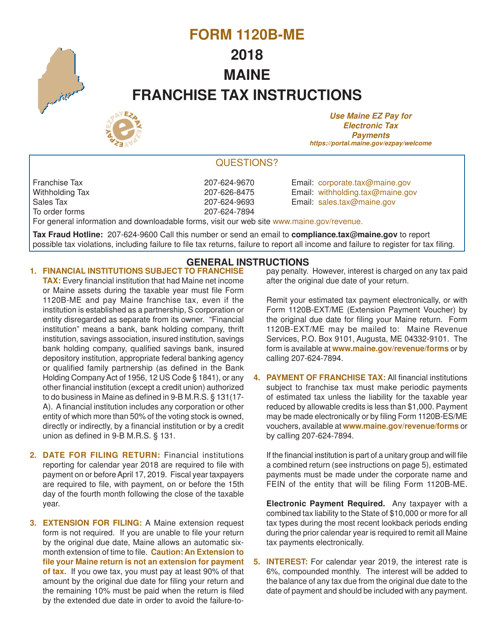

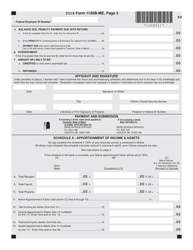

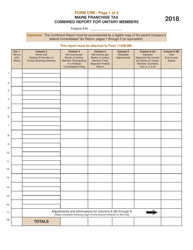

