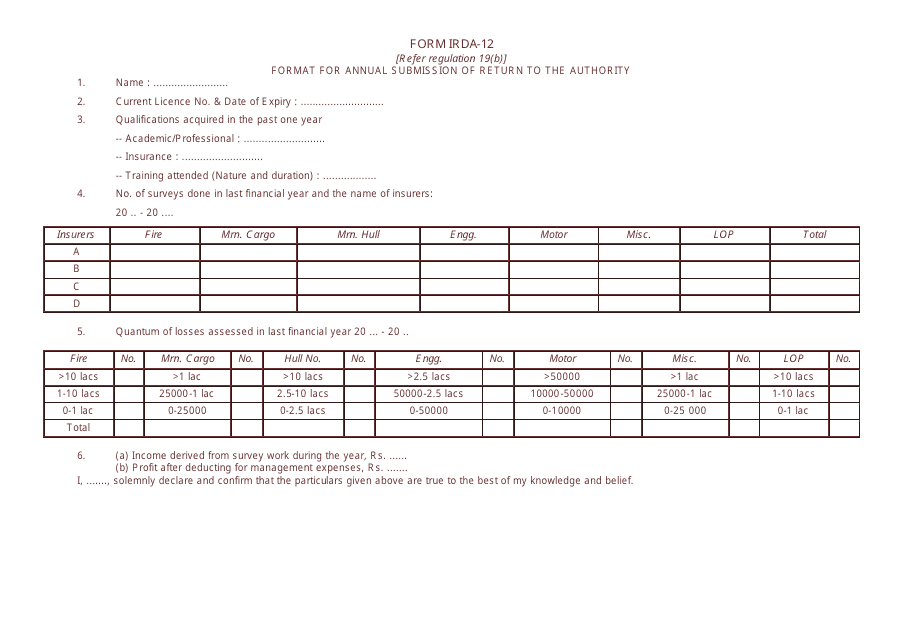

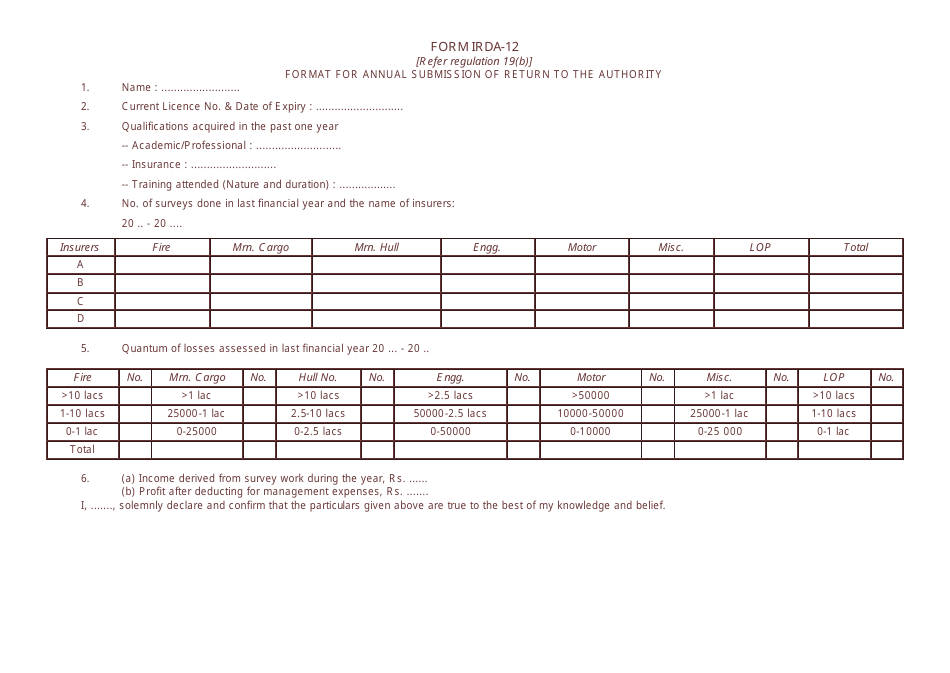

Form IRDA-12 Format for Annual Submission of Return to the Authority - India

Form IRDA-12 is a format used in India for the annual submission of returns to the Insurance Regulatory and Development Authority of India (IRDAI). Insurance companies in India are required to submit this form to the IRDAI, which is the regulatory body responsible for overseeing the insurance sector in the country. The form is used to provide detailed information and data on various aspects of the insurance business, including financial statements, capital requirements, and policy details. It serves as a means for insurance companies to demonstrate their compliance with regulatory guidelines and to provide transparency in their operations.

The Form IRDA-12 for Annual Submission of Return to the Authority in India is filed by insurance companies.

FAQ

Q: What is IRDA-12?

A: IRDA-12 is the format for the annual submission of returns to the Insurance Regulatory and Development Authority of India (IRDAI).

Q: Who needs to use IRDA-12?

A: Insurance companies in India are required to use IRDA-12 for submitting their annual returns to the IRDAI.

Q: What information does IRDA-12 require?

A: The IRDA-12 format requires insurance companies to provide detailed financial information, such as balance sheets, income statements, and investment details.

Q: When is the deadline for submitting IRDA-12?

A: The deadline for submitting IRDA-12 is usually within three months after the end of the financial year.

Q: Are there any penalties for late submission of IRDA-12?

A: Yes, insurance companies may face penalties for late submission of IRDA-12, which could include fines or other regulatory actions.