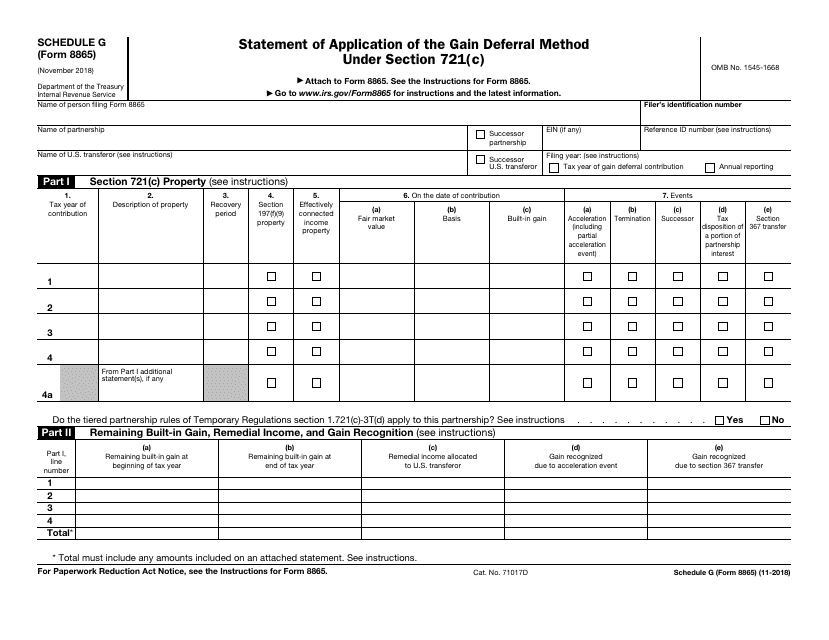

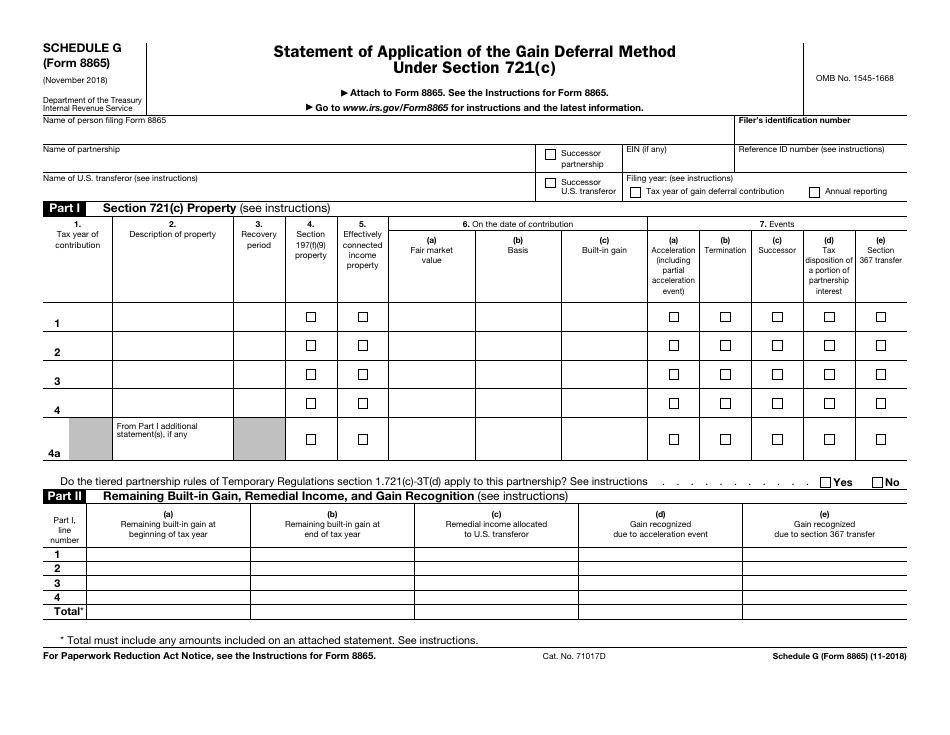

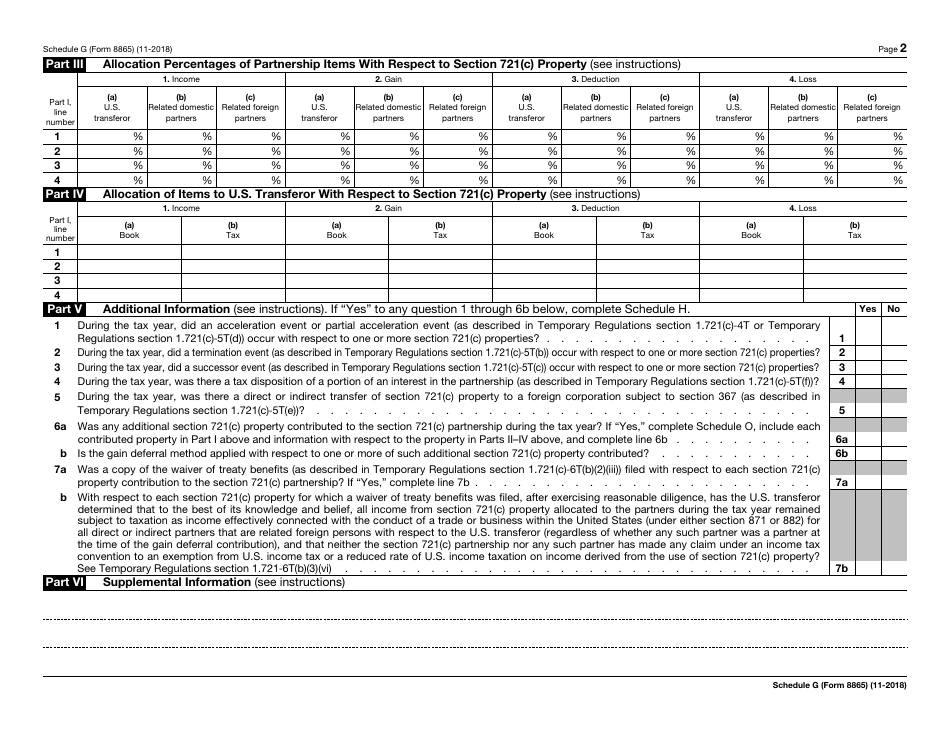

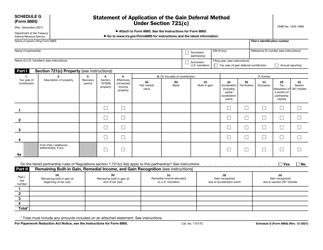

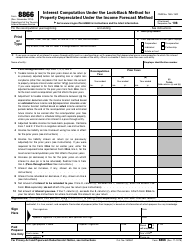

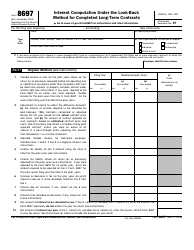

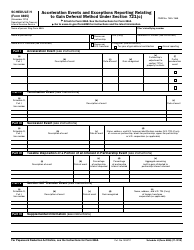

IRS Form 8865 Schedule G Statement of Application of the Gain Deferral Method Under Section 721(C)

What Is IRS Form 8865 Schedule G?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2018. The document is a supplement to IRS Form 8865, Statement of Application of the Gain Deferral Method Under Section 721(C). As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8865 Schedule G?

A: IRS Form 8865 Schedule G is a statement used to report the application of the gain deferral method under Section 721(c) of the Internal Revenue Code.

Q: When is the Form 8865 Schedule G used?

A: The Form 8865 Schedule G is used when a partnership wants to report the application of the gain deferral method under Section 721(c) for certain transfers of property to a foreign partnership.

Q: What is the gain deferral method under Section 721(c)?

A: The gain deferral method under Section 721(c) allows a partnership to defer recognition of gain on certain transfers of property to a foreign partnership.

Q: Who is required to file Form 8865 Schedule G?

A: Partnerships that want to report the application of the gain deferral method under Section 721(c) for certain transfers of property to a foreign partnership are required to file Form 8865 Schedule G.

Form Details:

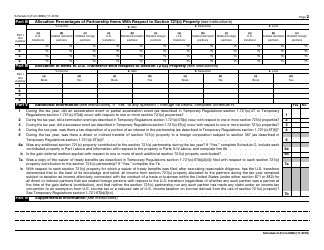

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8865 Schedule G through the link below or browse more documents in our library of IRS Forms.