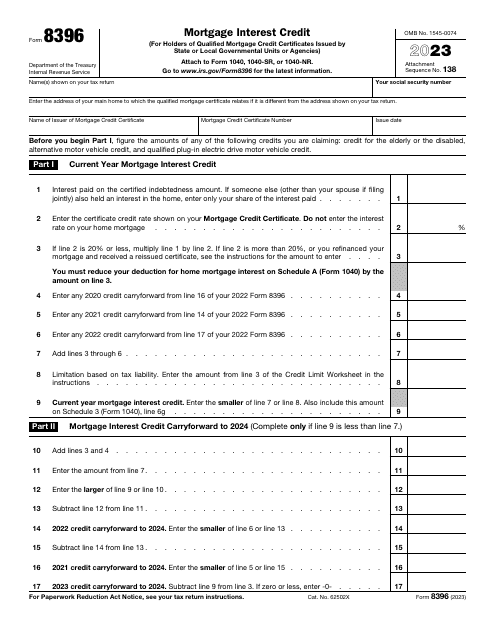

IRS Form 8396 Mortgage Interest Credit

What Is IRS Form 8396?

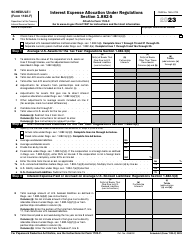

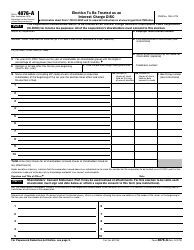

IRS Form 8396, Mortgage Interest Credit , is a formal document filled out by taxpayers in order to compute the amount of mortgage interest credit over the course of the year and report the information to fiscal authorities.

Alternate Names:

- Mortgage Interest Credit Form;

- Tax Form 8396.

Only people that received mortgage credit certificates from governmental agencies and units (both on a state and local level) are entitled to claim this type of credit - if you participated in a program for individuals with lower income, you may obtain a certificate of this sort and save up to $2,000 every year.

This instrument was released by the Internal Revenue Service (IRS) in 2023 , rendering older editions of the form obsolete. An IRS Form 8396 fillable version is available for download below.

The IRS Mortgage Interest Credit Form is revised annually and attached to IRS Form 1040, U.S. Individual Income Tax Return, or IRS Form 1040-NR U.S. Nonresident Alien Income Tax Return, before submitting.

What Is IRS Form 8396 Used For?

Prepare and submit Tax Form 8396 to demonstrate how you calculated the mortgage interest credit and request a tax credit from fiscal organs. If during the tax period you describe in your income statement as well as in this form you bought residential property you use as your main home and got a certificate that confirms a mortgage credit, you have an opportunity to reduce the amount of tax you are otherwise obliged to pay.

The main objective of this tool is to provide financial assistance to homeowners, especially those with lower incomes - they get to pay fewer taxes than people without the financial burden of paying for a new house or apartment. Remember that you get to file this form regularly and claim the tax credit every year for as long as you are dealing with paying mortgage interest.

