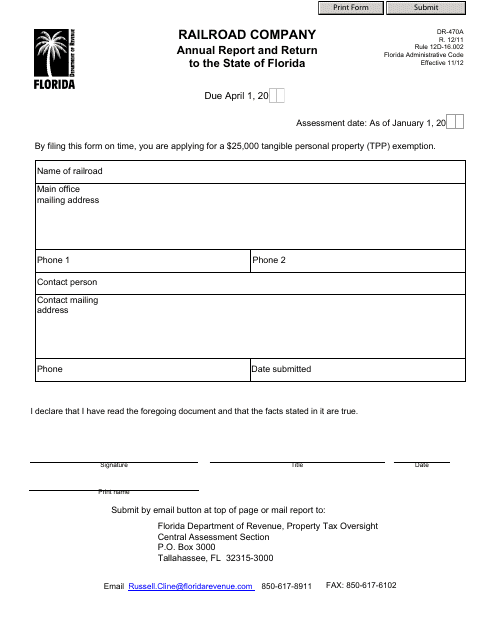

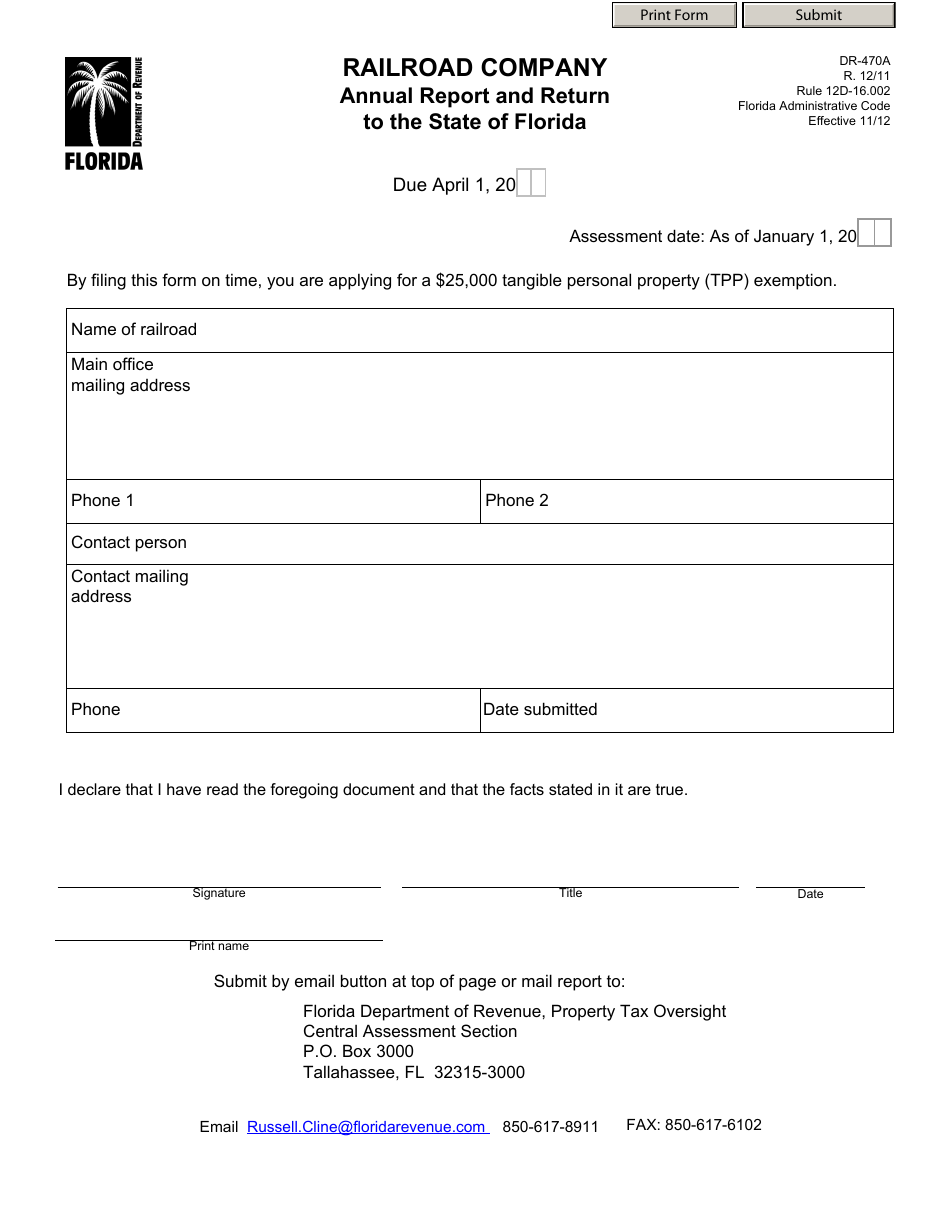

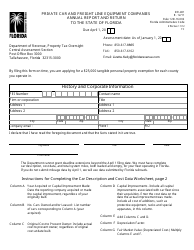

Form DR-470A Railroad Company Annual Report and Return to the State of Florida - Florida

What Is Form DR-470A?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-470A?

A: Form DR-470A is the Railroad Company Annual Report and Return to the State of Florida.

Q: Who needs to file Form DR-470A?

A: Railroad companies operating in Florida need to file Form DR-470A.

Q: What is the purpose of Form DR-470A?

A: The purpose of Form DR-470A is for railroad companies to report and return taxes owed to the State of Florida.

Q: Is there a deadline for filing Form DR-470A?

A: Yes, Form DR-470A must be filed by April 1st of each year.

Q: Are there any fees associated with filing Form DR-470A?

A: No, there are no fees associated with filing Form DR-470A.

