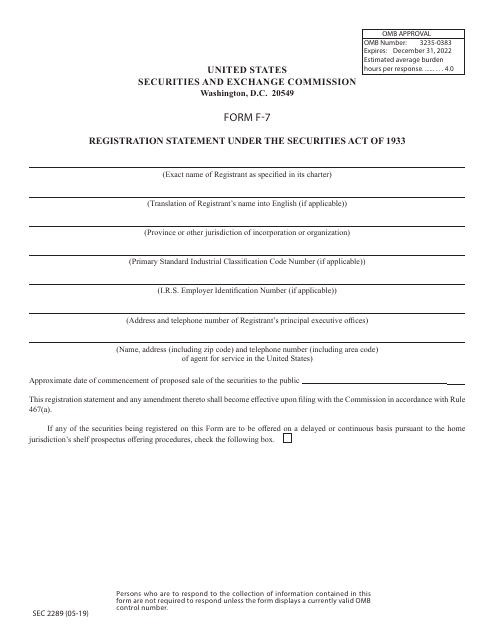

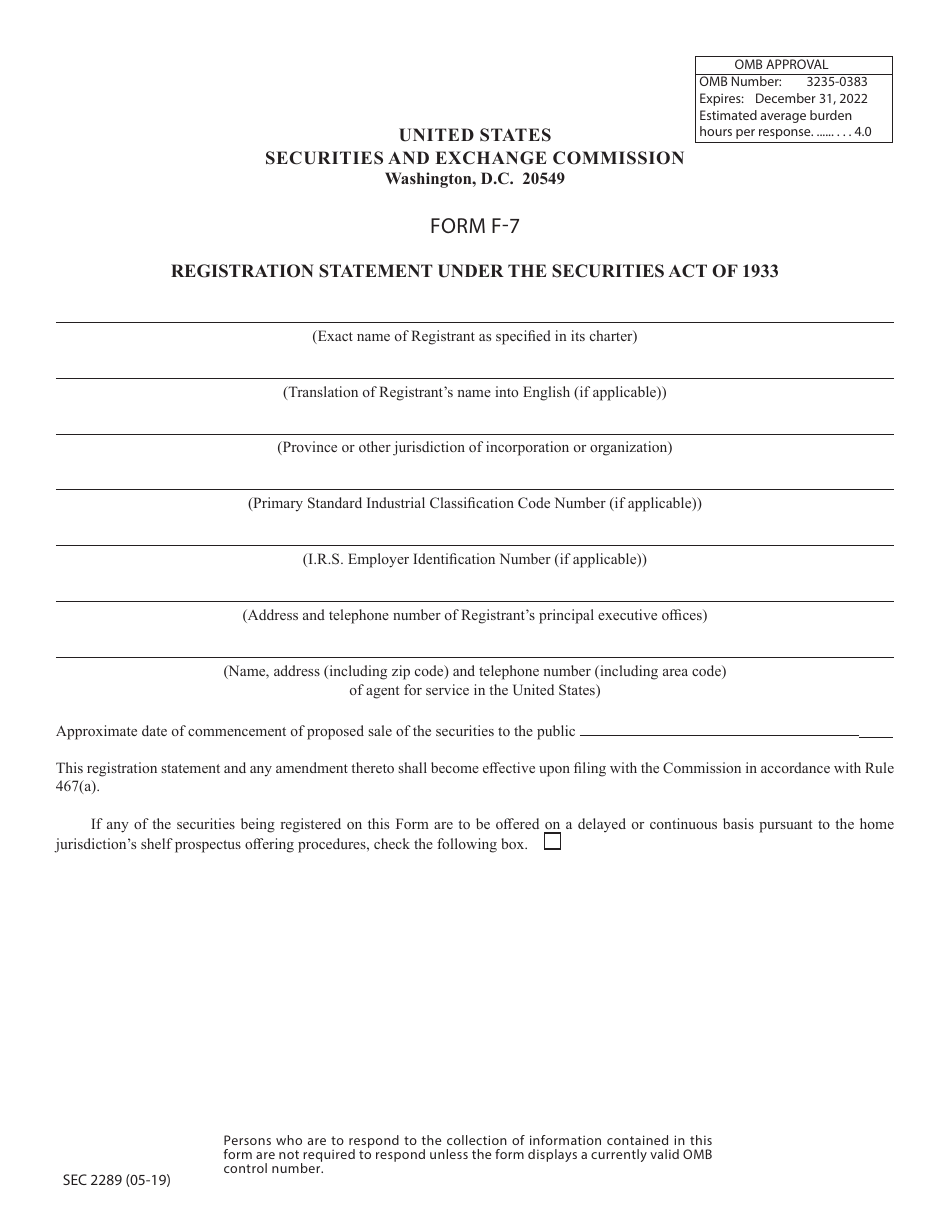

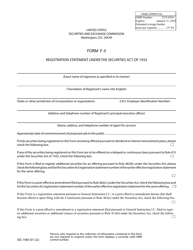

Form F-7 (SEC Form 2289) Registration Statement Under the Securities Act of 1933 for Securities of Certain Canadian Issuers Offered for Cash Upon the Exercise of Rights Granted to Existing Security Holders

What Is Form F-7 (SEC Form 2289)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on May 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-7?

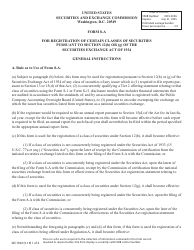

A: Form F-7 is a registration statement used under the Securities Act of 1933 for securities of certain Canadian issuers offered for cash upon the exercise of rights granted to existing security holders.

