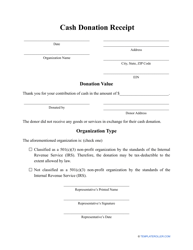

Cash Receipt Template

What Is a Cash Receipt?

A Cash Receipt is a printed statement of the amount of cash received in a cash sale transaction from a customer or an investor. It is used to report transactions in writing form. Some companies sell products and services on credit and expect cash payment after a certain period, and some require immediate cash payment for their goods or services.

Alternate Name:

- Cash Payment Receipt.

In both cases, the company has to provide a receipt for cash payment to their clients as confirmation of receiving the payment for their goods or service rendered. A seller should provide this receipt for every product or service purchased from their business. The services for which a Cash Receipt can be provided may be the following: renting out equipment or building, or interest received on investments.

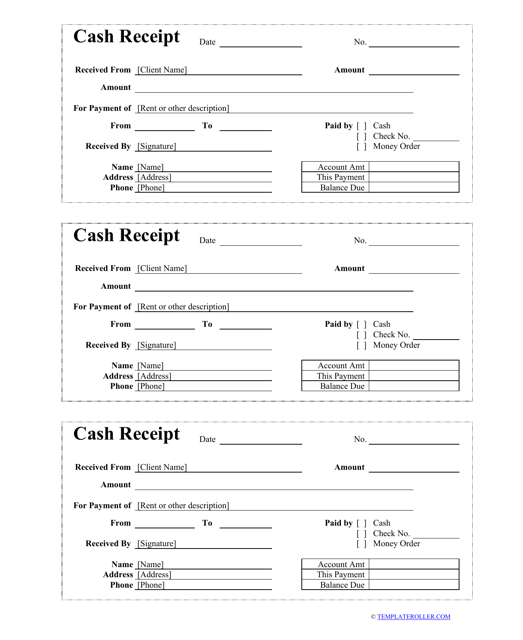

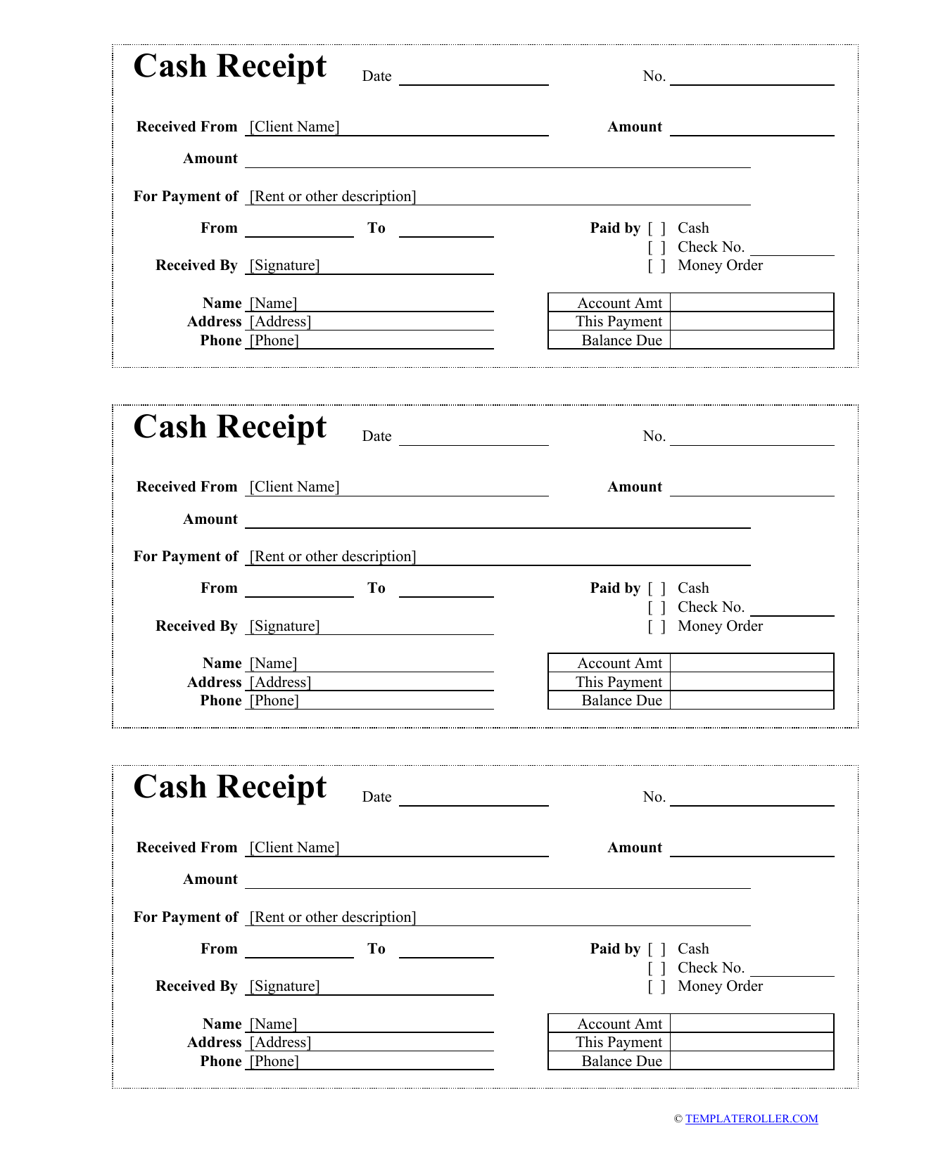

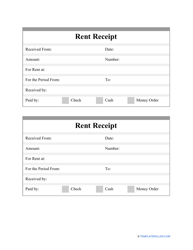

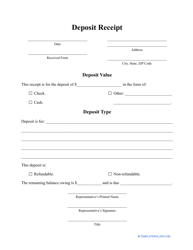

A printable Cash Receipt template can be downloaded through the link below.

How to Write a Receipt for Cash?

A Cash Receipt should include the following:

- The seller has to indicate information about their company. The company's name, its address, website, email, and phone number should be entered.

- The seller has to provide information about the purchaser or customer. Enter the contact name, company name, their address, phone number, and email.

- The receipt number and the transaction date should be indicated.

- The seller must provide a description of the goods delivered or services that were sold. Indicate each good or service in a separate line. They should enter the quantity, the unit price, and the total for each specified good or service.

- When all of the goods or services are listed, the seller must specify the subtotal. If the seller has offered a discount to the purchaser, they should indicate its amount. Enter the subtotal less discount in the corresponding box.

