Tax Regulations Templates

Documents:

480

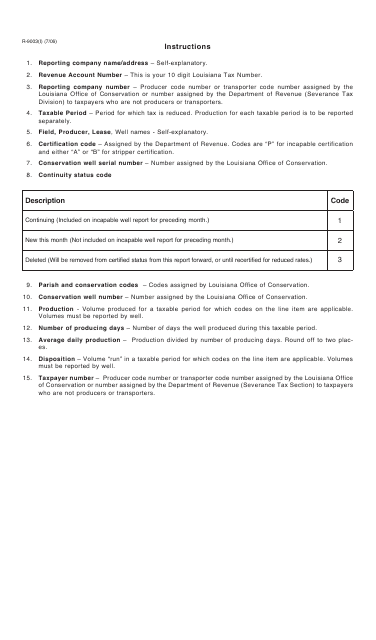

This form is used for reporting oil severance in the state of Louisiana. It provides instructions on how to properly fill out and submit the form.

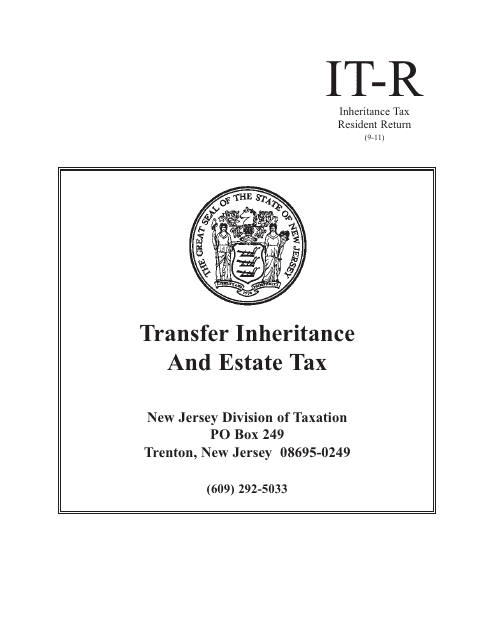

This form is used for reporting and paying inheritance tax for residents of New Jersey.

This Form is used for reporting income and expenses of electing large partnerships in the United States.

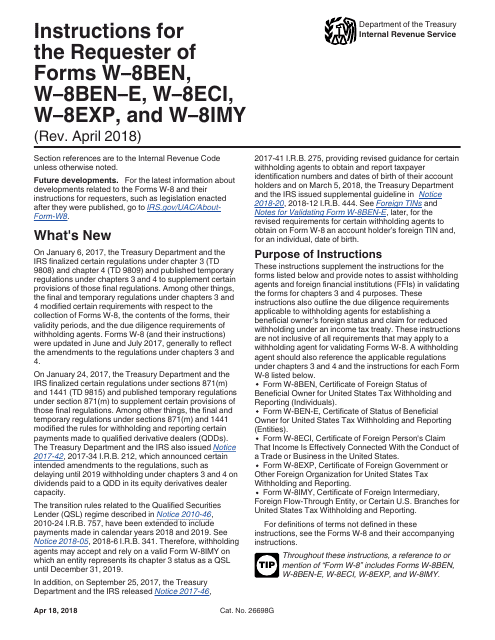

This document provides instructions for various IRS forms including W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. These forms are used to certify the foreign status of the taxpayer and claim eligibility for tax treaty benefits, exemption from withholding, or reduced withholding rates. The instructions guide taxpayers on how to complete these forms correctly and provide required information to the IRS.

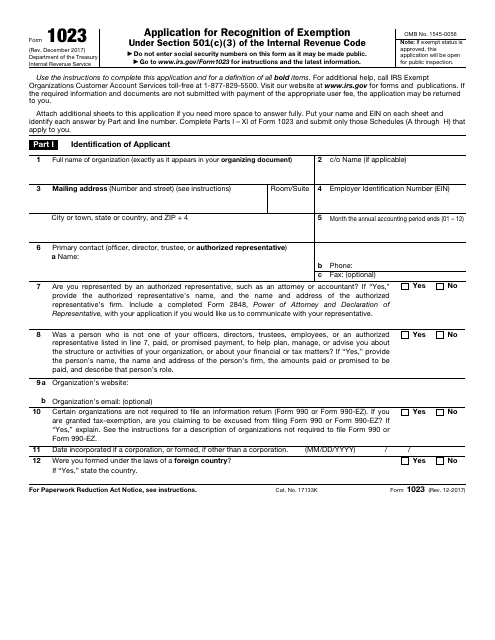

This Form is used for applying for tax-exempt status for charitable organizations with the IRS.

