Tax Regulations Templates

Documents:

480

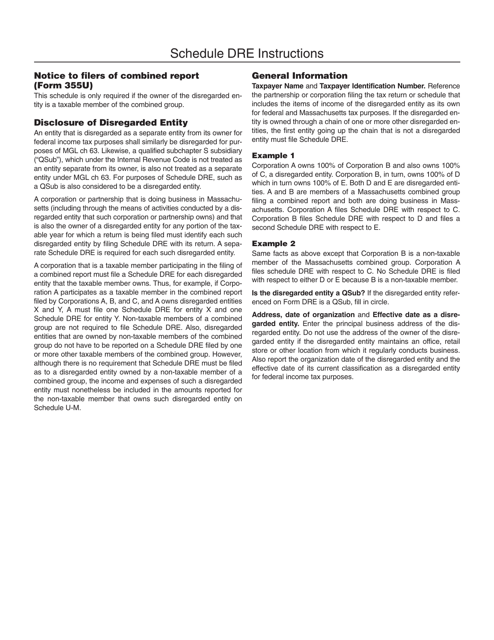

This document provides instructions for disclosing disregarded entities on Schedule DRE in Massachusetts.

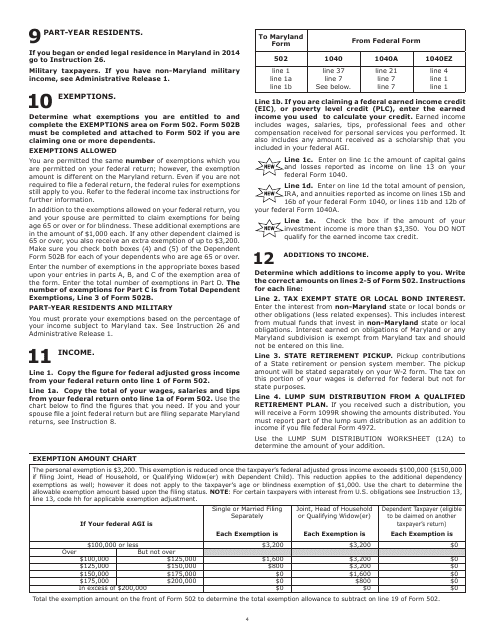

This document provides an exemption amount chart specifically for the state of Maryland. It details the specific amounts that individuals or businesses may be exempt from certain taxes or fees in Maryland.

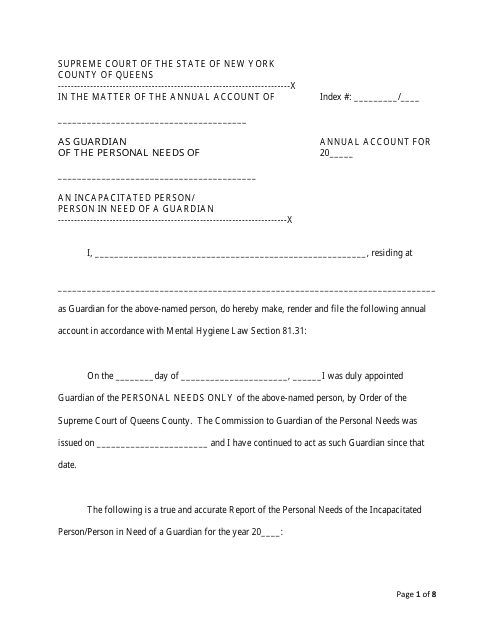

This document is used for filing annual accounts in New York. It provides a summary of a company's financial activities for the year.

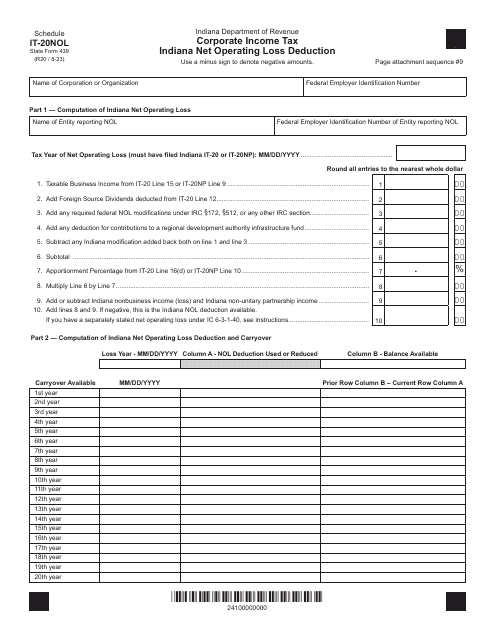

State Form 439 Schedule IT-20NOL Corporate Income Tax Indiana Net Operating Loss Deduction - Indiana

