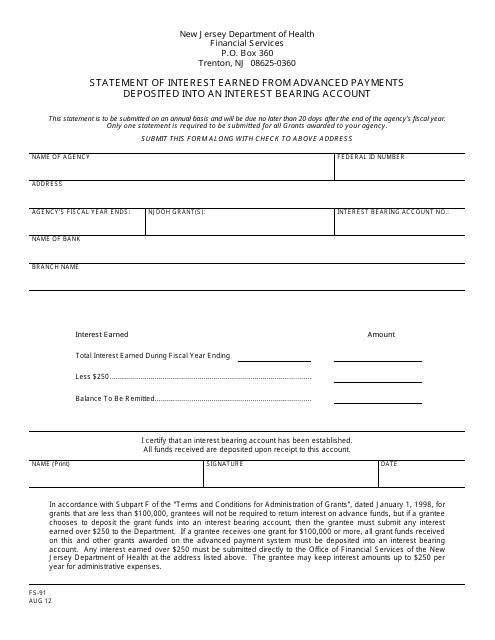

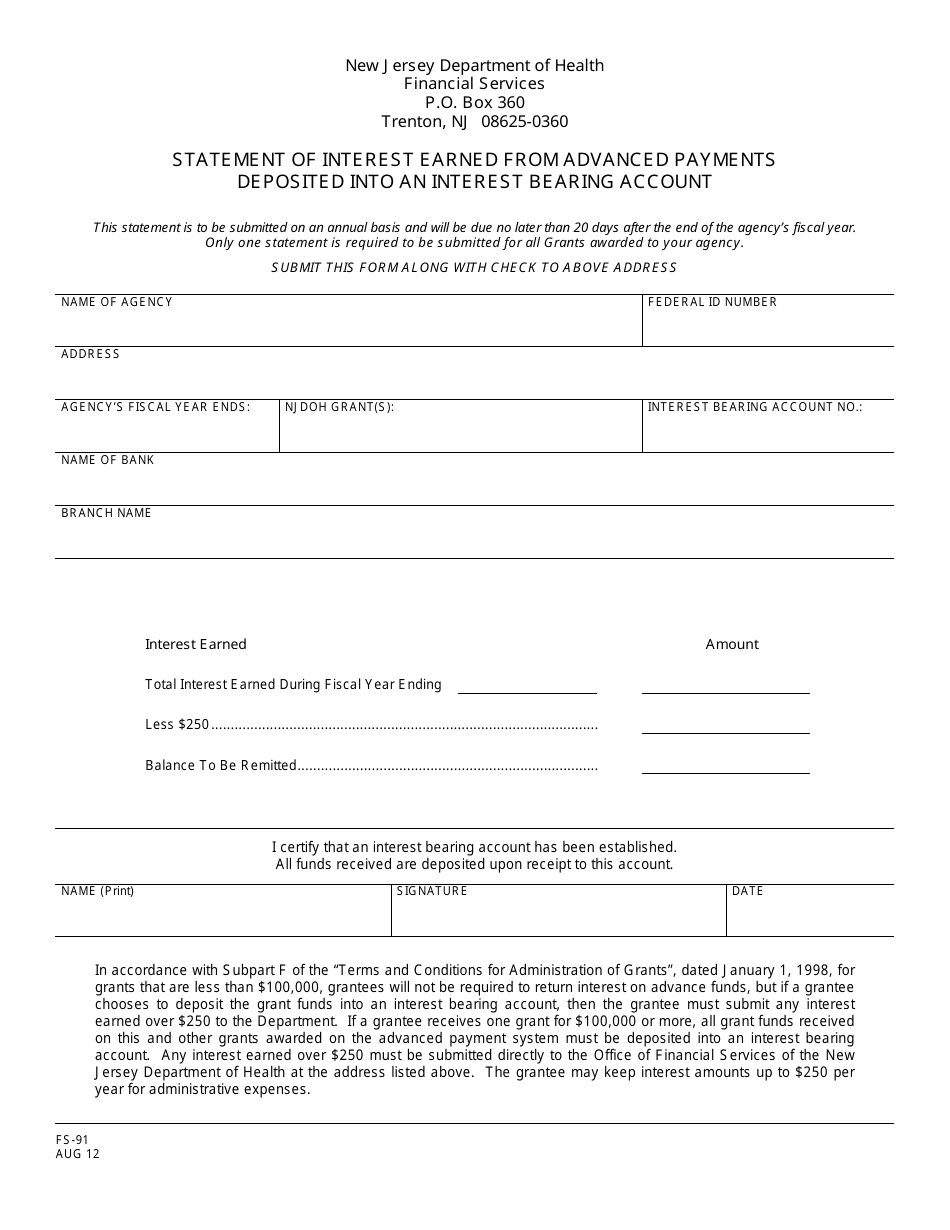

Form FS-91 Statement of Interest Earned From Advance Payments Deposited Into an Interest Bearing Account - New Jersey

What Is Form FS-91?

This is a legal form that was released by the New Jersey Department of Health - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FS-91?

A: Form FS-91 is the Statement of Interest Earned From Advance Payments Deposited Into an Interest Bearing Account.

Q: What is the purpose of Form FS-91?

A: The purpose of Form FS-91 is to report the interest earned on advance payments deposited into an interest-bearing account.

Q: Who needs to file Form FS-91?

A: Individuals or businesses who receive advance payments and deposit them into an interest-bearing account in the state of New Jersey need to file Form FS-91.

Q: What information do I need to complete Form FS-91?

A: You will need to provide information such as your name, address, Social Security number or taxpayer identification number, the amount of interest earned, and the name of the account.

Q: When is the deadline to file Form FS-91?

A: Form FS-91 must be filed no later than April 15th of the following year.

Q: Is there a penalty for not filing Form FS-91?

A: Yes, there is a penalty for failure to file Form FS-91 or for filing it late.

Q: Can I e-file Form FS-91?

A: No, you cannot e-file Form FS-91. It must be filed by mail.

Q: Is Form FS-91 only applicable to residents of New Jersey?

A: No, Form FS-91 is applicable to anyone who receives advance payments and deposits them into an interest-bearing account in the state of New Jersey, regardless of residency.

Q: Do I need to include copies of bank statements with Form FS-91?

A: No, you do not need to include copies of bank statements with Form FS-91. However, you should keep them for your records in case of an audit.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the New Jersey Department of Health;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FS-91 by clicking the link below or browse more documents and templates provided by the New Jersey Department of Health.