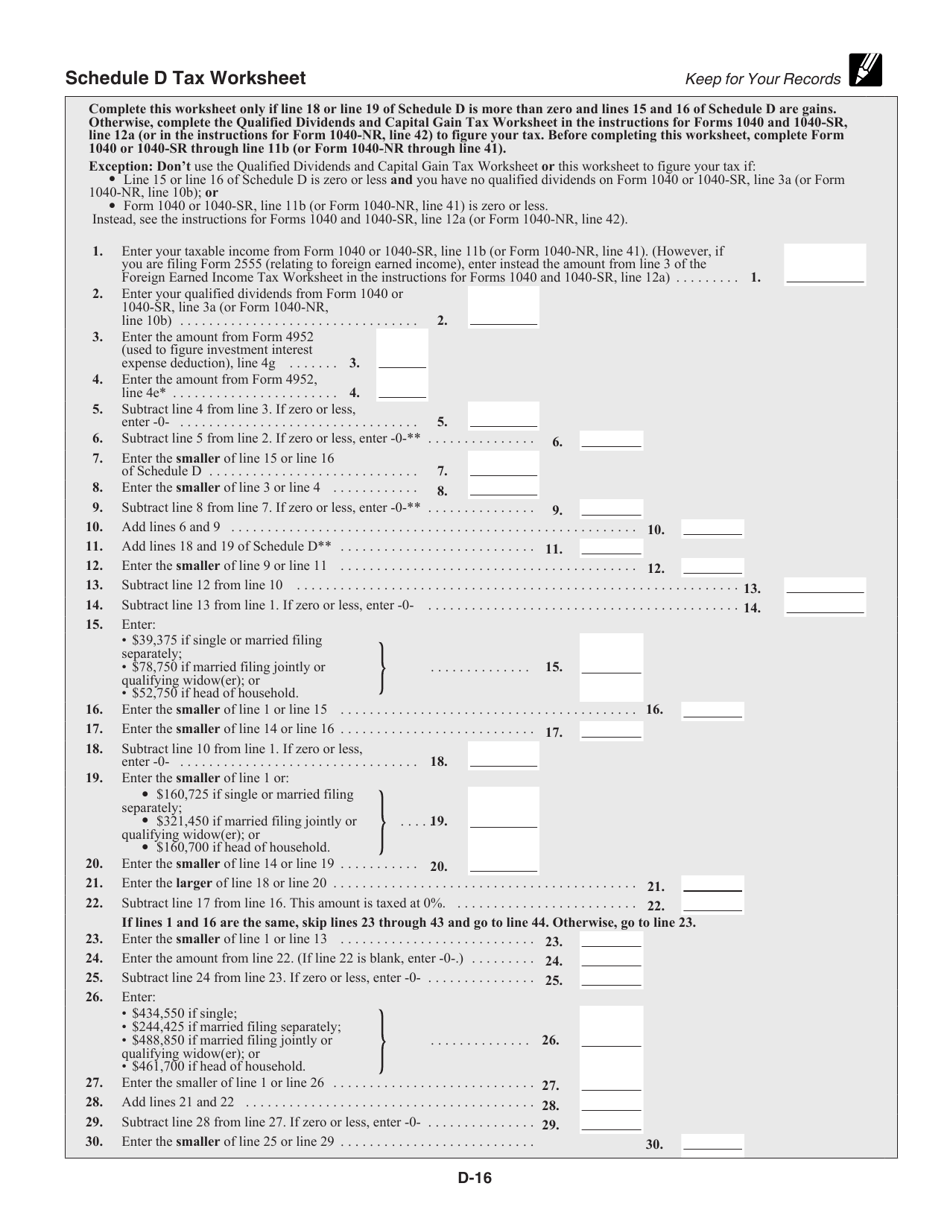

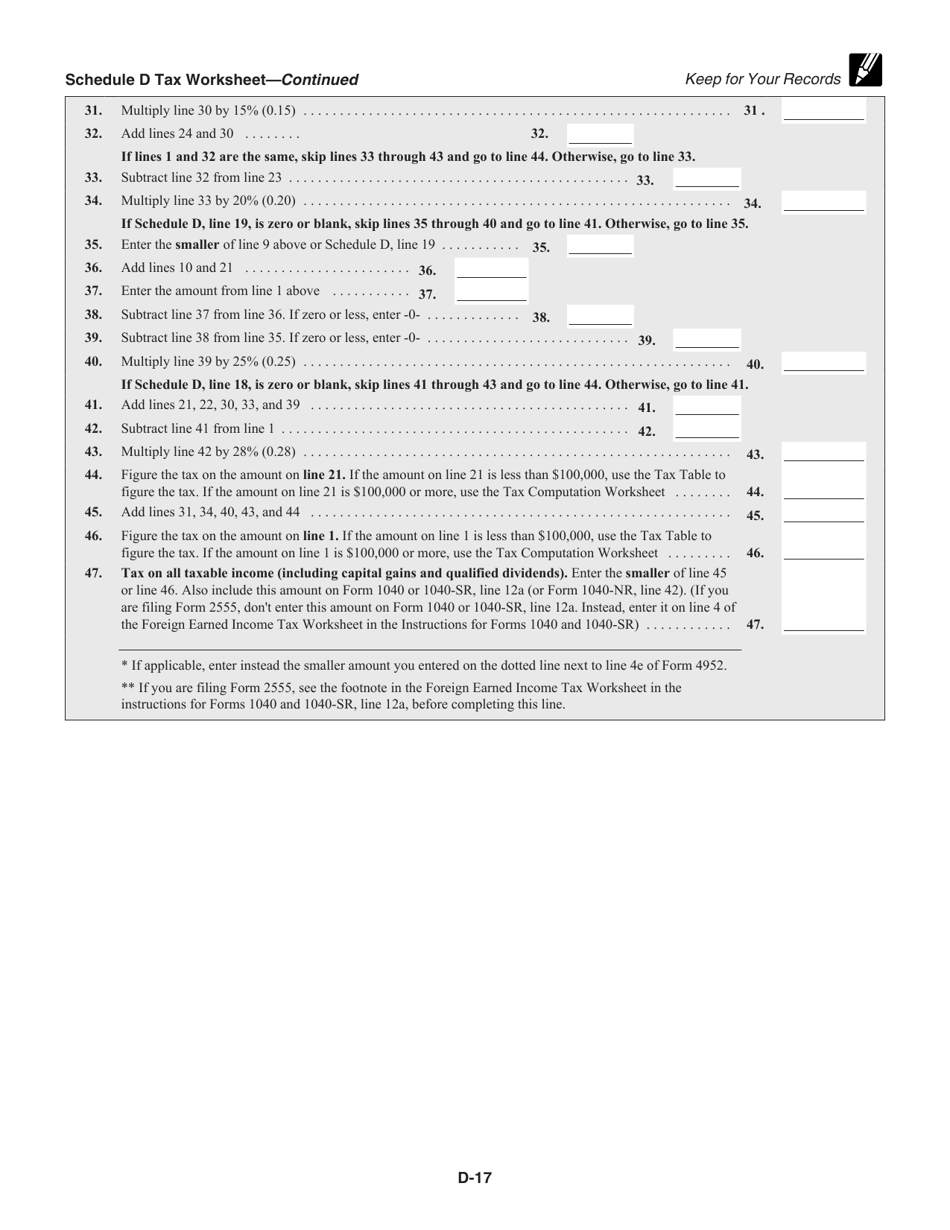

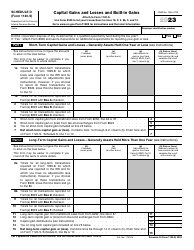

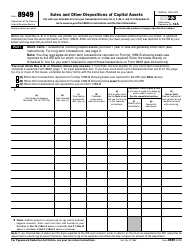

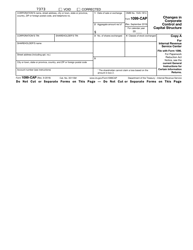

Instructions for IRS Form 1040, 1040-SR Schedule D Capital Gains and Losses

This document contains official instructions for IRS Form 1040 Schedule D and IRS Form 1040-SR Schedule D . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 (1040-SR) Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the standard tax form used by individuals to file their annual income tax returns.

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a simplified version of Form 1040 designed specifically for seniors (over the age of 65) to file their tax returns.

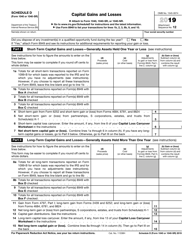

Q: What is Schedule D?

A: Schedule D is a tax form used to report capital gains and losses from the sale of investments, such as stocks or real estate.

Q: What are capital gains?

A: Capital gains are profits made from the sale of capital assets, such as stocks, bonds, or real estate.

Q: What are capital losses?

A: Capital losses occur when the sale of a capital asset results in a decrease in value, leading to a financial loss.

Q: When do I need to file Schedule D?

A: You need to file Schedule D if you have capital gains or losses to report on your tax return.

Q: What information do I need to complete Schedule D?

A: You will need to gather information about your investment transactions, including the purchase price, sale price, and dates of purchase and sale.

Q: Can I use Form 1040-SR to report capital gains and losses?

A: Yes, Form 1040-SR can be used to report capital gains and losses for seniors.

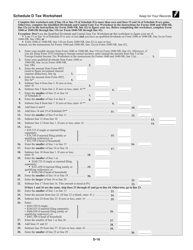

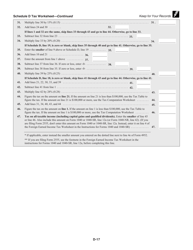

Q: Are there any special rules or deductions for capital gains and losses?

A: Yes, there are specific rules and deductions related to capital gains and losses, such as the capital gains tax rate and the ability to offset capital gains with capital losses.

Instruction Details:

- This 17-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.