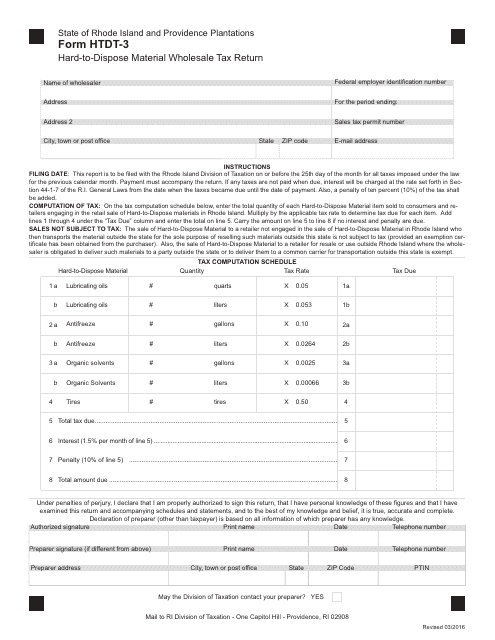

This Form is used for filing the Hard-To-Dispose Material Wholesale Tax Return in Rhode Island.

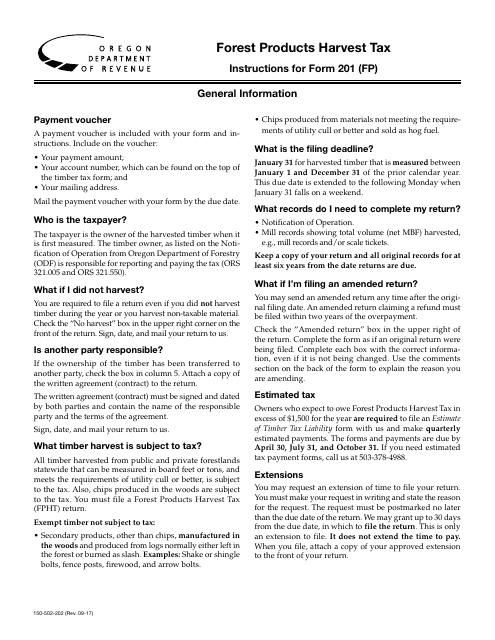

This form is used for reporting and paying the Forest Products Harvest Tax in the state of Oregon.

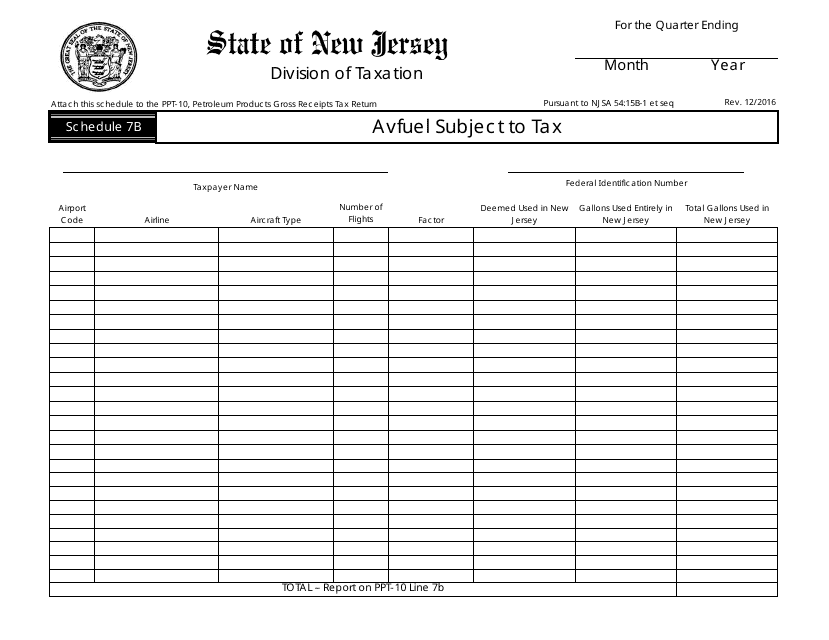

This Form is used for reporting Avfuel subject to tax in New Jersey.

