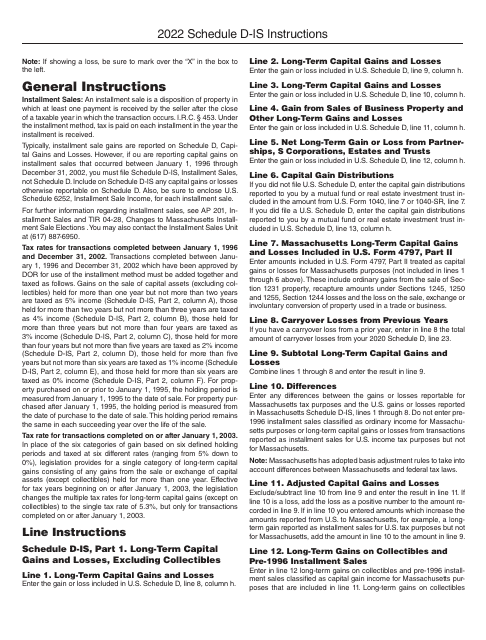

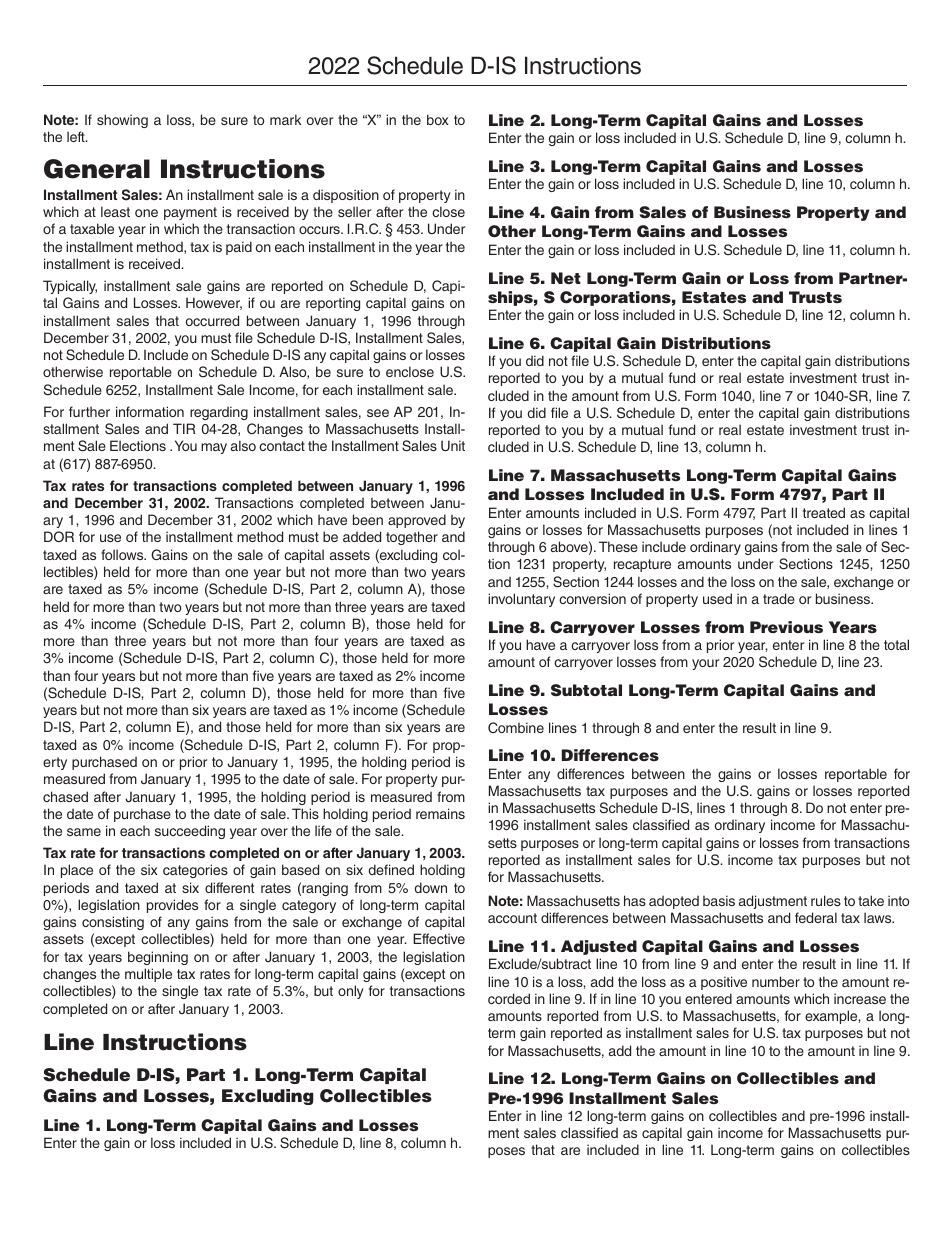

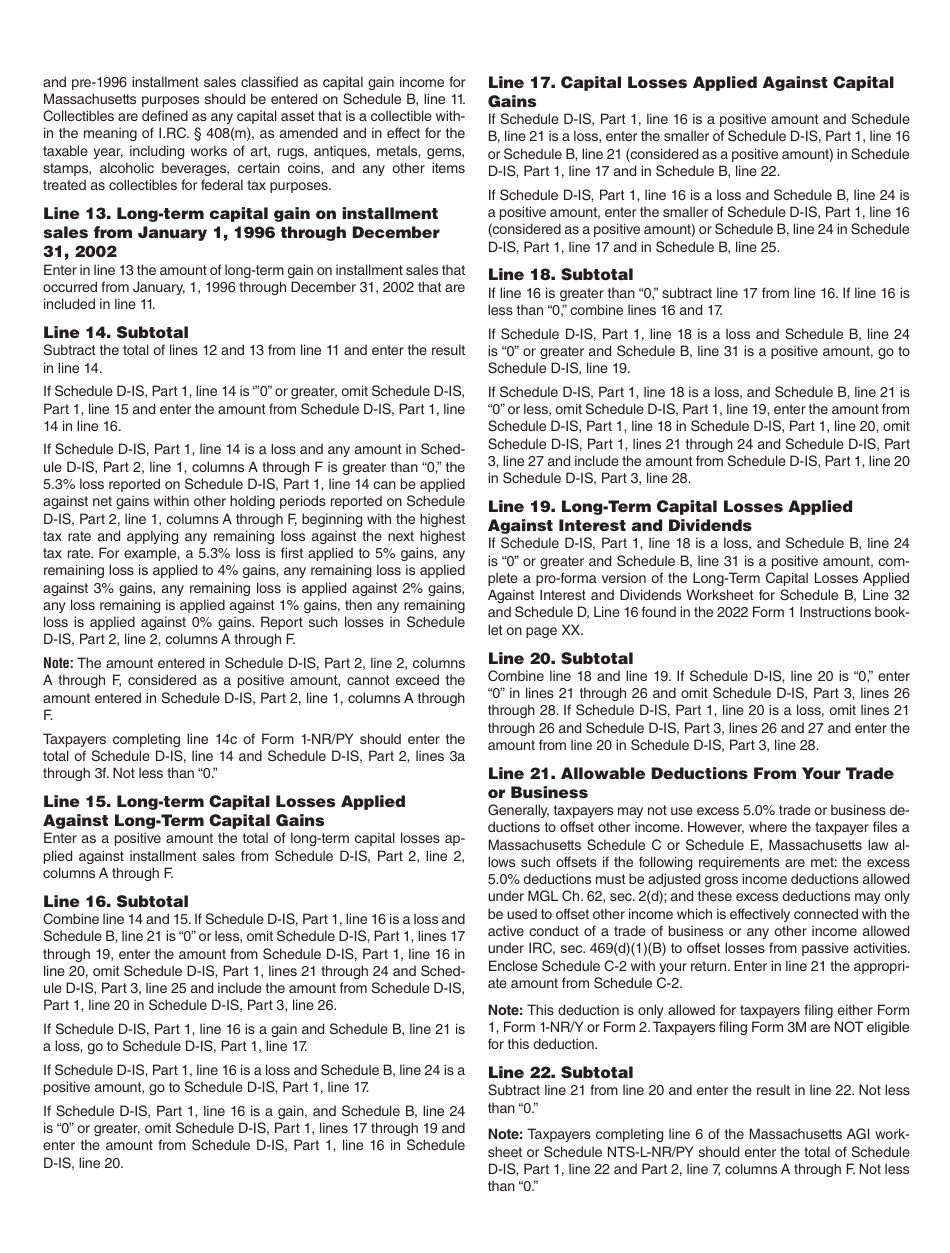

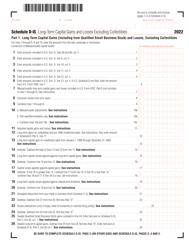

Instructions for Schedule D-IS Long-Term Capital Gains and Losses Excluding Collectibles - Massachusetts

This document contains official instructions for Schedule D-IS , Long-Term Capital Gains and Losses Excluding Collectibles - a form released and collected by the Massachusetts Department of Correction.

FAQ

Q: What is Schedule D-IS?

A: Schedule D-IS is a tax form used to report long-term capital gains and losses excluding collectibles in the state of Massachusetts.

Q: Who needs to file Schedule D-IS?

A: You need to file Schedule D-IS if you are a Massachusetts resident and have long-term capital gains or losses from investments excluding collectibles.

Q: What is considered a long-term capital gain or loss?

A: A long-term capital gain or loss is when you sell an investment that you held for more than one year before selling.

Q: What are collectibles?

A: Collectibles include items like coins, stamps, and art, but do not include investments like stocks or bonds.