- The seller should enter the tax rate, which is subject to the payment, and the total tax amount in the corresponding fields.

- If shipping or handling have been ordered by a customer, the total value of providing these services should be entered.

- The seller must indicate the balance paid.

- The seller should then fill in the terms and instructions section of the form. Information about the payment method should be indicated here. The payment method can be not only cash but also check and money order. The seller can also add delivery terms and returns policy in this section, which governs a purchaser's right to return or exchange goods.

- The seller and the purchaser should sign the form, thus confirming the conclusion of the transaction.

The seller should approve a Cash Receipt Form for their company and issue every receipt following the established template. A Cash Payment Receipt has to be provided to a purchaser, and a copy of it should be retained in the company for accounting purposes. A Receipt for Cash Payment must be recorded as an increase to the cash account and is used by the seller to track their sales and goods sold, calculate and estimate their income. The purchaser should keep the Cash Receipt as proof of purchase.

Is a Handwritten Receipt Legal?

Companies or individuals may use a hand-written receipt when they perform their transactions without a terminal or cash register. When a payment is paid in cash, a Cash Receipt is the only proof of this payment so the receipt acts as a legal document that a buyer can use to establish their ownership of a purchased item or service. This kind of receipt can also be provided to purchasers of different products if it is set by the tax deduction rules.

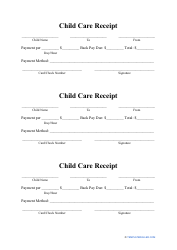

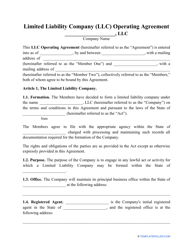

Haven't found the template you're looking for? Take a look at the related templates below: