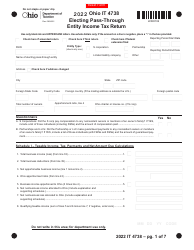

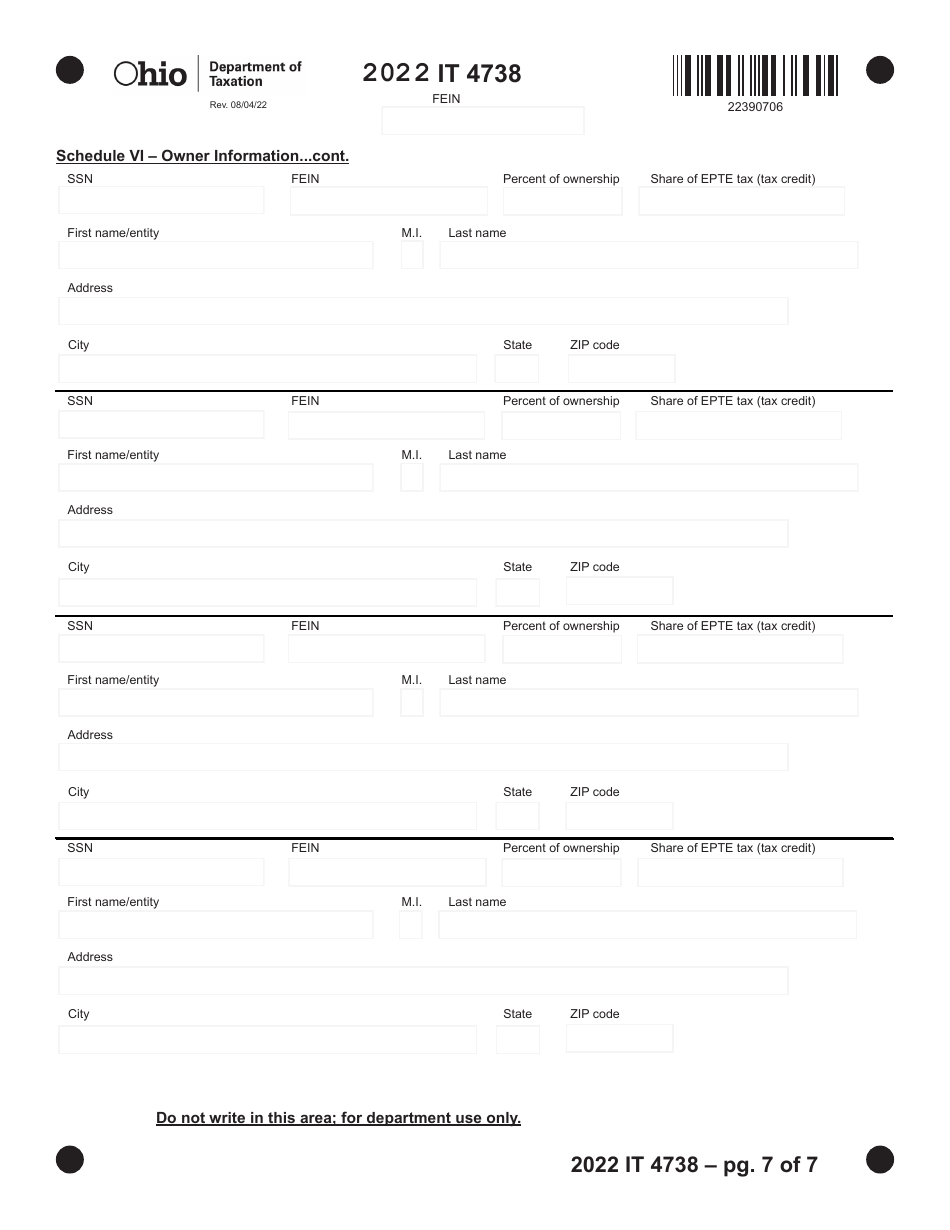

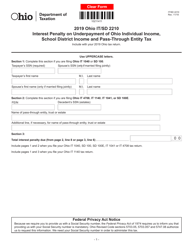

Form IT4738 Electing Pass-Through Entity Income Tax Return - Ohio

What Is Form IT4738?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT4738?

A: Form IT4738 is the Electing Pass-Through Entity Income Tax Return in Ohio.