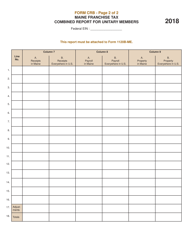

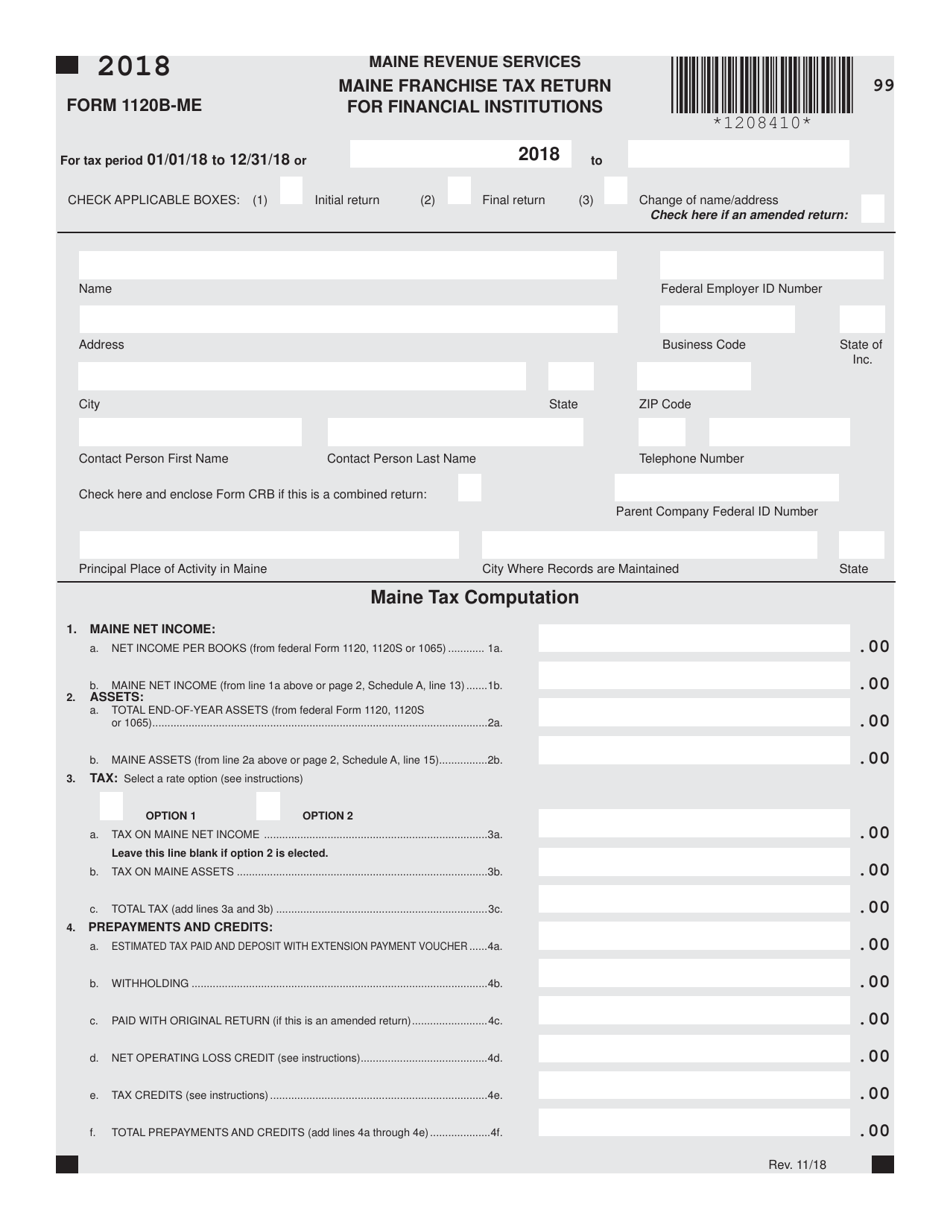

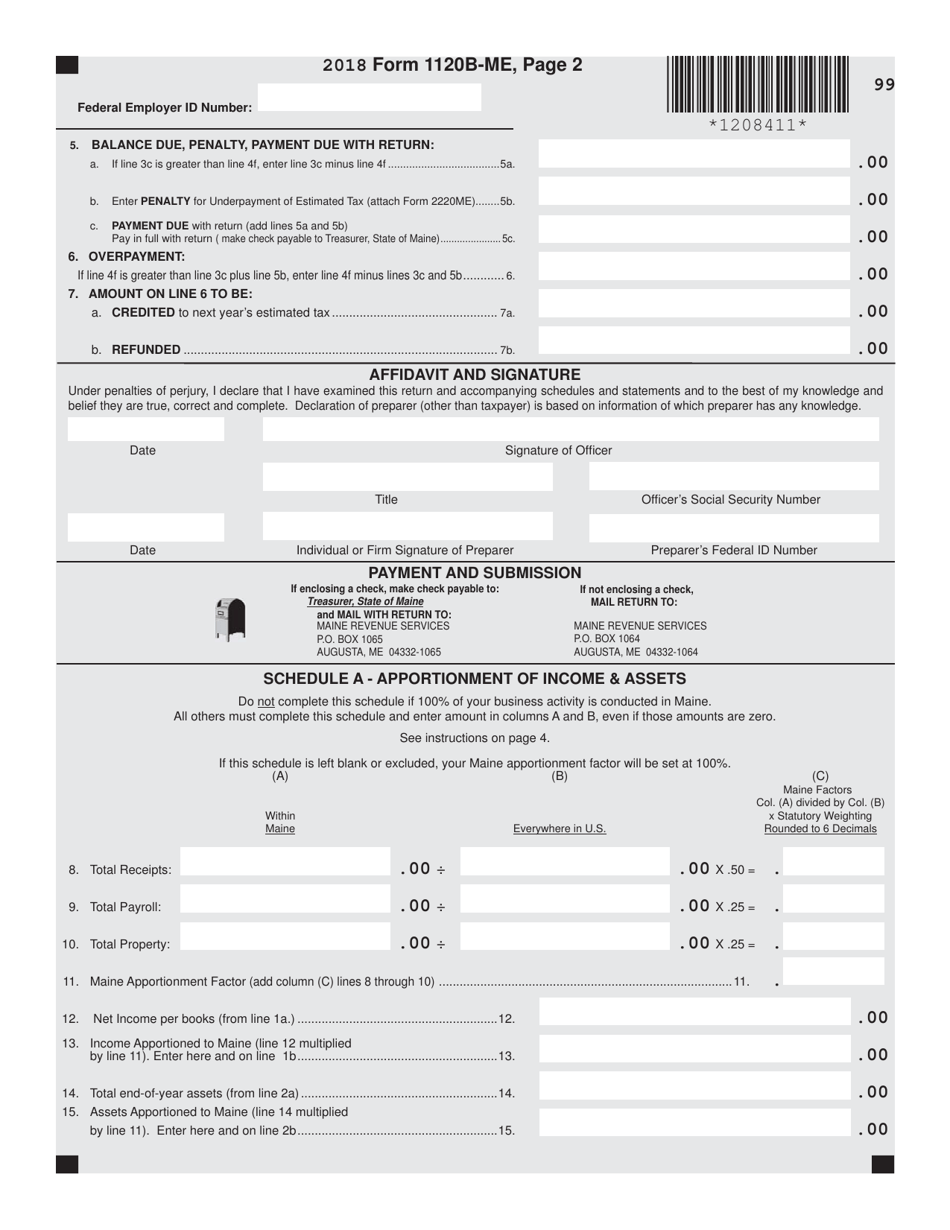

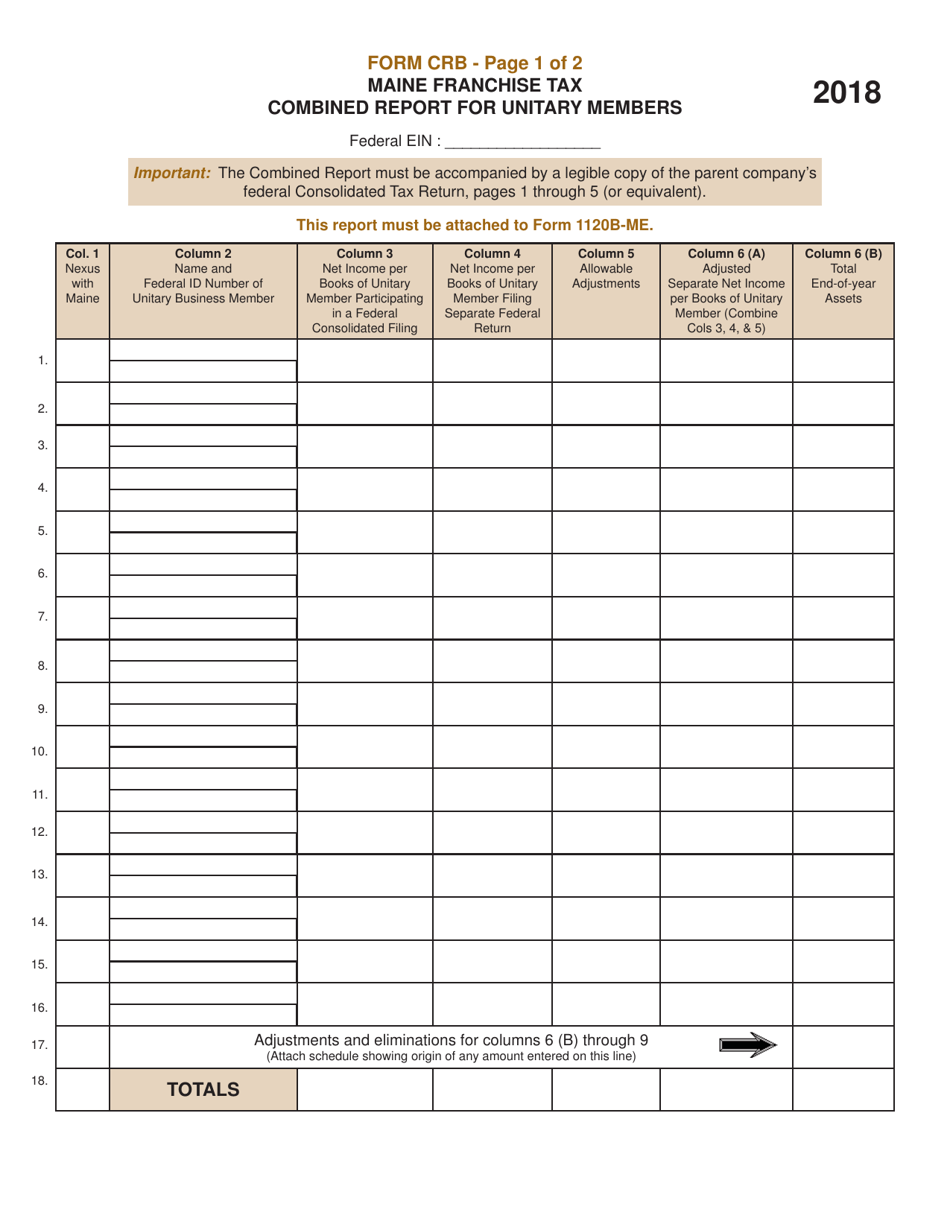

