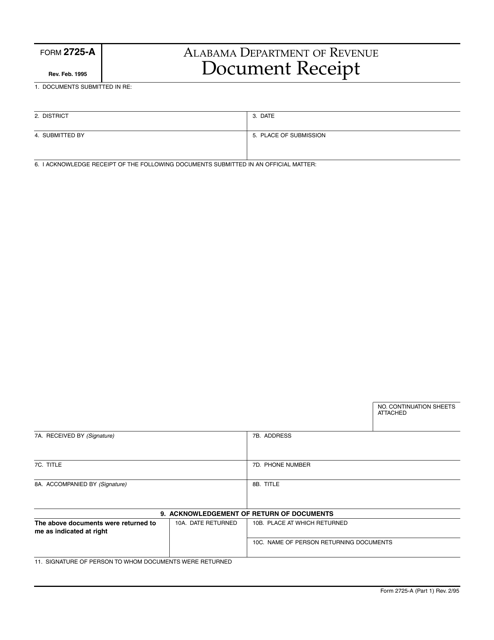

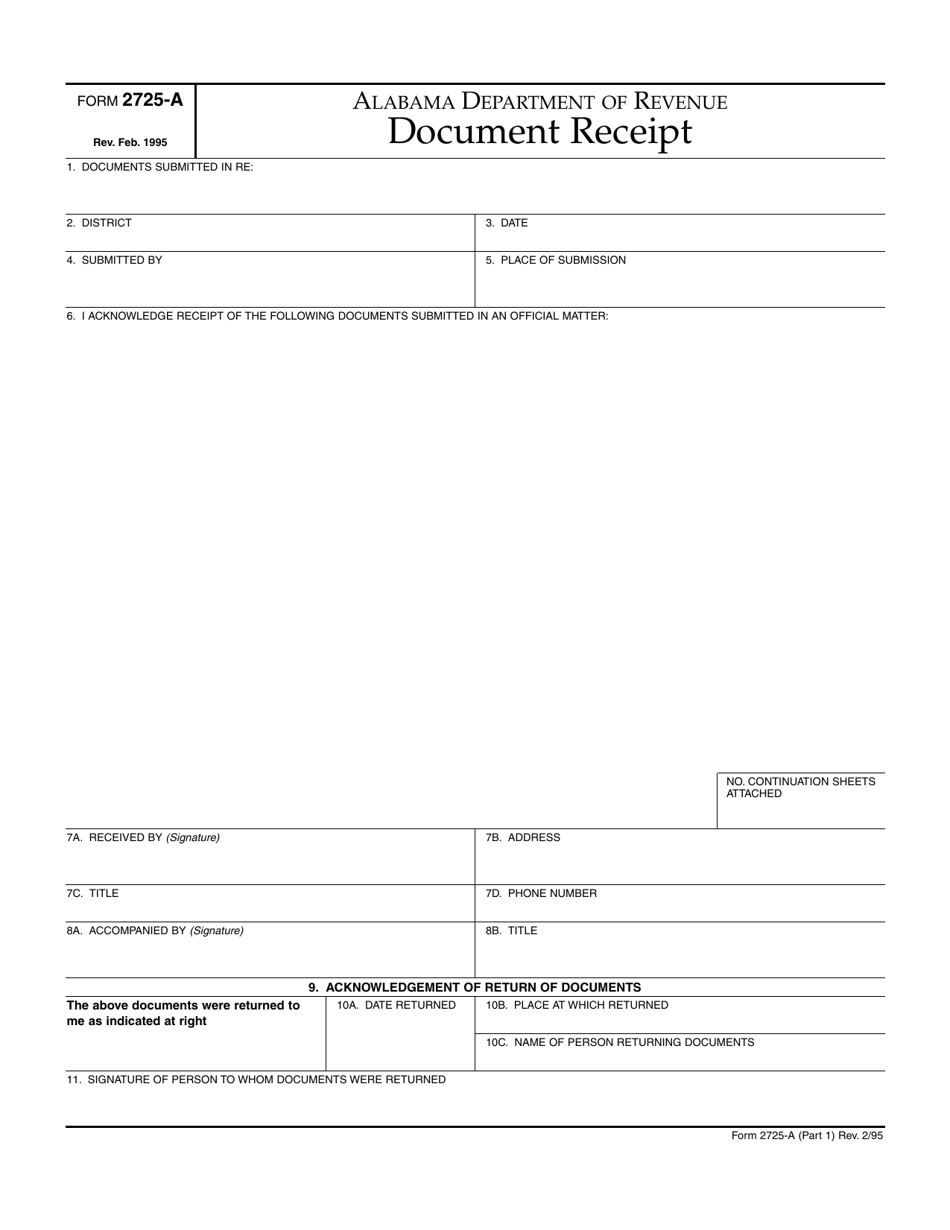

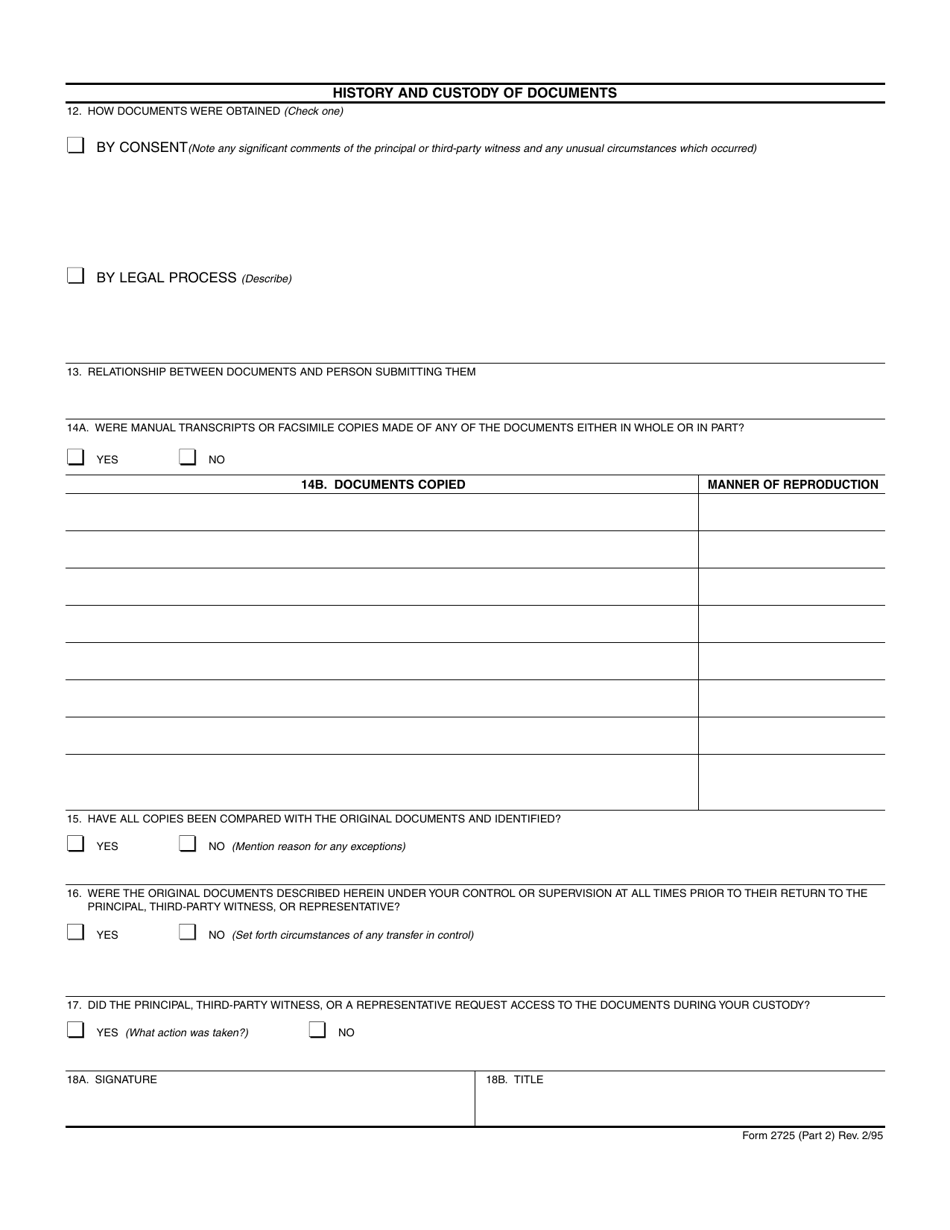

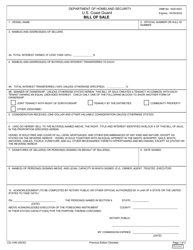

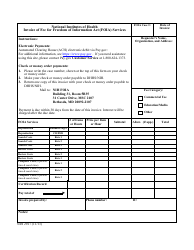

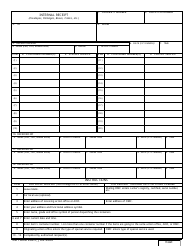

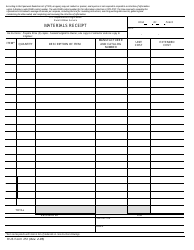

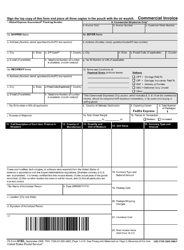

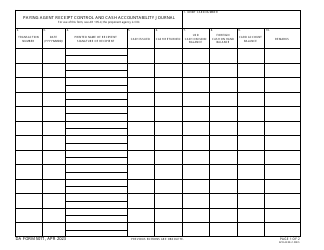

Form 2725-A Document Receipt - Alabama

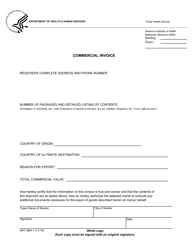

What Is Form 2725-A?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 2725-A?

A: Form 2725-A is a Document Receipt form used in Alabama.

Q: What is the purpose of Form 2725-A?

