This version of the form is not currently in use and is provided for reference only. Download this version of

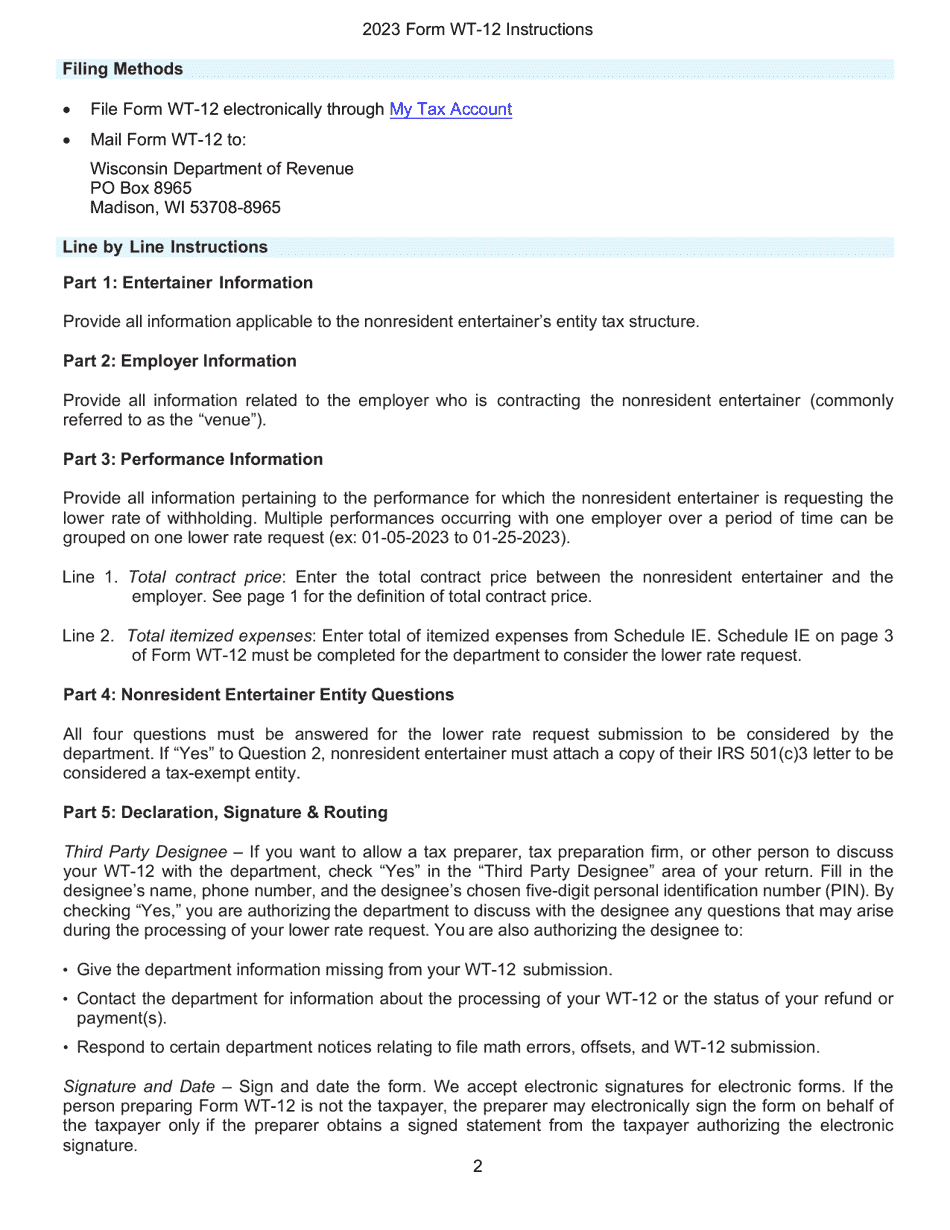

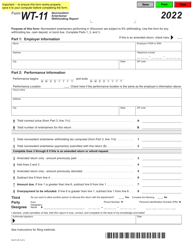

Instructions for Form WT-12, W-012LRR

for the current year.

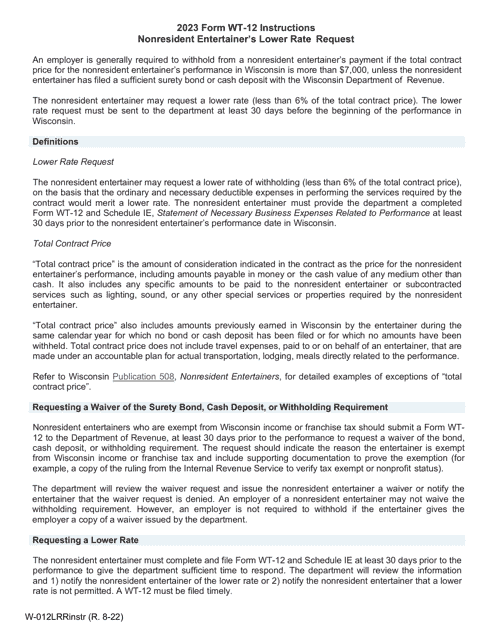

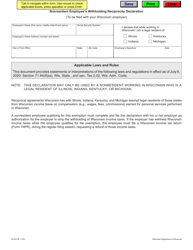

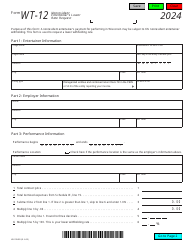

Instructions for Form WT-12, W-012LRR Nonresident Entertainer's Lower Rate Request - Wisconsin

This document contains official instructions for Form WT-12 , and Form W-012LRR . Both forms are released and collected by the Wisconsin Department of Revenue.