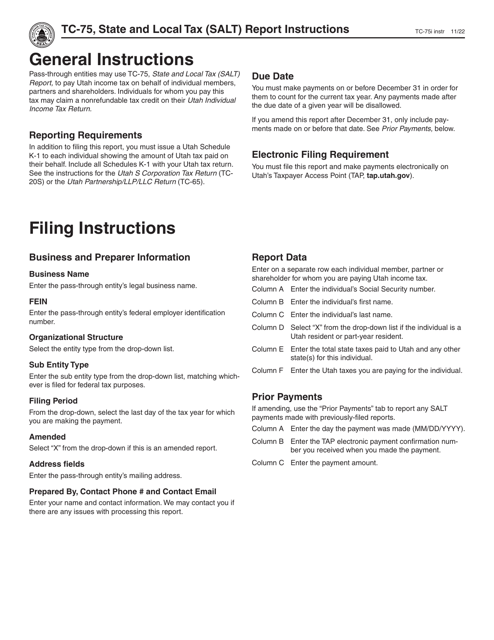

This Form is used for reporting state and local taxes in Utah. It provides instructions on how to accurately complete the TC-75 State and Local Tax Report.

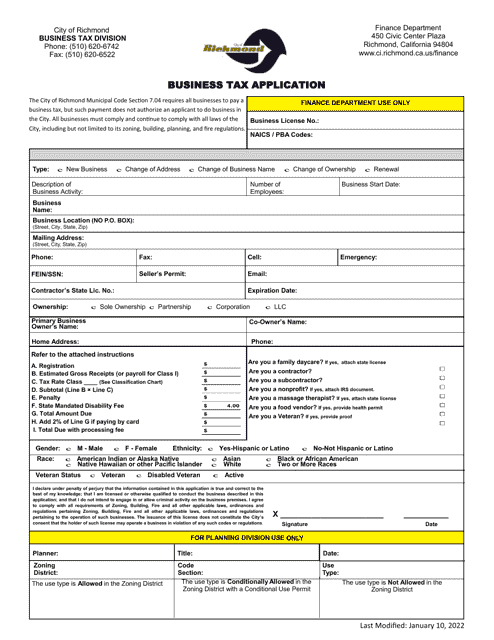

This form is used for applying for business tax in Richmond City, California.

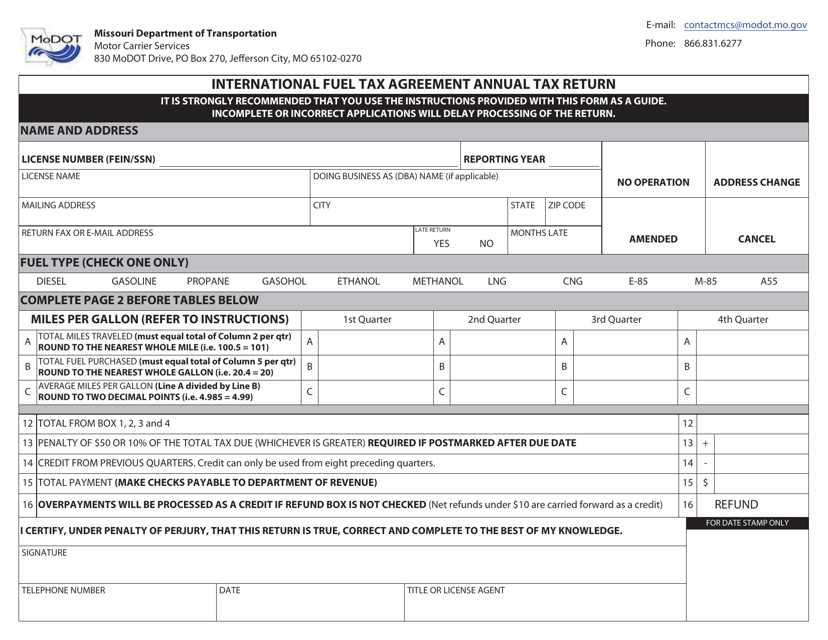

This document is used for filing the annual tax return related to the International Fuel Tax Agreement in the state of Missouri.