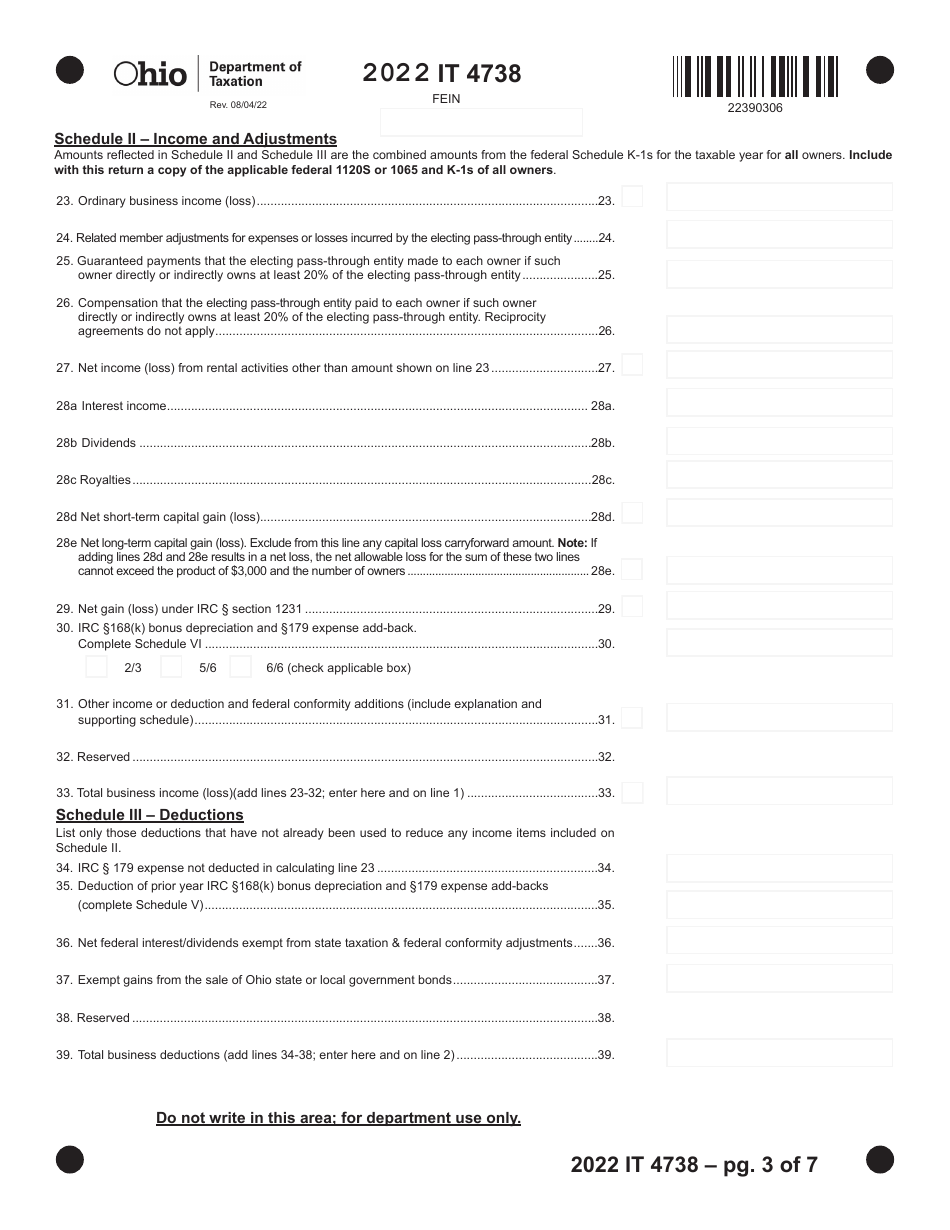

Q: Who needs to file Form IT4738?

A: Pass-through entities in Ohio who want to elect to be taxed at the entity level instead of the individual level need to file Form IT4738.

