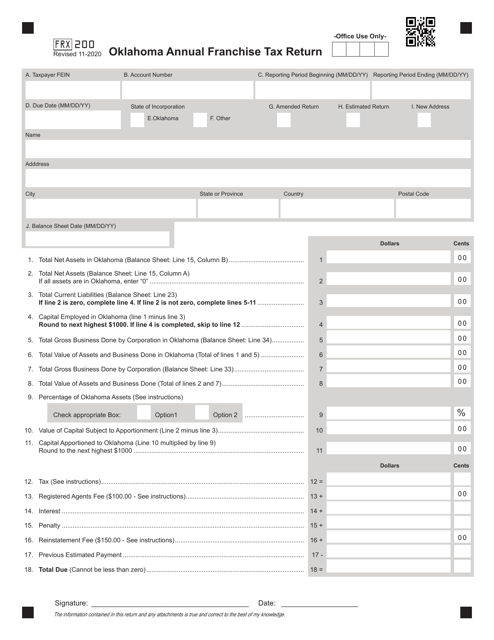

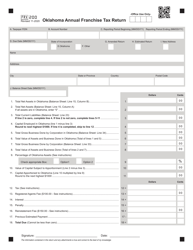

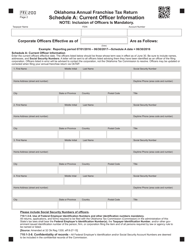

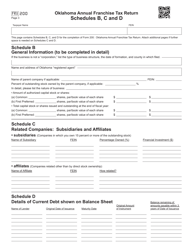

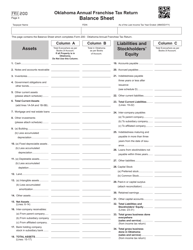

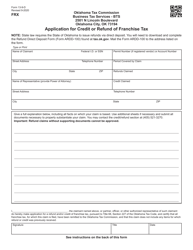

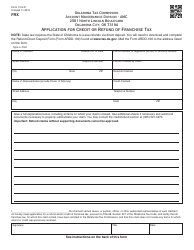

Form 200 Oklahoma Annual Franchise Tax Return - Oklahoma

What Is Form 200?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 200?

A: Form 200 is the Annual Franchise Tax Return for the state of Oklahoma.

