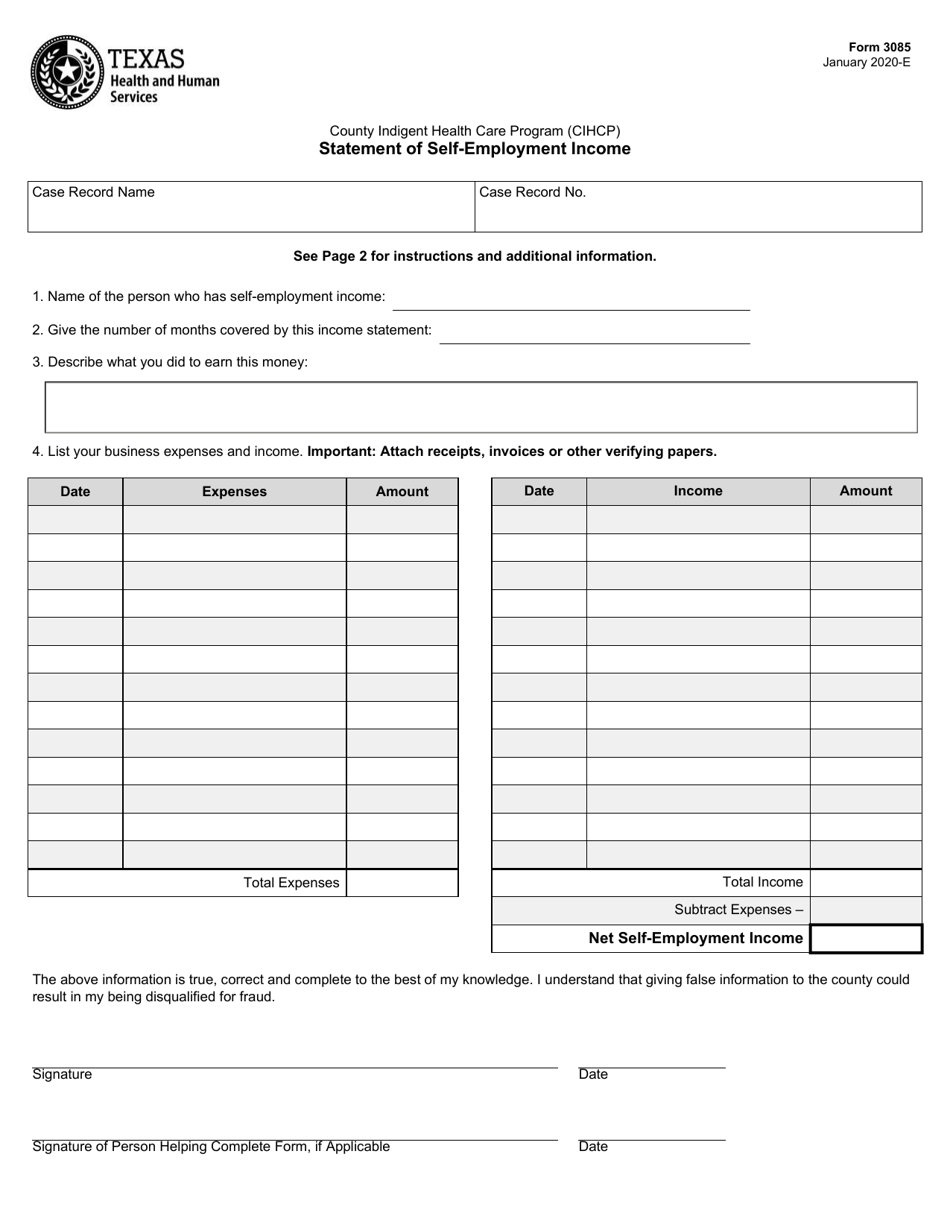

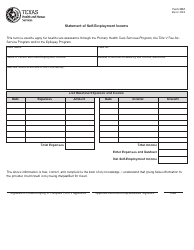

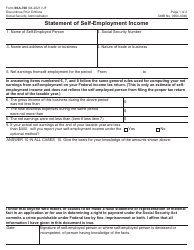

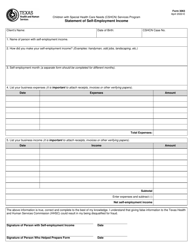

Form 3085 Statement of Self-employment Income - Texas

What Is Form 3085?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3085?

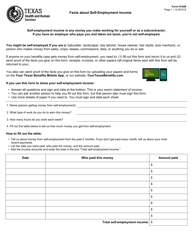

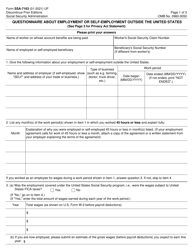

A: Form 3085 is the Statement of Self-employment Income used in Texas.

Q: Who needs to file Form 3085?

