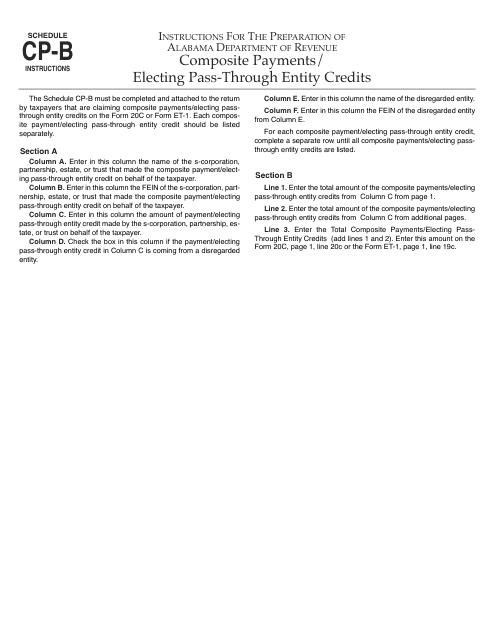

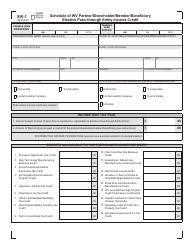

Instructions for Schedule CP-B Composite Payments / Electing Pass-Through Entity Credits - Alabama

This document contains official instructions for Schedule CP-B , Composite Payments/Electing Pass-Through Entity Credits - a form released and collected by the Alabama Department of Revenue.

FAQ

Q: What is Schedule CP-B?

A: Schedule CP-B is a form used in Alabama for reporting composite payments and electing pass-through entity credits.

Q: What are composite payments?

A: Composite payments are payments made by pass-through entities on behalf of their nonresident individual members to fulfill their state income tax obligations.

Q: What are pass-through entity credits?

A: Pass-through entity credits are credits that can be claimed by the pass-through entity on behalf of its owners or members.

Q: Who needs to file Schedule CP-B?

A: Pass-through entities that have made composite payments or have elected to claim pass-through entity credits on behalf of their owners or members in Alabama.

Q: How do I complete Schedule CP-B?

A: You will need to provide information about the pass-through entity, the nonresident individual members, and the composite payments or pass-through entity credits.

Q: When is the deadline to file Schedule CP-B?

A: The deadline to file Schedule CP-B in Alabama is the same as the deadline for filing the pass-through entity return, which is generally due on or before the 15th day of the fourth month following the close of the tax year.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.