This version of the form is not currently in use and is provided for reference only. Download this version of

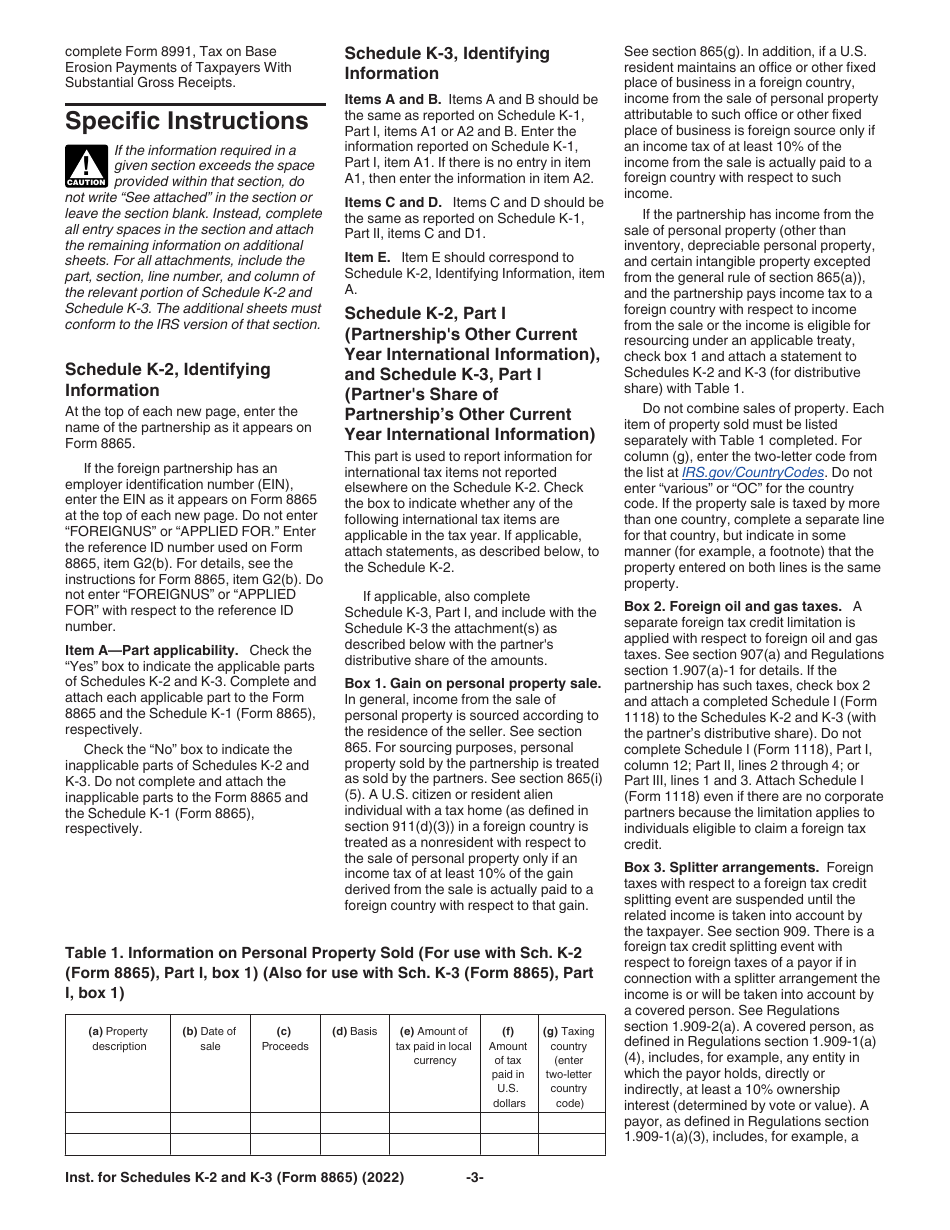

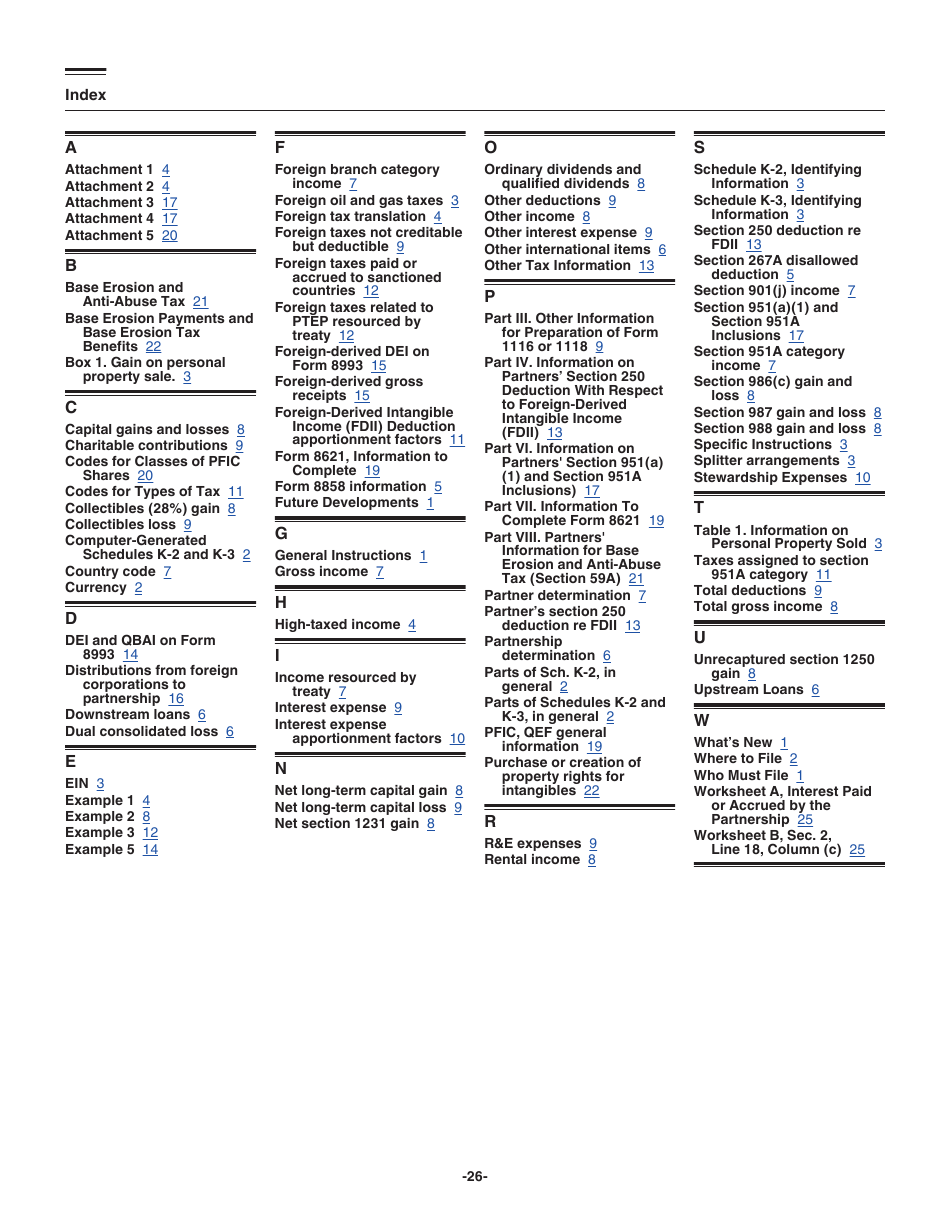

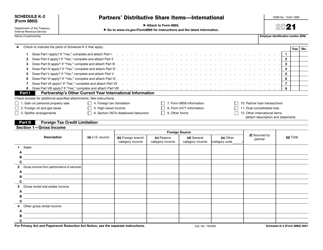

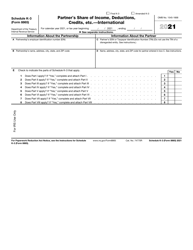

Instructions for IRS Form 8865 Schedule K-2, K-3

for the current year.

Instructions for IRS Form 8865 Schedule K-2, K-3

This document contains official instructions for IRS Form 8865 Schedule K-2 and Schedule K-3 . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8865 Schedule K-2?

A: IRS Form 8865 Schedule K-2 is used by a partnership to report a partner's distributive share of income, deductions, credits, etc.

Q: What is IRS Form 8865 Schedule K-3?

A: IRS Form 8865 Schedule K-3 is used by a partnership to report a partner's share of certain items that are required to be reported separately by partners.

Q: Who needs to file IRS Form 8865 Schedule K-2?

A: Partnerships that have foreign partners need to file IRS Form 8865 Schedule K-2.

Q: Who needs to file IRS Form 8865 Schedule K-3?

A: Partnerships that have foreign partners and have certain items that are required to be reported separately by partners need to file IRS Form 8865 Schedule K-3.

Q: What kind of information does IRS Form 8865 Schedule K-2 require?

A: IRS Form 8865 Schedule K-2 requires information about a partner's distributive share of income, deductions, credits, etc.

Q: What kind of information does IRS Form 8865 Schedule K-3 require?

A: IRS Form 8865 Schedule K-3 requires information about a partner's share of certain items that are required to be reported separately by partners.

Q: When is the deadline to file IRS Form 8865 Schedule K-2?

A: The deadline to file IRS Form 8865 Schedule K-2 is the same as the deadline to file the partnership's tax return.

Q: When is the deadline to file IRS Form 8865 Schedule K-3?

A: The deadline to file IRS Form 8865 Schedule K-3 is the same as the deadline to file the partnership's tax return.

Instruction Details:

- This 26-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.