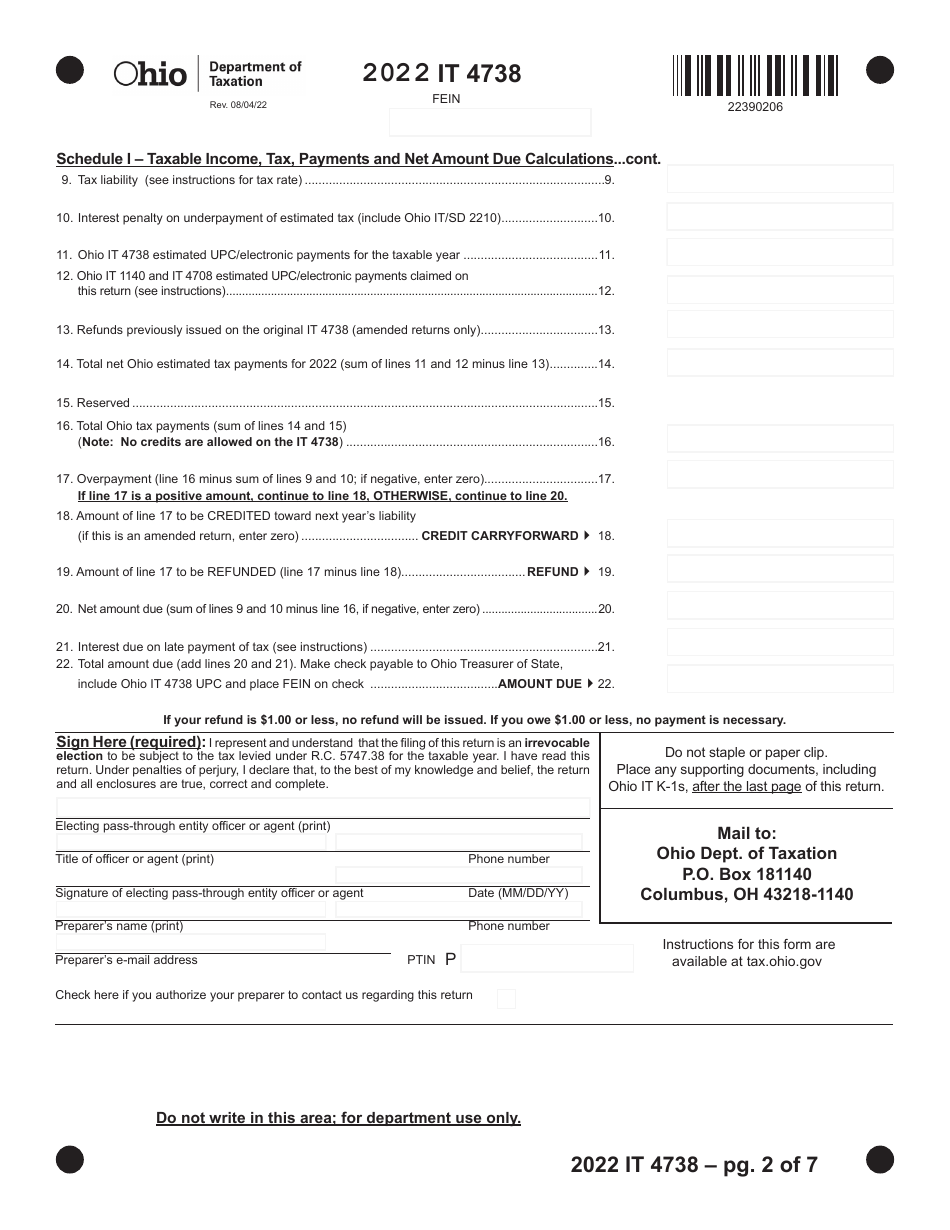

Q: What is a pass-through entity?

A: A pass-through entity is a business entity, such as a partnership or an S corporation, where the income or losses are passed through to the owners or shareholders for tax purposes.

Q: Why would a pass-through entity elect to be taxed at the entity level?

A: Pass-through entities may elect to be taxed at the entity level to take advantage of tax benefits or to simplify the individual tax reporting for the owners or shareholders.

