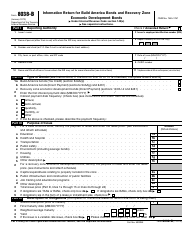

Instructions for IRS Form 8038-TC Information Return for Tax Credit Bonds and Specified Tax Credit Bonds

This document contains official instructions for IRS Form 8038-TC , Information Return for Tax Credit Bonds and Specified Tax Credit Bonds - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8038-TC is available for download through this link.

FAQ

Q: What is IRS Form 8038-TC?

A: IRS Form 8038-TC is the Information Return for Tax Credit Bonds and Specified Tax Credit Bonds.

Q: Who needs to file IRS Form 8038-TC?

A: Those who issue tax credit bonds or specified tax credit bonds are required to file Form 8038-TC.

Q: What is the purpose of IRS Form 8038-TC?

A: The purpose of Form 8038-TC is to report information related to tax credit bonds and specified tax credit bonds.

Q: What information is required on IRS Form 8038-TC?

A: Form 8038-TC requires information such as the issuer's name, bond issuance information, and the amount of credit claimed.

Q: When is IRS Form 8038-TC due?

A: Form 8038-TC is generally due by the 15th day of the 7th month after the close of the issuer's fiscal year.

Q: Is there a fee for filing IRS Form 8038-TC?

A: No, there is no fee for filing Form 8038-TC.

Q: Can IRS Form 8038-TC be filed electronically?

A: Yes, Form 8038-TC can be filed electronically through the IRS's Modernized e-File (MeF) system.

Q: What are the consequences of not filing IRS Form 8038-TC?

A: Failure to file Form 8038-TC or filing it late may result in penalties and interest.

Q: Are there any special considerations or requirements for filing IRS Form 8038-TC?

A: Yes, there are certain special rules and requirements that must be followed when filing Form 8038-TC. It is recommended to consult the instructions provided by the IRS or seek professional tax advice.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.