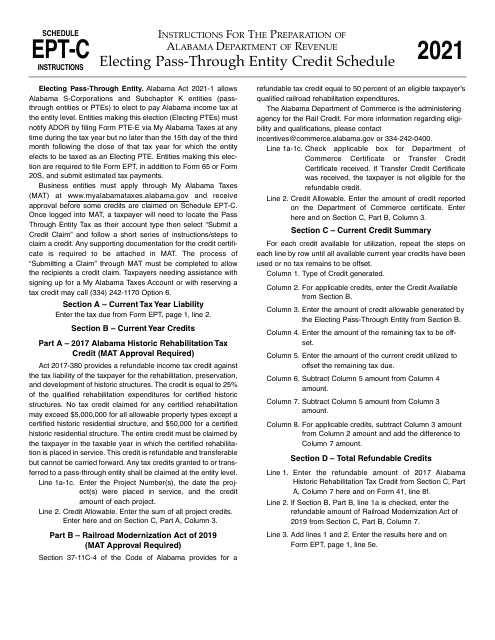

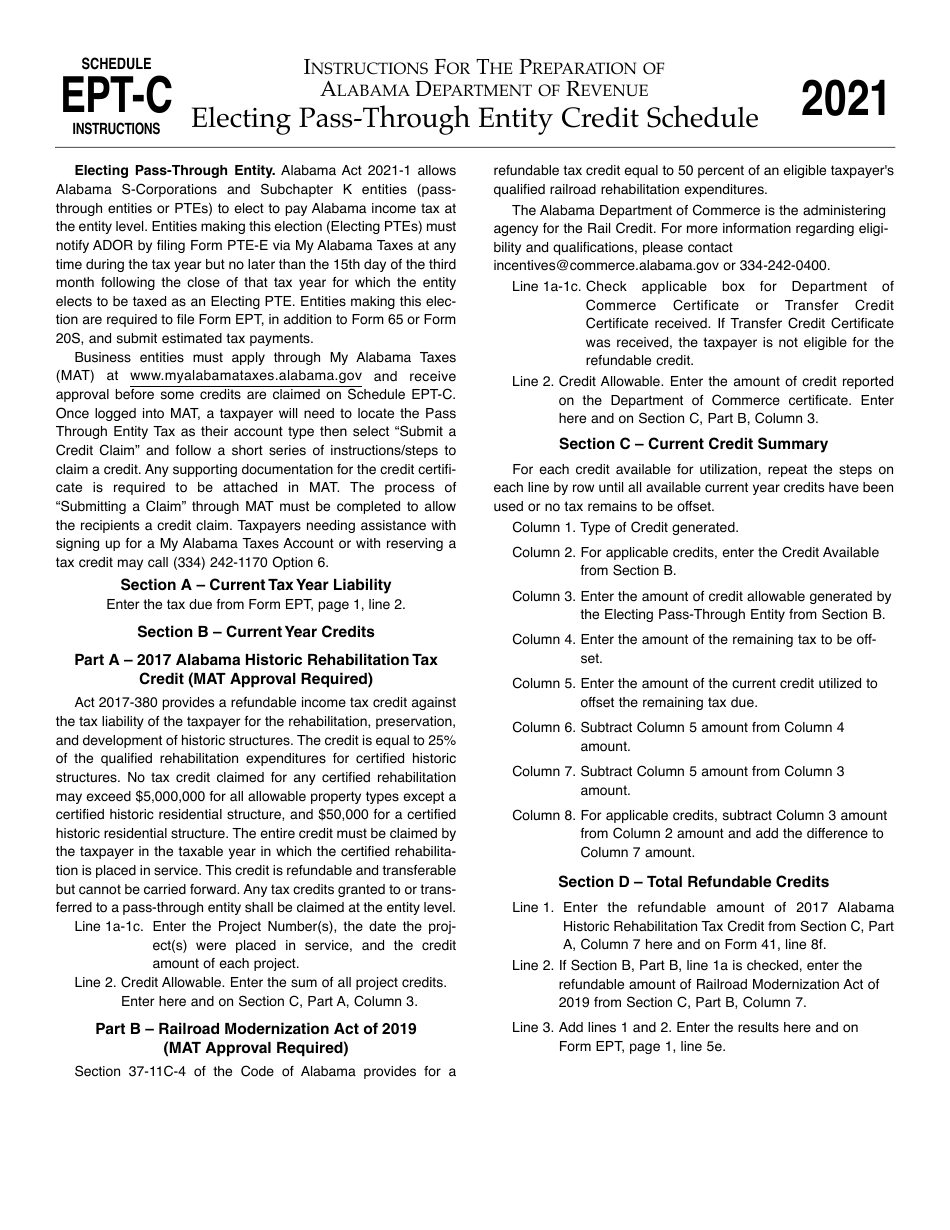

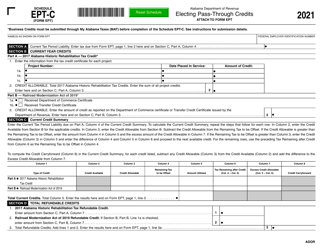

Instructions for Schedule EPT-C Electing Pass-Through Entity Credits - Alabama

This document contains official instructions for Schedule EPT-C , Electing Pass-Through Entity Credits - a form released and collected by the Alabama Department of Revenue.

FAQ

Q: What is Schedule EPT-C?

A: Schedule EPT-C is a form used to elect pass-through entity credits in Alabama.

Q: What are pass-through entity credits?

A: Pass-through entity credits are tax credits that are available to businesses that operate as pass-through entities, such as partnerships and S corporations.

Q: Why would a business elect pass-through entity credits?

A: A business would elect pass-through entity credits to take advantage of certain tax credits offered by the state of Alabama.

Q: What is the purpose of Schedule EPT-C?

A: The purpose of Schedule EPT-C is to provide a way for businesses to elect pass-through entity credits and calculate the amount of credits they are eligible for.

Q: Who needs to complete Schedule EPT-C?

A: Businesses that operate as pass-through entities in Alabama and want to elect pass-through entity credits need to complete Schedule EPT-C.

Q: Are there any specific requirements for electing pass-through entity credits?

A: Yes, businesses must meet certain requirements set by the state of Alabama in order to be eligible to elect pass-through entity credits.

Q: Is there any fee associated with filing Schedule EPT-C?

A: There is no fee associated with filing Schedule EPT-C.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.