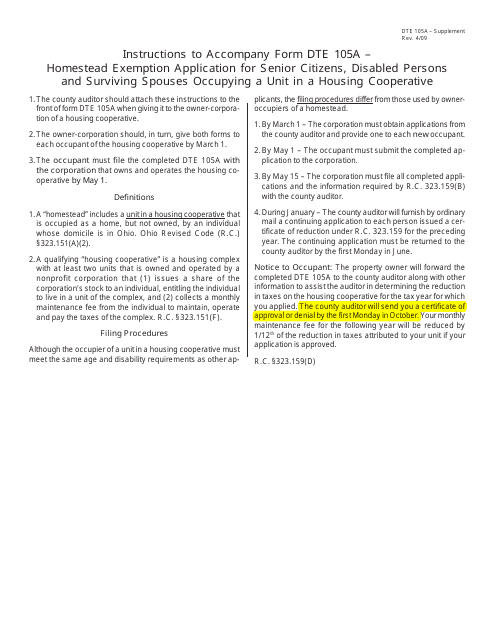

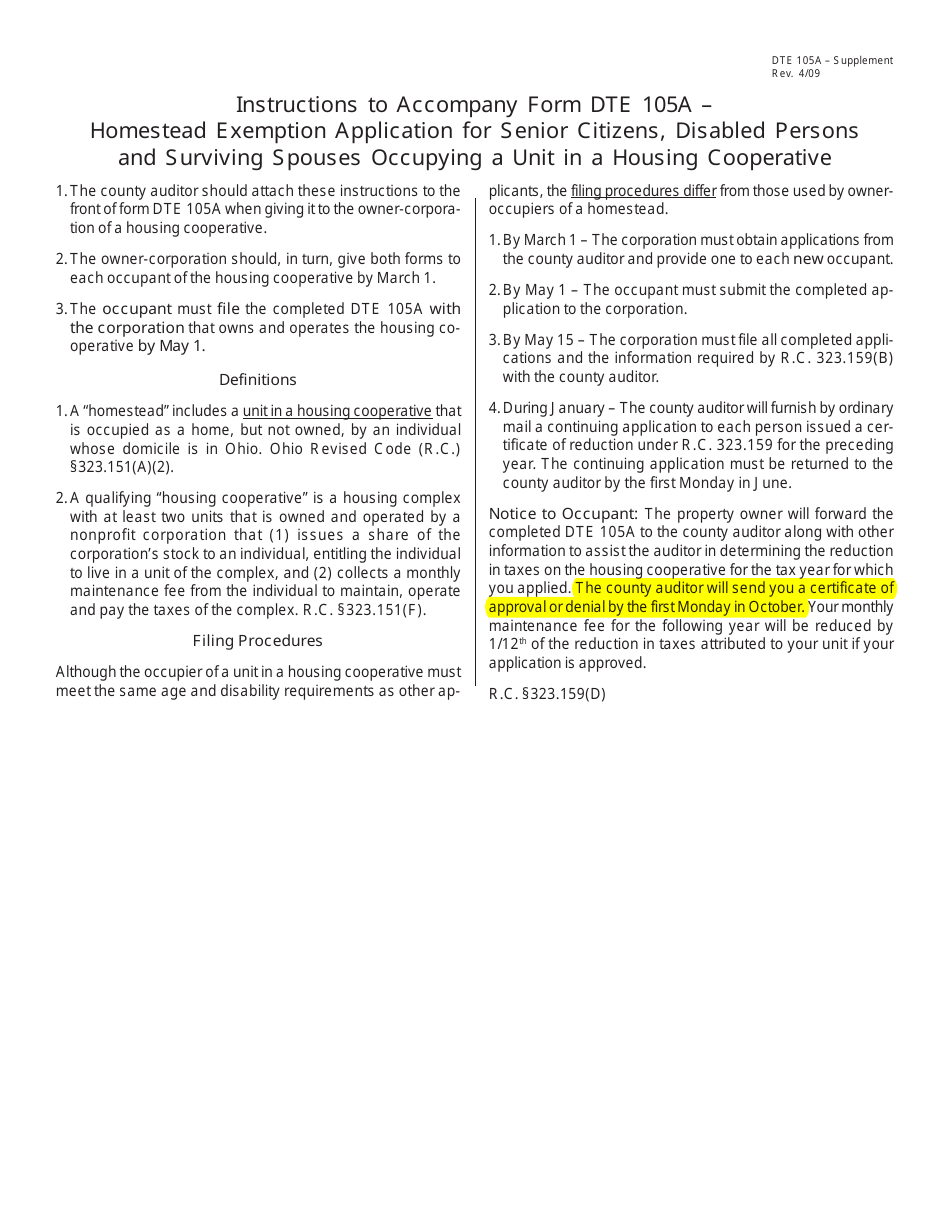

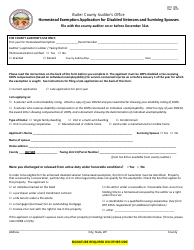

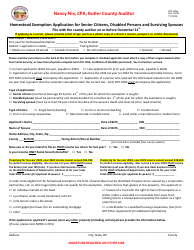

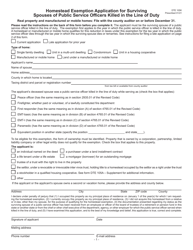

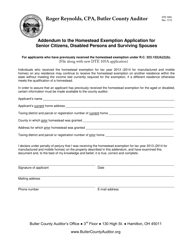

Instructions for Form DTE105A Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses Occupying a Unit in a Housing Cooperative - Ohio

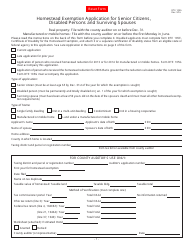

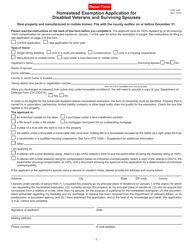

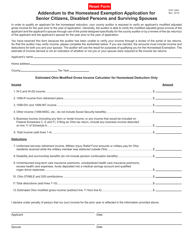

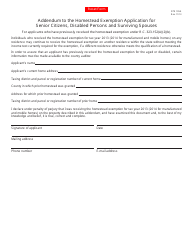

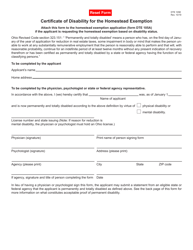

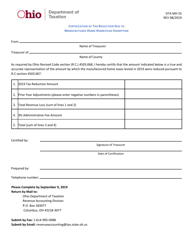

This document contains official instructions for Form DTE105A , Homestead Exemption Application for Disabled Persons and Surviving Spouses Occupying a Unit in a Housing Cooperative - a form released and collected by the Ohio Department of Taxation. An up-to-date fillable Form DTE105A is available for download through this link.

FAQ

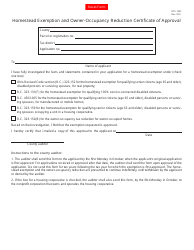

Q: Who is eligible for the Homestead Exemption?

A: Senior citizens, disabled persons, and surviving spouses occupying a unit in a housing cooperative in Ohio are eligible.

Q: What is the purpose of the Homestead Exemption?

A: The Homestead Exemption reduces property taxes for eligible individuals.

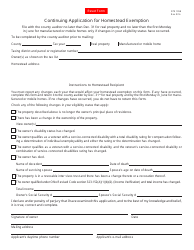