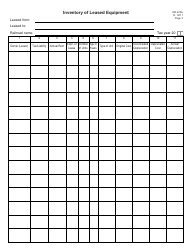

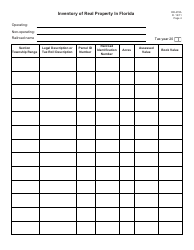

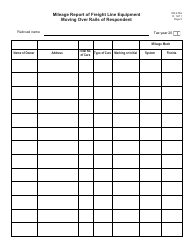

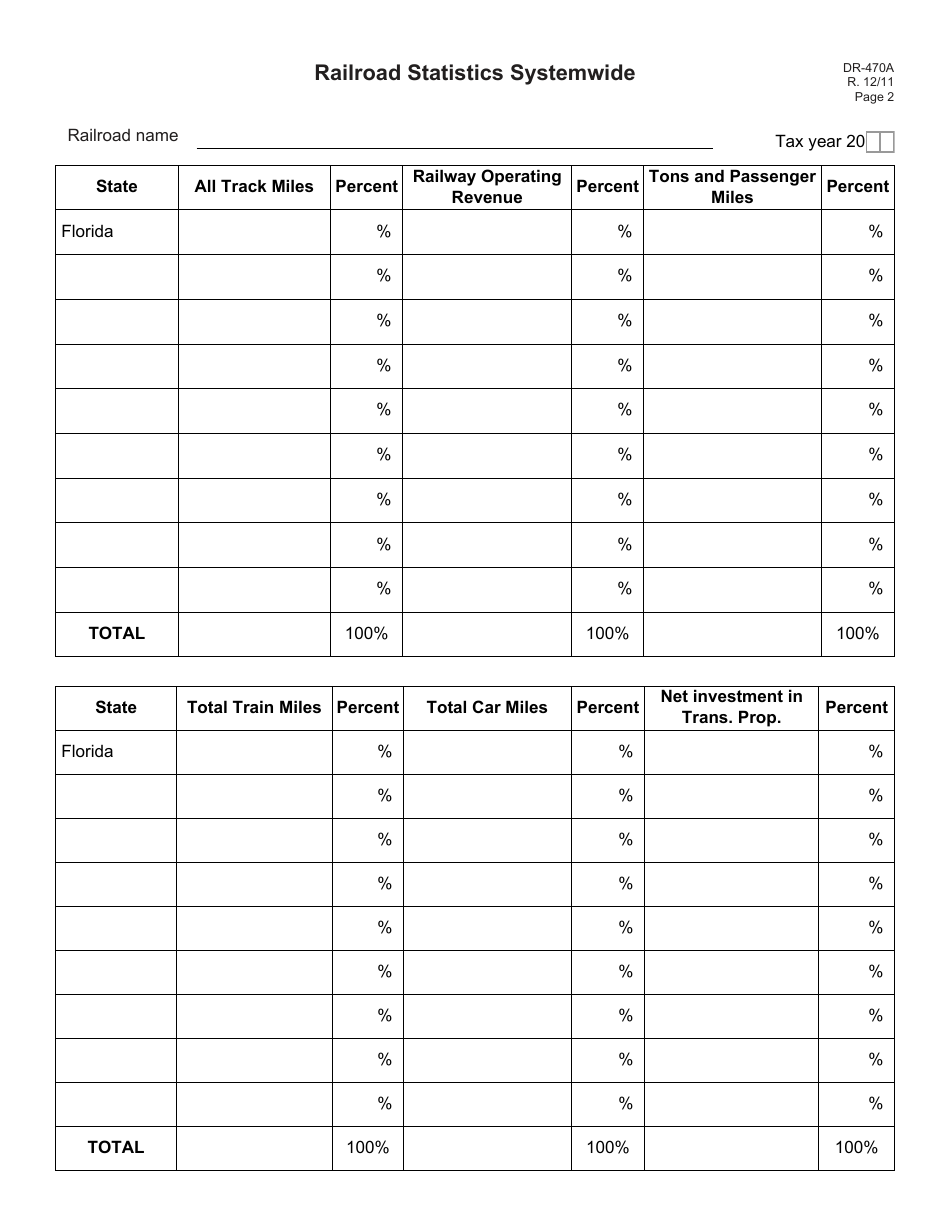

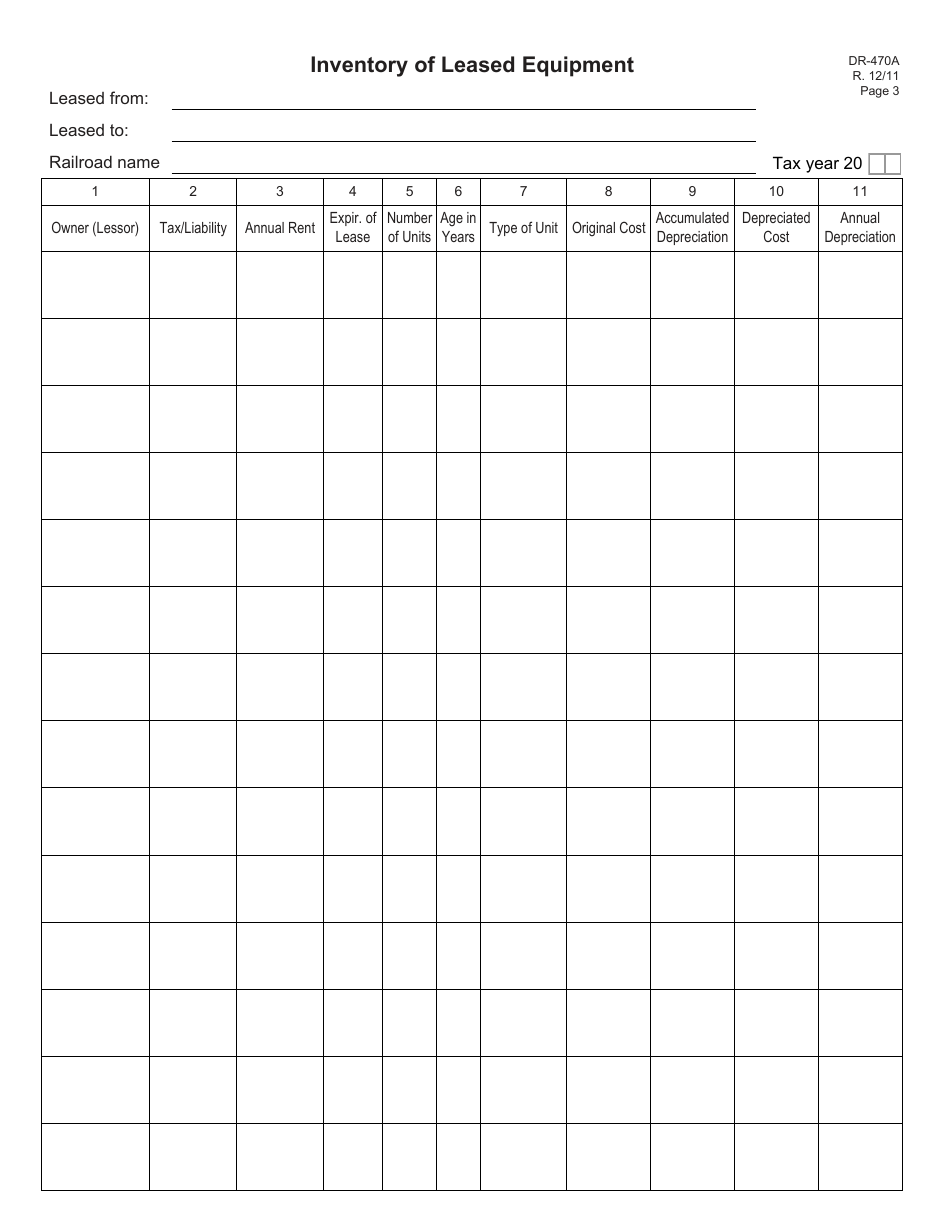

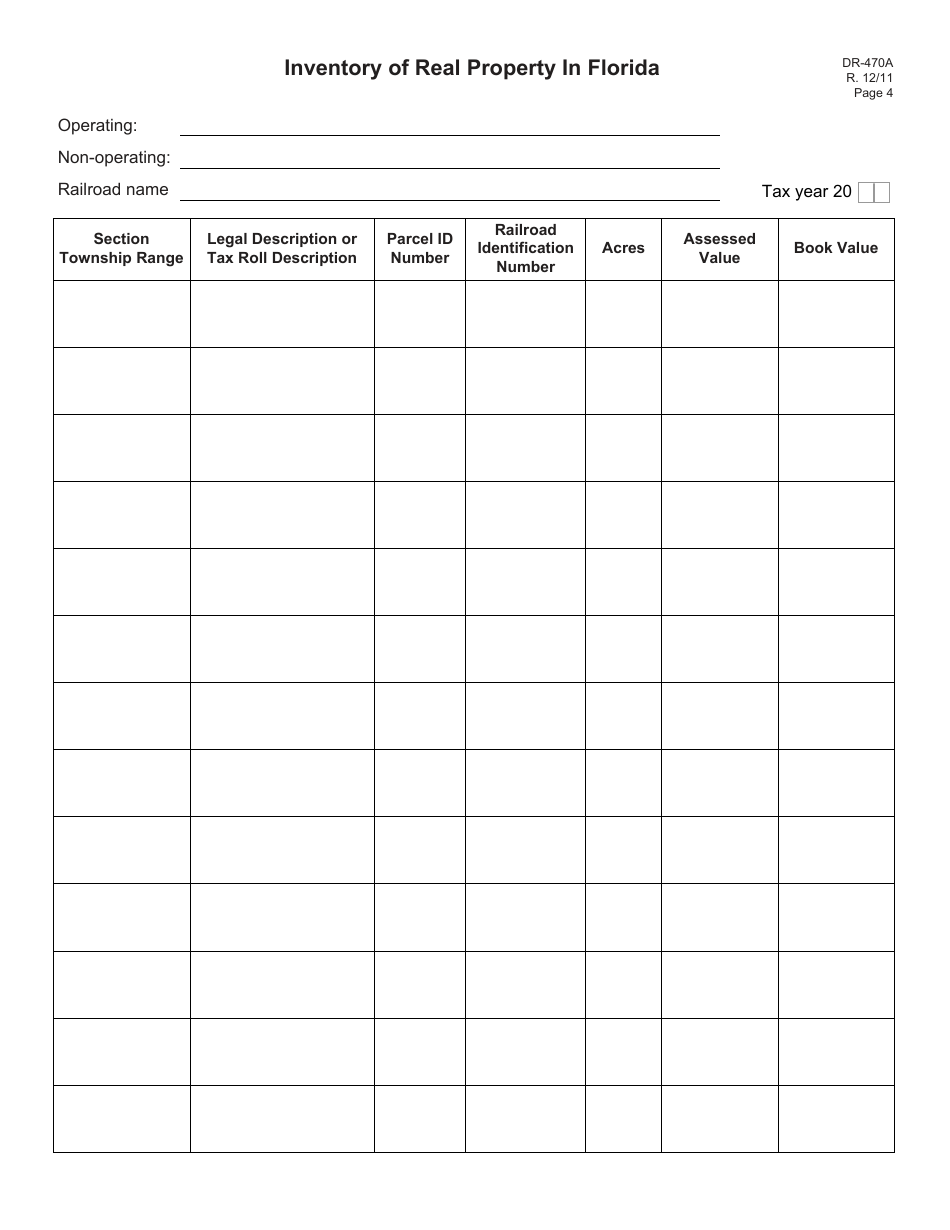

