This version of the form is not currently in use and is provided for reference only. Download this version of

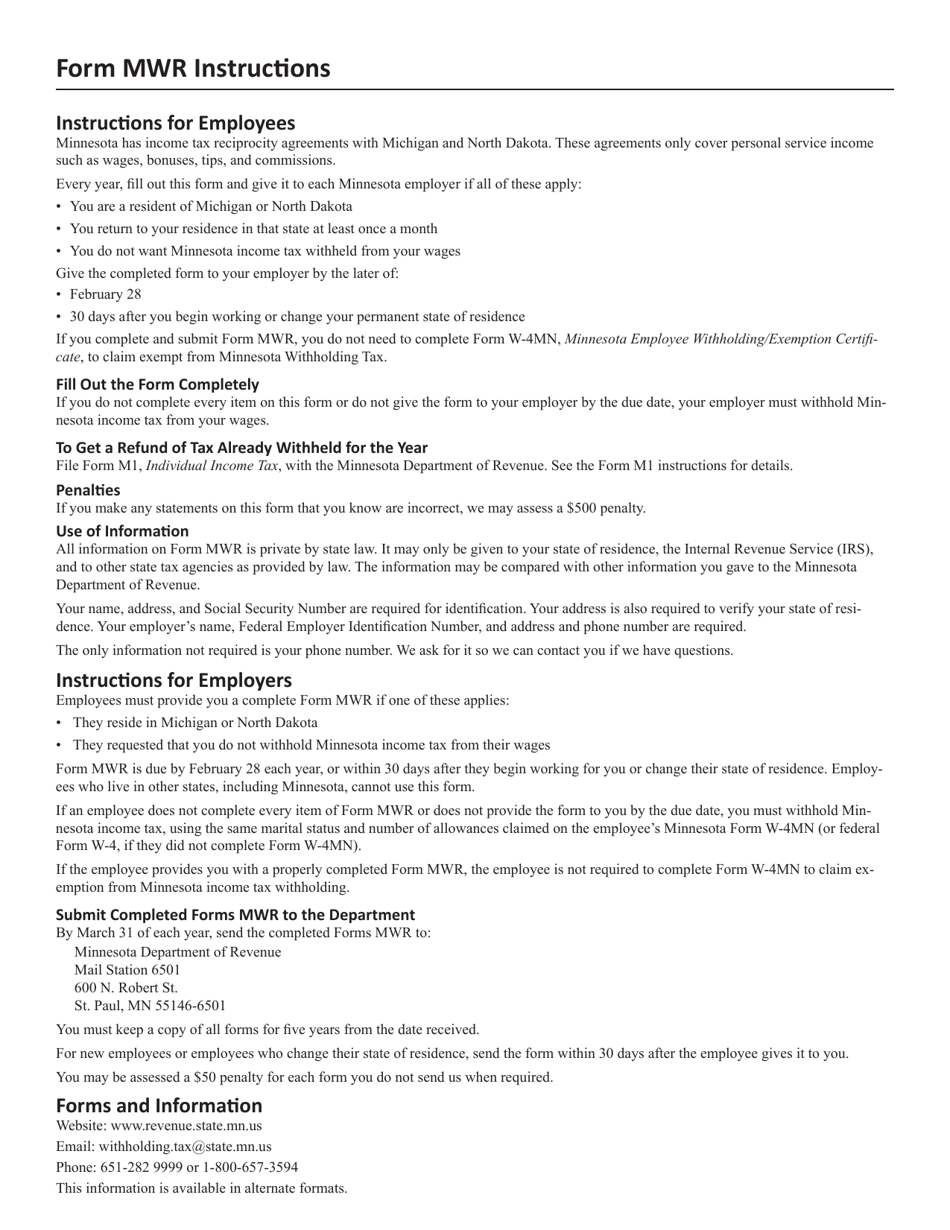

Form MWR

for the current year.

