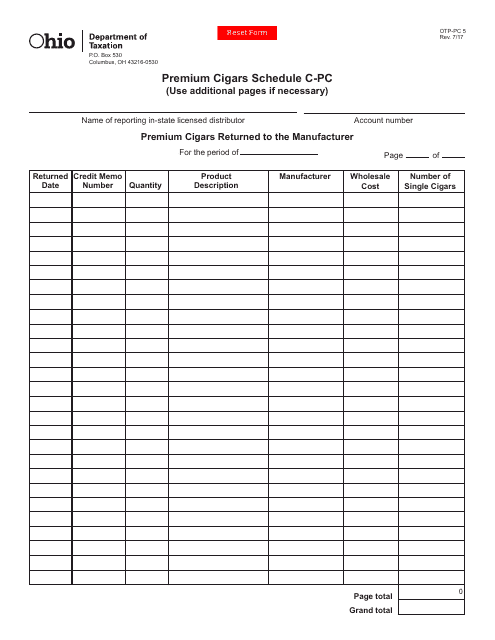

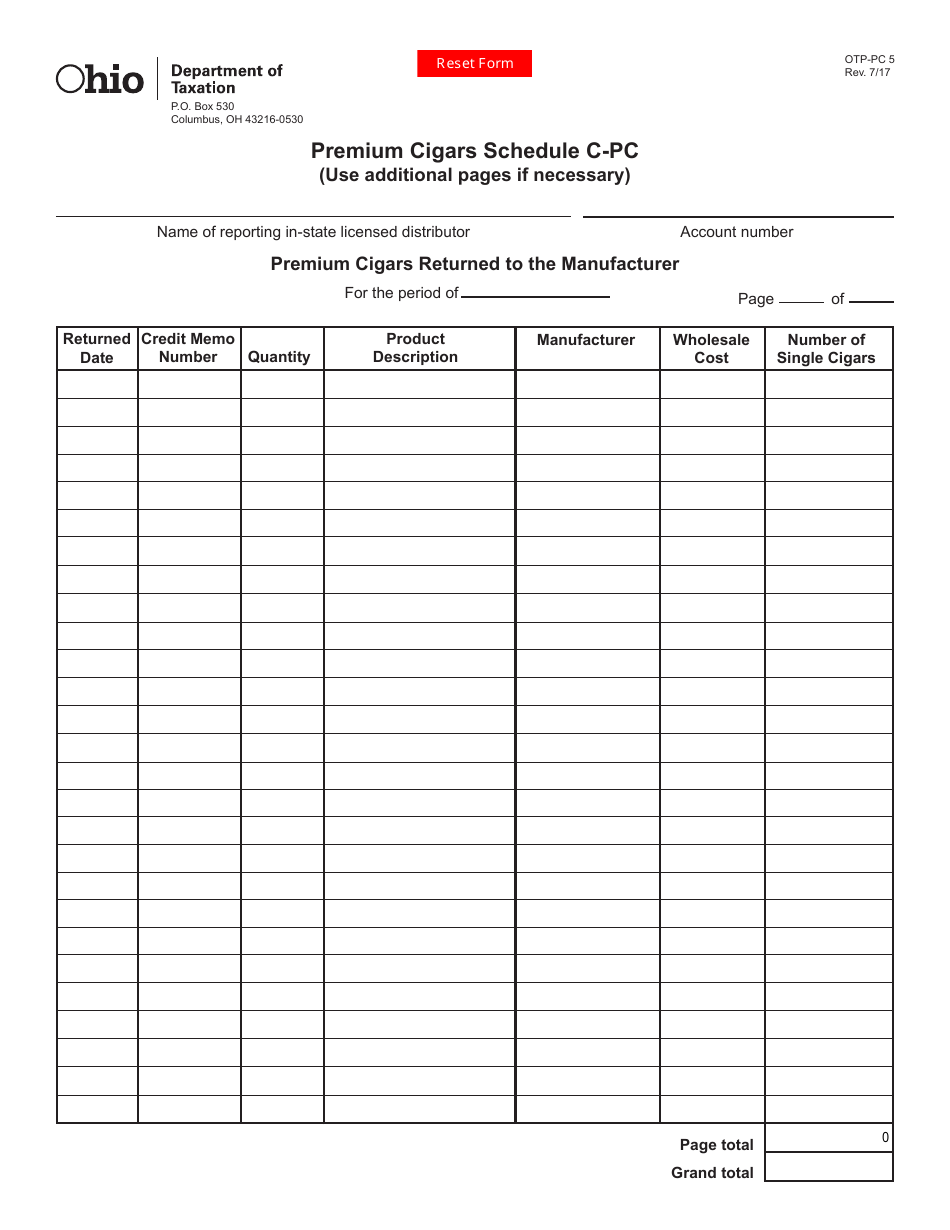

Form OTP-PC5 Premium Cigars Schedule C-Pc - Premium Cigars Returned to the Manufacturer - Ohio

What Is Form OTP-PC5?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTP-PC5?

A: OTP-PC5 refers to a form related to premium cigars.

Q: What does Schedule C-Pc mean?

A: Schedule C-Pc refers to a schedule within the OTP-PC5 form.

Q: What does 'Premium Cigars Returned to the Manufacturer' mean?

A: 'Premium Cigars Returned to the Manufacturer' refers to the specific purpose of Schedule C-Pc of the OTP-PC5 form.

Q: Why is the form relevant to Ohio?

A: The form is relevant to Ohio because it is used for reporting premium cigars returned to the manufacturer in Ohio.

Q: What information does the OTP-PC5 form require?

A: The OTP-PC5 form requires information about premium cigars returned to the manufacturer, including details about the manufacturer, quantities, and reasons for return.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OTP-PC5 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.