Q: How do I apply for the Homestead Exemption?

A: To apply, you need to complete Form DTE105A and submit it to your county auditor's office.

Q: Are there any income requirements for the Homestead Exemption?

A: Yes, there are income requirements. You must meet certain income limits to qualify.

Q: What documents do I need to submit with the application?

A: You may need to provide proof of age, disability, or surviving spouse status, as well as proof of income.

Q: When is the deadline to apply for the Homestead Exemption?

A: The deadline to apply is the first Monday in June of the year you want the exemption to begin.

Q: Can I apply for the Homestead Exemption if I live in a rental property?

A: No, the Homestead Exemption is only available to individuals who own and occupy a unit in a housing cooperative.

Q: Is the Homestead Exemption transferable to a new property?

A: Yes, the exemption can be transferred to a new property if you meet certain requirements.

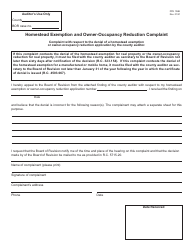

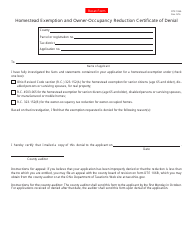

Q: What should I do if my application for the Homestead Exemption is denied?

A: If your application is denied, you have the right to appeal the decision. Contact your county auditor's office for more information.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Ohio Department of Taxation.