FAQ

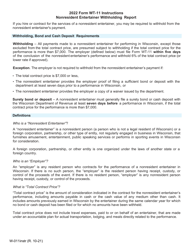

Q: What is Form WT-12?

A: Form WT-12 is a specific form used by nonresident entertainers in Wisconsin.

Q: What is the purpose of Form WT-12?

A: The purpose of Form WT-12 is to request a lower tax rate for nonresident entertainers in Wisconsin.

Q: Who should use Form WT-12?

A: Nonresident entertainers who perform in Wisconsin and want to request a lower tax rate should use Form WT-12.

Q: What is the lower tax rate requested on Form WT-12?

A: The lower tax rate requested on Form WT-12 is known as the Reduced Rate Refund (RRR).

Q: Are there any deadlines for filing Form WT-12?

A: Yes, Form WT-12 must be filed at least 30 days prior to the first performance or event in Wisconsin.

Q: Can I request a lower tax rate for multiple performances or events on one Form WT-12?

A: No, you must submit a separate Form WT-12 for each performance or event.

Q: What documentation should be included with Form WT-12?

A: You should include a copy of the performance contract, a completed Schedule S, and any other supporting documentation.

Instruction Details:

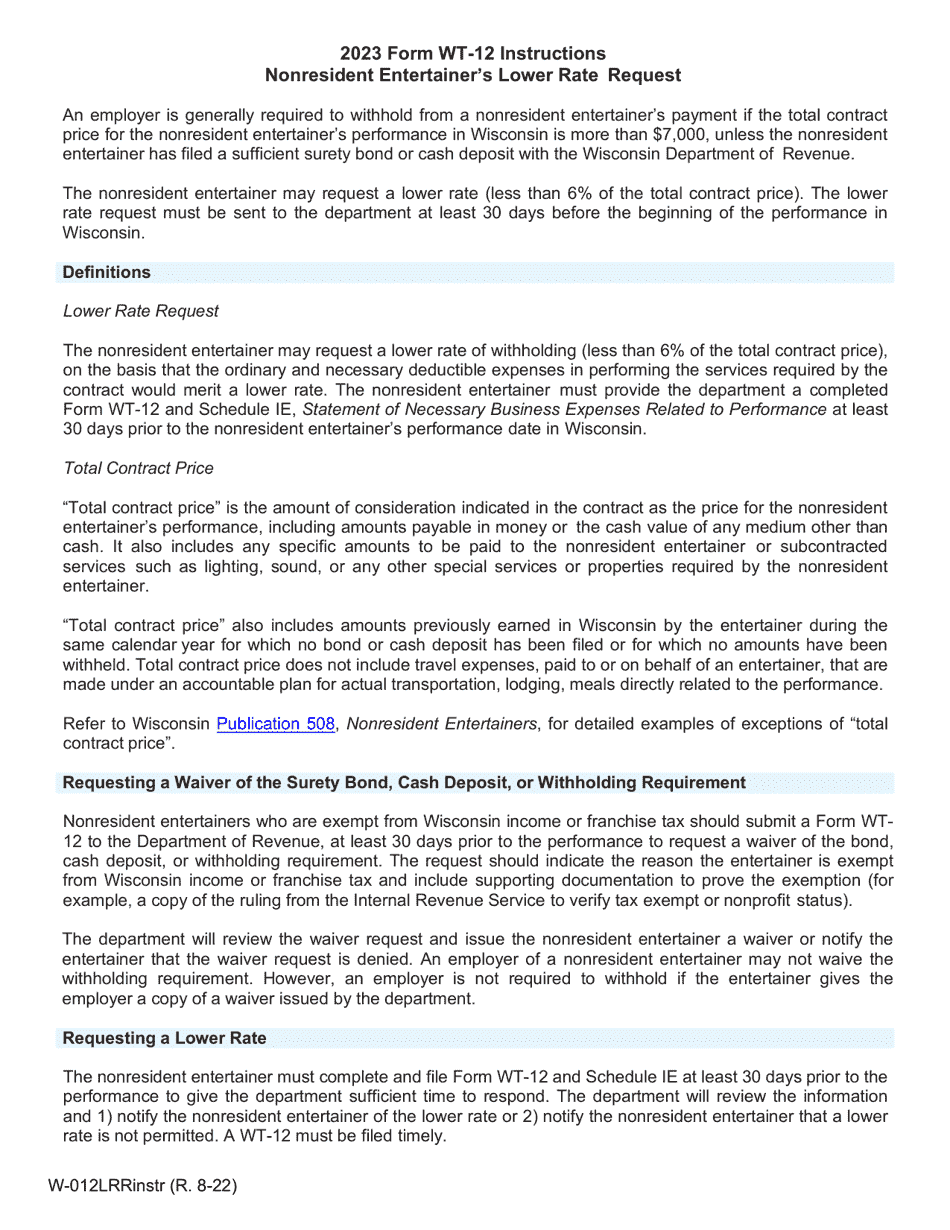

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose an older version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.