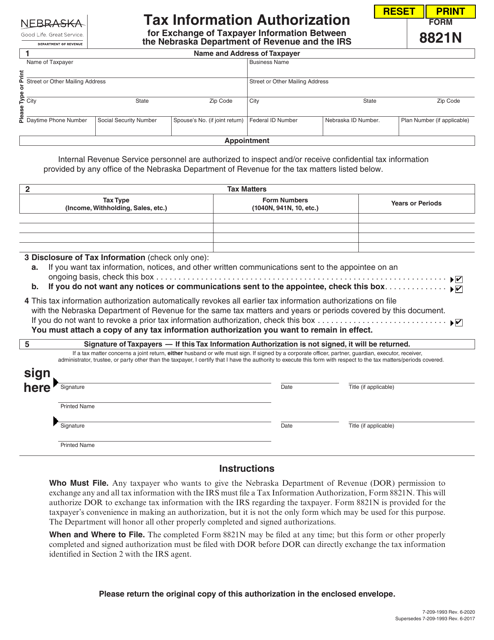

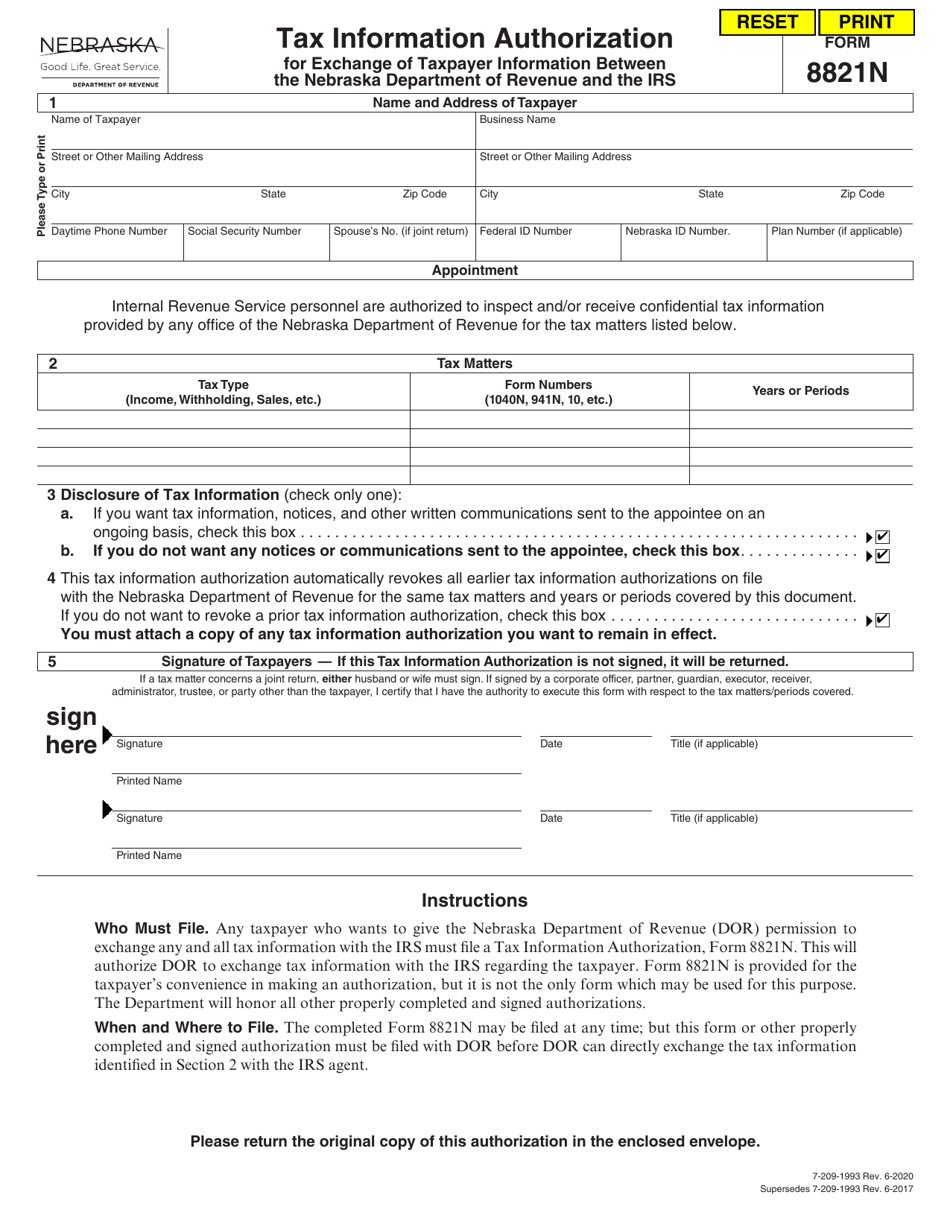

Form 8821N Tax Information Authorization for Exchange of Taxpayer Information Between the Nebraska Department of Revenue and the Irs - Nebraska

What Is Form 8821N?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 8821N?

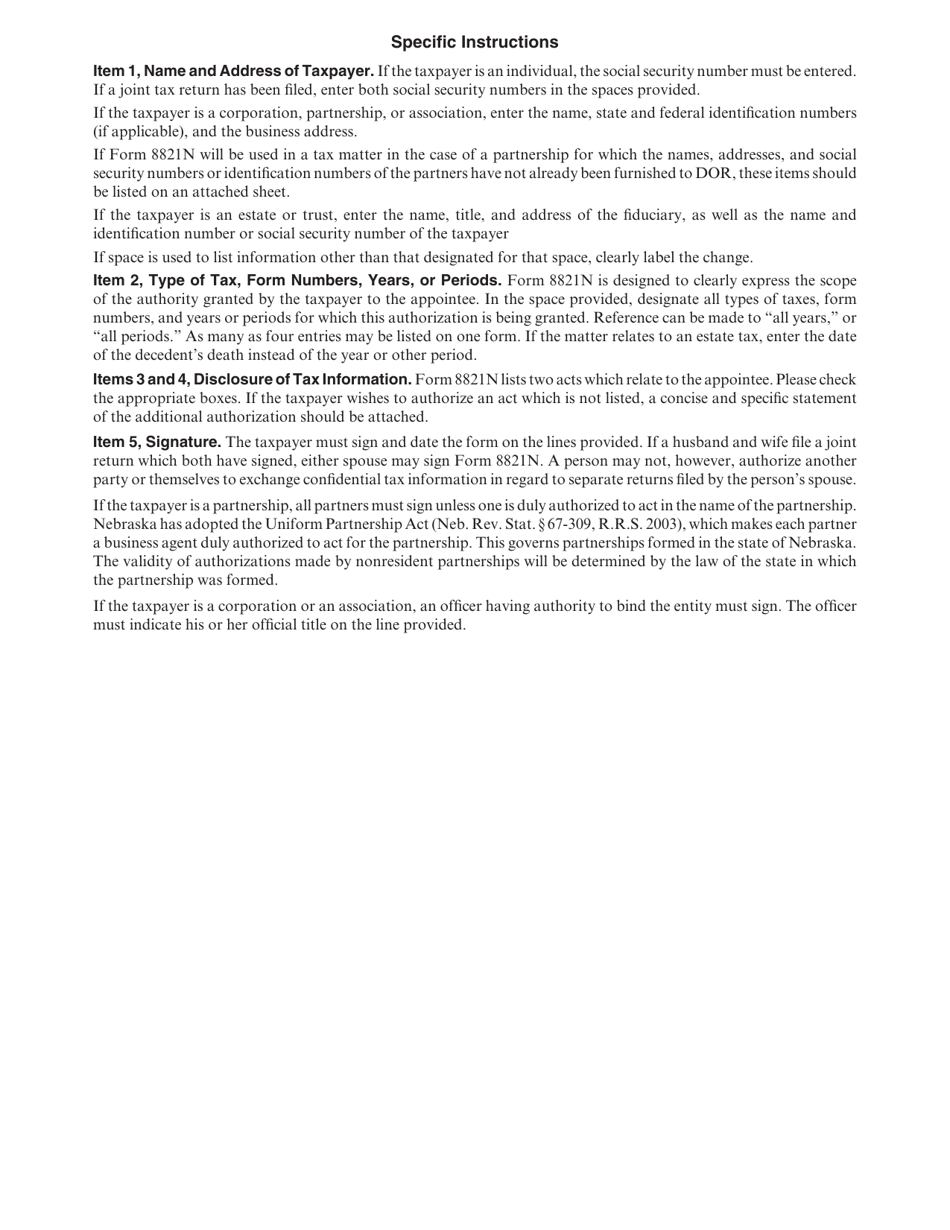

A: Form 8821N is a Tax Information Authorization for the exchange of taxpayer information between the Nebraska Department of Revenue and the IRS.

Q: Why would I need to fill out Form 8821N?

A: You would need to fill out Form 8821N if you want to authorize the Nebraska Department of Revenue to exchange your tax information with the IRS.

Q: Is Form 8821N specific to Nebraska residents?

A: Yes, Form 8821N is specific to residents of Nebraska.

Q: What information will be exchanged between the Nebraska Department of Revenue and the IRS?

A: The information that will be exchanged includes tax return information, tax account information, and other tax-related information.

Q: How long is the authorization valid?

A: The authorization on Form 8821N is valid for one year from the date signed, unless you specify a shorter period.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 8821N by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.