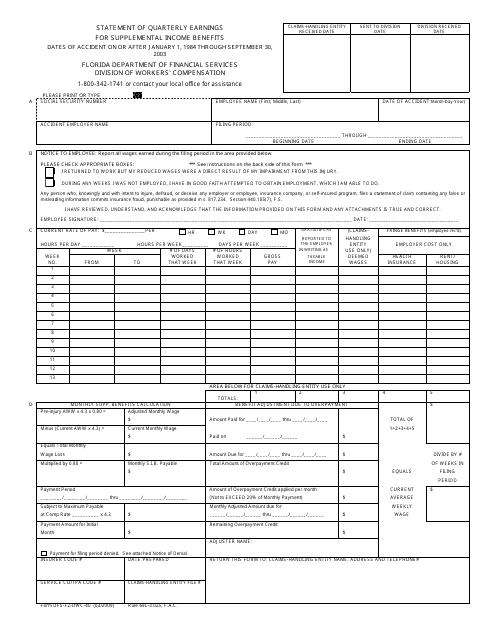

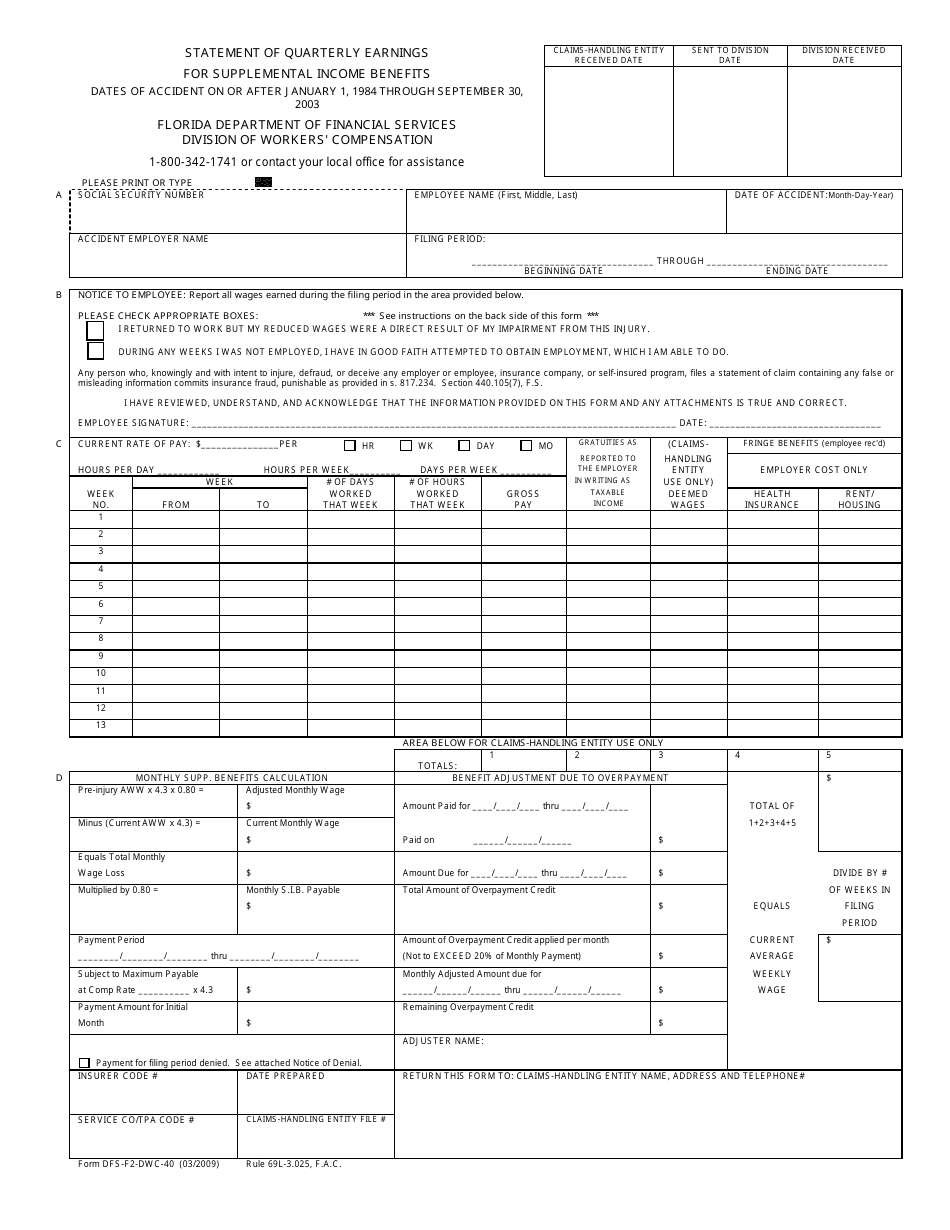

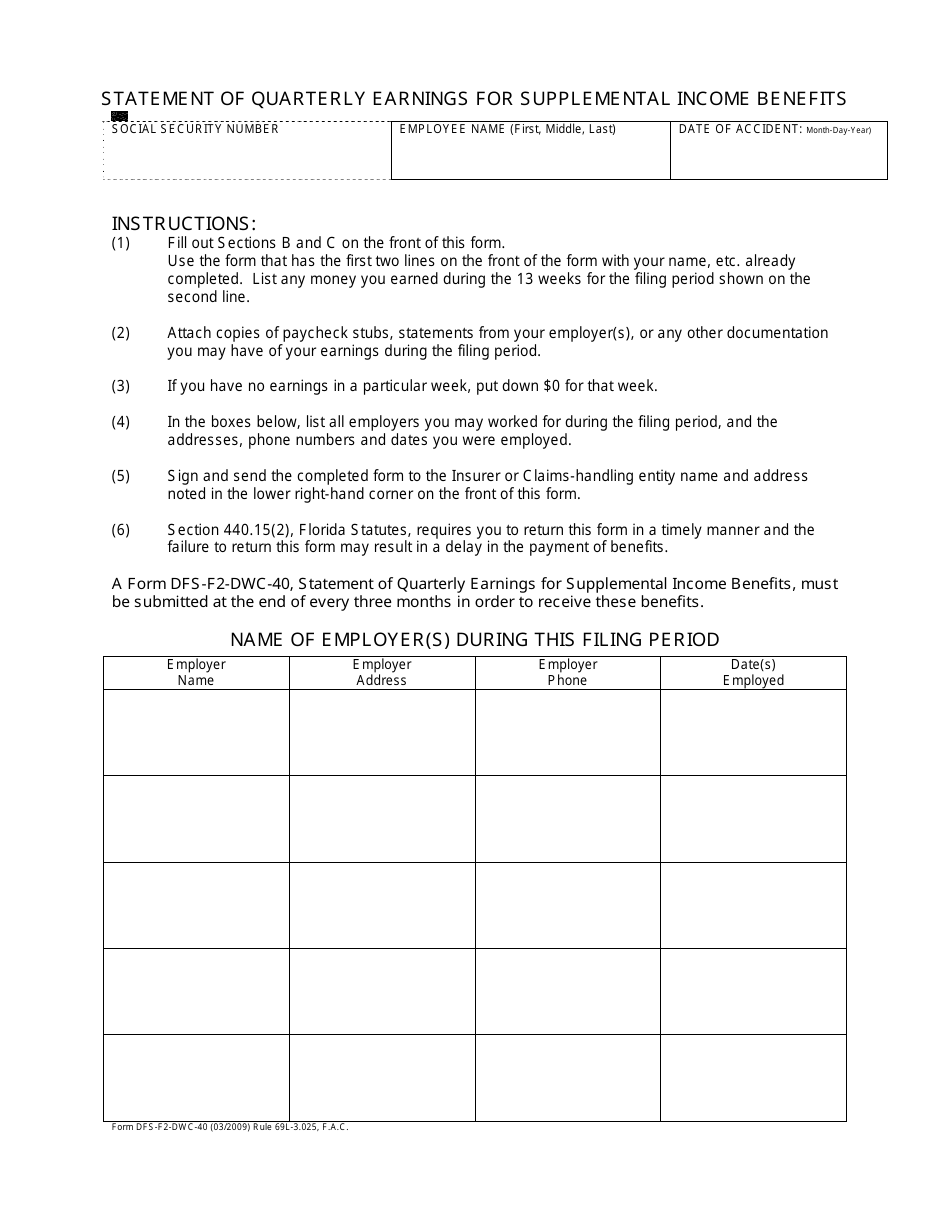

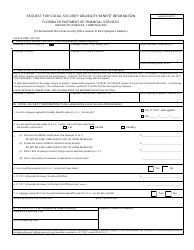

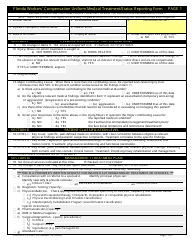

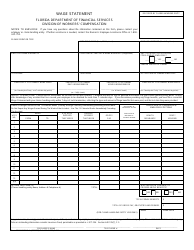

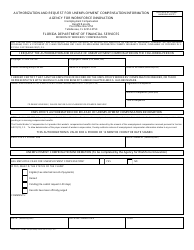

Form DFS-F2-DWC-40 Statement of Quarterly Earnings for Supplemental Income Benefits - Florida

What Is Form DFS-F2-DWC-40?

This is a legal form that was released by the Florida Department of Financial Services - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

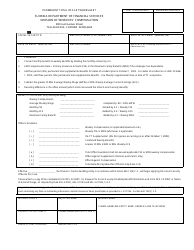

Q: What is the form DFS-F2-DWC-40 used for?

A: The form DFS-F2-DWC-40 is used to report quarterly earnings for Supplemental Income Benefits in Florida.

Q: Who needs to file the form DFS-F2-DWC-40?

