This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule D-IS

for the current year.

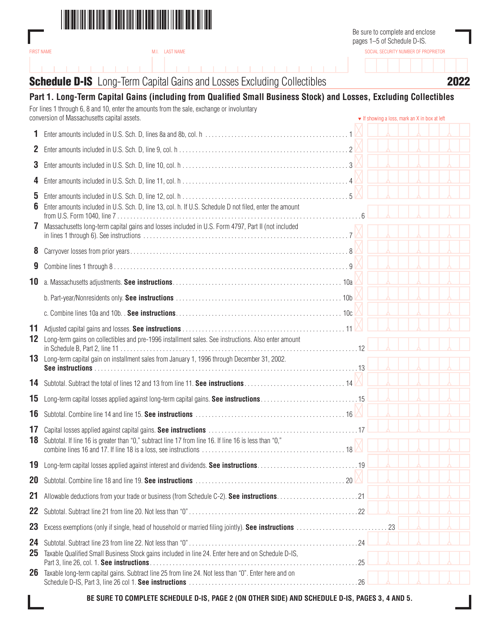

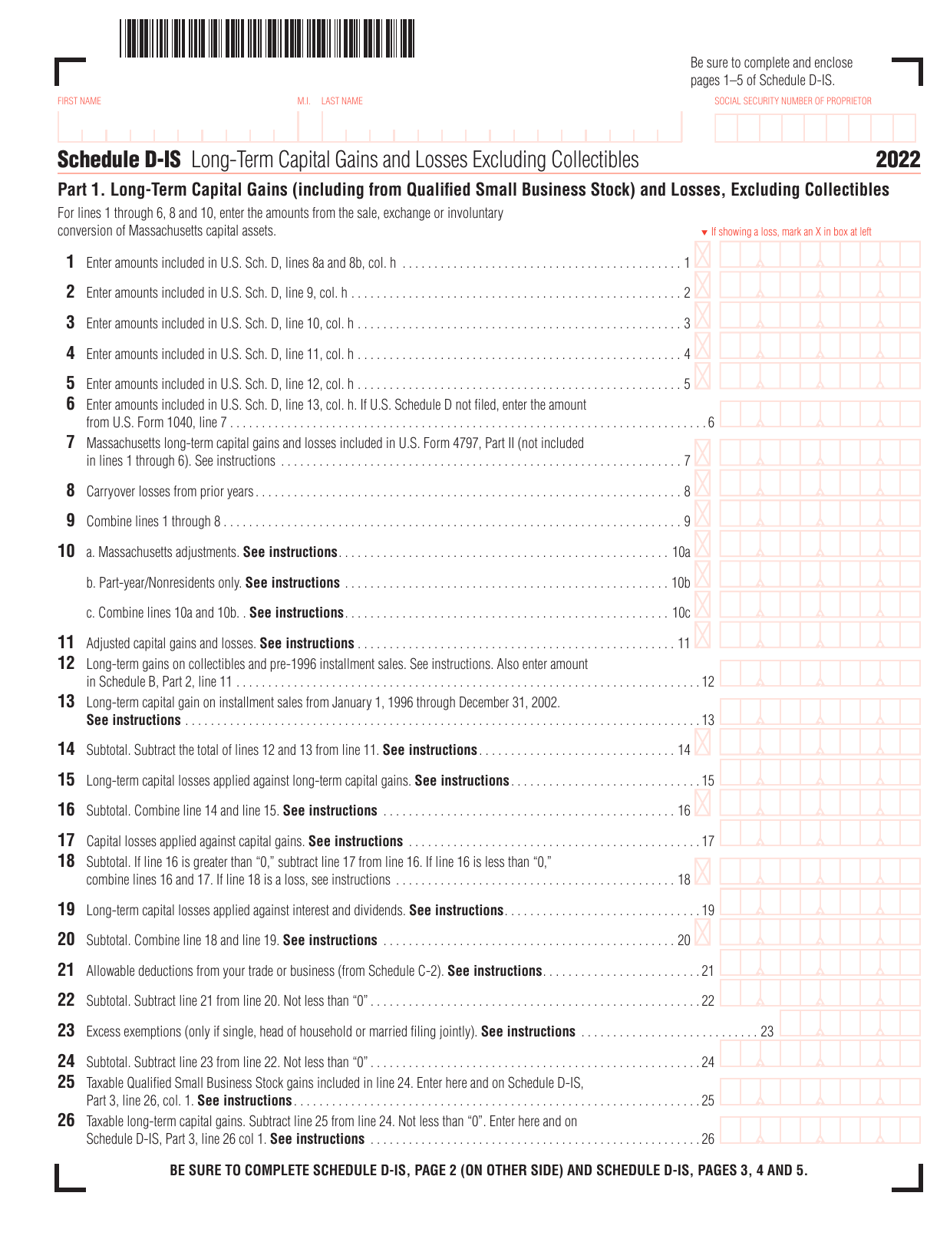

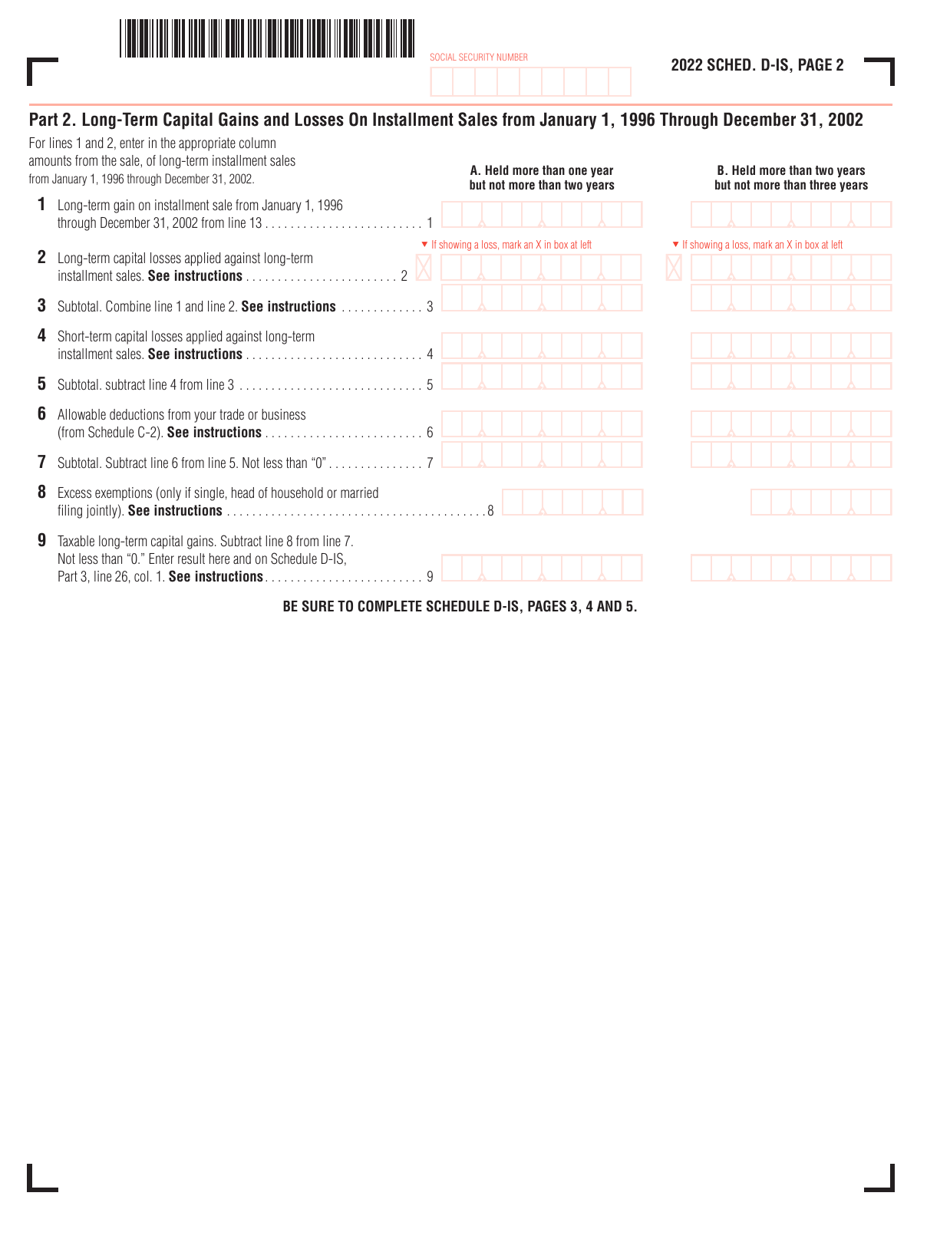

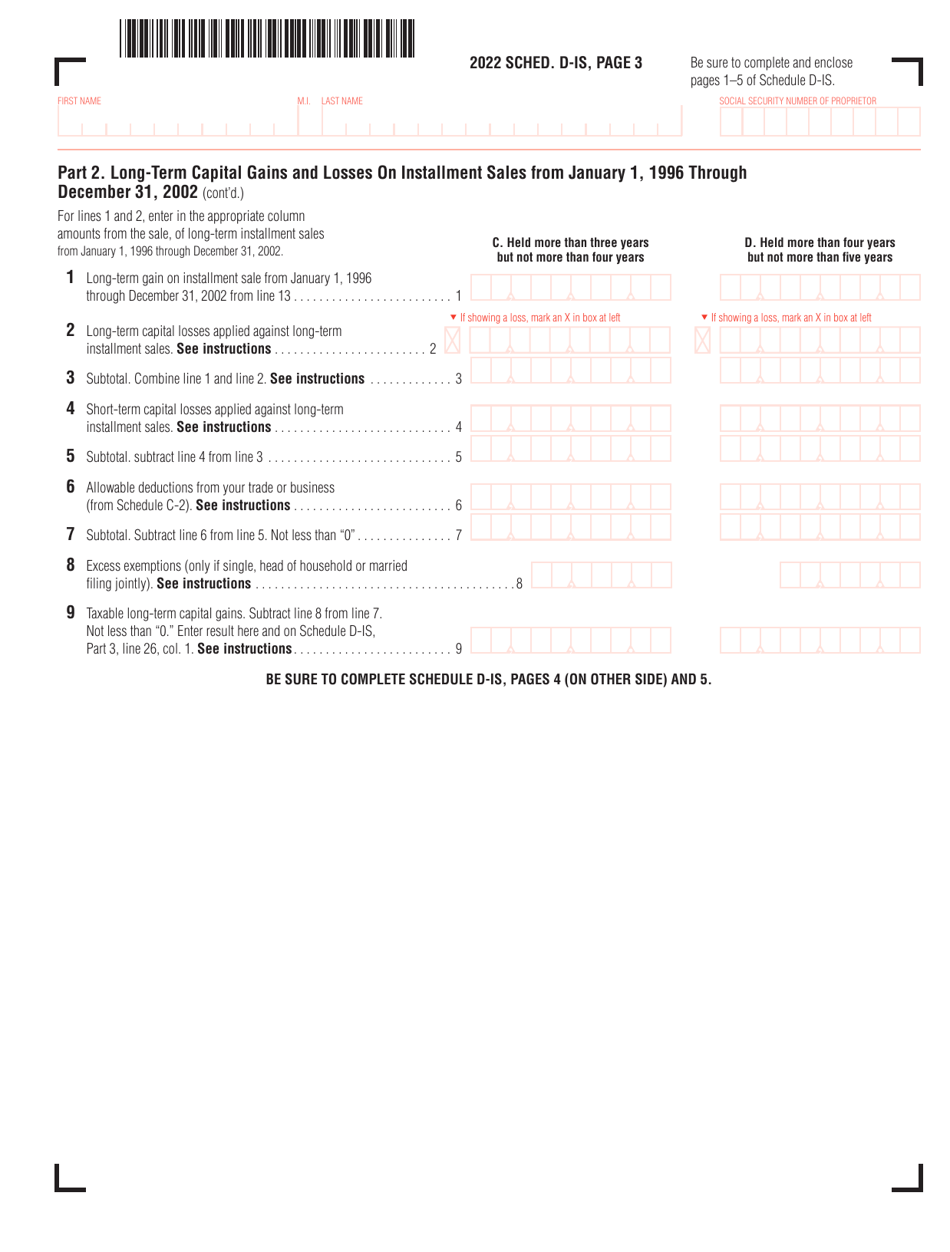

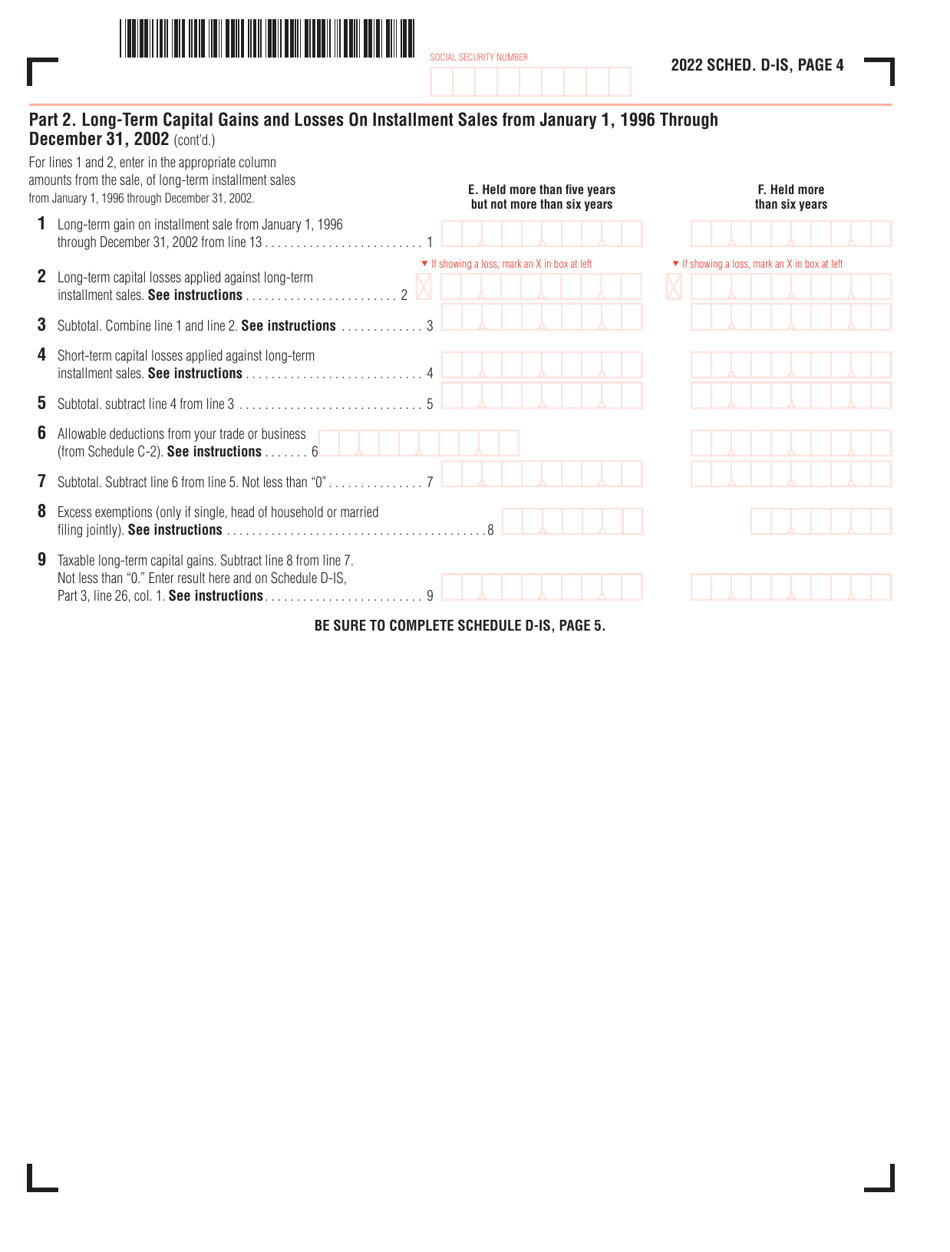

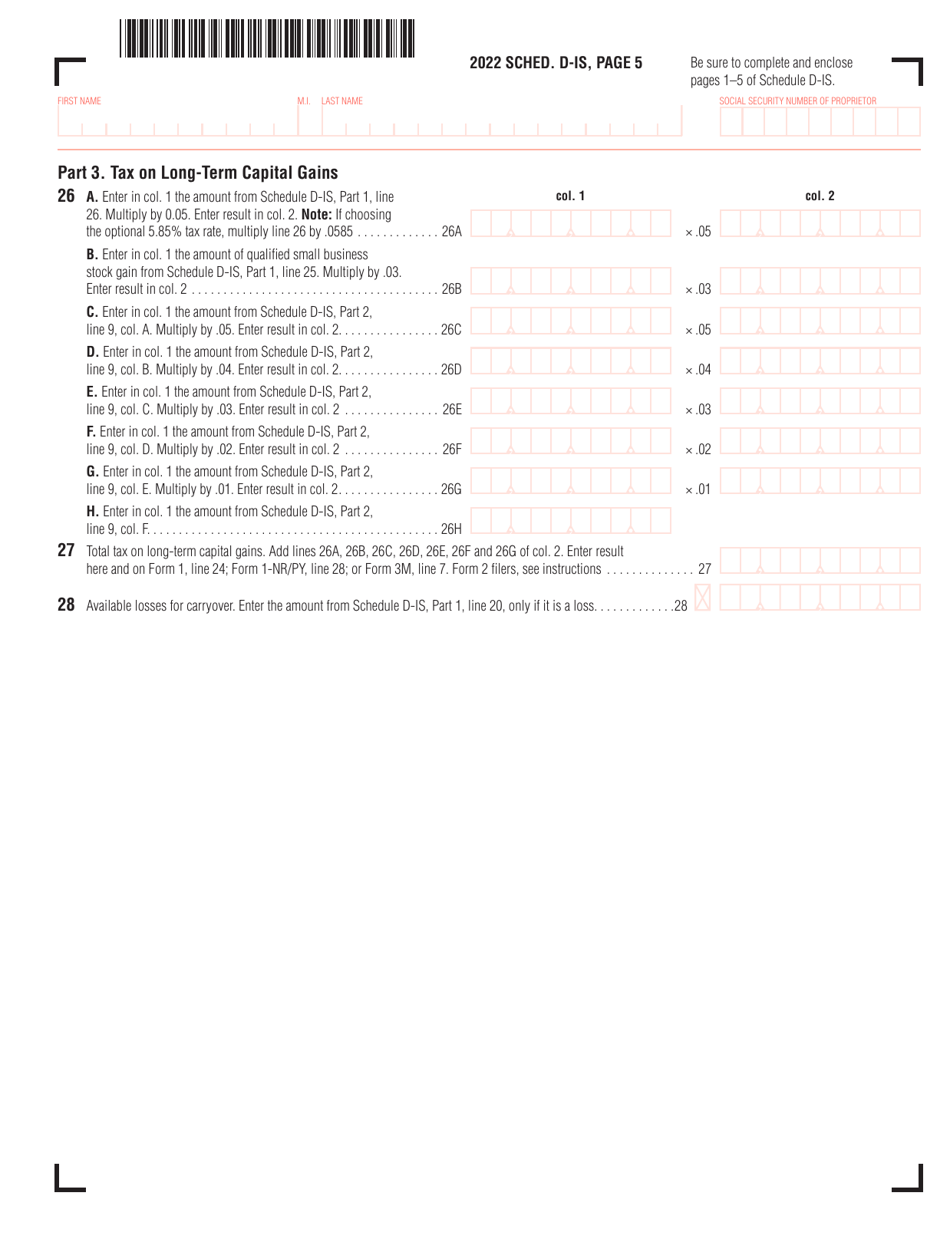

Schedule D-IS Long-Term Capital Gains and Losses Excluding Collectibles - Massachusetts

What Is Schedule D-IS?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule D-IS?

A: Schedule D-IS is a tax form used to report long-term capital gains and losses excluding collectibles for residents of Massachusetts.

Q: What are long-term capital gains and losses?

A: Long-term capital gains and losses are the profits or losses from the sale of assets held for more than one year.

Q: What are collectibles?

A: Collectibles are items like artwork, coins, antiques, and precious metals that are considered to have value due to their rarity or uniqueness.

Q: Who needs to file Schedule D-IS?

A: Residents of Massachusetts who have long-term capital gains or losses excluding collectibles need to file Schedule D-IS.

Q: What information is required on Schedule D-IS?

A: You will need to provide details about the assets you sold, the dates of acquisition and sale, and the resulting gains or losses.

Q: Is Schedule D-IS the same as federal Schedule D?

A: No, Schedule D-IS is a state-specific form for Massachusetts residents and is not the same as the federal Schedule D.

Q: When is the deadline to file Schedule D-IS?

A: The deadline to file Schedule D-IS is the same as the deadline for your Massachusetts state tax return, which is usually April 15th, or the next business day if that falls on a weekend or holiday.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule D-IS by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.