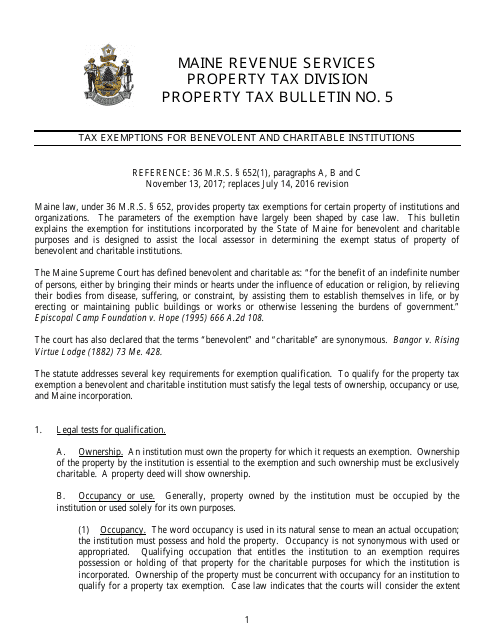

This document provides information about tax exemptions available to benevolent and charitable institutions in the state of Maine. It outlines the eligibility criteria and the process for obtaining these exemptions.

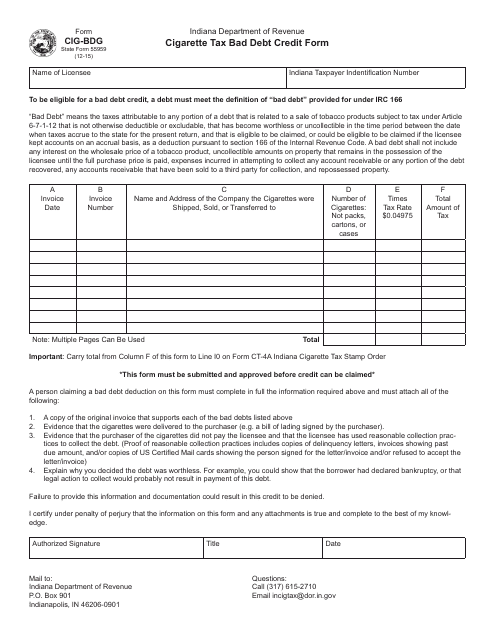

This form is used for claiming a bad debt credit related to cigarette taxes in Indiana.

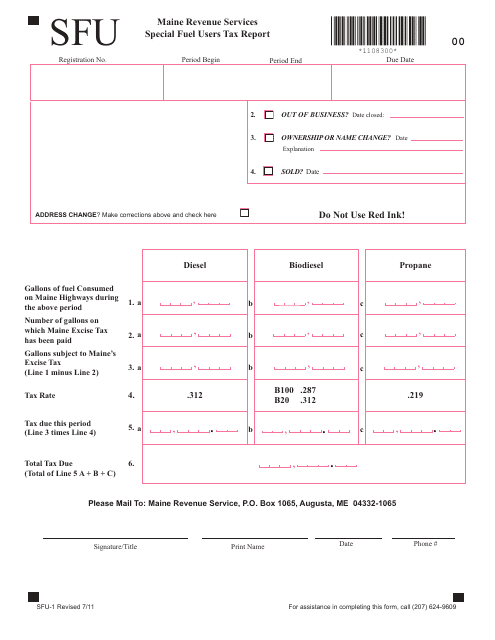

This form is used for reporting taxes on special fuel usage in the state of Maine. It is mandatory for businesses and individuals who use special fuel for their operations to file this report.

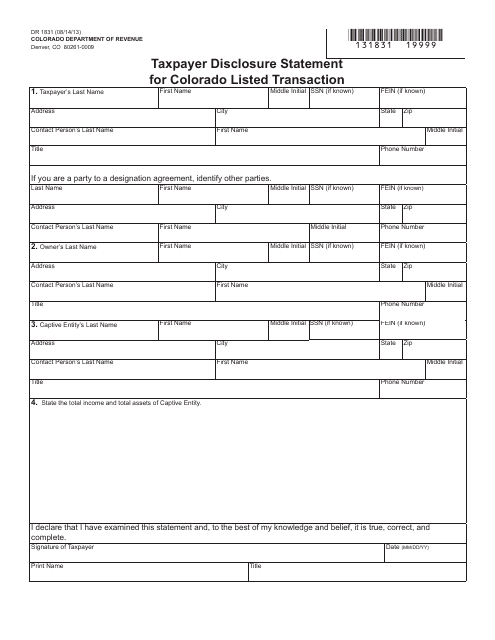

This form is used for taxpayers in Colorado to provide disclosure statements for listed transactions related to taxes.