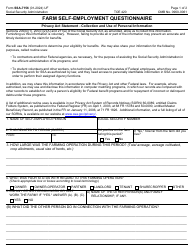

A: Individuals who are self-employed in Texas need to file Form 3085.

Q: What is the purpose of Form 3085?

A: Form 3085 is used to report self-employment income for tax purposes in Texas.

Q: Is Form 3085 required for all self-employed individuals in Texas?

A: Yes, all self-employed individuals in Texas are required to file Form 3085 to report their income.

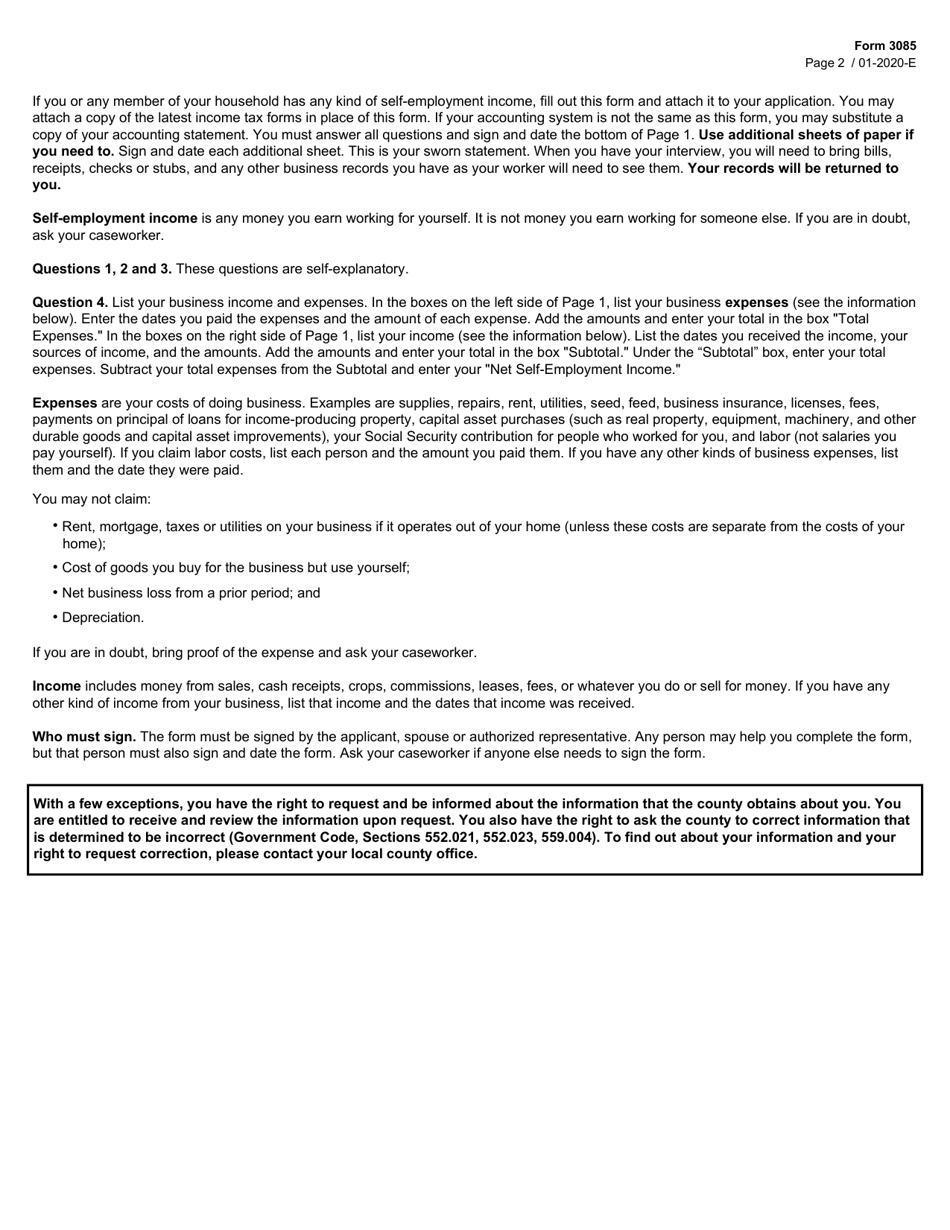

Q: What information do I need to complete Form 3085?

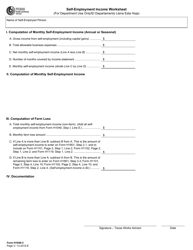

A: You will need to provide details about your self-employment income, including income sources, expenses, and deductions.

Q: When is the deadline to file Form 3085?

A: The deadline to file Form 3085 is usually April 15th of each year, unless it falls on a weekend or holiday.

Q: Do I need to attach any documents with Form 3085?

A: It is advisable to keep all relevant documents and receipts to support your income and expenses, but you do not need to attach them to the form.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3085 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.