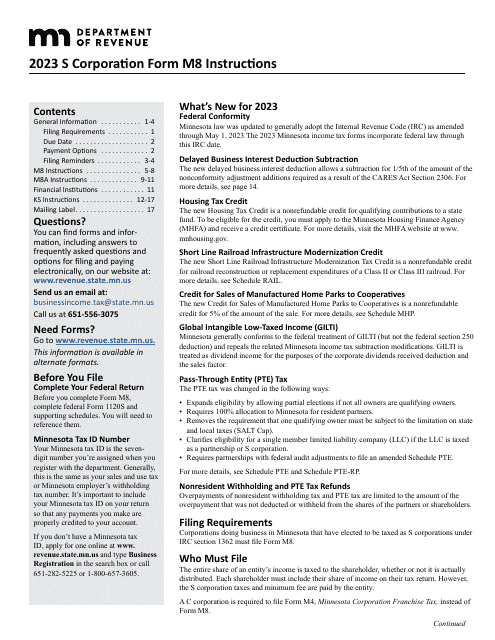

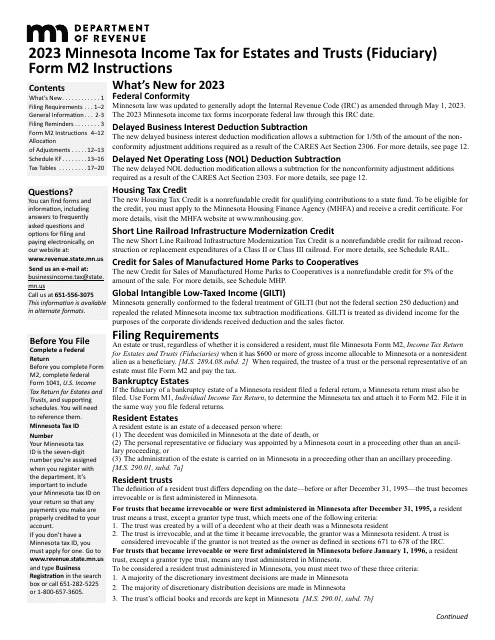

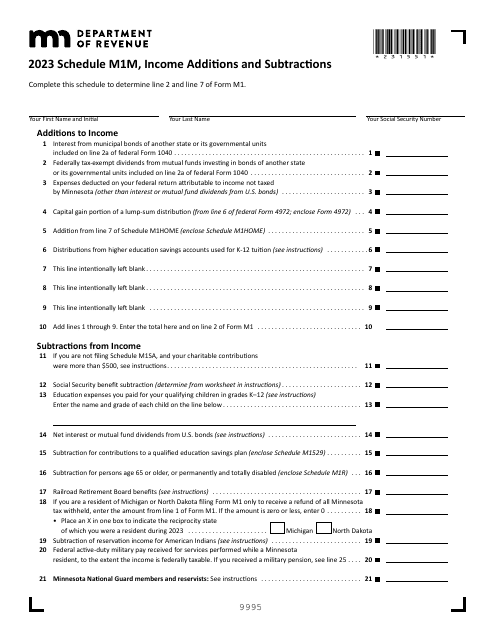

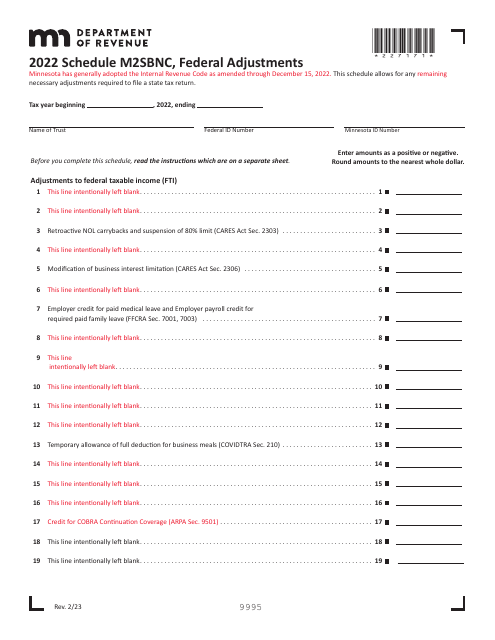

This document is used for reporting federal adjustments made on the Minnesota state tax return. It is specifically for businesses (M2SBNC) in Minnesota.