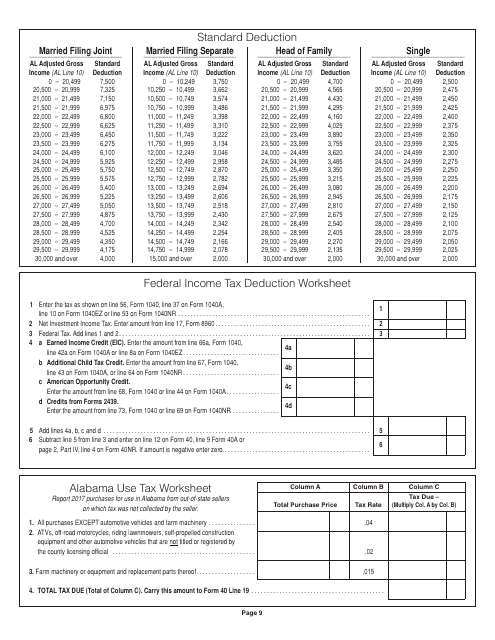

This document provides a worksheet for Alabama residents to calculate their federal income tax deductions.

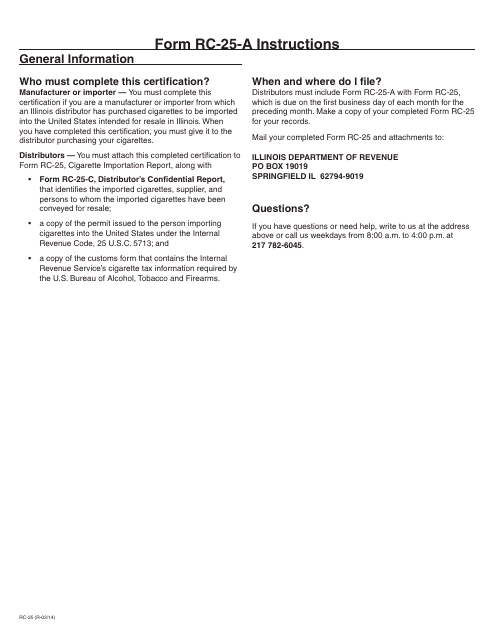

This form is used for cigarette manufacturers and importers in Illinois to certify compliance with state regulations. It provides instructions for completing and submitting Form RC-25-A.

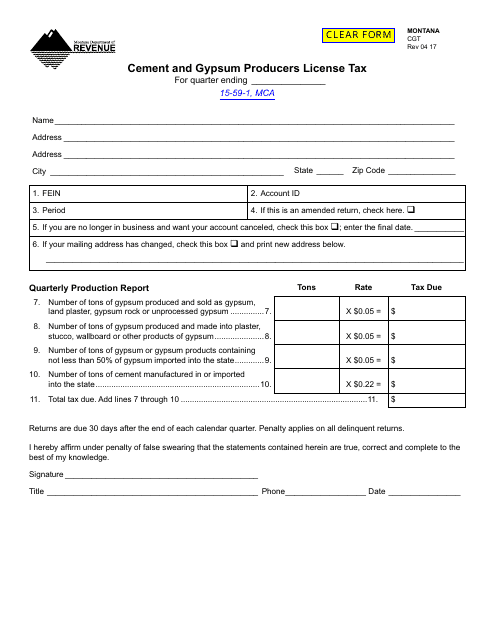

This form is used for obtaining a license tax for cement and gypsum producers in the state of Montana.