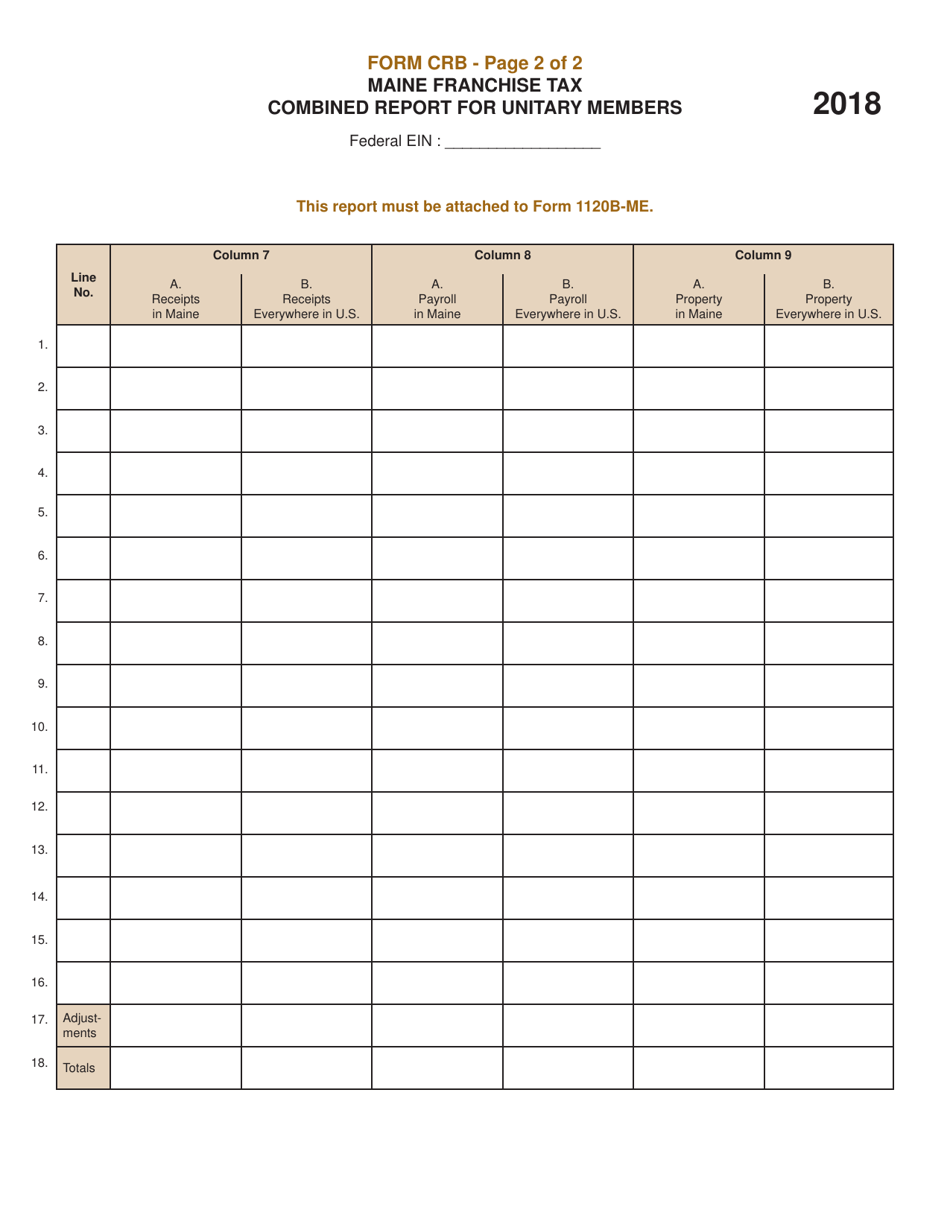

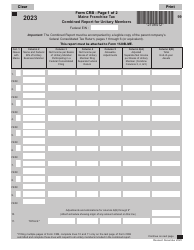

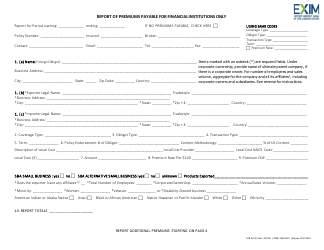

Form 1120B-ME Maine Franchise Tax Return for Financial Institutions - Maine

What Is Form 1120B-ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120B-ME?

