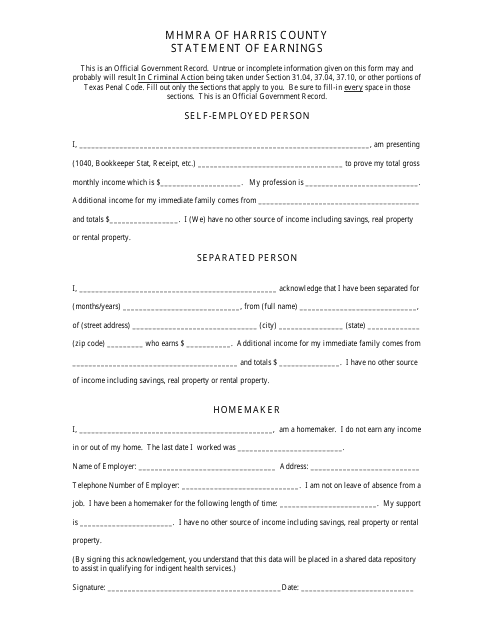

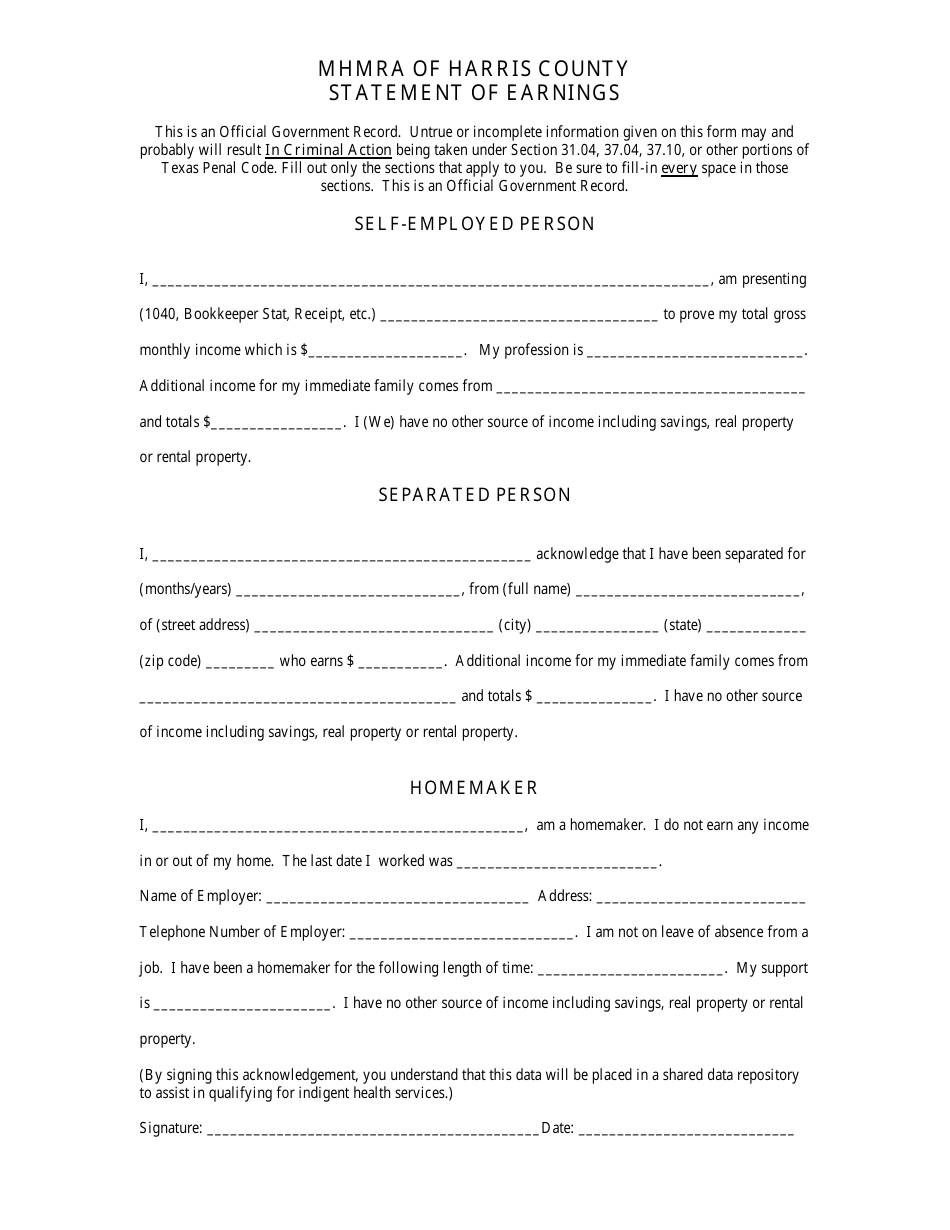

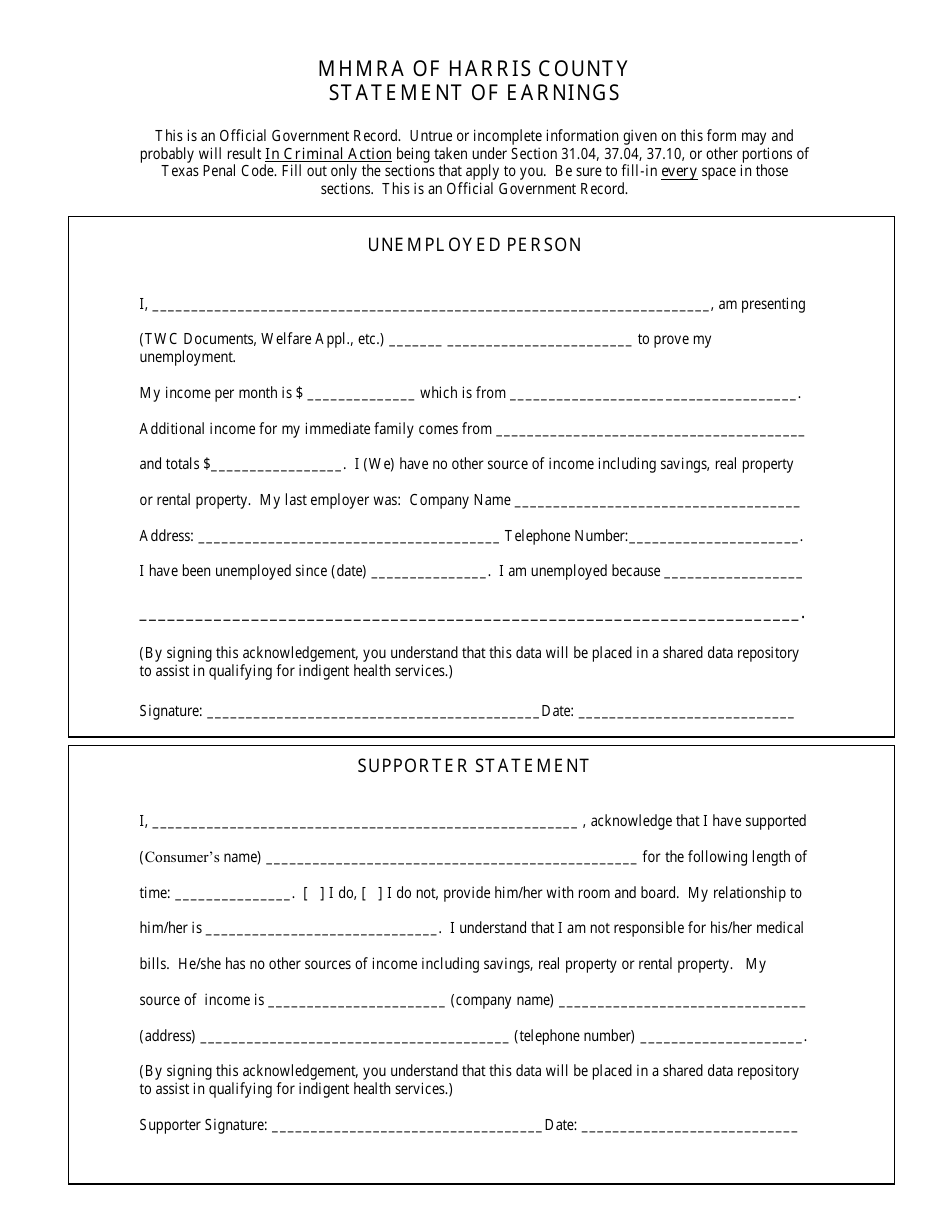

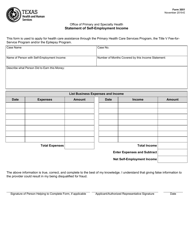

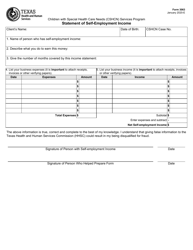

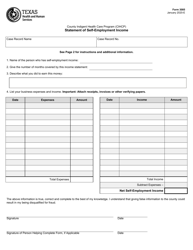

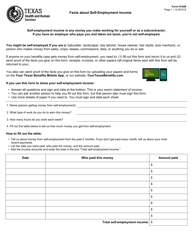

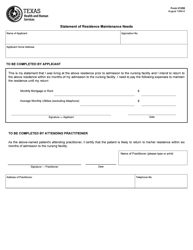

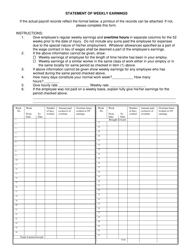

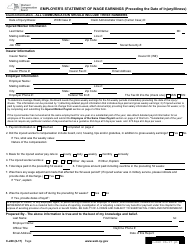

Statement of Earnings Form - Texas

The Statement of Earnings Form in Texas is used to report an individual's earnings for a specific period of time, typically when applying for unemployment benefits or for income verification purposes.

In Texas, the Statement of Earnings form is typically filed by the employer.

FAQ

Q: What is a Statement of Earnings form?

A: A Statement of Earnings form is a document that shows an individual's earnings, such as wages or salaries, for a specific period of time.

Q: Why do I need a Statement of Earnings form?

A: You may need a Statement of Earnings form for various purposes, such as applying for a loan, renting a property, or proving your income for government benefits.

Q: What information is included in a Statement of Earnings form?

A: A Statement of Earnings form typically includes details such as the individual's name, employer information, pay period dates, gross earnings, and deductions.

Q: Can I use a pay stub instead of a Statement of Earnings form?

A: In some cases, a pay stub may be accepted as a substitute for a Statement of Earnings form. However, it is recommended to check with the specific organization or institution requesting the form to ensure their requirements are met.

Q: Do I need to keep a copy of my Statement of Earnings form?

A: It is always a good idea to keep a copy of your Statement of Earnings form for your records, as you may need it for future reference or documentation purposes.