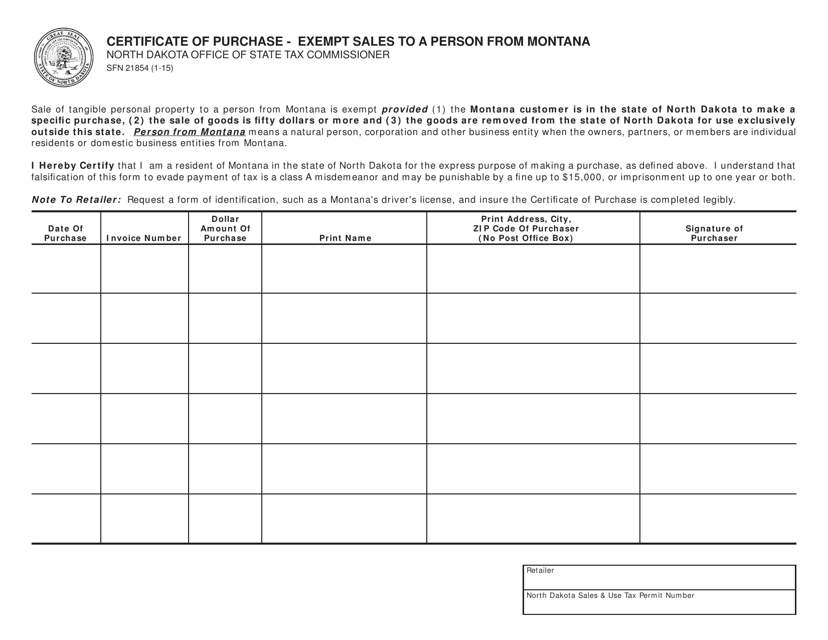

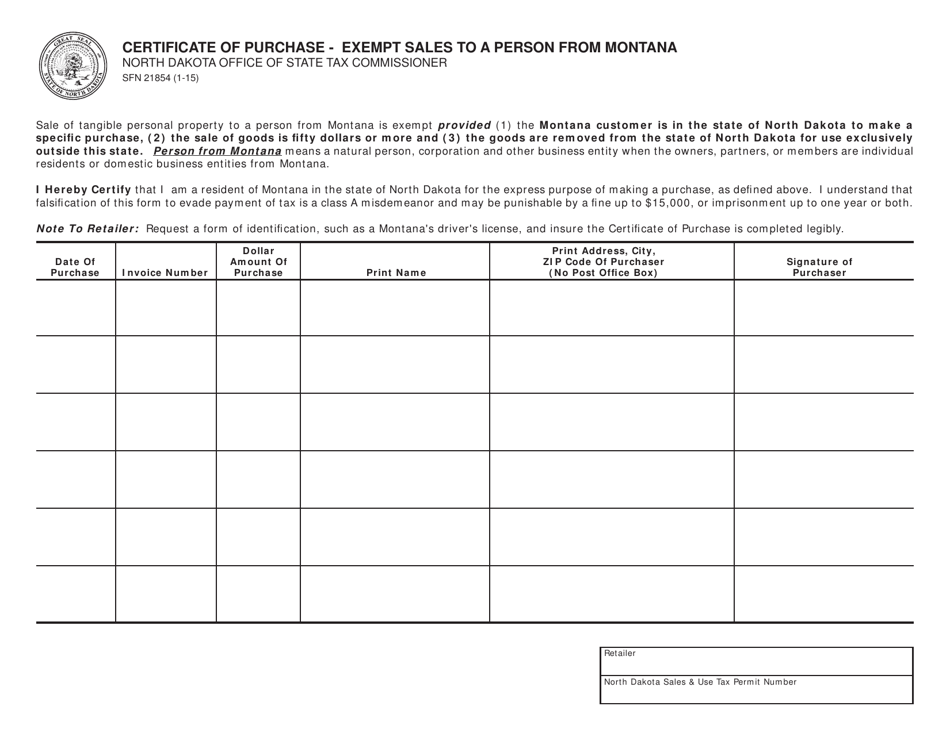

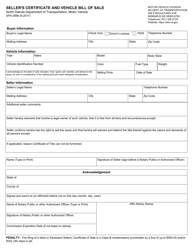

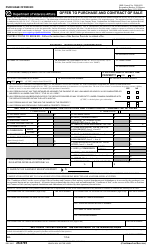

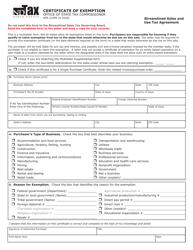

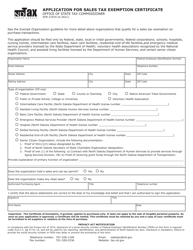

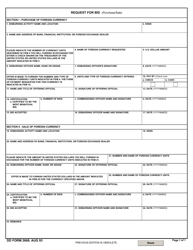

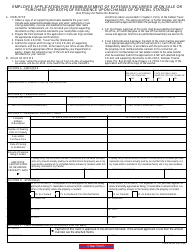

Form SFN21854 Certificate of Purchase - Exempt Sales to a Person From Montana - North Dakota

What Is Form SFN21854?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form SFN21854?

A: Form SFN21854 is a Certificate of Purchase for exempt sales to a person from Montana - North Dakota.

Q: Who uses Form SFN21854?

A: Form SFN21854 is used by sellers who have made exempt sales to a person from Montana - North Dakota.

Q: What is the purpose of Form SFN21854?

A: The purpose of Form SFN21854 is to provide documentation of exempt sales made to a person from Montana - North Dakota.

Q: How do I obtain Form SFN21854?

A: You can obtain Form SFN21854 from the relevant tax authority in your state.

Q: When should I use Form SFN21854?

A: You should use Form SFN21854 when you have made exempt sales to a person from Montana - North Dakota.

Q: Are there any eligibility requirements to use Form SFN21854?

A: There may be eligibility requirements to use Form SFN21854, such as the type of exempt sales made and the residency of the buyer.

Q: Is Form SFN21854 specific to the states of Montana and North Dakota?

A: Yes, Form SFN21854 is specific to exempt sales made to a person from Montana - North Dakota.

Q: What information is required on Form SFN21854?

A: Form SFN21854 typically requires information such as the seller's information, buyer's information, and details of the exempt sales.

Q: Do I need to submit Form SFN21854 with my tax return?

A: It depends on the requirements of the tax authority in your state. You should check with them to determine if Form SFN21854 needs to be submitted with your tax return.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN21854 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.