Q: What is SEC Form 2289?

A: SEC Form 2289 is the specific form number assigned to Form F-7.

Q: What is the Securities Act of 1933?

A: The Securities Act of 1933 is a federal law that regulates the offering and sale of securities to the public. It requires companies to register with the Securities and Exchange Commission (SEC) and disclose certain information to investors.

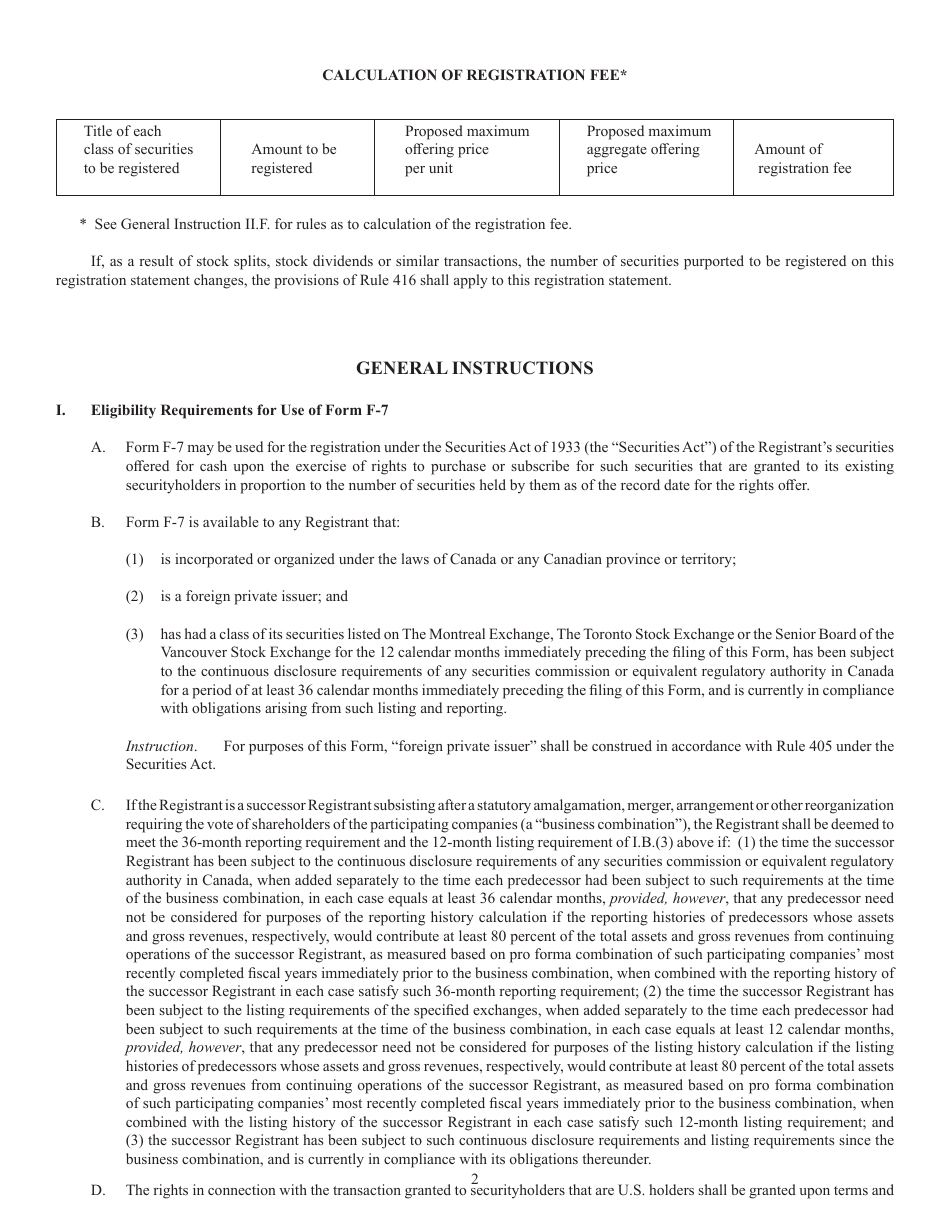

Q: Who can use Form F-7?

A: Form F-7 can be used by certain Canadian issuers who are offering securities for cash upon the exercise of rights granted to existing security holders.

Q: What is the purpose of Form F-7?

A: The purpose of Form F-7 is to provide information to the SEC and investors regarding the offering of securities by Canadian issuers.

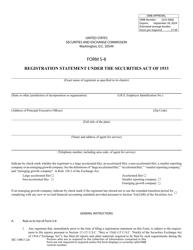

Q: What information is required in Form F-7?

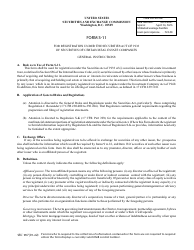

A: Form F-7 requires information about the issuer, the securities being offered, the terms of the offering, and other relevant details.

Q: Is Form F-7 specific to Canadian issuers?

A: Yes, Form F-7 is specifically designed for Canadian issuers offering securities for cash upon the exercise of rights granted to existing security holders.

Q: When should Form F-7 be filed?

A: Form F-7 should be filed with the SEC prior to the offering of securities by the Canadian issuer.

Form Details:

- Released on May 1, 2019;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F-7 (SEC Form 2289) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.