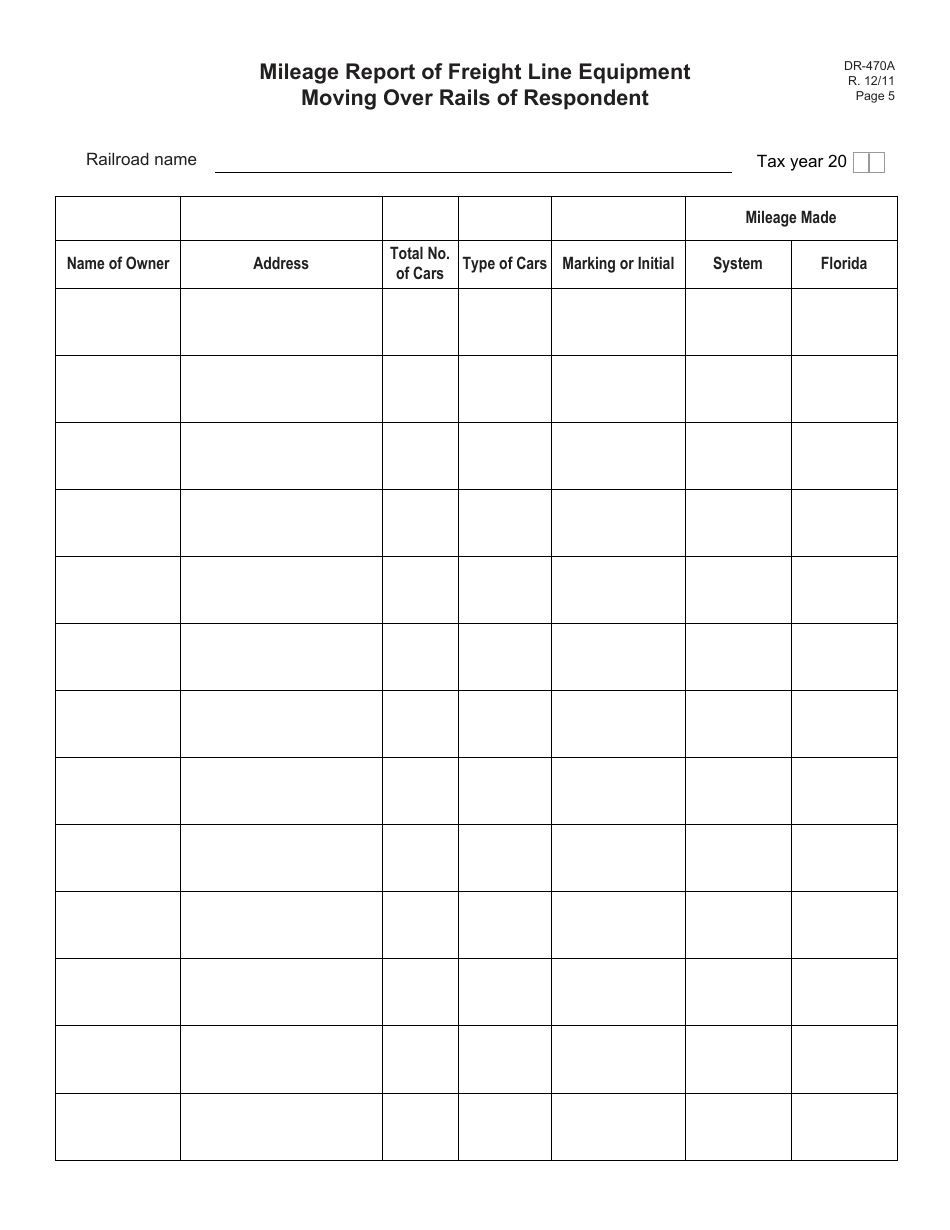

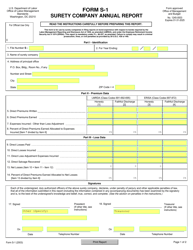

Q: What information do I need to provide when filing Form DR-470A?

A: You will need to provide details of the railroad company's revenue, payroll expenses, and other relevant financial information.

Q: What happens if I don't file Form DR-470A?

A: Failure to file Form DR-470A may result in penalties and legal consequences.

Q: Is Form DR-470A specific to railroad companies in Florida only?

A: Yes, Form DR-470A is specific to railroad companies operating in the state of Florida only.

Form Details:

- Released on December 1, 2011;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-470A by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.