A: Form 1120B-ME is the Maine Franchise Tax Return for Financial Institutions in Maine.

Q: Who needs to file Form 1120B-ME?

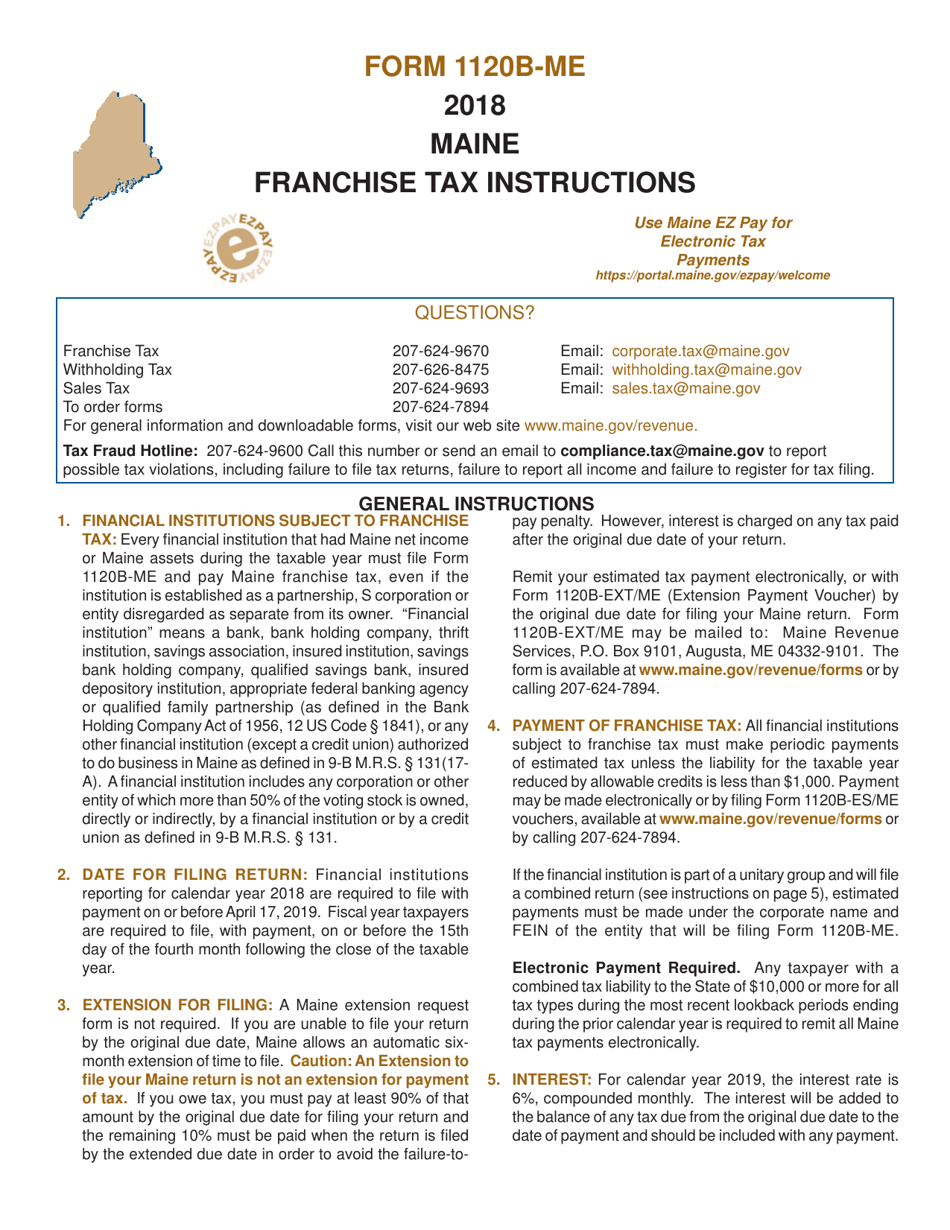

A: Financial institutions operating in Maine are required to file Form 1120B-ME.

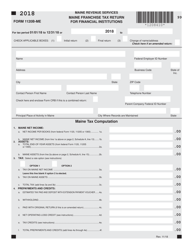

Q: What is the purpose of Form 1120B-ME?

A: The purpose of Form 1120B-ME is to calculate and report the franchise tax owed by financial institutions in Maine.

Q: When is the deadline to file Form 1120B-ME?

A: The filing deadline for Form 1120B-ME is typically on or before the 15th day of the fourth month following the close of the tax year.

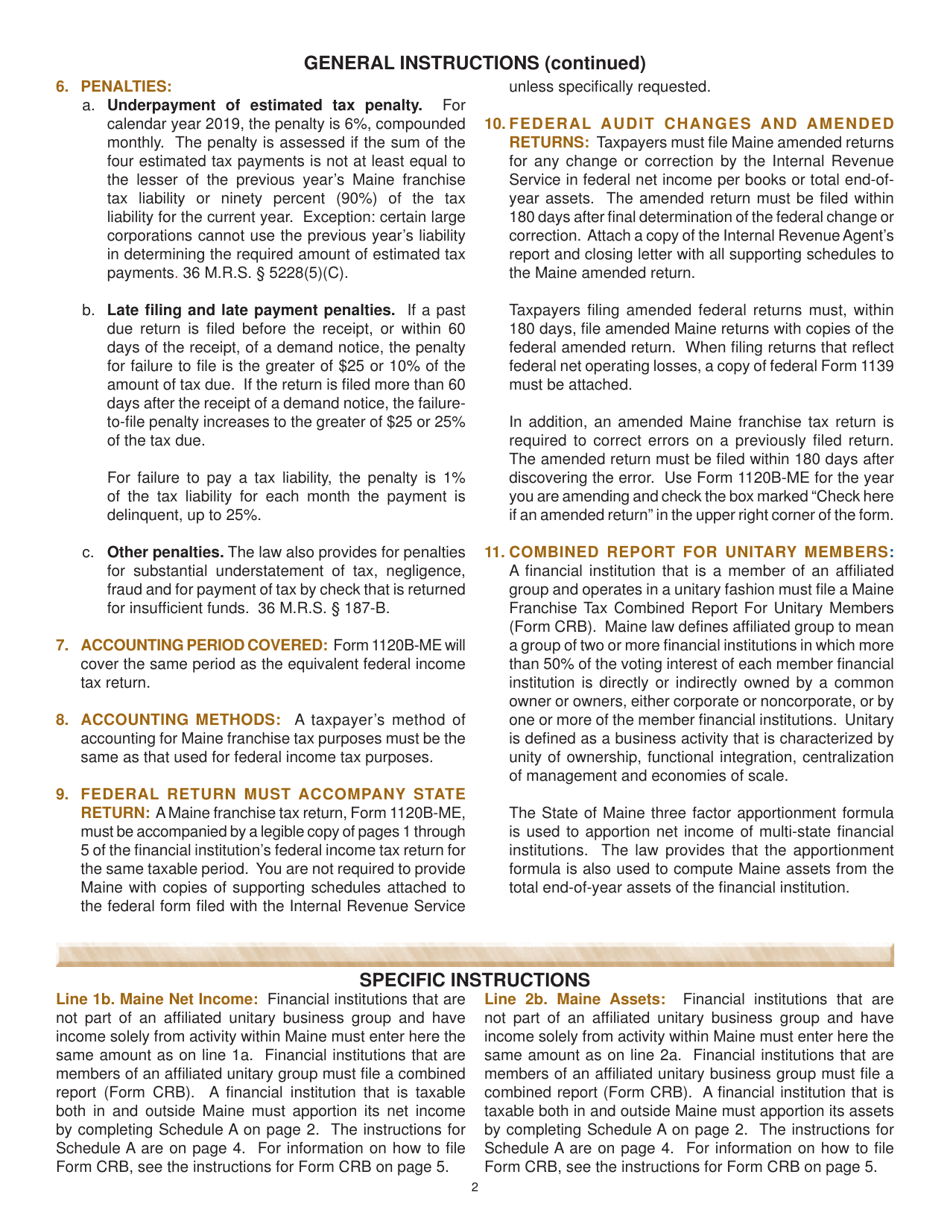

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing or failure to file Form 1120B-ME, so it is important to file the return on time.

