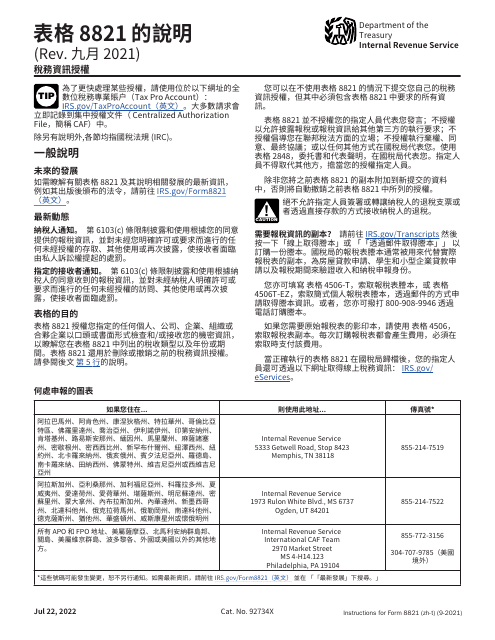

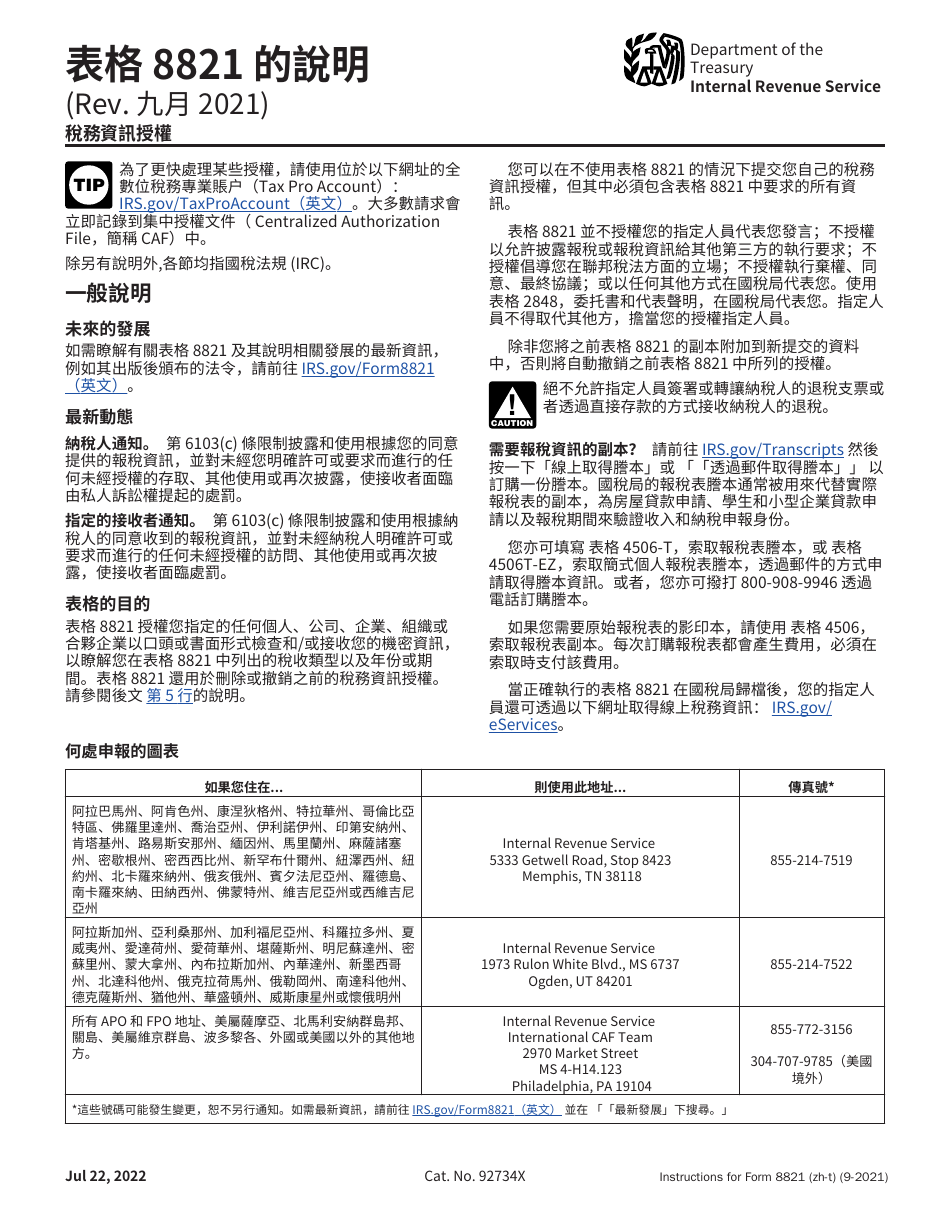

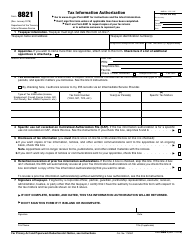

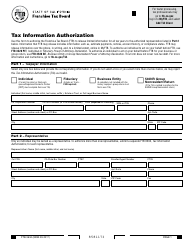

Instructions for IRS Form 8821 Tax Information Authorization (Chinese)

IRS Form 8821 Tax Information Authorization (Chinese) provides instructions for individuals who prefer to authorize someone else to access their tax information, written in Chinese language.

The instructions for IRS Form 8821 Tax Information Authorization (Chinese) would typically be filed by the taxpayer or their authorized representative.

FAQ

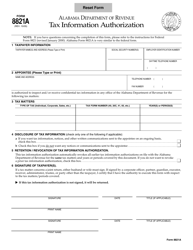

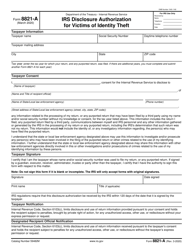

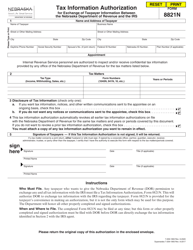

Q: What is IRS Form 8821?

A: IRS Form 8821 is a Tax Information Authorization form used to authorize a representative to receive and inspect your tax information.

Q: Who can use IRS Form 8821?

A: Any individual or business that wants to authorize another person to access their tax information can use IRS Form 8821.

Q: What information can be authorized to be shared using Form 8821?

A: IRS Form 8821 allows you to authorize the sharing of various tax information such as tax returns, transcripts, and account information.

Q: Do I need to submit any supporting documents with Form 8821?

A: No, you do not need to submit any supporting documents with Form 8821. However, you must sign and date the form.

Q: How long is the authorization valid for?

A: The authorization provided by IRS Form 8821 is generally valid for one year from the date signed, unless a shorter period is specified.

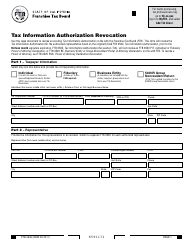

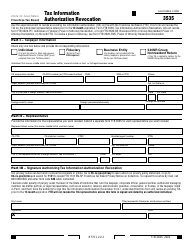

Q: Can I revoke the authorization provided by Form 8821?

A: Yes, you can revoke the authorization at any time by submitting a written statement to the IRS.

Q: Is there a fee for submitting Form 8821?

A: No, there is no fee for submitting IRS Form 8821.