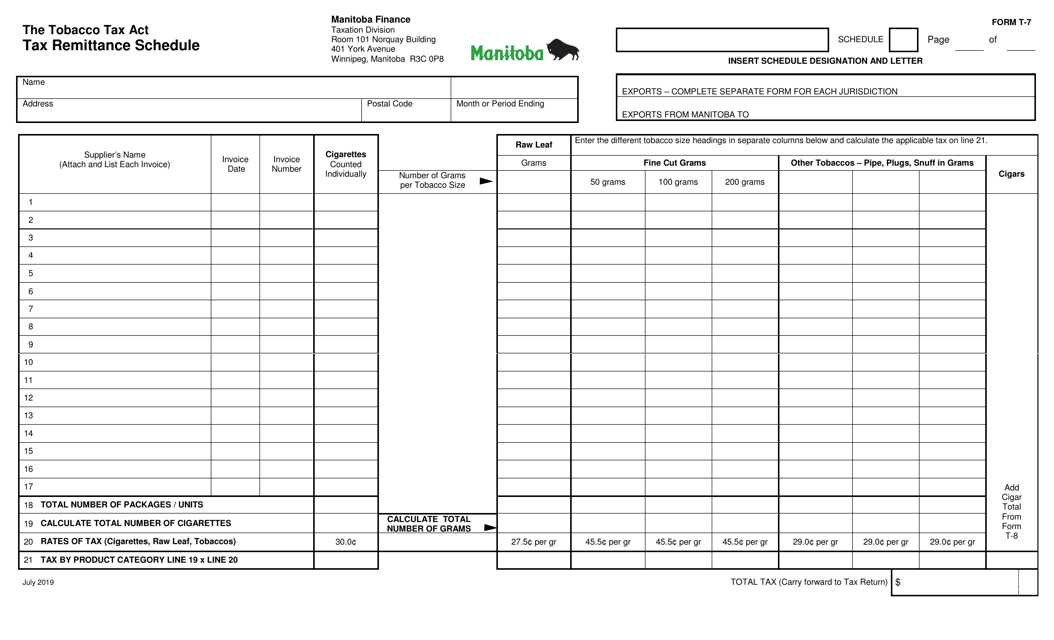

This form is used for reporting and remitting taxes in the province of Manitoba, Canada. It is necessary for businesses to accurately declare and remit taxes owed to the government on a regular schedule. Failure to do so can result in penalties and fines.

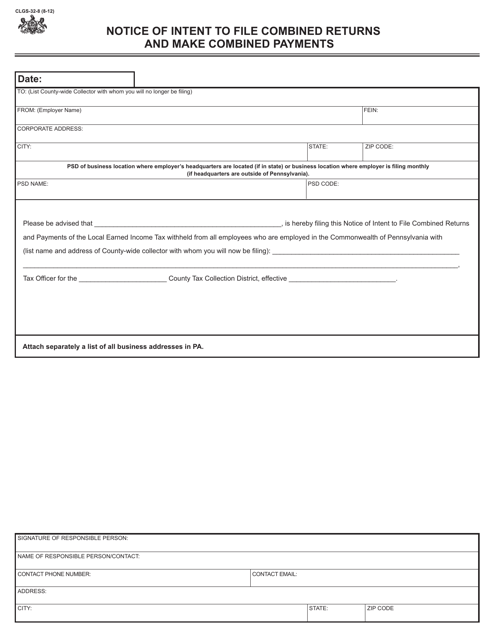

This Form is used for notifying the Pennsylvania Department of Revenue of the intent to file combined returns and make combined payments for multiple entities.

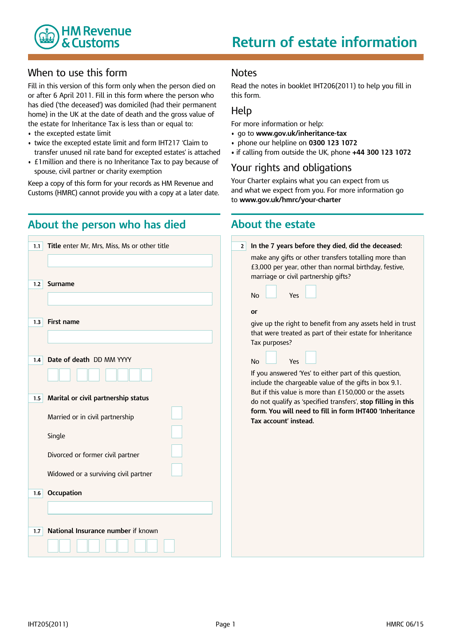

Individuals may prepare this supplemental document when they file an application for a grant of probate or a grant of letters of administration and have to confirm there is no inheritance tax due on the estate.

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

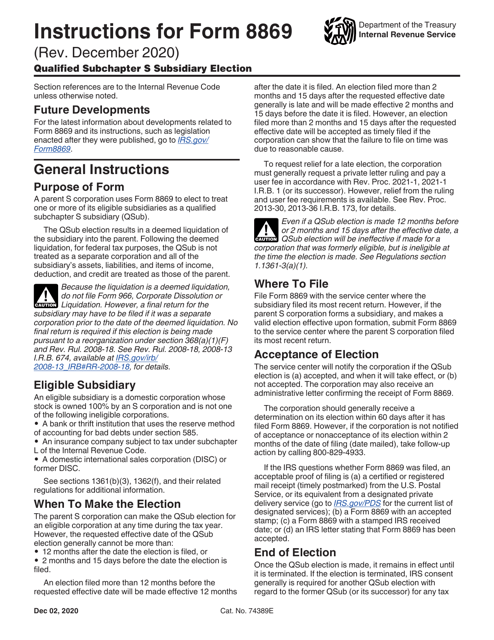

This Form is used for electing to treat a domestic corporation as a Qualified Subchapter S Subsidiary (QSub).

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

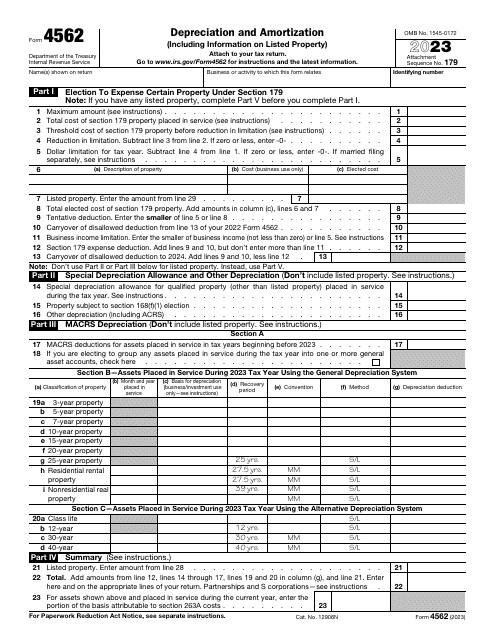

This is a formal document prepared by business owners whose intention is to ask for tax deductions due to depreciation of assets they used to carry out business operations and amortization of this property.