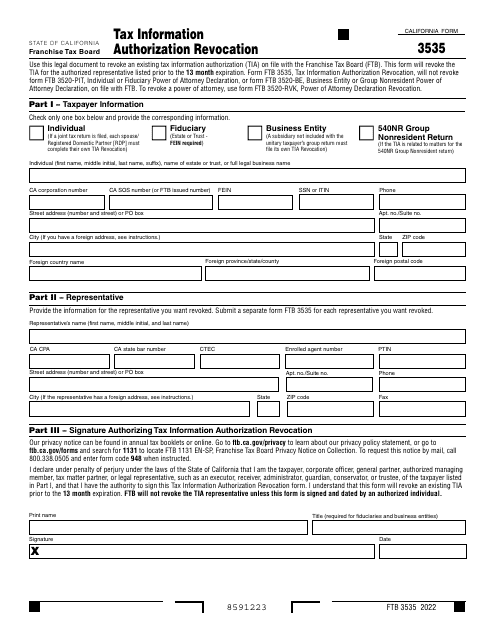

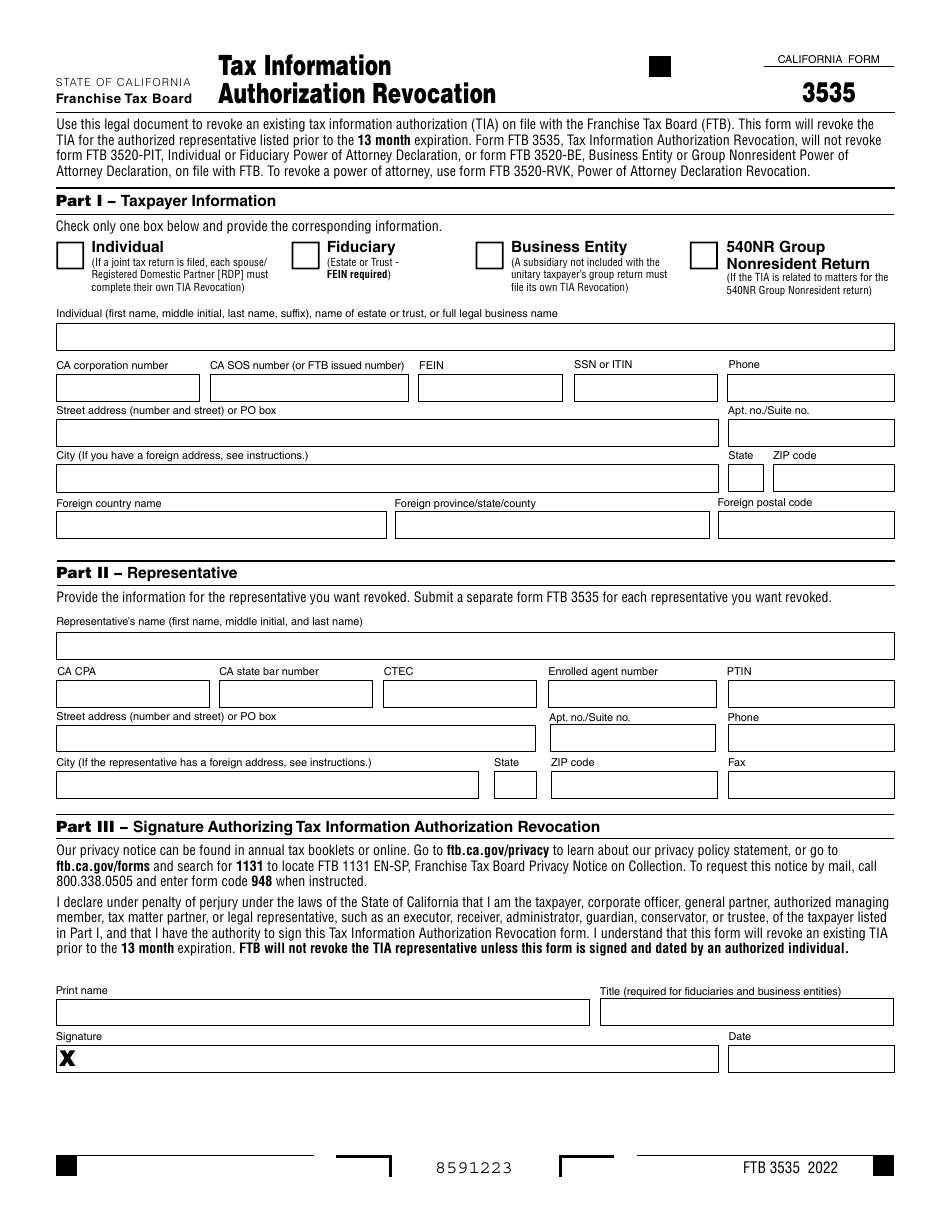

Form 3535 Tax Information Authorization Revocation - California

What Is Form 3535?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3535 for?

A: Form 3535 is used to revoke a previously filed Tax Information Authorization in California.

Q: Why would I need to revoke a Tax Information Authorization?

A: You may need to revoke a Tax Information Authorization if you no longer want the authorized individuals or organizations to have access to your tax information.

Q: Who can revoke a Tax Information Authorization using Form 3535?

A: The taxpayer or the authorized representative can revoke a Tax Information Authorization using Form 3535.

Q: What information do I need to provide on Form 3535?

A: You will need to provide your name, Social Security number or taxpayer identification number, the name and contact information of the authorized individual or organization, and the date of revocation.

Q: Is there a fee for submitting Form 3535?

A: No, there is no fee for submitting Form 3535.

Q: When should I submit Form 3535?

A: You should submit Form 3535 as soon as you want to revoke the Tax Information Authorization.

Q: Can I revoke a Tax Information Authorization at any time?

A: Yes, you can revoke a Tax Information Authorization at any time.

Q: Do I need to provide a reason for revoking a Tax Information Authorization?

A: No, you do not need to provide a reason for revoking a Tax Information Authorization.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3535 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.