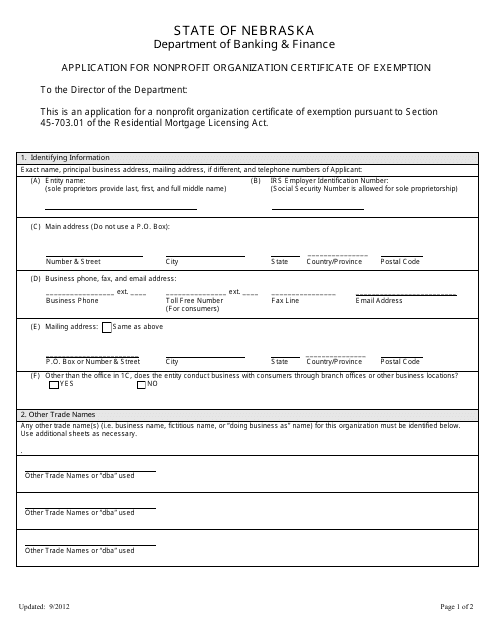

This document is used for applying for a certificate of exemption for nonprofit organizations in the state of Nebraska.

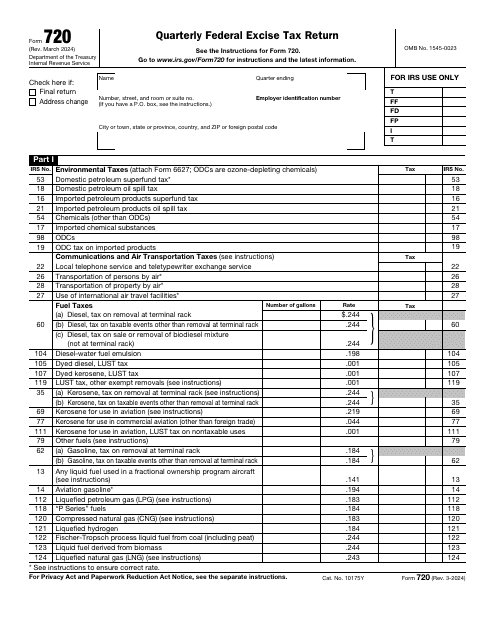

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

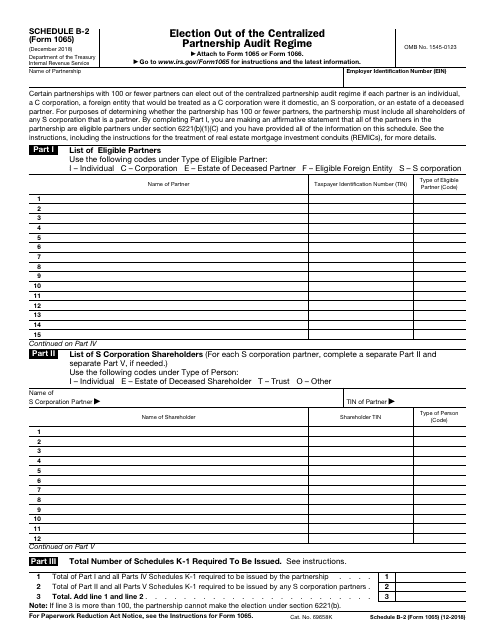

This is form is used by partnerships to inform the tax authorities they choose not to be subject to a partnership audit regime prescribed by current fiscal legislation.

This is a formal IRS document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

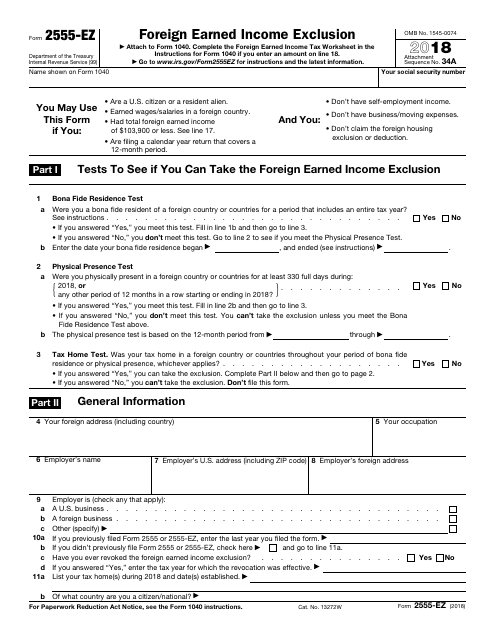

This document is used for claiming the Foreign Earned Income Exclusion on your taxes.