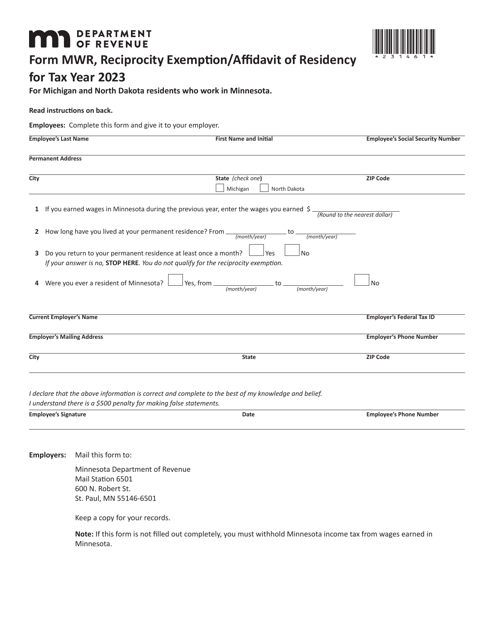

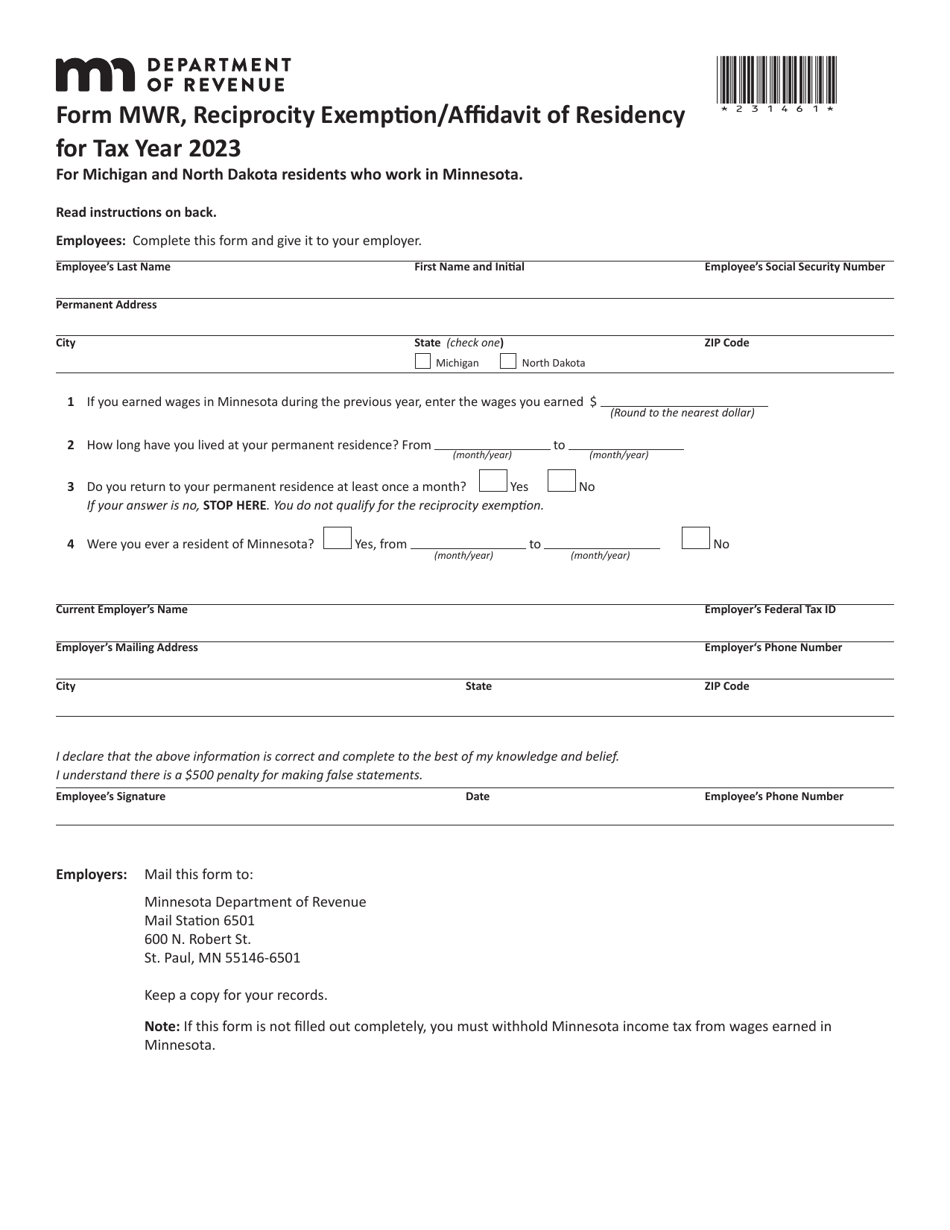

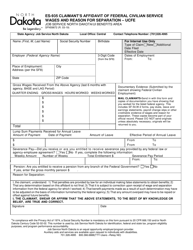

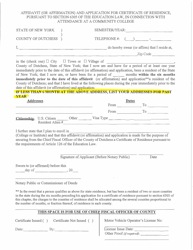

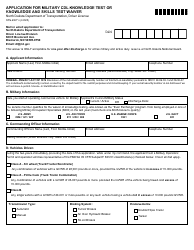

Form MWR Reciprocity Exemption / Affidavit of Residency or Michigan and North Dakota Residents Who Work in Minnesota - Minnesota

What Is Form MWR?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

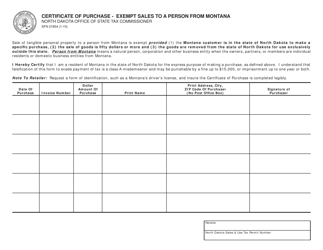

Q: What is the MWR reciprocity exemption?

A: The MWR reciprocity exemption is a form that allows residents of Michigan and North Dakota who work in Minnesota to be exempt from paying Minnesota withholding taxes.

Q: Who is eligible for the MWR reciprocity exemption?

A: Residents of Michigan and North Dakota who work in Minnesota are eligible for the MWR reciprocity exemption.

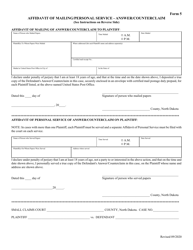

Q: What is the purpose of the Affidavit of Residency?

A: The Affidavit of Residency is used to declare that a person is a resident of Michigan or North Dakota and is working in Minnesota.

Q: How does the MWR reciprocity exemption benefit residents of Michigan and North Dakota?

A: The MWR reciprocity exemption allows residents of Michigan and North Dakota to avoid paying Minnesota withholding taxes, which can reduce their tax burden.

Q: Is the MWR reciprocity exemption form applicable to all residents of Michigan and North Dakota working in Minnesota?

A: Yes, all residents of Michigan and North Dakota who work in Minnesota are eligible to use the MWR reciprocity exemption form.

Q: Are there any specific requirements to be eligible for the MWR reciprocity exemption?

A: To be eligible for the MWR reciprocity exemption, you must be a resident of Michigan or North Dakota and work in Minnesota.

Q: Is the MWR reciprocity exemption a one-time exemption or does it apply to every paycheck?

A: The MWR reciprocity exemption applies to every paycheck, as long as you continue to meet the eligibility requirements.

Q: What happens if I do not submit the MWR reciprocity exemption form?

A: If you do not submit the MWR reciprocity exemption form, Minnesota withholding taxes will be withheld from your paycheck.

Q: Can I apply for the MWR reciprocity exemption retroactively?

A: No, the MWR reciprocity exemption cannot be applied retroactively. You must submit the form before any Minnesota withholding taxes are withheld from your paycheck.

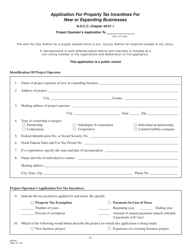

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MWR by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.