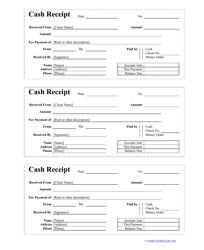

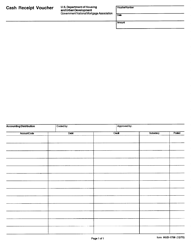

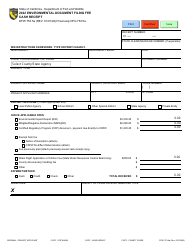

Instructions for Form FRMS-7 Cash Receipt - Alabama

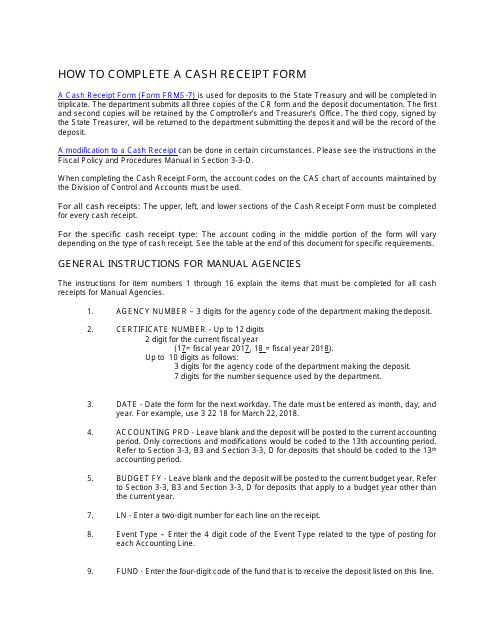

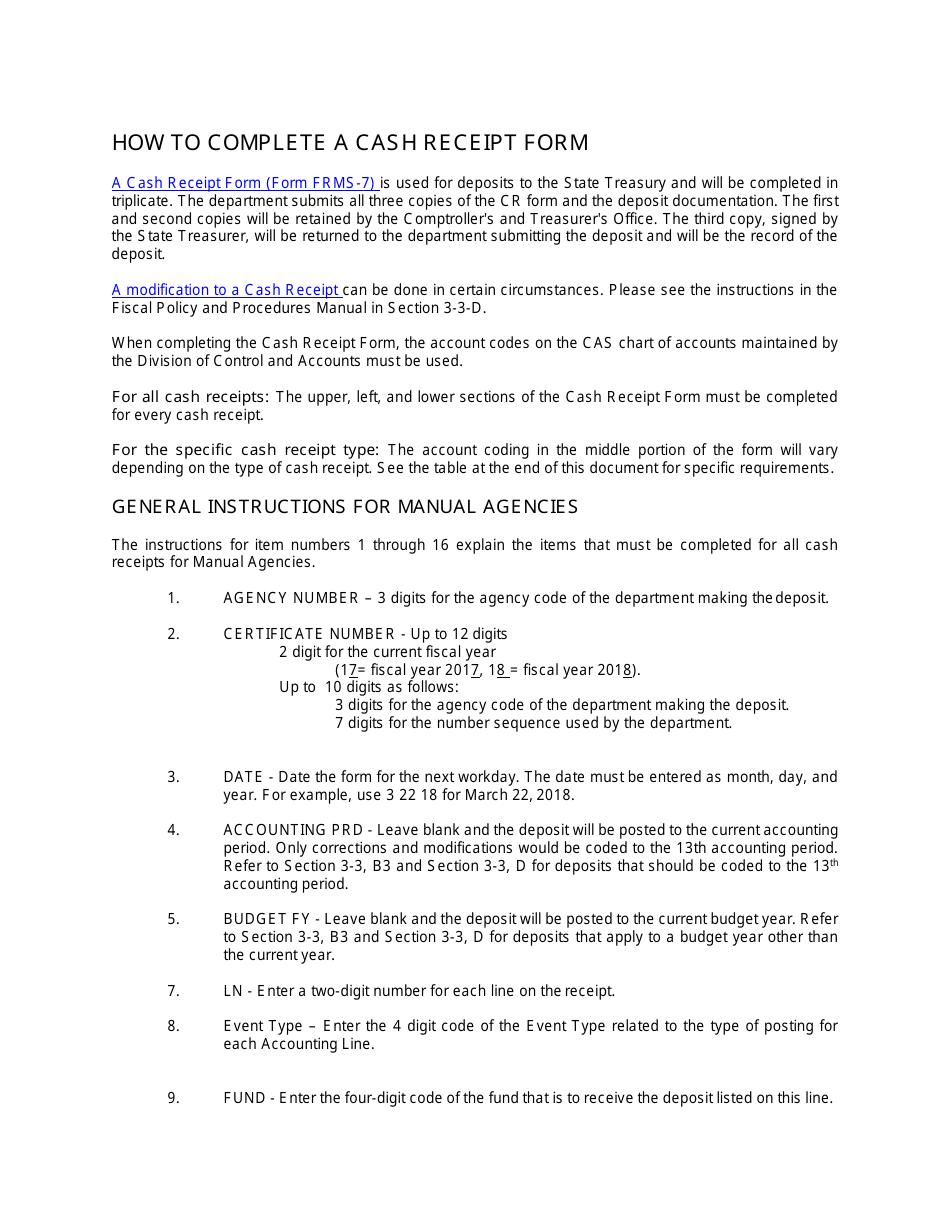

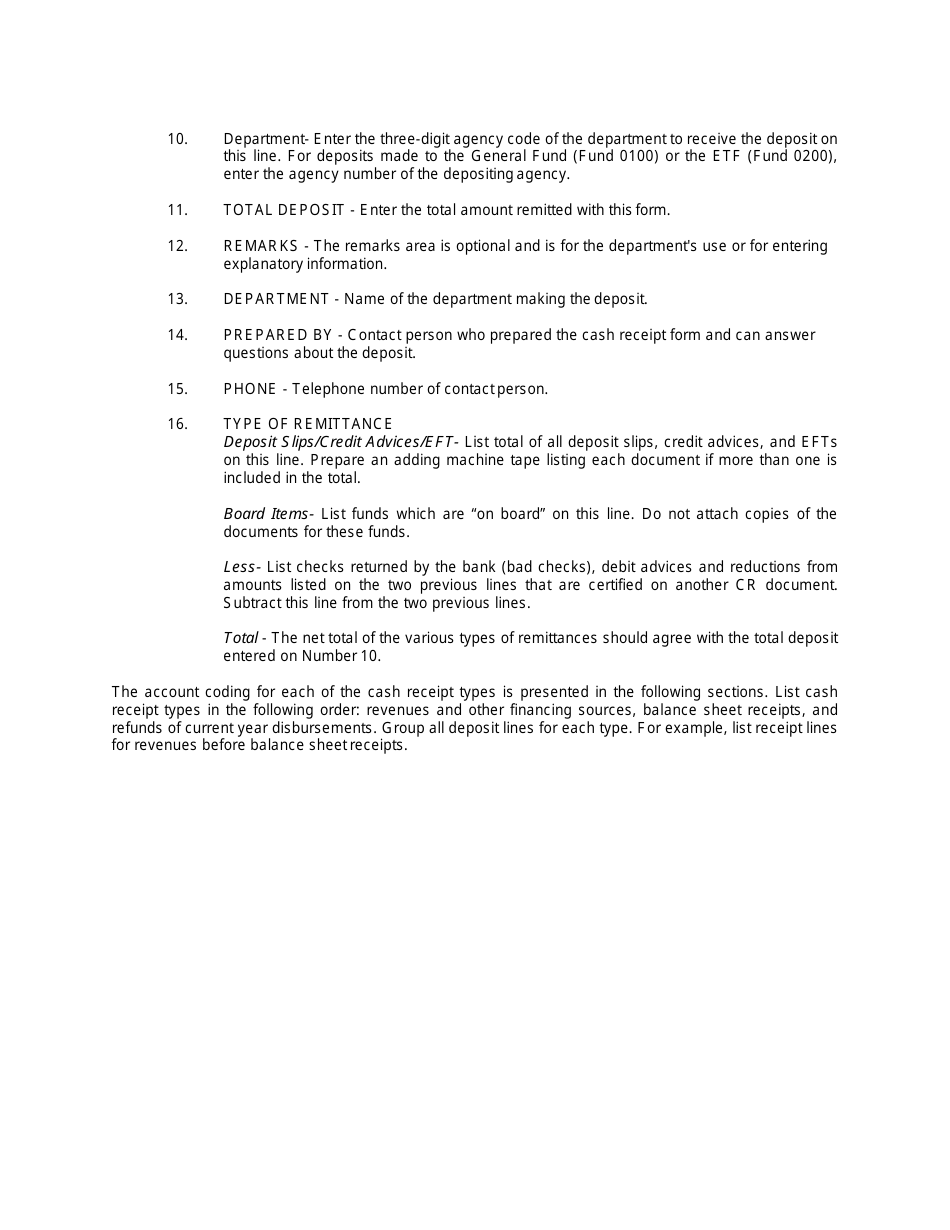

This document contains official instructions for Form FRMS-7 , Cash Receipt - a form released and collected by the Alabama Department of Finance - State Comptroller's Office.

FAQ

Q: What is Form FRMS-7?

A: Form FRMS-7 is a cash receipt form used in Alabama.

Q: Who should use Form FRMS-7?

A: Anyone in Alabama who receives cash payments and needs to issue a receipt.

Q: What is the purpose of Form FRMS-7?

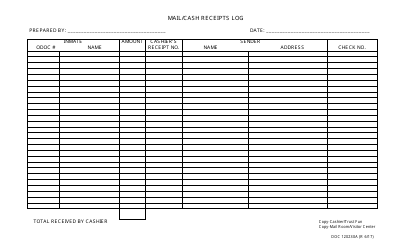

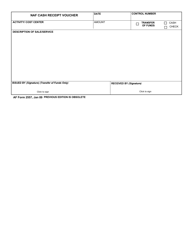

A: The form is used to document and track cash payments received.

Q: Do I need to file Form FRMS-7 with the state?

A: No, Form FRMS-7 is not filed with the state, but it should be kept for your records.

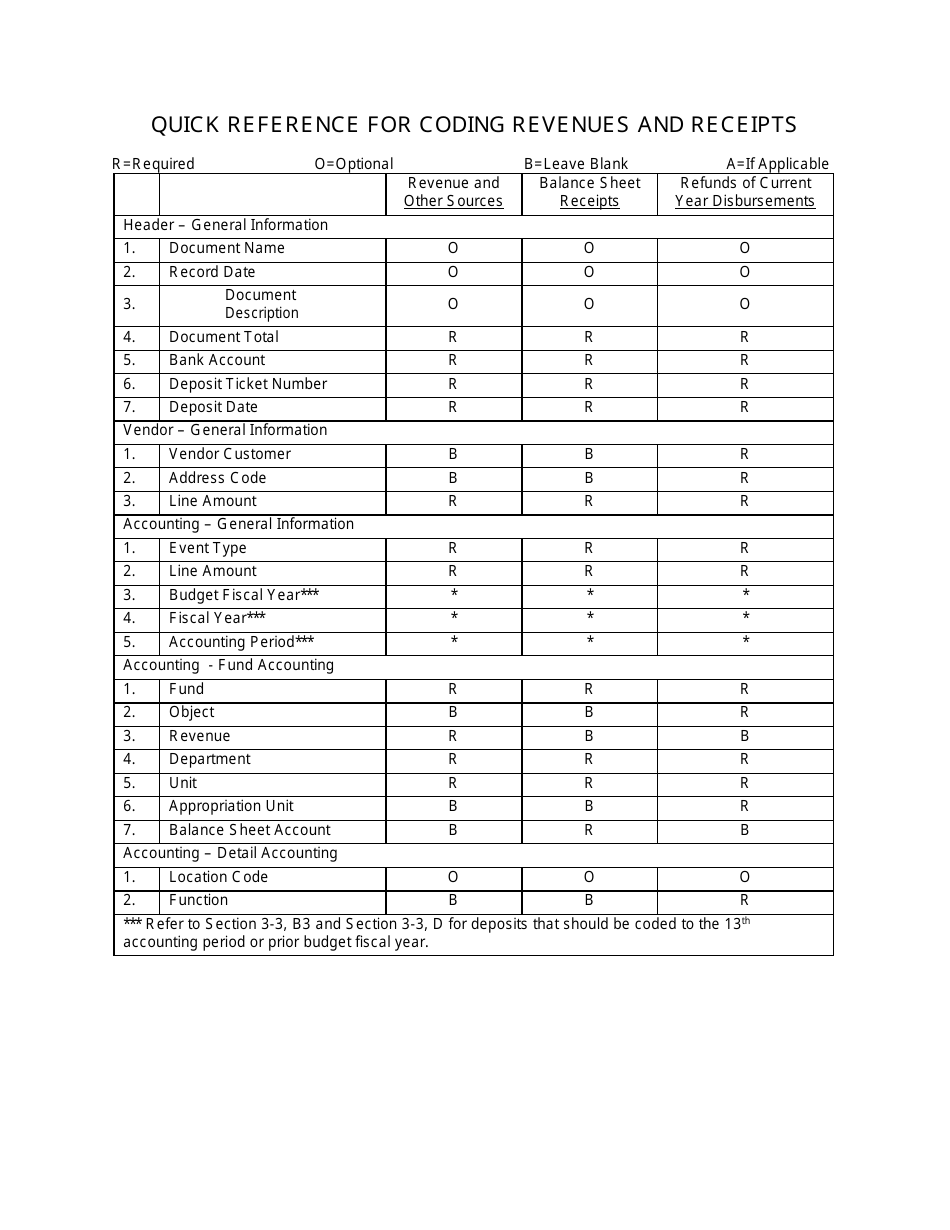

Q: How do I fill out Form FRMS-7?

A: You will need to provide information about the payer, purpose of payment, payment amount, and other details as indicated on the form.

Q: When should I use Form FRMS-7?

A: You should use Form FRMS-7 whenever you receive cash payments in Alabama and need to provide a receipt to the payer.

Q: Are there any fees associated with Form FRMS-7?

A: No, there are no fees associated with Form FRMS-7.

Q: Can I use Form FRMS-7 for non-cash payments?

A: No, Form FRMS-7 is specifically for documenting cash payments.

Q: Can I use a digital or electronic version of Form FRMS-7?

A: It is recommended to use the printed version of Form FRMS-7, but you can discuss the acceptability of electronic versions with the Alabama Department of Revenue.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Finance - State Comptroller's Office.