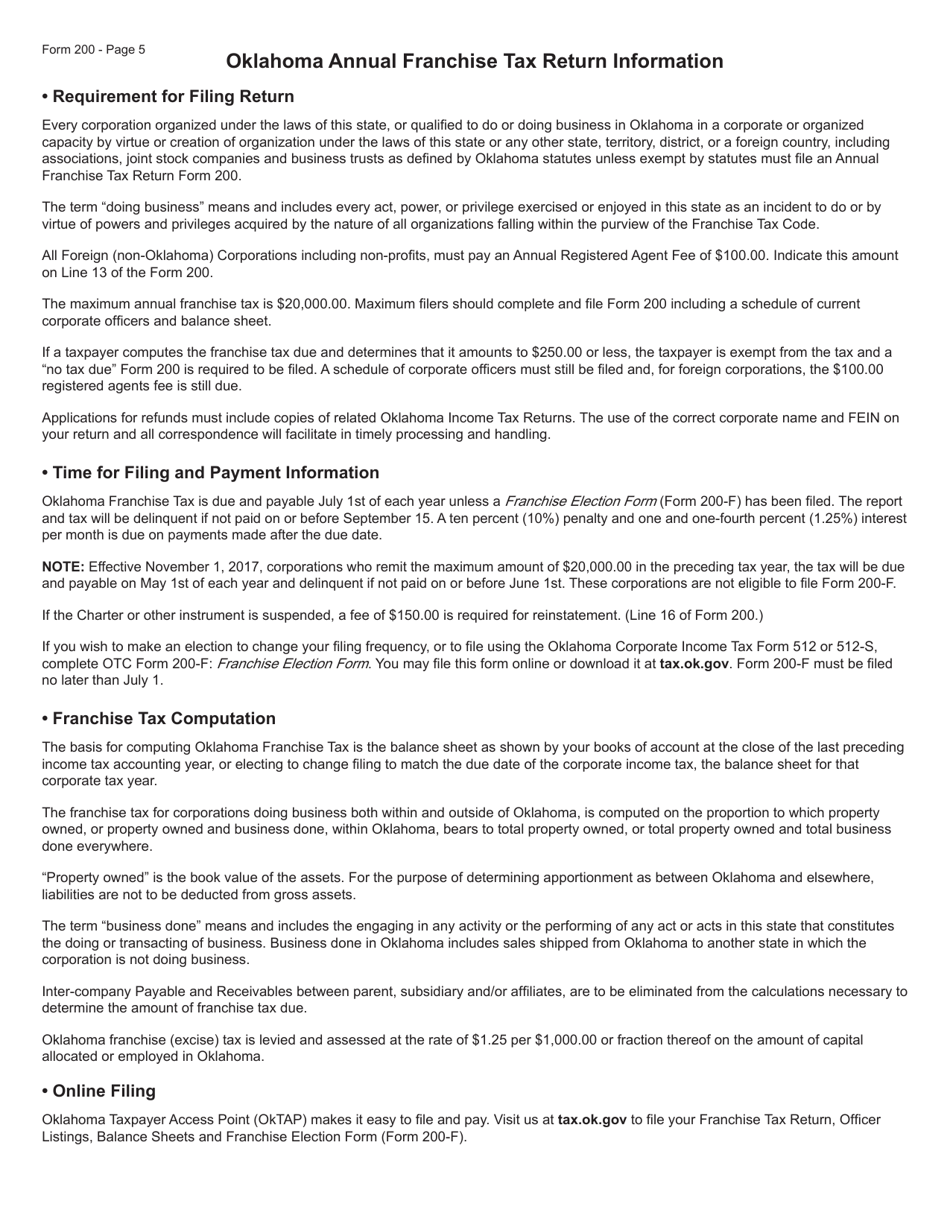

Q: Who is required to file Form 200?

A: All corporations, limited liability companies (LLCs), and partnerships doing business in Oklahoma are required to file Form 200.

Q: What is the purpose of Form 200?

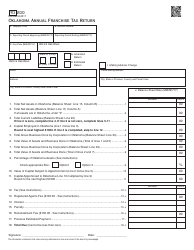

A: Form 200 is used to report and pay the annual franchise tax to the state of Oklahoma.

Q: When is Form 200 due?

A: Form 200 is due on or before the 15th day of the fourth month following the close of the tax year.

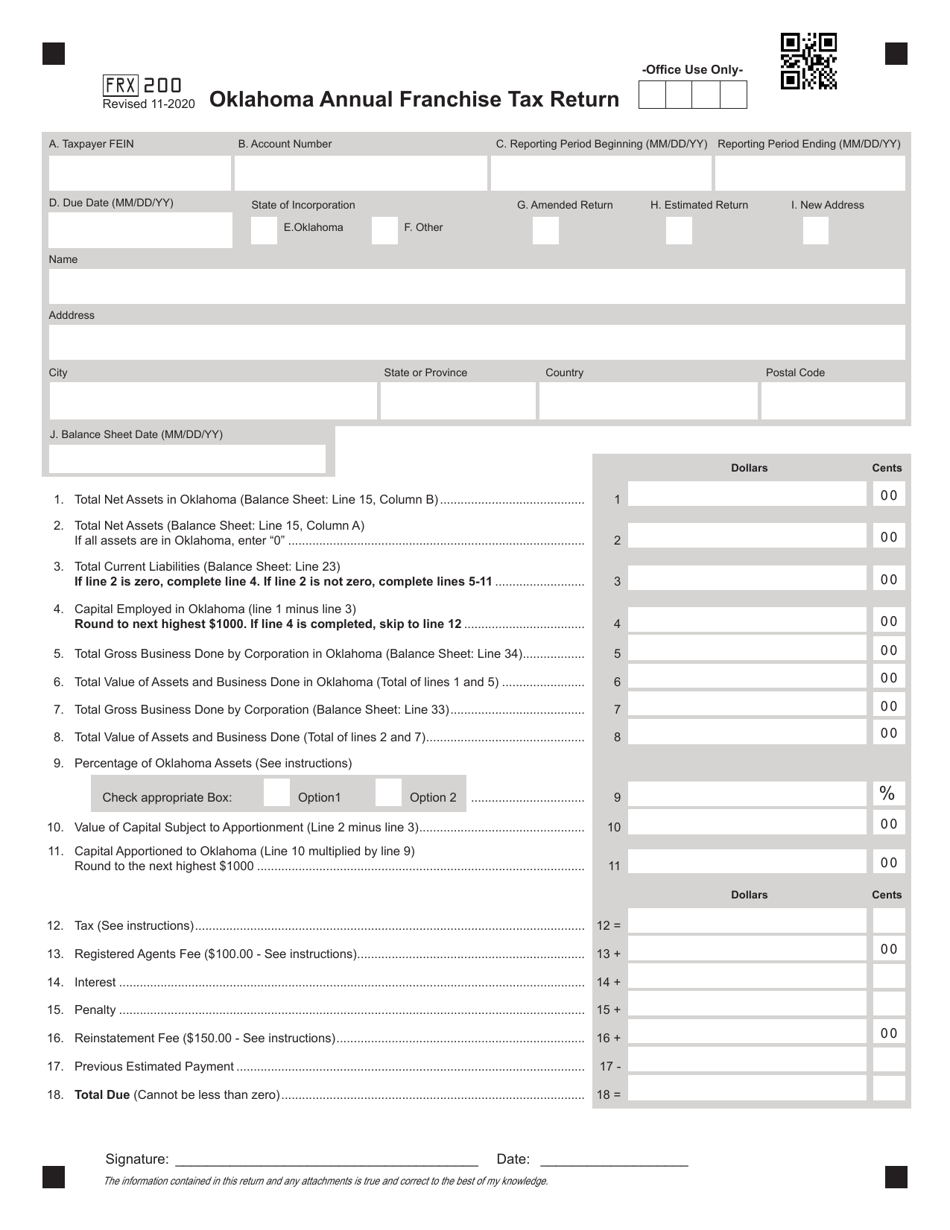

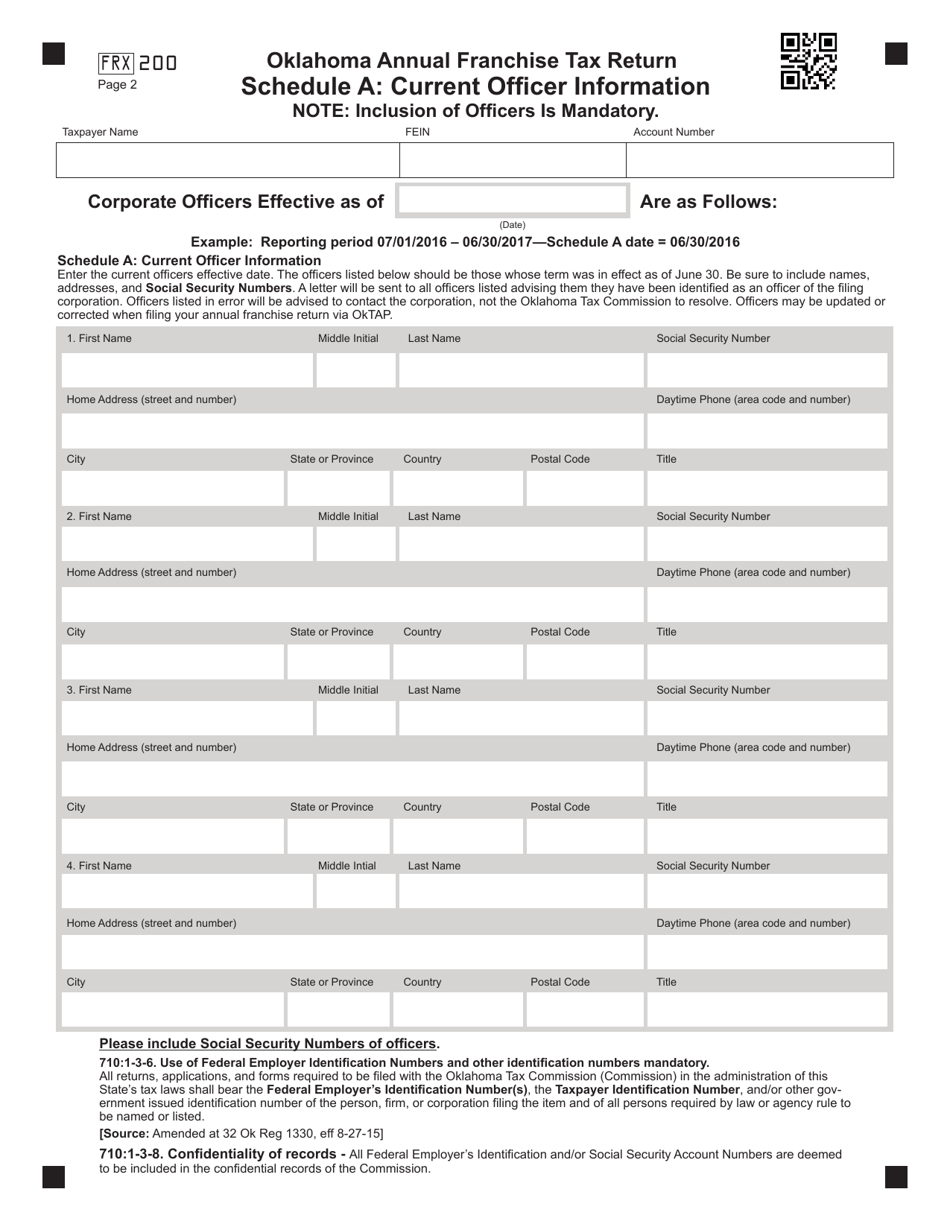

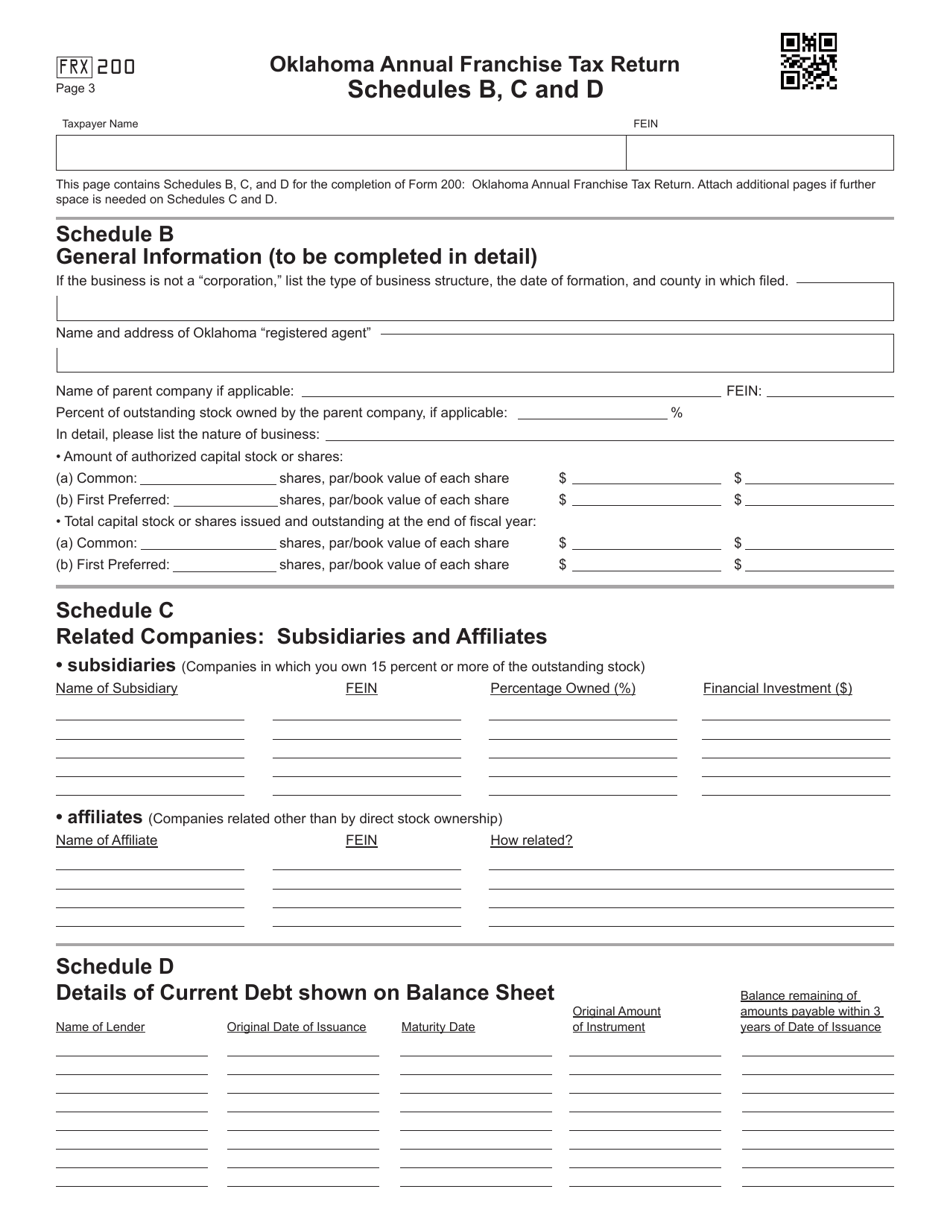

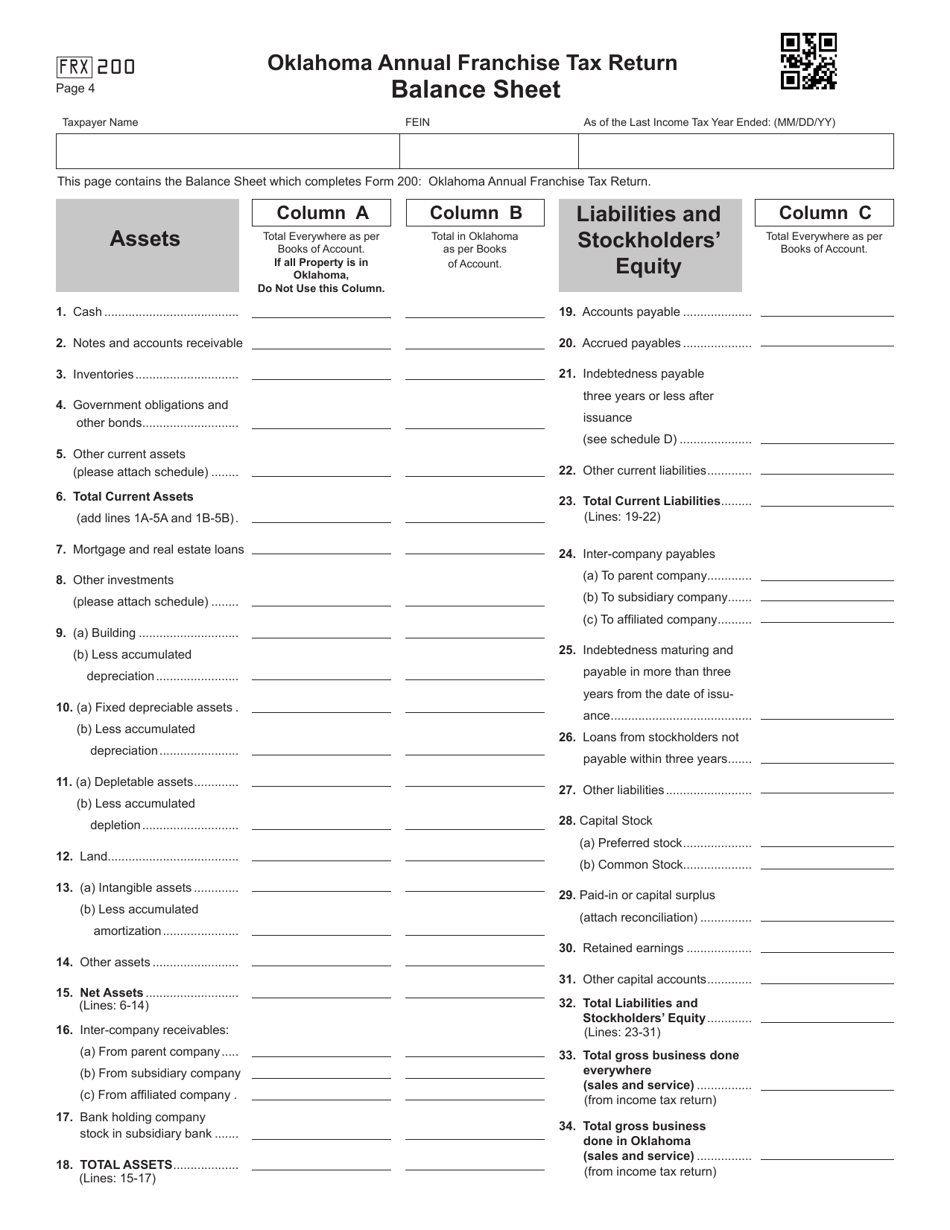

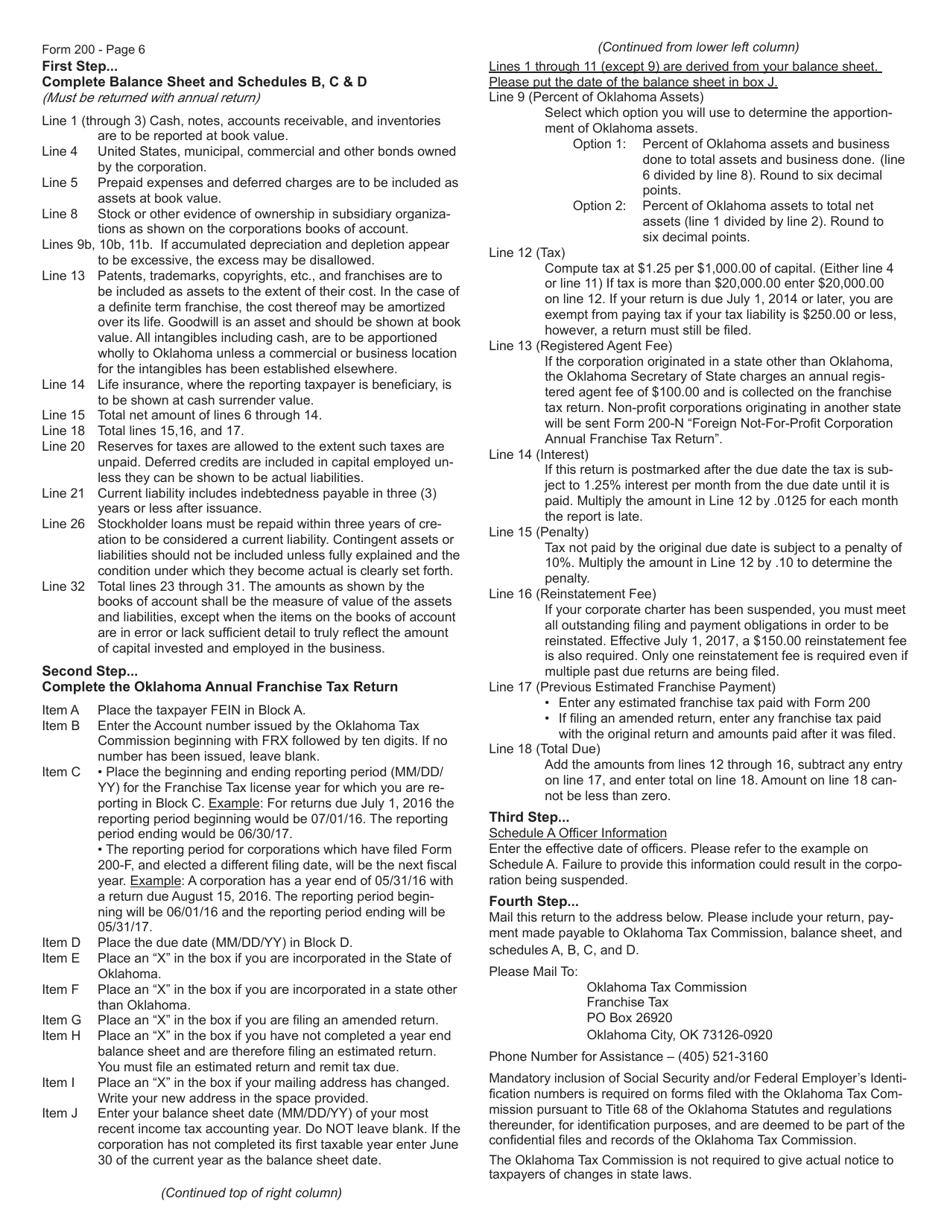

Q: What information is required on Form 200?

A: Form 200 requires information such as the corporation's or company's name, address, federal employer identification number, business activities, and financial data.

Q: What happens if I don't file Form 200?

A: Failure to file Form 200 or pay the franchise tax can result in penalties and interest being assessed by the Oklahoma Tax Commission.

Q: Are there any exemptions to filing Form 200?

A: Certain corporations, LLCs, and partnerships may be exempt from filing Form 200. It is best to consult with the Oklahoma Tax Commission or a tax professional to determine if you qualify for an exemption.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 200 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.