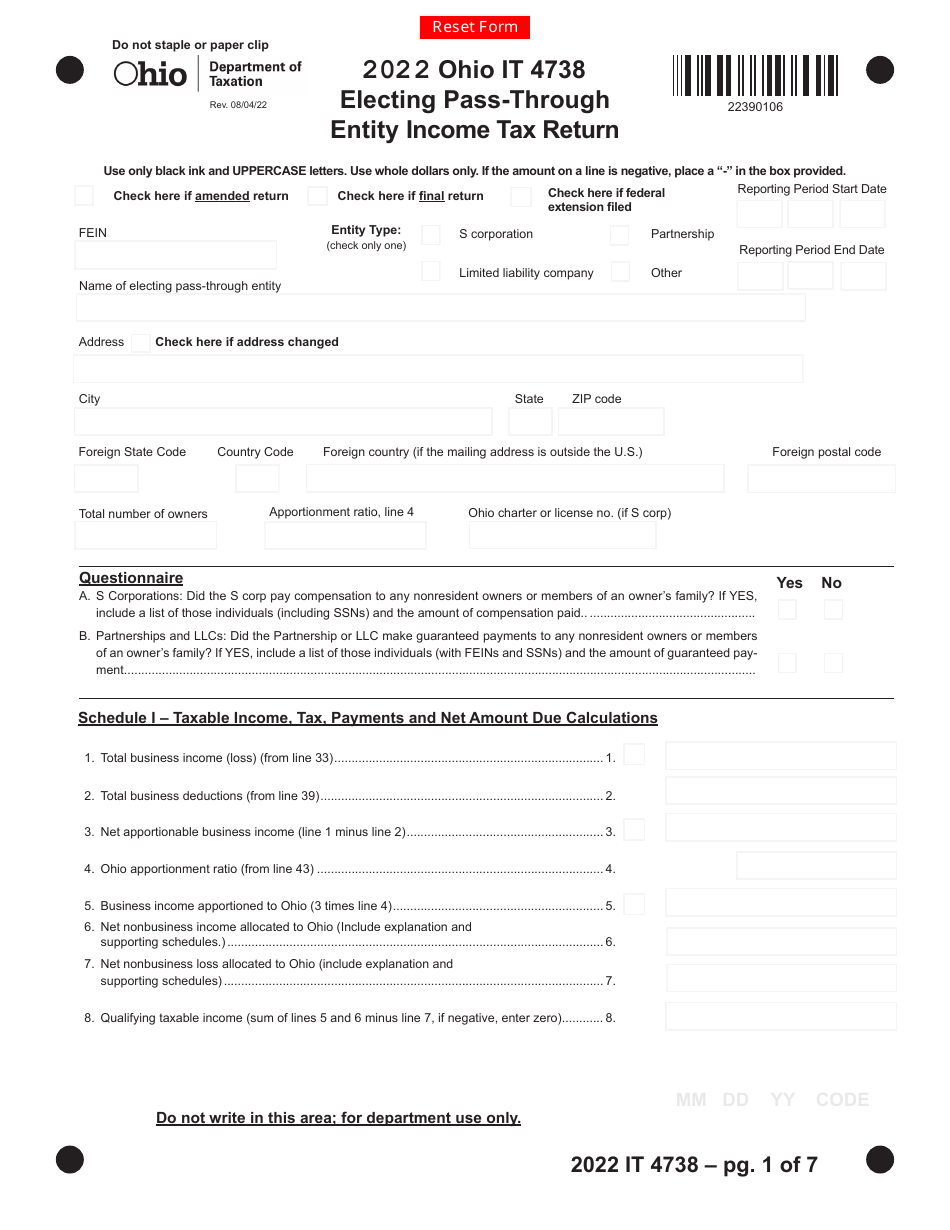

Q: When is the deadline to file Form IT4738?

A: The deadline to file Form IT4738 in Ohio is the 15th day of the fourth month after the close of the taxable year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing. It is important to file Form IT4738 on time to avoid penalties and interest.

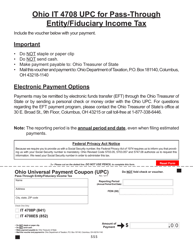

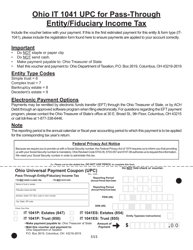

Q: Can Form IT4738 be filed electronically?

A: Yes, Form IT4738 can be filed electronically through the Ohio Business Gateway or other approved electronic filing methods.

Q: Do I need to attach any other forms or documents with Form IT4738?

A: Depending on your specific situation, you may need to attach additional forms or documents, such as Schedules K-1, to Form IT4738.

Form Details:

- Released on August 4, 2022;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT4738 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.