This version of the form is not currently in use and is provided for reference only. Download this version of

Form WT-4 (W-204)

for the current year.

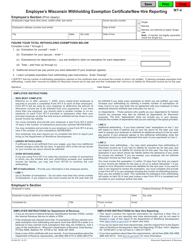

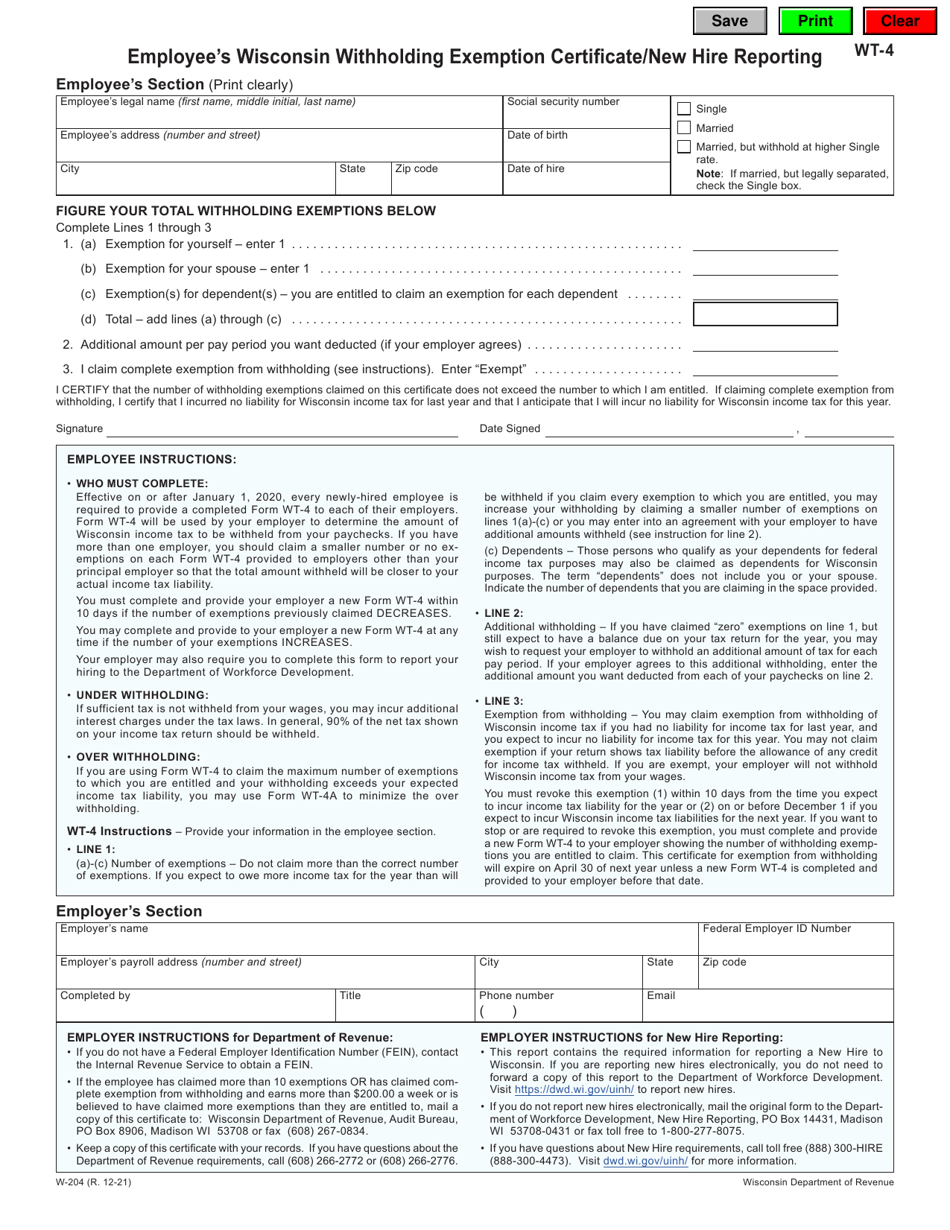

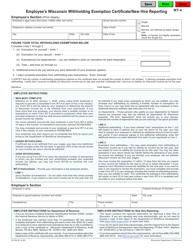

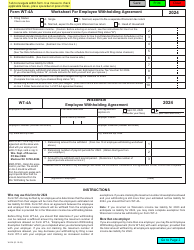

Form WT-4 (W-204) Employee's Wisconsin Withholding Exemption Certificate / New Hire Reporting - Wisconsin

What Is Form WT-4 (W-204)?

This is a legal form that was released by the Wisconsin Department of Workforce Development - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WT-4 (W-204)?

A: Form WT-4 (W-204) is the Employee's Wisconsin Withholding Exemption Certificate/New Hire Reporting form used in Wisconsin.

Q: What is the purpose of Form WT-4 (W-204)?

A: The purpose of Form WT-4 (W-204) is to determine the amount of Wisconsin income tax to be withheld from an employee's wages.

Q: When should Form WT-4 (W-204) be completed?

A: Form WT-4 (W-204) should be completed by a new employee or an existing employee who wants to change their withholding exemptions.

Q: How do I submit Form WT-4 (W-204)?

A: Employers should keep the completed Form WT-4 (W-204) on file and do not need to submit it to the Wisconsin Department of Revenue.

Q: What information is required on Form WT-4 (W-204)?

A: Form WT-4 (W-204) requires information such as the employee's name, Social Security number, address, marital status, and number of withholding exemptions.

Q: Can Form WT-4 (W-204) be revised?

A: Yes, if an employee's personal or financial situation changes, they should complete a new Form WT-4 (W-204) to reflect the updated information.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Wisconsin Department of Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WT-4 (W-204) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Workforce Development.