Form 8396 Instructions

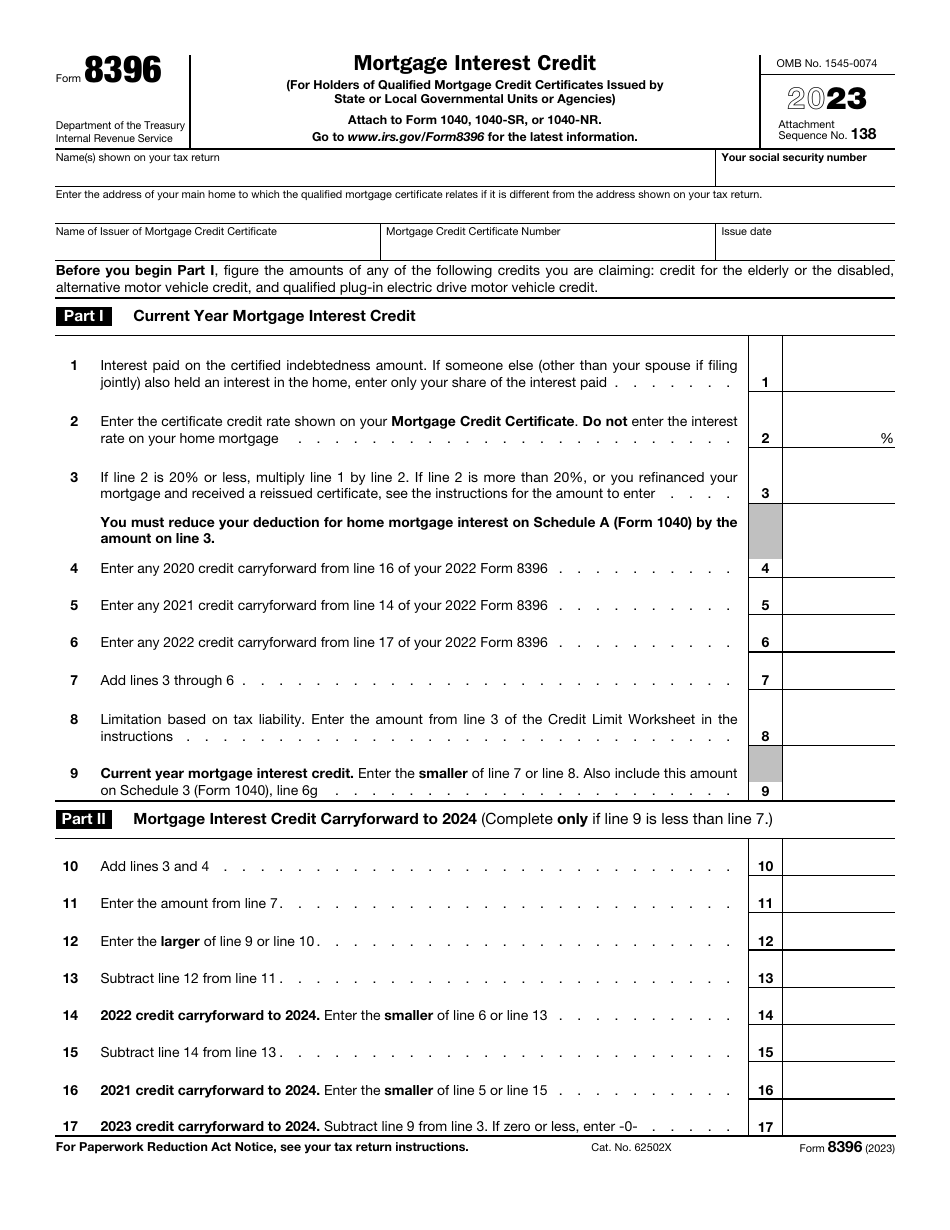

Follow these Form 8396 instructions to claim mortgage interest credit:

-

Identify yourself - add the name you include on your annual income statement, your social security number, and the address of the residence listed on the certificate (the latter field should be completed only if the address is not the same one you put on your income statement) . Write down the name of the certificate issuer, record the number of the mortgage credit certificate, and state when it was issued.