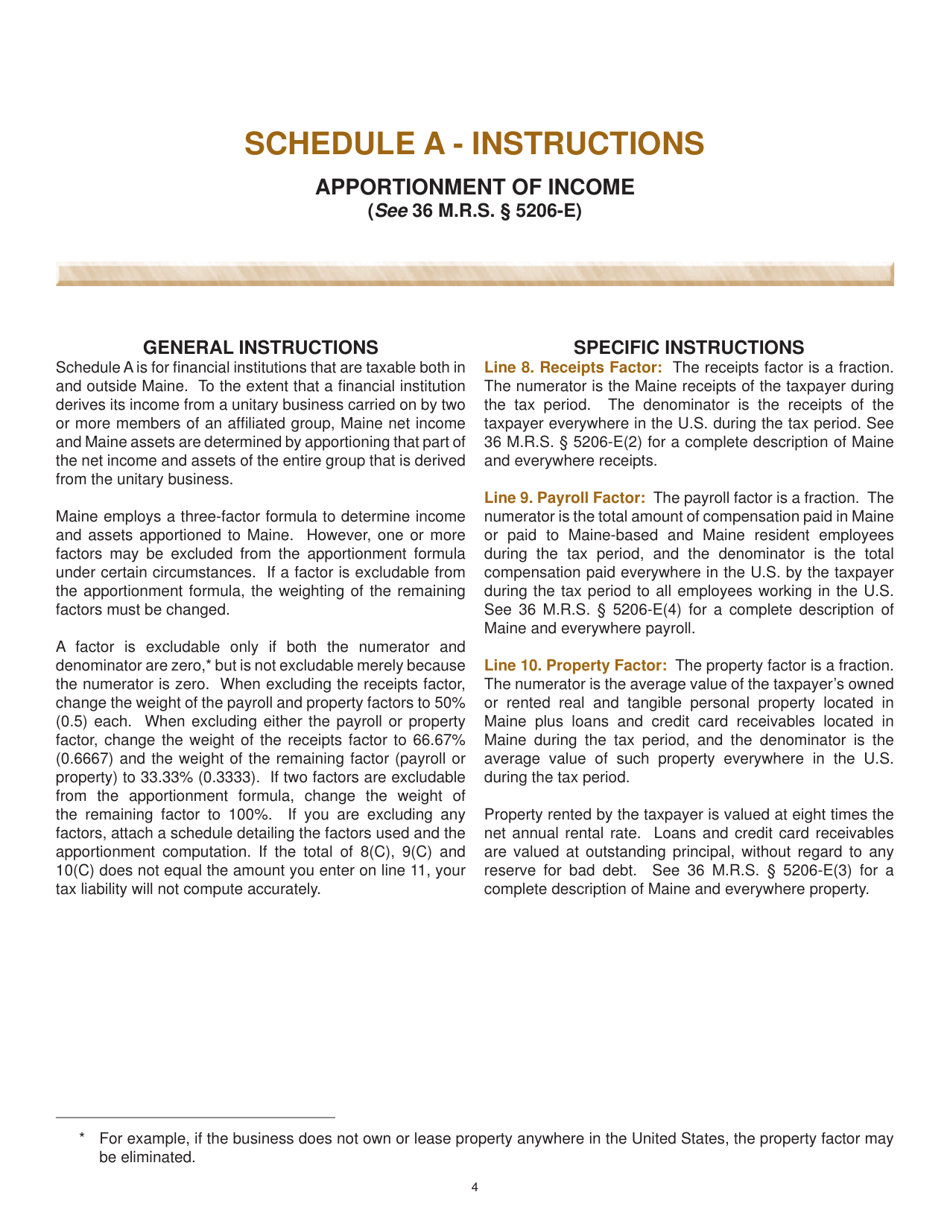

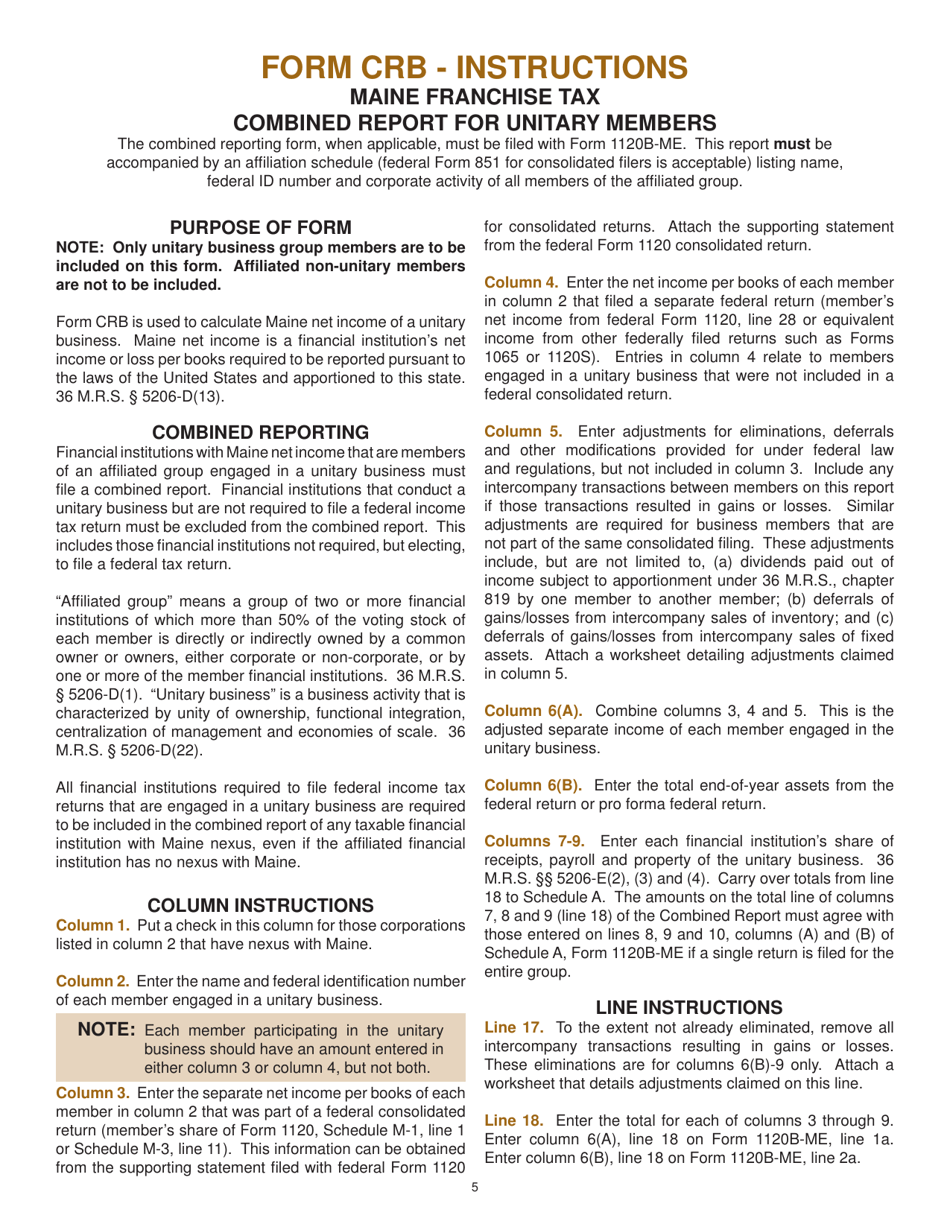

Q: Are there any special considerations for completing Form 1120B-ME?

A: Yes, financial institutions may have specific instructions or requirements for completing Form 1120B-ME, so it is important to review the instructions provided by the Maine Revenue Services.

Q: Can I e-file Form 1120B-ME?

A: Yes, the Maine Revenue Services allows for electronic filing of Form 1120B-ME.

Q: Is there a separate form for individual taxpayers in Maine?

A: No, Form 1120B-ME is specific to financial institutions and not for individual taxpayers.

Form Details:

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1120B-ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.