A: Claimants who receive Supplemental Income Benefits in Florida need to file the form DFS-F2-DWC-40.

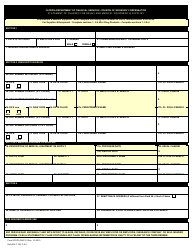

Q: When is the form DFS-F2-DWC-40 due?

A: The form DFS-F2-DWC-40 is due on a quarterly basis, specifically by the 15th day of the month following the end of each quarter.

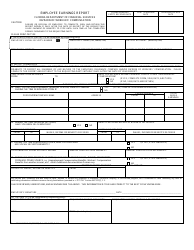

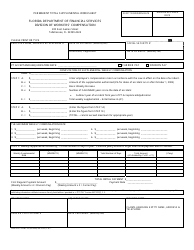

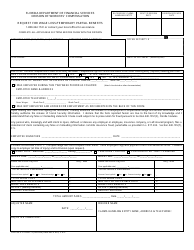

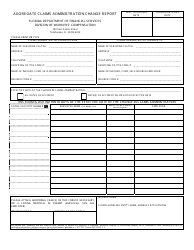

Q: What information do I need to provide on the form DFS-F2-DWC-40?

A: You will need to provide your name, Social Security number, dates of employment during the quarter, gross earnings, and any other income received during the quarter.

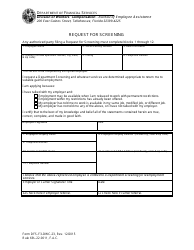

Q: What happens if I don't file the form DFS-F2-DWC-40?

A: Failing to file the form DFS-F2-DWC-40 may result in a delay or denial of Supplemental Income Benefits.

Q: How often do I need to file the form DFS-F2-DWC-40?

A: The form DFS-F2-DWC-40 needs to be filed on a quarterly basis.

Q: Are there any penalties for not filing the form DFS-F2-DWC-40?

A: Yes, failing to file the form DFS-F2-DWC-40 may result in penalties or other consequences as determined by the Florida Division of Workers' Compensation.

Form Details:

- Released on March 1, 2009;

- The latest edition provided by the Florida Department of Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DFS-F2-DWC-40 by clicking the link below or browse more documents and templates provided by the Florida Department of Financial Services.