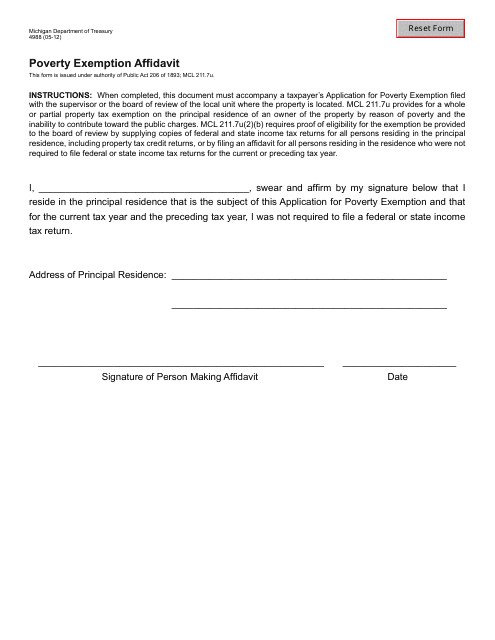

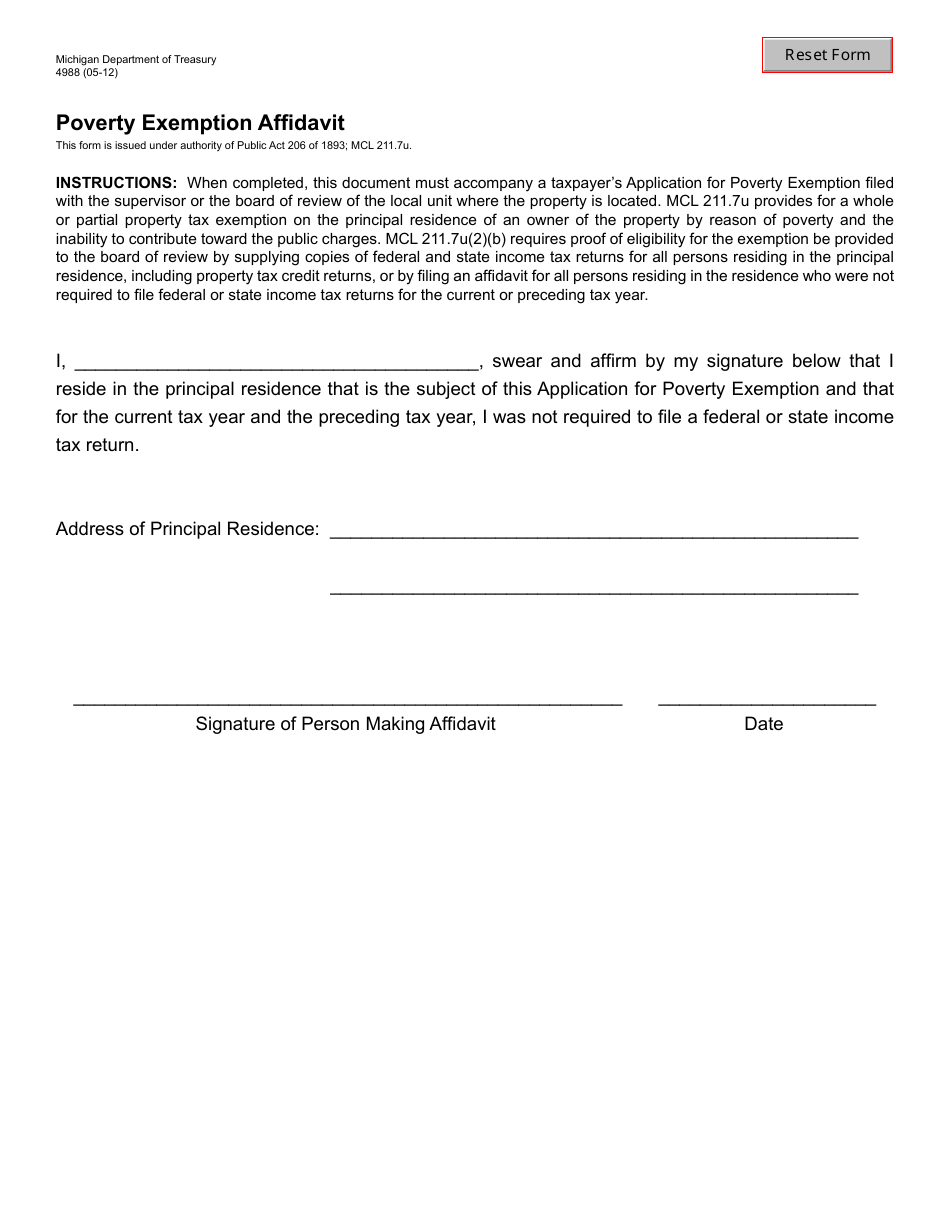

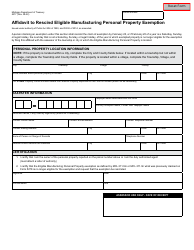

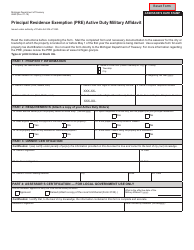

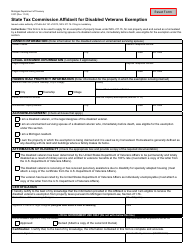

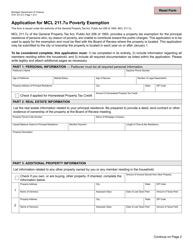

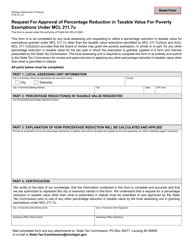

Form 4988 Poverty Exemption Affidavit - Michigan

What Is Form 4988?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4988?

A: Form 4988 is the Poverty Exemption Affidavit in Michigan.

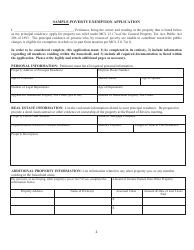

Q: Who is eligible to file Form 4988?

A: Individuals who meet the income and asset requirements set by the state of Michigan may be eligible to file Form 4988.

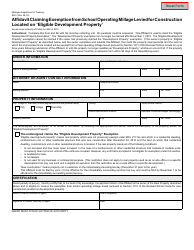

Q: What is the purpose of Form 4988?

A: The purpose of Form 4988 is to request a poverty exemption from property taxes for eligible individuals in Michigan.

Q: What documents are required to file Form 4988?

A: The required documents may vary depending on the local assessor's office, but generally, you will need to provide proof of income, expenses, and assets.

Q: When is the deadline to file Form 4988?

A: The deadline to file Form 4988 varies by municipality, so it's important to check with your local assessor's office for the specific deadline.

Q: What happens after filing Form 4988?

A: After filing Form 4988, the local assessor's office will review your application and determine if you qualify for a poverty exemption.

Q: How long does a poverty exemption last?

A: A poverty exemption in Michigan is typically valid for one year. You will need to reapply each year to maintain the exemption.

Q: Can I appeal if my Form 4988 application is denied?

A: Yes, if your Form 4988 application is denied, you have the right to appeal the decision.

Q: Who can I contact for more information about Form 4988?

A: For more information about Form 4988 and the poverty exemption process in Michigan, you can contact your local assessor's office or the Michigan Department of Treasury.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4988 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.