-

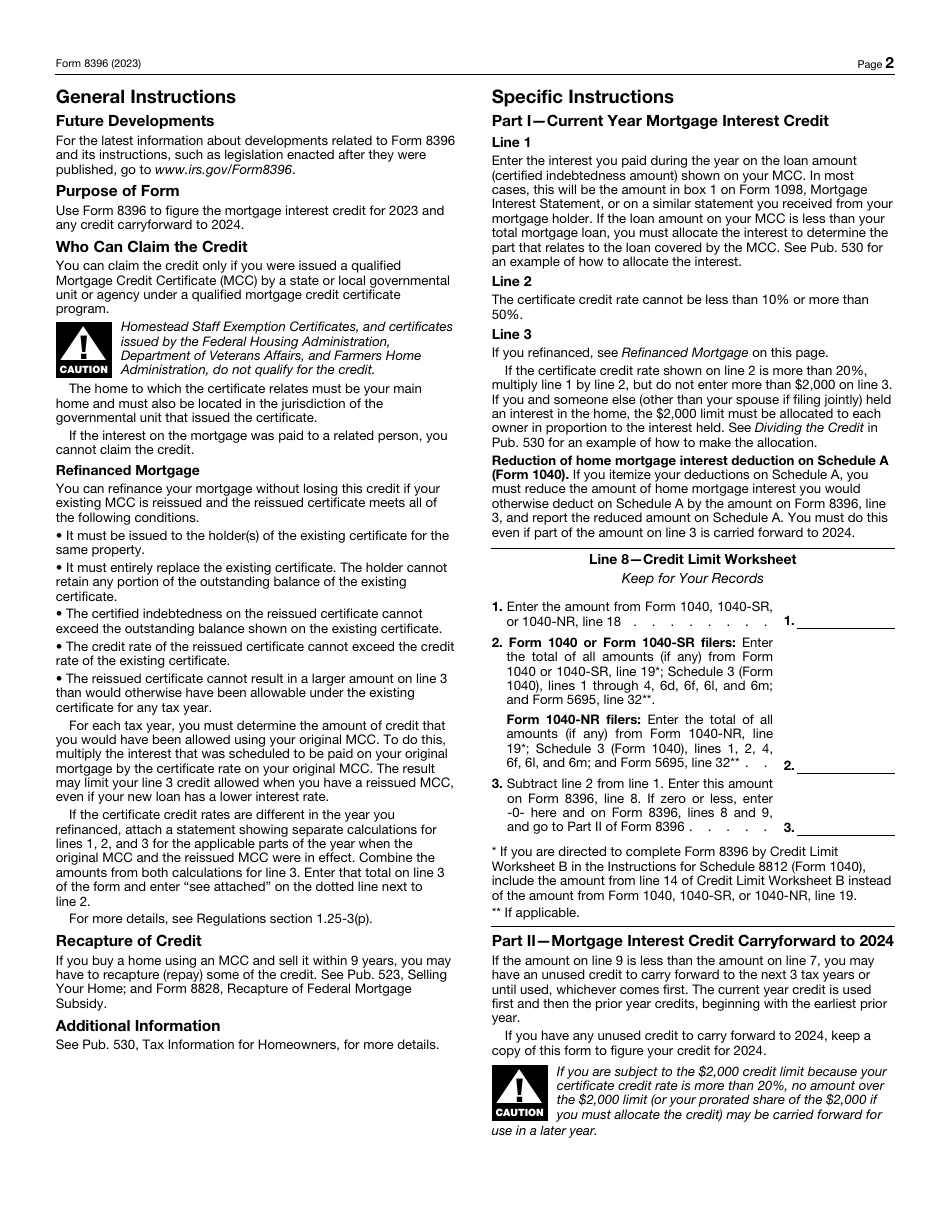

Specify how much interest you paid on the amount of loan the mortgage credit certificate contains . In many instances, mortgage holders provide homeowners with IRS Form 1098, Mortgage Interest Statement - you can find this detail in this document. Indicate how big the credit rate from the certificate is, and if that rate is equal to 20% or lower than that, multiply the previous two numbers you have listed in writing. The sum of these results can be increased if you need to report any credit carryforward from the last three years.

-

Use the worksheet on the second page of the form to figure out the limitation based on your tax liability . Either the limitation or the combination of the amounts above will be smaller - you must write down the smaller number in the form. Elaborate on the credit carryforward that will apply to the next instrument of this kind you file in the future by following the formulas in the form.

-

When the document is prepared, attach it to your tax return and file the paperwork before the deadline . The filing method is up to you - you may file electronically or prepare a paper return with a printed-out credit claim. Do not forget to keep a copy of Form 8396 in your records in case there is any credit you did not use and want to carry forward to the next tax period.