Q: Do I need to file Schedule D-IS if I only have short-term capital gains or losses?

A: No, Schedule D-IS is specifically for reporting long-term capital gains and losses excluding collectibles. If you only have short-term gains or losses, you should use a different form.

Q: Is there a deadline for filing Schedule D-IS?

A: Yes, the deadline for filing Schedule D-IS is the same as the deadline for filing your Massachusetts state tax return, which is usually April 15th.

Q: Can I e-file Schedule D-IS?

A: Yes, you can e-file Schedule D-IS if you are filing your Massachusetts state tax return electronically.

Q: What if I have both long-term and short-term capital gains or losses?

A: If you have both long-term and short-term capital gains or losses, you will need to file both Schedule D-IS for the long-term gains or losses and another form for the short-term gains or losses.

Q: What information do I need to fill out Schedule D-IS?

A: You will need information about the investments you sold, including the purchase and sale dates, the amount you received from the sale, and your adjusted basis in the investment.

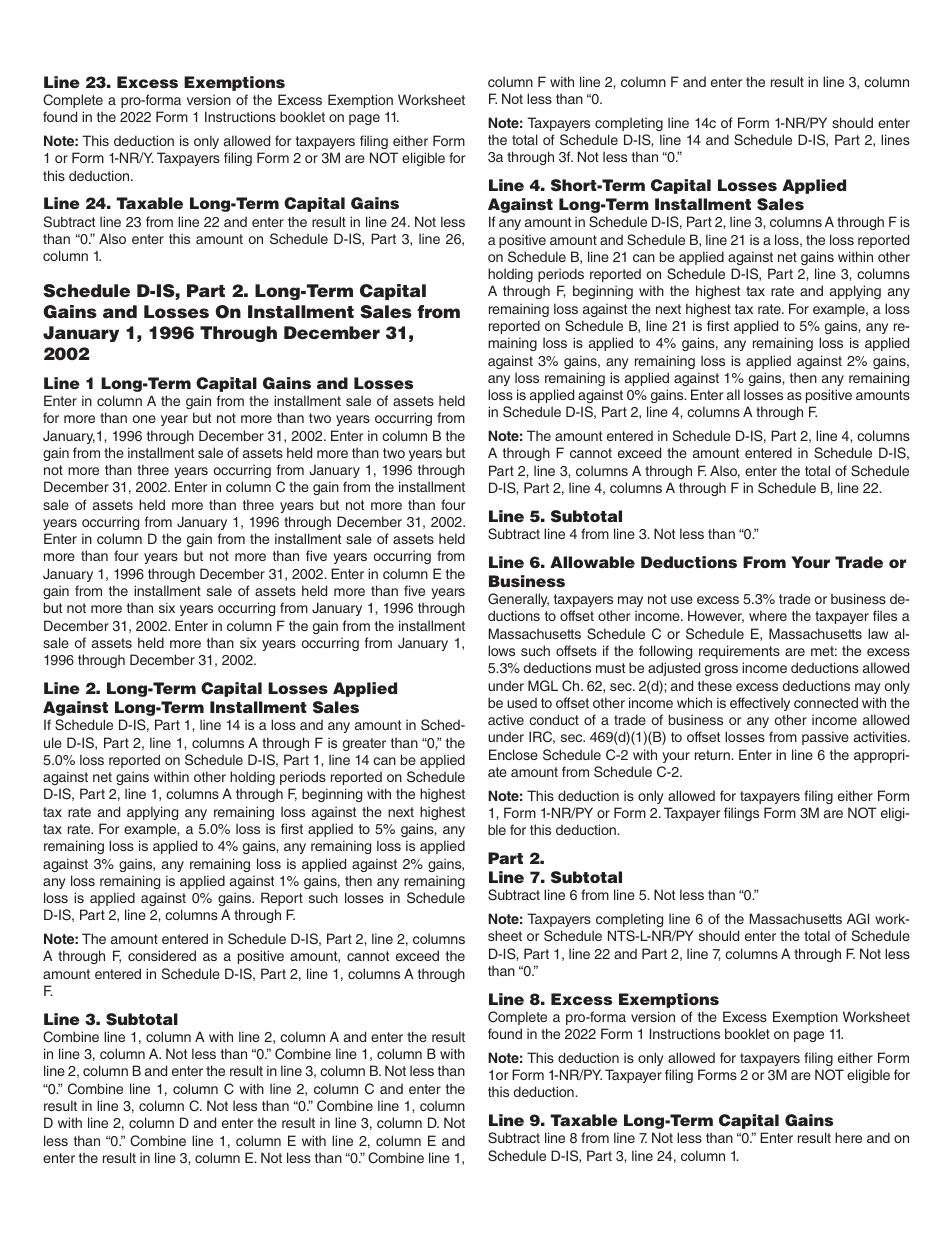

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Massachusetts Department of Correction.