A: The purpose of Form 2725-A is to acknowledge receipt of documents.

Q: Who uses Form 2725-A?

A: Form 2725-A is used by individuals or organizations receiving documents in Alabama.

Q: When is Form 2725-A used?

A: Form 2725-A is used whenever documents are being received.

Q: Is there a fee for Form 2725-A?

A: There is usually no fee for Form 2725-A.

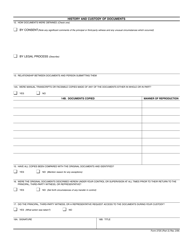

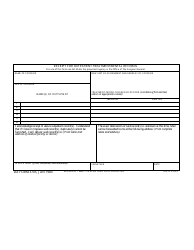

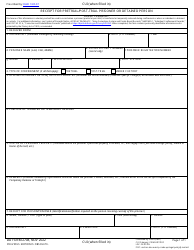

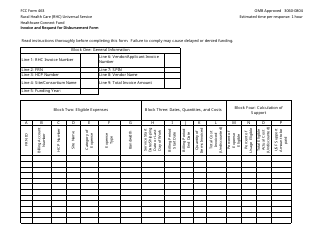

Q: What information is required on Form 2725-A?

A: Form 2725-A typically requires information about the recipient, the documents being received, and the date of receipt.

Q: How should Form 2725-A be filled out?

A: Form 2725-A should be filled out accurately, providing all requested information.

Q: Can Form 2725-A be submitted electronically?

A: It depends on the specific requirements of the Alabama Department of Revenue. Check with the department for accepted submission methods.

Q: What should I do with Form 2725-A once it is filled out?

A: Form 2725-A should be kept for your records.

Form Details:

- Released on February 1, 1995;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2725-A by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.